Bitcoin has reached a new all-time high once again, surging to $123,200 earlier today, a move that has reignited bullish sentiment across the cryptocurrency market. After weeks of steady consolidation and strong institutional inflows, the top cryptocurrency continues its upward momentum, breaking past key psychological levels and entering uncharted territory.

Related Reading

One of the most notable developments fueling this surge is the rise in demand from so-called “accumulator” addresses. According to top analyst Darkfost, these wallets—classified by their consistent behavior of only accumulating BTC without any history of selling—have hit a new record high in 2025. This group of addresses is often associated with high-conviction holders, including long-term retail investors, institutional participants, and funds with strategic positioning.

The spike in accumulator activity reveals a deeper layer of confidence in Bitcoin’s long-term trajectory. Even with BTC above $120,000, these addresses continue to stack sats aggressively, suggesting that smart money is not waiting for lower prices. Instead, they appear to be preparing for a potential continuation of the bull cycle.

Accumulators Add BTC, But Will They Hold Through Volatility?

As of today, Bitcoin accumulator addresses have collectively added approximately 248,000 BTC, well above the monthly average of 164,000 BTC. This significant uptick highlights a sharp increase in demand over a short period, indicating that long-term players are actively positioning themselves despite Bitcoin continuing to post new all-time highs.

These addresses, often associated with entities that have never sold BTC, are typically viewed as highly sophisticated investors with long-term horizons. The recent surge in accumulation suggests these players see continued upside potential, even after Bitcoin reached $123,200. Their behavior reflects strong market confidence and a belief that the current rally may be far from over.

However, there is a caveat. If Bitcoin enters a phase of correction or prolonged consolidation, some of these addresses may begin to exit their positions. Doing so would strip them of their accumulator status and introduce substantial selling pressure into the market. With the 248,000 BTC added now worth around $30 billion, any significant liquidation from this cohort could impact short-term price stability.

This week will be particularly crucial. The highly anticipated “Crypto Week” in Washington begins, with the US House of Representatives scheduled to discuss and vote on key crypto regulatory bills. The outcomes could drive volatility and influence whether these accumulators continue to hold or begin to fold.

Related Reading

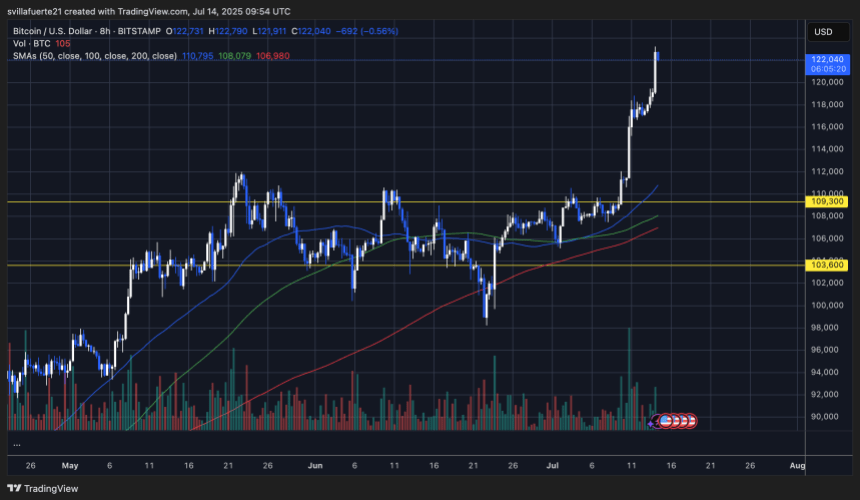

Bitcoin Breaks Out With Strong Momentum Above $120K

The 8-hour chart shows Bitcoin has decisively broken out above the key resistance at $109,300, accelerating sharply to reach new all-time highs at $123,200. This breakout follows weeks of consolidation between the $103,600 and $109,300 levels, during which Bitcoin established a solid base of support. The move was accompanied by a notable surge in volume, confirming strong buyer conviction behind the rally.

Technically, BTC is now trading well above its 50, 100, and 200-period simple moving averages (SMAs), which currently sit at $110,795, $108,079, and $106,980, respectively. The bullish alignment of these moving averages supports the ongoing uptrend and indicates that buyers have regained full control of the market structure.

Related Reading

The explosive breakout above $110K suggests the market has entered a price discovery phase, where historical resistance levels offer little guidance. If Bitcoin manages to hold above $120K in the coming sessions, this level may flip into new support.

Featured image from Dall-E, chart from TradingView