Updated on July 11th, 2025 by Bob Ciura

High dividend stocks means more income for every dollar invested. All other things equal, the higher the dividend yield, the better.

Income investors often like to find low-priced dividend stocks, as they can buy more shares than they could with higher-priced securities.

In this research report, we analyze 11 stocks trading below $10.00 per share and offering high dividend yields of 5.0% and greater.

Additionally, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Keep reading to see analysis on these 11 high-yielding securities, based in the U.S., trading below $10.00 per share that we cover in the Sure Analysis Research Database.

The list is sorted by dividend yield, in ascending order.

Table of Contents

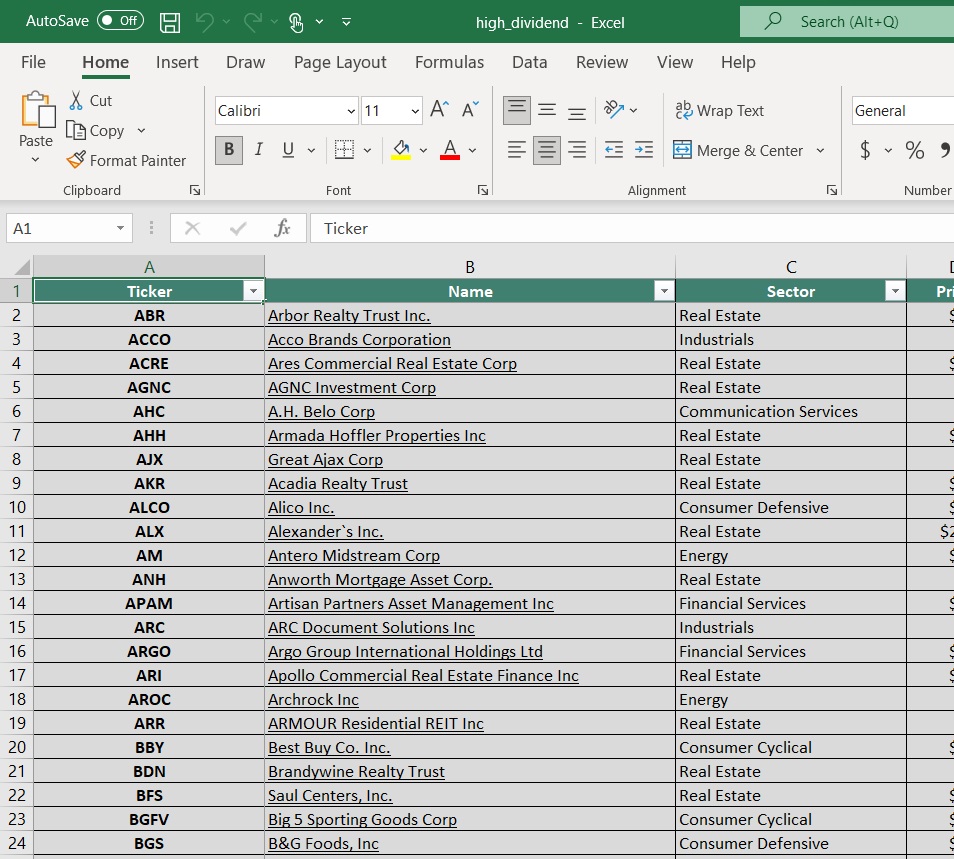

Low-Priced High Dividend Stock #11: LXP Industrial Trust (LXP) – Dividend Yield of 6.3%

Lexington Realty Trust owns equity and debt investments in single-tenant properties and land across the United States. The trust’s portfolio is primarily industrial equity investments.

The trust grows the industrial portfolio by financing, or by acquiring new investments with long-term leases, repositioning the portfolio by recycling capital and opportunistically taking advantage of capital markets.

Additionally, the company supplies investment advisory and asset management services for investors in the single-tenant net-lease asset market.

On May 1st, 2025, Lexington reported first quarter 2025 results for the period ending March 31st, 2025. The trust announced adjusted funds from operations (AFFO) of $0.16 per share for the quarter, flat against the prior year quarter.

Same-store NOI rose 5.2% from a year ago. For Q1, the trust completed 540K square feet of new leases and lease extensions, which increased base and cash base rents by 52.5% and 58.9%, respectively. It also began the redevelopment of a 250K square foot warehouse, and disposed of another warehouse for gross proceeds of $35 million.

Click here to download our most recent Sure Analysis report on LXP (preview of page 1 of 3 shown below):

