Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a livestream broadcast on X, independent market technician Kevin, known online as @Kev_Capital_TA, argued that crypto markets are only now entering what he called “the real bull run,” pointing to a confluence of technical signals, macroeconomic data and inter-market correlations that he believes have not been fully appreciated by traders.

The Real Bull Run Starts Here

Kevin placed particular emphasis on the behavior of Tether dominance (USDT.D), the share of crypto market capitalization held in the dollar-pegged stablecoin. The analyst displayed two long-term logarithmic USDT.D charts, each showing an initial sharp decline followed by what he described as a “rising channel slash bear flag.”

In both 2024 and the present structure, the measured-move target of the pattern sits at 3.70 percent. “It’s really astonishing how this is kind of attempting to play out,” he said, stressing that any sustainable rally in risk assets will require that level to be reached. “The two key words that are going to be the most important words over the next couple of weeks are follow through.”

Related Reading

He then overlaid a macro descending triangle on a separate two-week USDT.D chart dating back to March 2020. Each time the two-week Stochastic RSI crossed downward, the dominance metric fell sharply, coinciding with periods of strength in Bitcoin and altcoins. The latest cross, now curling lower, again targets 3.70 percent. If that support were to give way, Kevin allowed, a deeper slide toward “the two-percent handle” could mark a “peak bull market” phase—though he cautioned against speculating that far ahead.

The technical discussion broadened to Bitcoin’s hash-ribbon indicator, which tracks miner capitulation and recovery. Historically, weekly “buy” signals have preceded 40 to 100 percent upside moves within nine weeks, with what Kevin called a “100 percent hit rate” over eight years of back-testing.

Kevin linked the on-chain data to macro conditions. Citing the real-time inflation gauge “Truthflation,” he highlighted a 1.66 percent reading—below the Federal Reserve’s nominal 2 percent target—and falling import prices, both of which, he argued, increase the odds of an imminent shift to easier policy. “If Truthflation stays below 2 percent, you’re going to get the easing you want,” he said, predicting that markets would price in an end to quantitative tightening ahead of any official announcement. “Retail traders are becoming more educated than they’ve ever been.… The market will sniff out rate cuts coming.”

Altcoin capital rotation formed a second pillar of the bullish thesis. Ethereum’s market-share chart, he said, had been basing at 2019-2020 lows, with monthly MACD, Stochastic RSI and Market Cipher signals all turning up. Early reallocations into ETH-beta names such as Chainlink and Uniswap are already “up 60 percent” from their accumulation zones, he claimed, framing the moves as the foothills of a broader run. Nonetheless, he warned viewers not to wait for central-bank confirmation: “Don’t be the person sitting on the sidelines waiting for Powell to come out saying QT is over.”

Related Reading

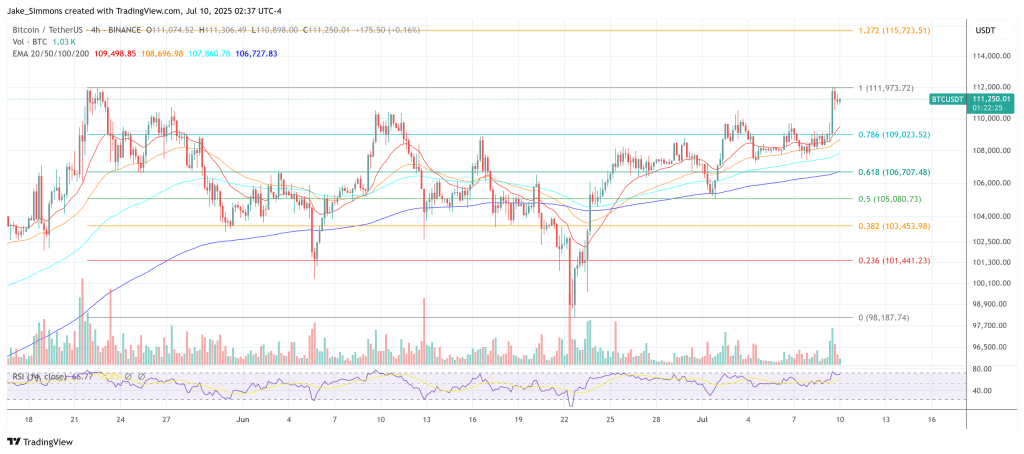

Turning to Bitcoin itself, Kevin acknowledged that the benchmark still faces substantial resistance. Price must clear the March record, then the $112,000–$116,000 range and, ultimately, $120,000 before “thin air” opens a path to $140,000–$150,000. Similarly, the “total three” index—market cap excluding Bitcoin and Ethereum—needs a daily close above $877 billion and, crucially, the yellow-shaded resistance band that has capped rallies five times since February. Only then, he argued, would a new all-time high for the broader alt-basket come into view.

Despite the optimism, Kevin repeatedly returned to the notion that conviction without confirmation is premature. “We need to see real deal price action,” he said, noting that Bitcoin’s daily RSI has not reached the 90-plus “euphoria” zone since 2017. He called the post-March tape “down-trending crappy price action” and insisted that any declaration of a full-fledged cycle peak must await multiple days of decisive follow-through.

In closing, the analyst underscored the time sensitivity of the opportunity. With the halving behind and the traditional four-year cycle ostensibly entering its final phase, “you’ve got five to six months of what should be elite-level price action,” he said. Whether or not the textbook cycle ends on schedule will depend, in his view, on the interaction between a Federal Reserve pivot and the crypto market’s ability to anticipate it.

For now, Kevin’s roadmap is unambiguous: monitor USDT dominance for a breakdown toward 3.70 percent, watch for successive hash-ribbon buy signals, and demand momentum “follow through” above the identified technical hurdles. If those conditions are met, he contends, the rally that many traders thought was already under way will reveal itself as only the warm-up act for “the real bull run.”

At press time, BTC traded at $111,250.

Featured image created with DALL.E, chart from TradingView.com