Updated on July 14th, 2025 by Nathan Parsh

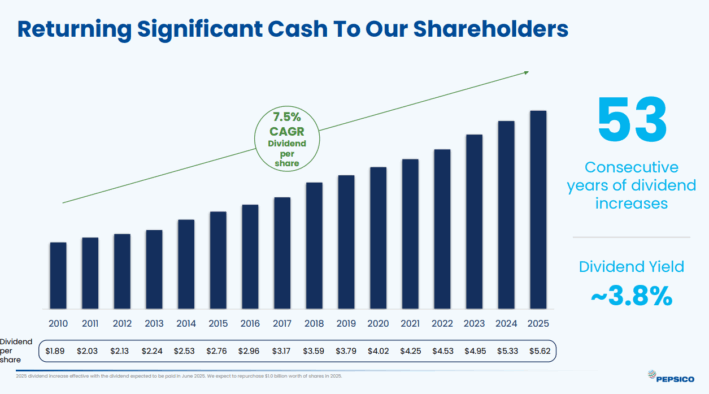

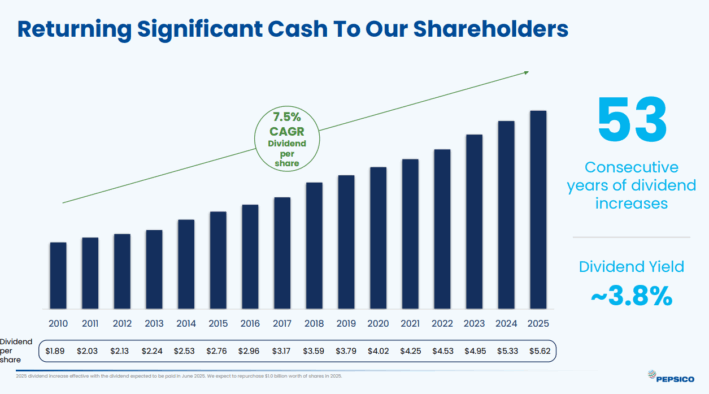

PepsiCo (PEP) recently increased its dividend by 5%. This marks the company’s 53rd consecutive year of increased dividends paid to shareholders.

As a result, it is on the list of Dividend Kings.

The Dividend Kings are a group of just 55 stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all 55 Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

PepsiCo is a recession-proof Dividend King with a leadership position in the food and beverage industry. It is a reliable dividend growth stock that can increase its dividend, even during recessions.

At the same time, the stock has a market-beating 4.2% dividend yield. Due to its above-average yield and long history of consistent annual dividend increases, PepsiCo remains a high-quality holding for income investors.

Business Overview

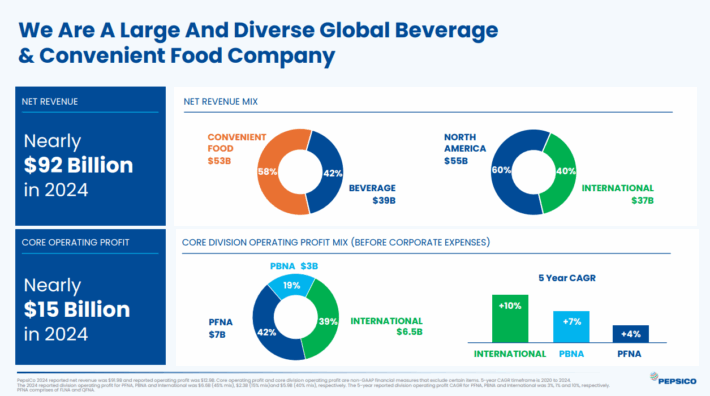

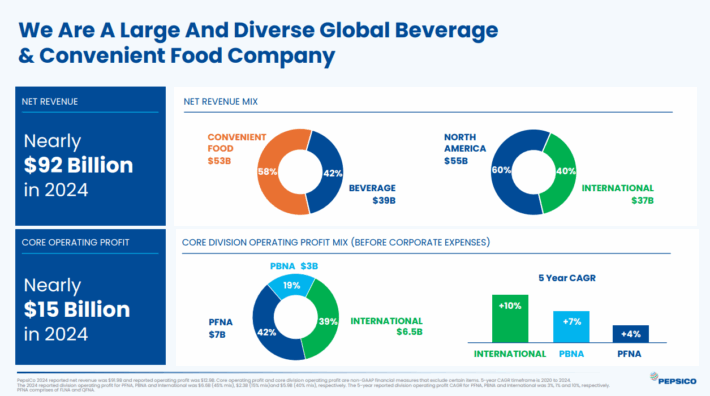

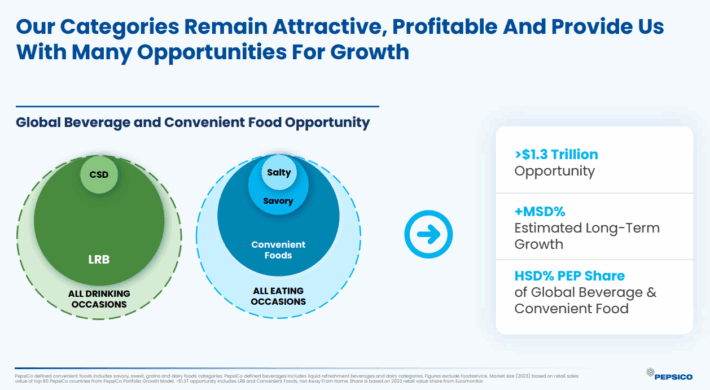

PepsiCo is a major consumer staples stock. It has an extensive portfolio of quality brands, including over 20 individual brands that generate annual sales of $1 billion or more. Just a few of its core brands include Pepsi, Frito-Lay, Quaker, Gatorade, and many more.