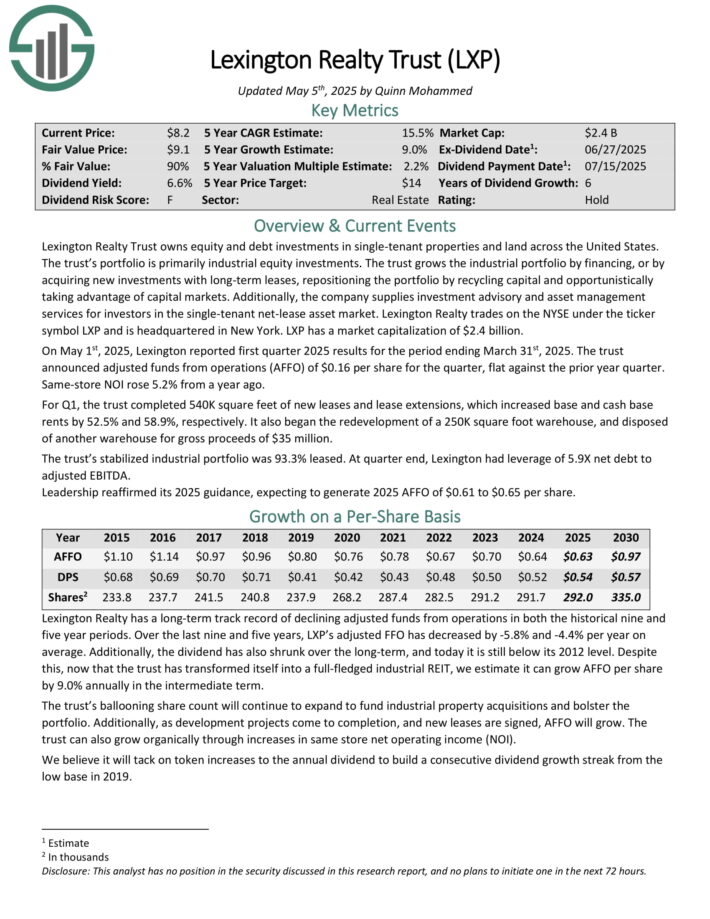

Low-Priced High Dividend Stock #10: Kearny Financial Corp. (KRNY) – Dividend Yield of 6.6%

Kearny Financial Corp. is a bank holding company. Headquartered in Fairfield, New Jersey, the bank operates 43 branches, primarily in New Jersey along with a couple of locations in New York City.

Over the years, Kearny has evolved from being a traditional thrift institution into a full-service community bank.

Kearny had enjoyed tremendous growth over the past decade as it executed on this strategy to enlarge and diversify the bank.

In the company’s Q3 2025 results, reported April 24th, 2025, Kearny reported a profit of $0.11 per share. This topped analyst consensus by a penny, but fell from the $0.12 the bank earned in the same period of last year.

We had expected a slightly better result given that Kearny’s business had stabilized in the prior quarter and appeared to be back on the upswing.

Click here to download our most recent Sure Analysis report on KRNY (preview of page 1 of 3 shown below):

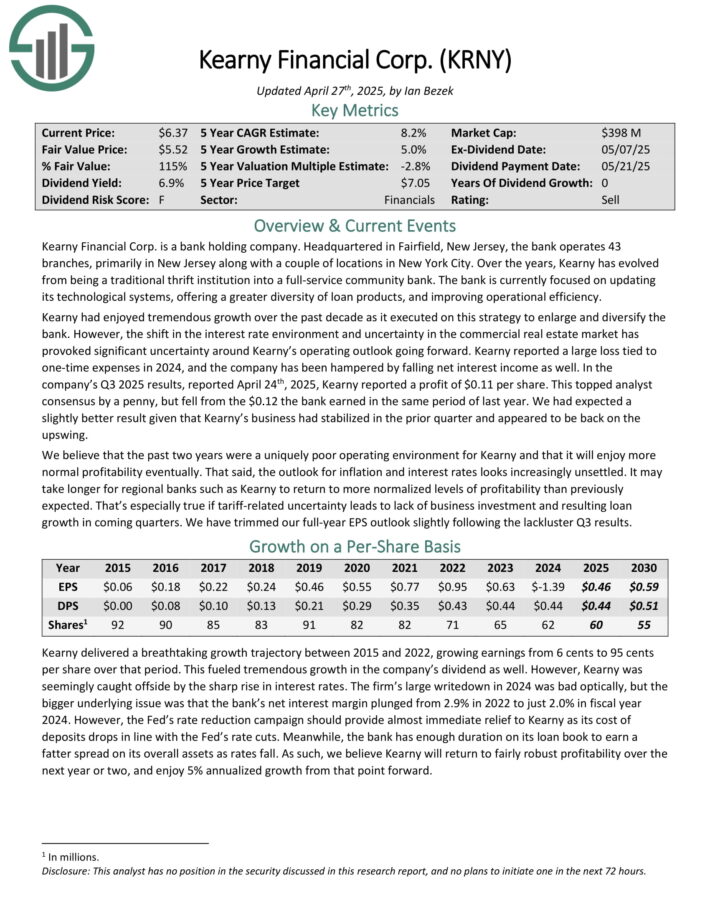

Low-Priced High Dividend Stock #9: Clipper Realty (CLPR) – Dividend Yield of 10.3%

Clipper Realty is a Real Estate Investment Trust, or REIT, that was founded by the merger of four pre-existing real estate companies. The founders retain about 2/3 of the ownership and votes today, as they have never sold a share.

Clipper owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City.

On May 12, 2025, Clipper Realty reported its financial results for the first quarter. The company achieved record quarterly revenues of $39.4 million, marking a 10.2% increase from the same period in 2024, driven by strong residential leasing and high occupancy rates across its portfolio.

Residential revenue rose by $3.1 million, or 11.8%, due to higher rental rates, occupancy, and collections, while commercial income increased by $0.6 million, or 5.7%, attributed to leasing smaller vacant spaces at Tribeca House and Aspen.

Despite the revenue growth, the company reported a net loss of $35.1 million, or $0.86 per share, primarily due to a $33.8 million impairment charge related to the 10 West 65th Street property, which is now held for sale. Excluding this impairment, the net loss was $1.3 million, or $0.03 per share.

Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below):

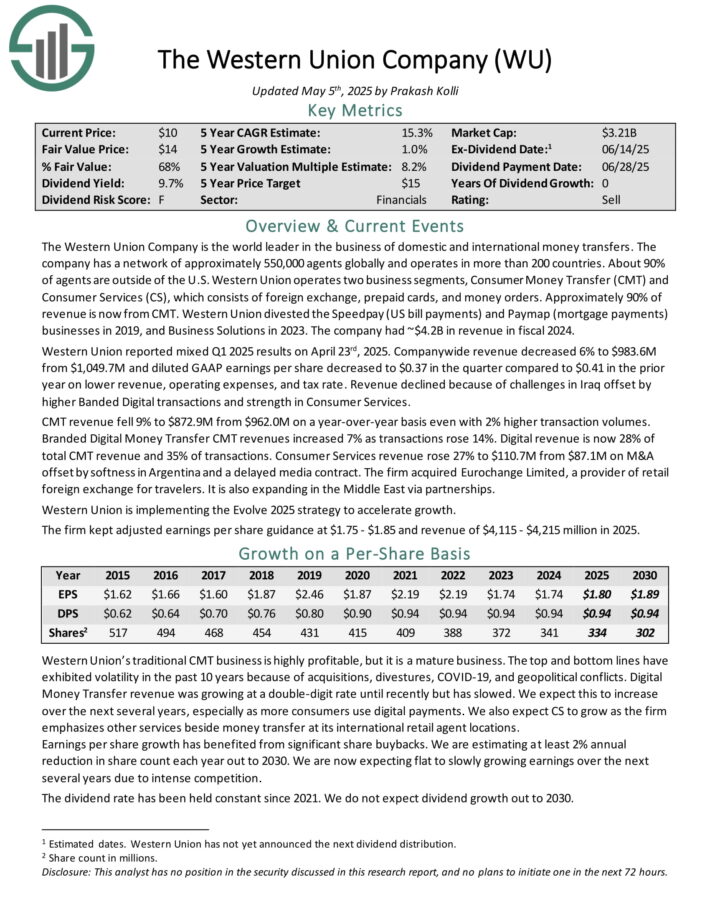

Low-Priced High Dividend Stock #8: Western Union (WU) – Dividend Yield of 11.0%

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries.

About 90% of agents are outside of the US. Western Union operates two business segments, Consumer-to-Consumer (C2C) and Other (bill payments in the US and Argentina).

Western Union reported mixed Q1 2025 results on April 23rd, 2025. Company-wide revenue decreased 6% to $983.6M from $1,049.7M and diluted GAAP earnings per share decreased to $0.37 in the quarter compared to $0.41 in the prior year on lower revenue, operating expenses, and tax rate.

Revenue declined because of challenges in Iraq offset by higher Banded Digital transactions and strength in Consumer Services.

CMT revenue fell 9% to $872.9M from $962.0M on a year-over-year basis even with 2% higher transaction volumes. Branded Digital Money Transfer CMT revenues increased 7% as transactions rose 14%. Digital revenue is now 28% of total CMT revenue and 35% of transactions.

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

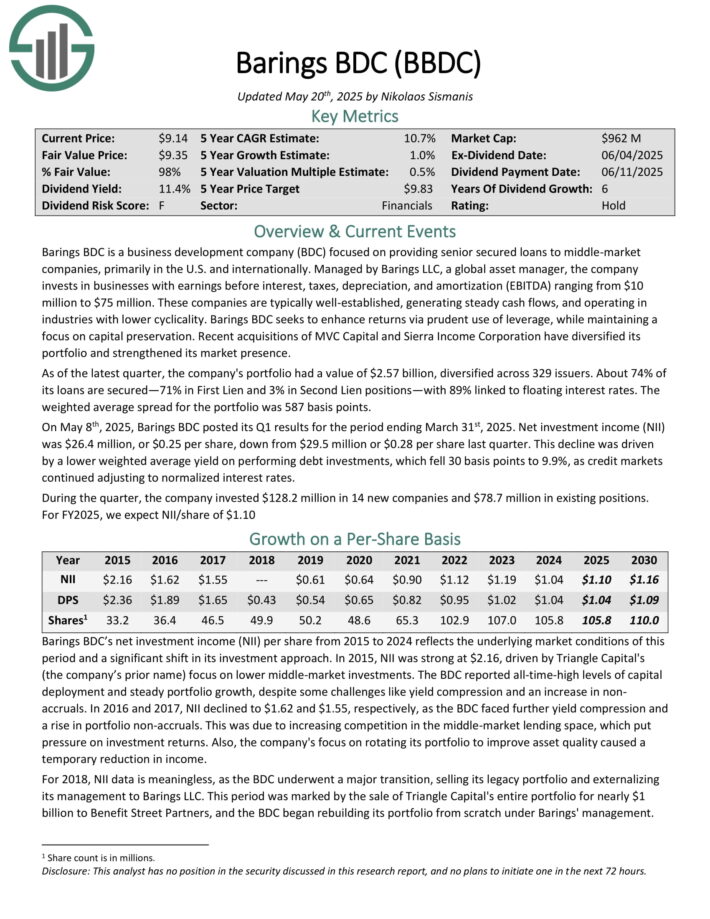

Low-Priced High Dividend Stock #7: Barings BDC (BBDC) – Dividend Yield of 11.0%

Barings BDC is a business development company (BDC) focused on providing senior secured loans to middle-market companies, primarily in the U.S. and internationally.

Managed by Barings LLC, a global asset manager, the company invests in businesses with earnings before interest, taxes, depreciation, and amortization (EBITDA) ranging from $10 million to $75 million.

As of the latest quarter, the company’s portfolio had a value of $2.57 billion, diversified across 329 issuers. About 74% of its loans are secured—71% in First Lien and 3% in Second Lien positions—with 89% linked to floating interest rates.

