Inflation expectations are skyrocketing. The University of Michigan Survey of Consumers[1] shows that median forecasts jumped to 6.5% in April from 3.3% in January, and professional forecasters have also revised their projections upward. But history shows that both groups frequently miss the mark. The gap between expected and actual inflation has been wide and persistent, making it difficult to anticipate when and how inflation will hit portfolios. For investors, this uncertainty underscores the value of real assets, which have historically helped hedge against the surprises that traditional assets often fail to absorb.

Historically, realized inflation levels have often been quite different than consumer and forecaster expectations. This is a topic we tackle in some recent research, “Expecting the Unexpected With Real Assets.” In it, we document the historical correlation between expected inflation and actual inflation (one year later). From the third quarter of 1981 to first quarter of 2025, the correlation has been relatively low at 0.20 for consumers and only slightly higher for professional forecasters at 0.34.

This piece explores the performance of real assets in different inflationary environments, with a particular focus on performance during periods of high expected and unexpected inflation. Historical evidence suggests that real assets, which include commodities, real estate, and global infrastructure, have been especially effective diversifiers for investors concerned with inflation risk. Therefore, maintaining allocations to real assets, regardless of inflation expectations, is an excellent way to prepare a portfolio for the unexpected.

Expecting Inflation

Expectations of future inflation vary both over time and among different types of investors. There are a variety of surveys that are used to gauge these expectations. For example, the Federal Reserve Bank of Philadelphia[2] has been conducting its “Survey of Professional Forecasters” quarterly since the second quarter of 1990.[3] Respondents, including professional forecasters who produce projections in fulfillment of their professional responsibilities, are asked to provide their one-year-ahead expectations of inflation (as measured by the CPI).

In addition, the University of Michigan’s monthly survey of US households asks, “By about what percent do you expect prices to go up/down, on the average, during the next 12 months?” There are also more aggregated models such as those by the Federal Reserve Bank of Cleveland[4].

Exhibit 1 includes inflation expectations for professional forecasters (defined as responses to the Federal Reserve Bank of Philadelphia survey) and consumers (from the University of Michigan survey) from January 1978 to May 2025.

Exhibit 1: Inflation Expectations: January 1978 to May 2025

Source: Federal Reserve Bank of Philadelphia, the University of Michigan and Authors’ Calculations.

We can see that inflation expectations have varied significantly over time. While expected inflation from forecasters and consumers is often similar, with a correlation of 0.49 over the entire period, there are significant differences over time. For instance, while inflation expectations from forecasters have been relatively stable, consumer expectations have exhibited a higher level of variability — especially recently.

Expectations around inflation — like those for investment returns — play a critical role in portfolio construction. Inflation assumptions often serve as a foundational input in estimating asset return expectations (i.e., capital market assumptions). As a result, when inflation expectations are low, some investors may question the value of including real assets that are typically used to hedge inflation risk in their portfolios.

A consideration, though, is that historically there has been a decent amount of error in forecasting inflation. For example, in June 2021, the expected inflation for the subsequent 12 months among professional forecasters was approximately 2.4%, while actual inflation during that future one-year period ended up being approximately 9.0%. This gap, or estimation error, of approximately 6.6% is called unexpected inflation. The correlation between expected inflation and actual inflation (one year ahead) has been 0.34 for forecasters and 0.20 for consumers, demonstrating the sizable impact unexpected inflation can have. Put simply, while forecasts of future inflation have been somewhat useful, there have been significant differences between observed inflation and expected inflation historically.

Real Assets and Inflation

Understanding how different investments perform in different types of inflationary environments, especially different periods of unexpected inflation, is important to ensure the portfolio is as diversified as possible.

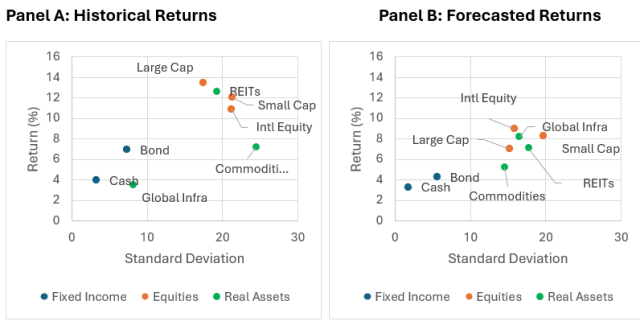

Real assets, such as commodities, real estate, and infrastructure are commonly cited as important diversifiers against inflation risk. They don’t always appear to be that beneficial, however, when the risk and returns of these assets are viewed in isolation. This effect is illustrated in Exhibit 3. Panel A shows the historical risk (standard deviations) and returns for various asset classes from Q3 1981 to Q4 2024. Panel B displays expected future returns and risk, based on the PGIM Quantitative Solutions Q4 2024 Capital Market Assumptions (CMAs).

