The Minneapolis-based iGaming firm is picking up its accumulation pace as it goes all in on the second largest crypto asset.

SharpLink Gaming has made a series of large-scale Ethereum (ETH) purchases in the past 24 hours, investing roughly $113 million, according to EmberCN data. Conducted in two parts, the purchases included 21,487 ETH worth $64.26 million bought through Galaxy Digital and Coinbase Prime on Monday, and an additional 16,374 ETH at $48.85 million on the same day.

The latest acquisition follows a separate 10,000 ETH buy from the Ethereum foundation just days ago, worth $25.7M at an average price of $2,572.

SharpLink’s total ETH holdings now sit at 270,000, making it world’s second-largest holder of the asset. The firm promotes its strategy as betting on Ethereum’s track to becoming the foundational layer for global finance with a long-term accumulation mission.

All of the firm’s ETH is staked, with additional yield generated through restaking, and the firm provides transparency tools that give shareholders direct insight into its on-chain exposure.

“We believe ETH is the superior asset for corporate reserves,” said the iGaming giant. ”Our goal is not just to hold ETH, but to activate it, using native staking, restaking, and Ethereum-based yield strategies to increase the value of our treasury and create long-term shareholder value.”

SharpLink’s latest purchases come as ETH itself leverages the ongoing institutional interest and broader market uptick to claim new highs. Trading at $3,030 at the time of writing, ETH has climbed roughly 17% over the past seven days, breaking out of the downward trend that long held it back for months. The token is up by over 120% from its lowest point this year, with a $366 billion market capitalization.

Meanwhile, other institutions are also shifting to Ethereum. Nasdaq-listed Bit Digital recently dumped its entire Bitcoin (BTC) holdings in favor of a fully ETH-based treasury strategy. The firm now holds around 100,600 ETH and says it’s aiming to become the “preeminent ETH holding company in the world.”

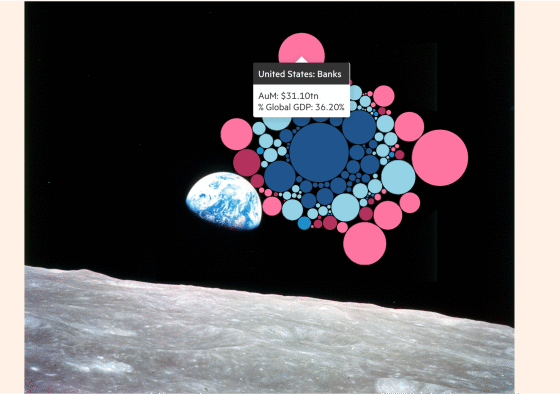

More than 1.2 million ETH are now held in corporate treasuries globally, worth over $3.6 billion at current prices.