The weighted average spread for the portfolio was 587 basis points.

On May 8th, 2025, Barings BDC posted its Q1 results for the period ending March 31st, 2025. Net investment income (NII) was $26.4 million, or $0.25 per share, down from $29.5 million or $0.28 per share last quarter.

This decline was driven by a lower weighted average yield on performing debt investments, which fell 30 basis points to 9.9%, as credit markets continued adjusting to normalized interest rates.

Click here to download our most recent Sure Analysis report on BBDC (preview of page 1 of 3 shown below):

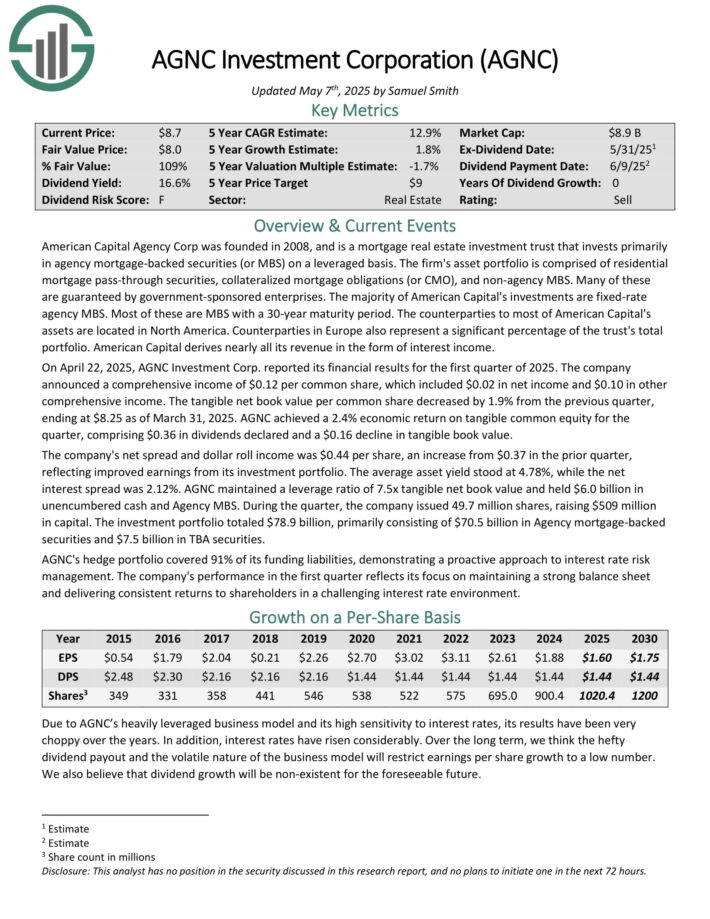

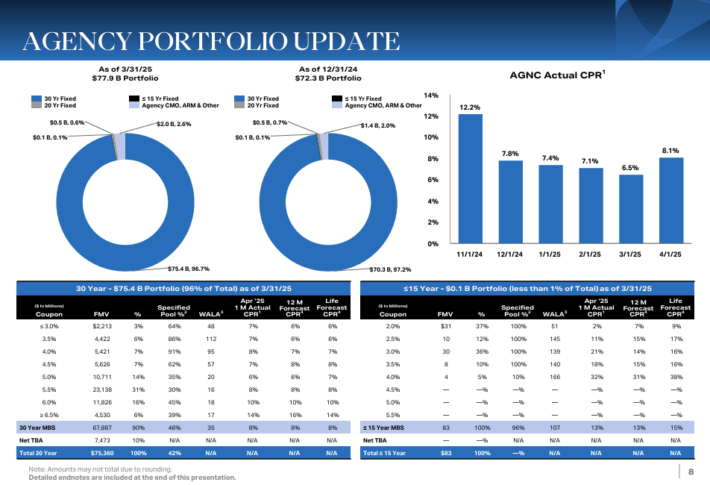

Low-Priced High Dividend Stock #6: AGNC Investment Corp. (AGNC) – Dividend Yield of 15.3%

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS.

Many of these are guaranteed by government–sponsored enterprises.

Source: Investor Presentation

On April 22, 2025, AGNC Investment Corp. reported its financial results for the first quarter of 2025. The company announced a comprehensive income of $0.12 per common share, which included $0.02 in net income and $0.10 in other comprehensive income.

The tangible net book value per common share decreased by 1.9% from the previous quarter, ending at $8.25 as of March 31, 2025. AGNC achieved a 2.4% economic return on tangible common equity for the quarter, comprising $0.36 in dividends declared and a $0.16 decline in tangible book value.

The company’s net spread and dollar roll income was $0.44 per share, an increase from $0.37 in the prior quarter, reflecting improved earnings from its investment portfolio.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