Exhibit 2: Return and Risk for Various Asset Classes

Source: Morningstar Direct, PGIM Quantitative Solutions Q4 2024 Capital Market Assumptions and Authors’ Calculations.

We can see in Exhibit 2 that real assets, which include commodities, global infrastructure, and REITs, appear to be relatively inefficient historically when compared to the more traditional fixed income and equity asset classes when plotted on a traditional efficient frontier graph (in Panel A). However, while they may still be relatively less efficient when using forward-looking estimates (in Panel B), the expectations around lower risk-adjusted performance have narrowed.

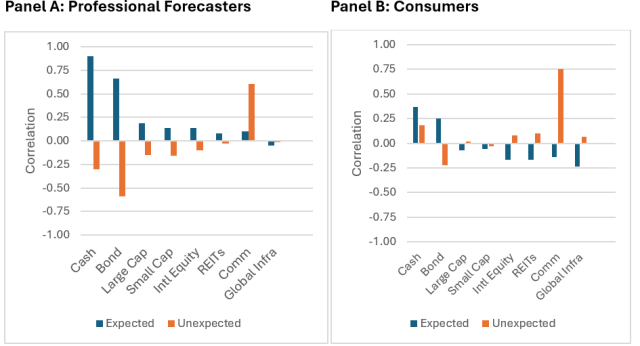

When thinking about the potential benefits of investments in a portfolio, though, it’s important to view the impact of an allocation holistically, not in isolation. Not only do real assets have lower correlations with more traditional asset classes, but they also serve as important diversifiers when inflation varies from expectations (i.e. periods of higher unexpected inflation). This effect is documented in Exhibit 3, which includes asset class return correlations with both expected and unexpected inflation levels, based on professional forecasters’ expectations (Panel A) and consumer expectations (Panel B).

Exhibit 3: Asset Class Return Correlations to Expected and Unexpected Inflation Levels: Q3 1981 to Q4 2024

Source: Morningstar Direct, Federal Reserve Bank of Philadelphia, the University of Michigan and Authors’ Calculations.

We can see in Exhibit 3 that more traditional investments, such as cash and bonds, tend to be positively correlated with expected inflation. This means as expectations around inflation increase, future realized returns for these asset classes have increased as well (consistent with most building blocks models). However, these more traditional asset classes haven’t performed as well when unexpected inflation is higher and generally exhibit negative correlations with inflation. Specifically, when unexpected inflation is relatively high, more traditional assets tend to deliver lower returns, on average.

By contrast, real assets, in particular commodities, have historically had stronger performance during periods of higher unexpected inflation. While the correlations to unexpected inflation have varied among the three real assets considered, they each collectively exhibit higher (positive) correlations to inflation than the more traditional asset classes. This isn’t necessarily surprising given the body of research on the potential benefits of allocating to real assets, but it does provide useful context as to why including real assets in a portfolio can be especially valuable for investors concerned with inflation risk, as real assets have tended to perform better during periods of higher inflation when other, more traditional assets, have not.

Key Takeaway

Real assets may seem unnecessary when inflation expectations are muted. But that view overlooks a key lesson from history: it’s the inflation we don’t expect that often matters most. Maintaining exposure to real assets helps position portfolios to weather surprises and sustain purchasing power, especially for households near or in retirement, where inflation risk can most directly impact long-term financial security.

[1] https://data.sca.isr.umich.edu/data-archive/mine.php

[2] https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/inflation-forecasts

[3] Before this data used is from surveys from the American Statistical Association (ASA) and the National Bureau of Economic Research (NBER) going back to the fourth quarter of 1968.

[4] https://www.clevelandfed.org/indicators-and-data/inflation-expectations