Source: Investor Presentation

Its business is nearly equally split between its food and beverage segments. It is also balanced geographically between the U.S. and the rest of the world.

The company reported its first-quarter 2025 results on April 24th, 2025, with the company producing revenue of $17.9 billion, which was a slight decline of 1.8% from the prior year. However, this was $190 million better than analysts had anticipated. Adjusted earnings-per-share of $1.48 fell 8.1% from the prior year and was $0.01 below estimates.

Organic sales grew 1% for the first-quarter. Volume for beverages was flat while food decreased 3%. PepsiCo Beverages North America grew 1% despite a 3% drop in volume. Frito-Lay North America decreased 2% and the International Beverages segment grew 7% due to strengthening demand. By regions, Europe/Middle East/Africa grew 8%, Latin America improved 3%, and Asia Pacific declined 1%.

Growth Prospects

PepsiCo has a long history of steady growth. Even in a challenging soda environment, the company has continued its consistent growth. The image below illustrates the company’s performance over the past several years.

Source: Investor Presentation

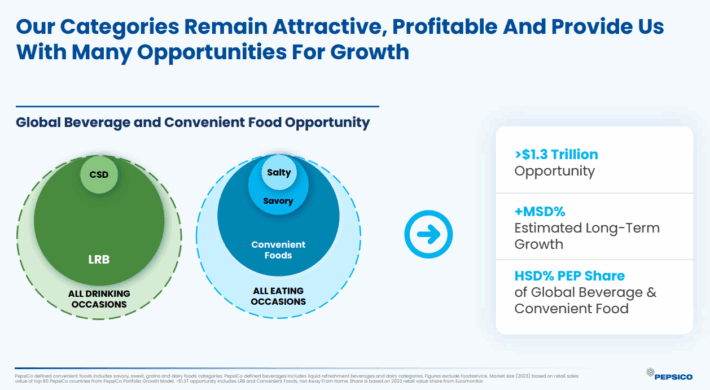

We believe PepsiCo will generate around 6% adjusted earnings-per-share growth per year over the next five years. Going forward, two of PepsiCo’s most promising catalysts are growth in healthier foods and beverages and in emerging markets.

Soda sales are slowing down in developed markets like the U.S., where soda consumption has steadily declined for over a decade.

As a result, large soda companies like PepsiCo have had to adapt to a more health-conscious consumer. To do this, PepsiCo has shifted its portfolio toward healthier foods that are resonating more strongly with changing consumer preferences.

In addition, PepsiCo has a significant growth opportunity in emerging markets such as China, Africa, India, and Latin America. These regions are underdeveloped, yet they have large consumer populations and high economic growth rates.

Emerging markets were once again a growth driver last quarter as most regions showed year-over-year growth.

Competitive Advantages & Recession Performance

PepsiCo has numerous competitive advantages, including strong brands and a global scale. In all, PepsiCo has over 20 individual brands that each collect at least $1 billion in annual revenue. Strong brands give PepsiCo optimal shelf space at retailers and the company’s pricing power.

PepsiCo’s financial strength also allows the company to invest in research and development and advertising to retain its competitive advantages.

For example, PepsiCo invests billions yearly in research and development to innovate new products and packaging designs. In addition, PepsiCo regularly spends more than $2 billion each year on advertising to maintain market share and build brand equity with consumers.

PepsiCo’s competitive advantages and strong brands make the company highly profitable, even during recessions. Food and beverages always retain a certain level of demand, which is why the company held up so well during the Great Recession.

Source: Investor Presentation

PepsiCo’s competitive advantages and profitability have enabled the company to increase its dividend for more than fifty years straight. Since 2010, on average, PepsiCo has increased its dividend by 7.5% per year.

PepsiCo’s earnings-per-share throughout the Great Recession of 2007-2009 are listed below:

- 2007 earnings-per-share of $3.34

- 2008 earnings-per-share of $3.21 (3.9% decline)

- 2009 earnings-per-share of $3.77 (17% increase)

- 2010 earnings-per-share of $3.91 (3.7% increase)

As you can see, PepsiCo’s earnings-per-share declined only modestly in 2008. The company then increased earnings by nearly 20% in 2009, which is very impressive. Earnings continued to grow once the recession ended.

The company reported strong growth in 2020 and 2021 when the coronavirus pandemic sent the U.S. economy into a recession. Therefore, PepsiCo is a recession-resistant business.

Valuation & Expected Returns

PepsiCo is expected to generate earnings per share of $8.16 for 2025. Based on this, the stock trades for a price-to-earnings ratio of 16.5. Our fair value estimate is a price-to-earnings ratio of 24.0, which is below the stock’s long- and medium-term averages. As a result, the stock is significantly undervalued in our view. An expanding price-to-earnings ratio could increase annual returns by 7.7% each year over the next five years.

Future returns will also be comprised of earnings-per-share growth and dividends. We expect PepsiCo to grow earnings-per-share each year by 6%, consisting of organic revenue growth, acquisitions, and share repurchases.

In addition, PepsiCo has a 4.2% current dividend yield. The combination of valuation changes, earnings growth, and dividends results in total expected returns of 17.0% per year over the next five years.

We currently rate PepsiCo stock a buy.

PepsiCo’s dividend is secure, with a projected payout ratio of 70% for 2025. This gives PepsiCo enough room to continue increasing the dividend at a rate in line with the growth rate of its adjusted EPS.

Final Thoughts

PepsiCo is a high-quality company with a diverse portfolio of strong brands. Its long-term growth will be fueled by its snacks business and its advancement in developing markets.

The company has increased its dividend for 53 consecutive years, and the stock currently yields above 4%. Therefore, it meets our definition of a blue-chip stock and should continue to deliver steady dividend increases each year.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.