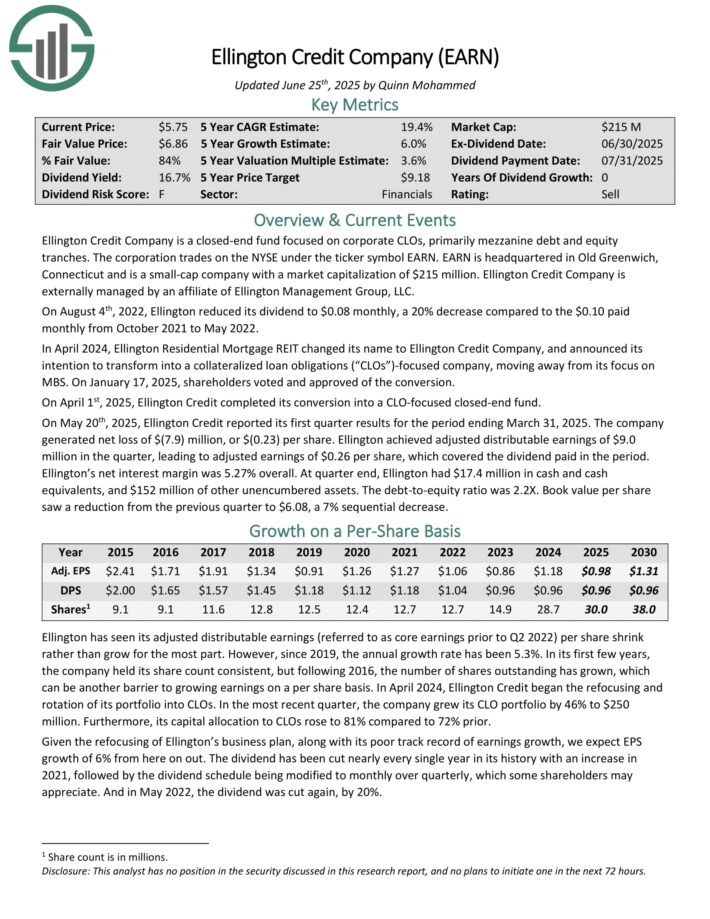

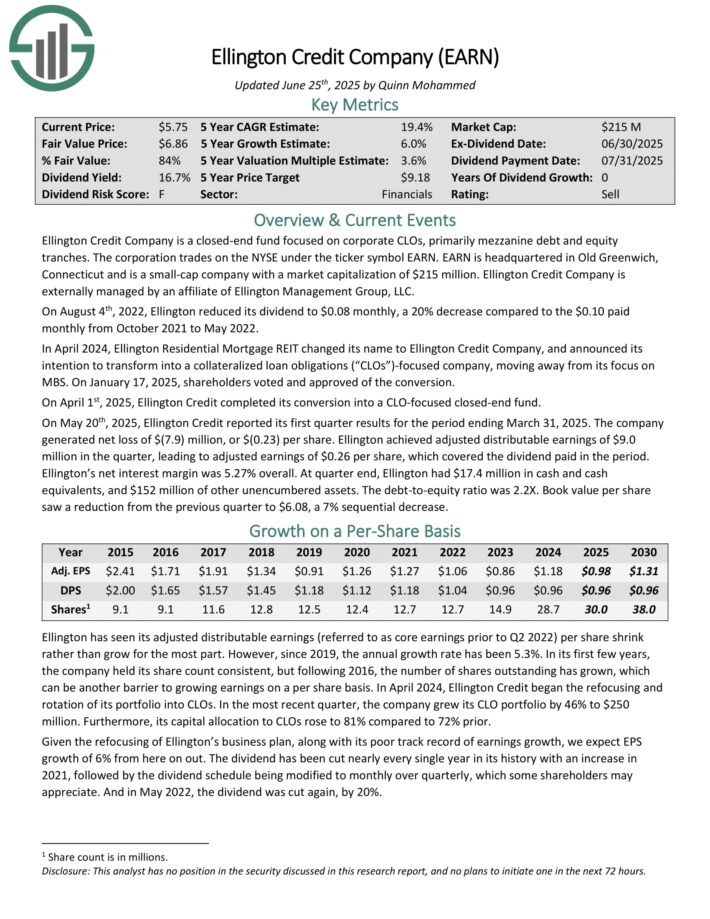

Low-Priced High Dividend Stock #5: Ellington Credit Co. (EARN) – Dividend Yield of 16.2%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On May 20th, 2025, Ellington Credit reported its first quarter results for the period ending March 31, 2025. The company generated net loss of $(7.9) million, or $(0.23) per share.

Ellington achieved adjusted distributable earnings of $9.0 million in the quarter, leading to adjusted earnings of $0.26 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 5.27% overall. At quarter end, Ellington had $17.4 million in cash and cash equivalents, and $152 million of other unencumbered assets.

The debt-to-equity ratio was 2.2X. Book value per share saw a reduction from the previous quarter to $6.08, a 7% sequential decrease.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

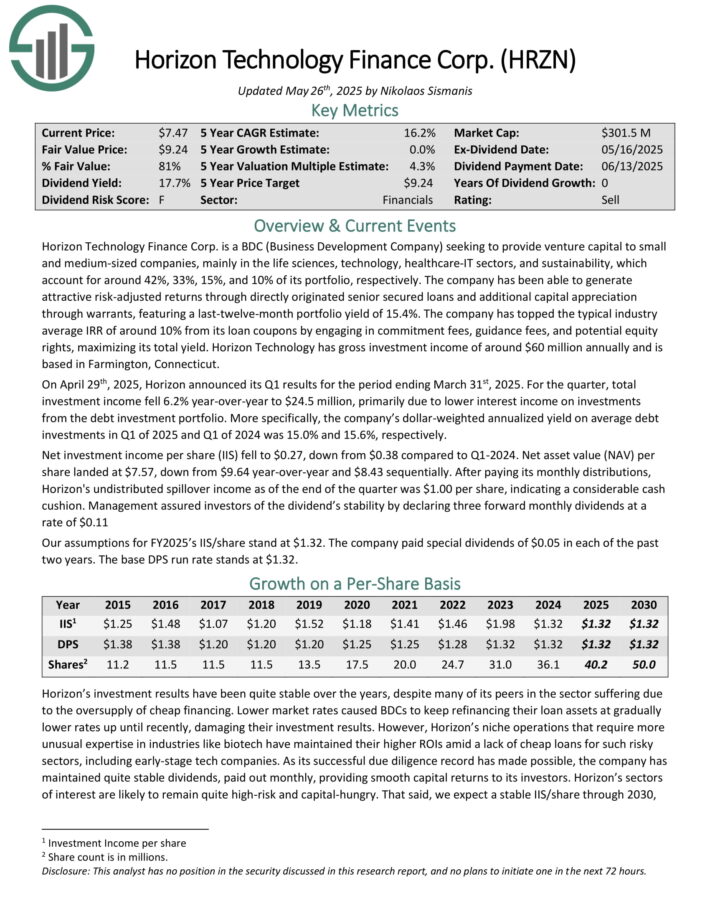

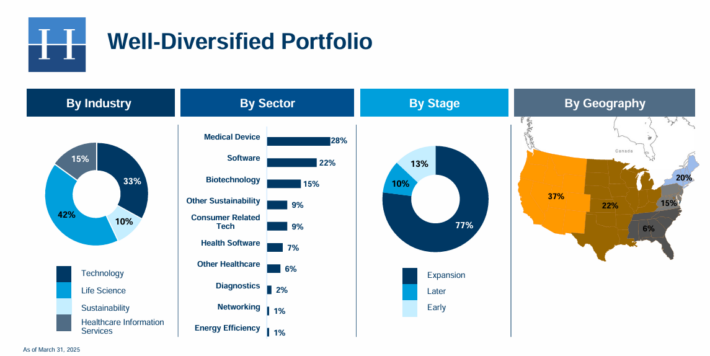

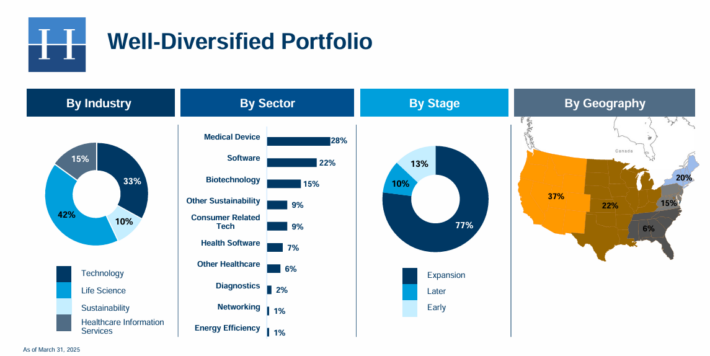

Low-Priced High Dividend Stock #4: Horizon Technology Finance (HRZN) – Dividend Yield of 16.3%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Source: Investor Presentation

On April 29th, 2025, Horizon announced its Q1 results for the period ending March 31st, 2025. For the quarter, total investment income fell 6.2% year-over-year to $24.5 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q1 of 2025 and Q1 of 2024 was 15.0% and 15.6%, respectively.

Net investment income per share (IIS) fell to $0.27, down from $0.38 compared to Q1-2024. Net asset value (NAV) per share landed at $7.57, down from $9.64 year-over-year and $8.43 sequentially.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

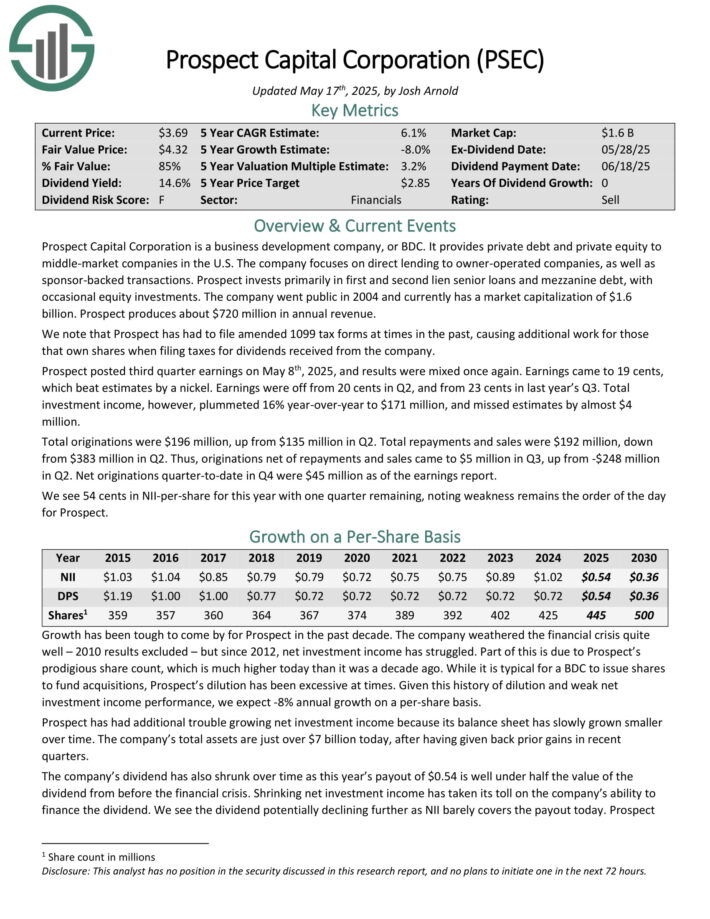

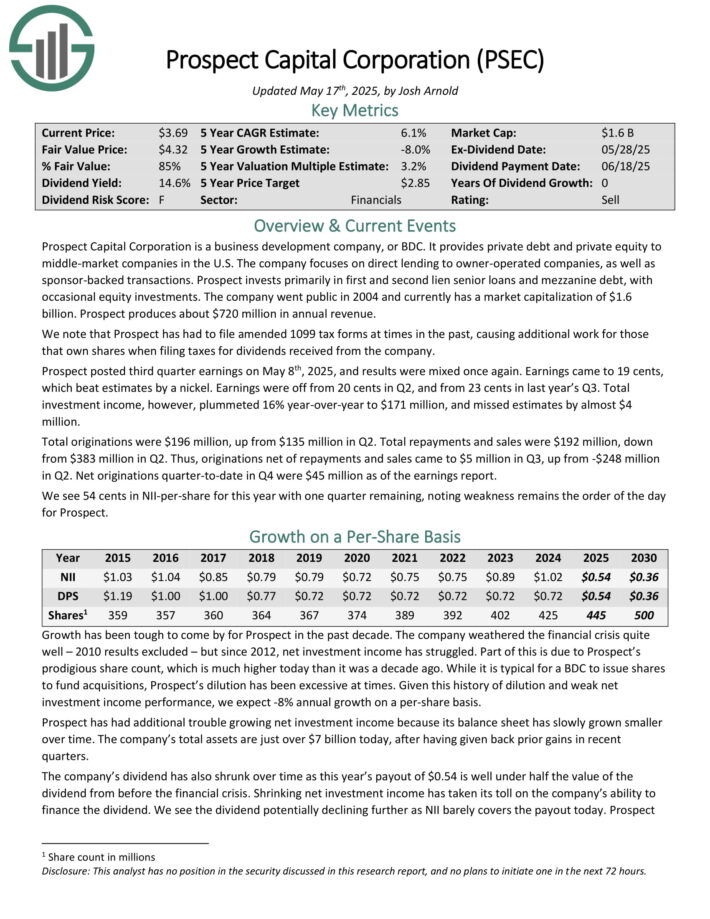

Low-Priced High Dividend Stock #3: Prospect Capital (PSEC) – Dividend Yield of 16.4%

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted third quarter earnings on May 8th, 2025, and results were mixed once again. Earnings came to 19 cents, which beat estimates by a nickel. Earnings were off from 20 cents in Q2, and from 23 cents in last year’s Q3.

Total investment income, however, plummeted 16% year-over-year to $171 million, and missed estimates by almost $4

million.

Total originations were $196 million, up from $135 million in Q2. Total repayments and sales were $192 million, down from $383 million in Q2.

Originations net of repayments and sales came to $5 million in Q3, up from -$248 million in Q2. Net originations quarter-to-date in Q4 were $45 million as of the earnings report.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

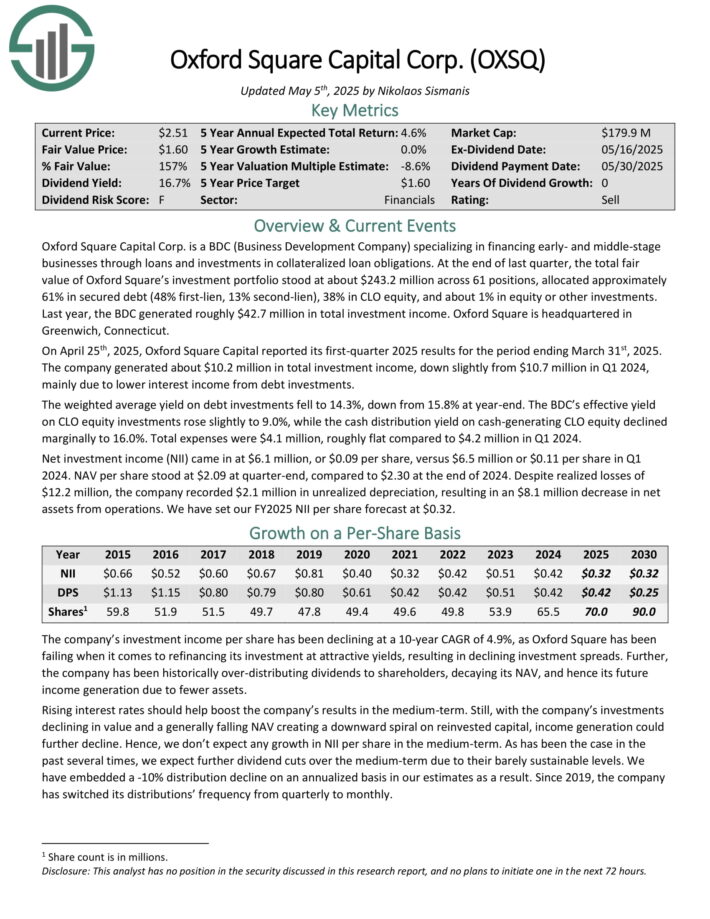

Low-Priced High Dividend Stock #2: Oxford Square Capital (OXSQ) – Dividend Yield of 18.3%

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early- and middle-stage businesses through loans and investments in collateralized loan obligations.

At the end of last quarter, the total fair value of Oxford Square’s investment portfolio stood at about $243.2 million across 61 positions, allocated approximately 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO equity, and about 1% in equity or other investments. Last year, the BDC generated roughly $42.7 million in total investment income.

On April 25th, 2025, Oxford Square Capital reported its first-quarter 2025 results for the period ending March 31st, 2025. The company generated about $10.2 million in total investment income, down slightly from $10.7 million in Q1 2024, mainly due to lower interest income from debt investments.

The weighted average yield on debt investments fell to 14.3%, down from 15.8% at year-end. The BDC’s effective yield on CLO equity investments rose slightly to 9.0%, while the cash distribution yield on cash-generating CLO equity declined marginally to 16.0%. Total expenses were $4.1 million, roughly flat compared to $4.2 million in Q1 2024.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

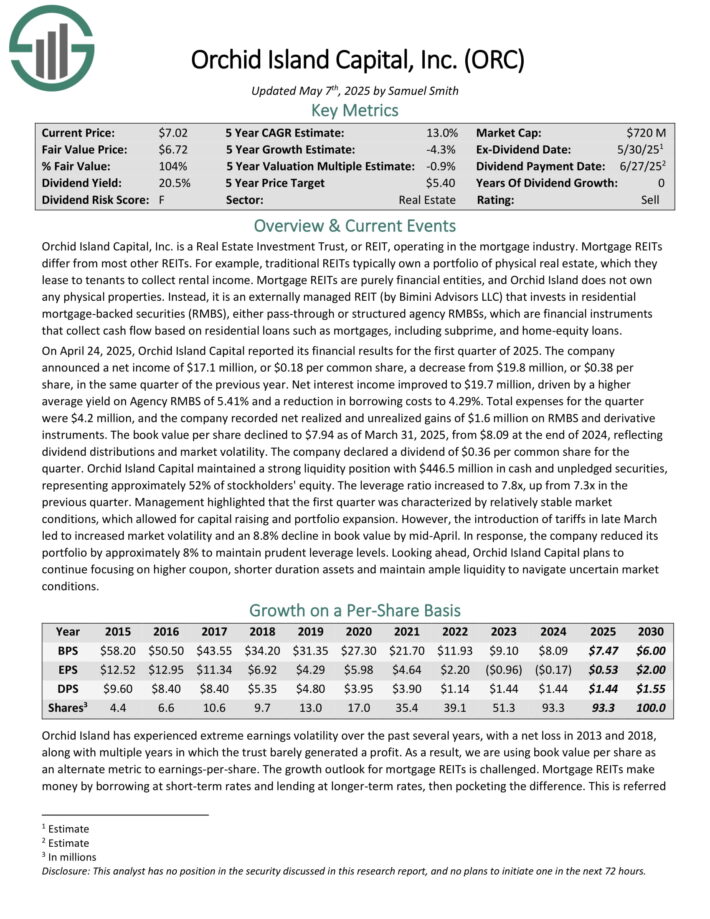

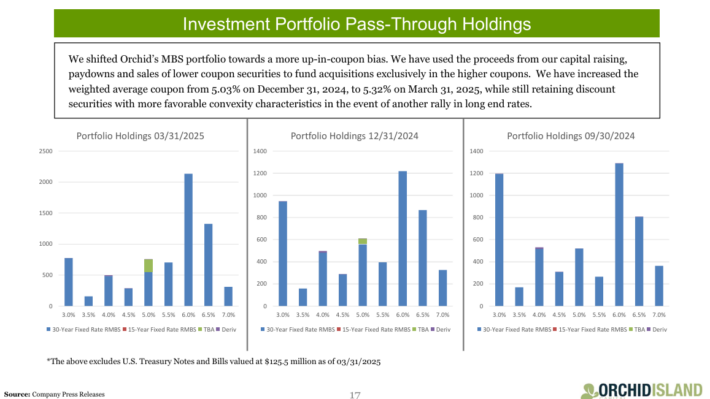

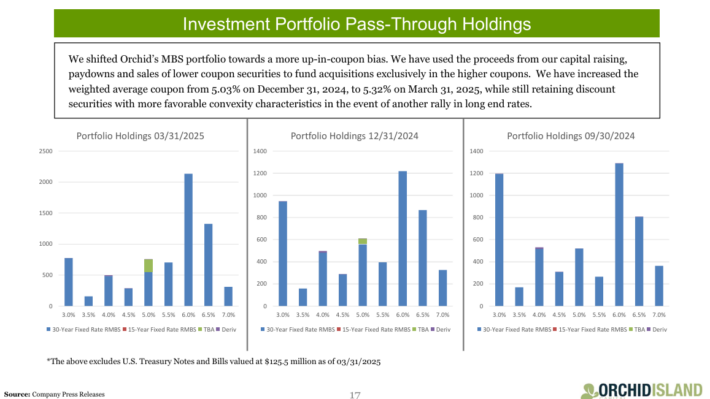

Low-Priced High Dividend Stock #1: Orchid Island Capital (ORC) – Dividend Yield of 20.1%

Orchid Island Capital, Inc. is an mREIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

On April 24, 2025, Orchid Island Capital reported its financial results for the first quarter of 2025. The company announced a net income of $17.1 million, or $0.18 per common share, a decrease from $19.8 million, or $0.38 per share, in the same quarter of the previous year.

Net interest income improved to $19.7 million, driven by a higher average yield on Agency RMBS of 5.41% and a reduction in borrowing costs to 4.29%.

Total expenses for the quarter were $4.2 million, and the company recorded net realized and unrealized gains of $1.6 million on RMBS and derivative instruments. The book value per share declined to $7.94 as of March 31, 2025, from $8.09 at the end of 2024.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Final Thoughts

When a stock offers an exceptionally high dividend yield, it usually signals that its dividend is at the risk of being cut. This rule certainly applies to most of the above stocks.

Nevertheless, some of the above stocks are highly attractive now thanks to their cheap valuation and still-high yield even after a potential reasonable dividend cut.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.