Published on July 7th, 2025 by Bob Ciura

The technology industry is one of the most exciting areas of the stock market, known for its high growth and propensity to create huge returns for early investors.

Until recently, the technology sector was not known for being a source of high-quality dividend investment ideas.

This is no longer the case.

Today, some of the most appealing dividend stocks come from the tech sector.

With that in mind, we’ve compiled a list of 130+ technology stocks complete with important investing metrics, which you can download by clicking below:

It is not easy to find dividend stocks from the tech sector that have higher yields than the S&P 500 average (currently at 1.3%).

Indeed, the Technology Select Sector SPDR ETF (XLK) yields just 0.6% right now.

However, high dividend tech stocks do exist. This article will discuss the 10 highest yielding stocks in the Sure Analysis Research Database.

The stocks are ranked in order of current dividend yield, in ascending order.

Table of Contents

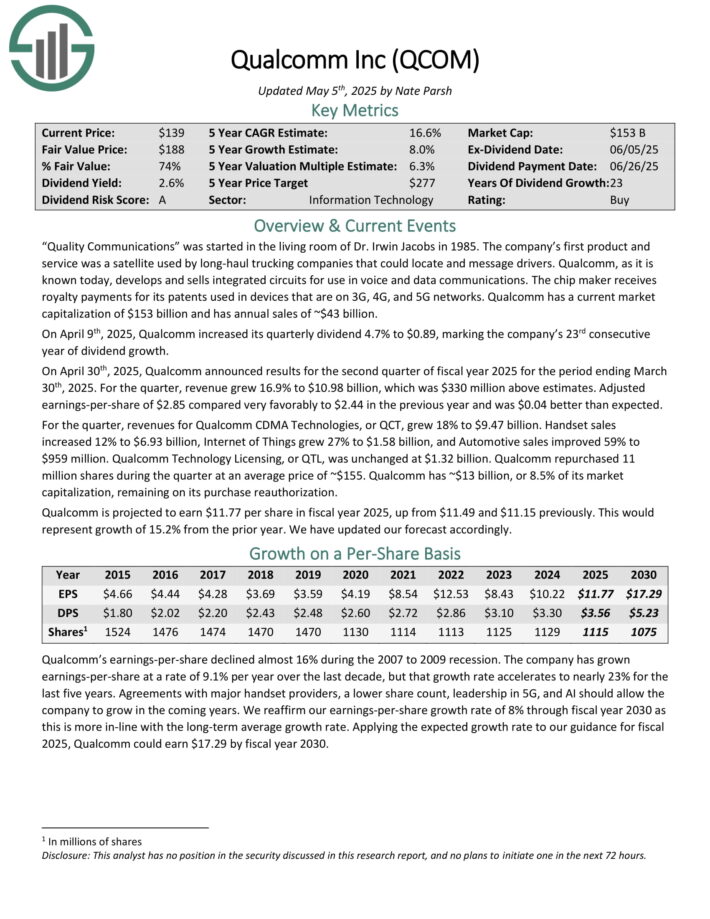

High Dividend Tech Stock #10: Qualcomm Inc. (QCOM)

Qualcomm develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G, 4G, and 5G networks. Qualcomm has annual sales of ~$43 billion.

On April 9th, 2025, Qualcomm increased its quarterly dividend 4.7% to $0.89, marking the company’s 23rd consecutive year of dividend growth.

On April 30th, 2025, Qualcomm announced results for the second quarter of fiscal year 2025 for the period ending March 30th, 2025. For the quarter, revenue grew 16.9% to $10.98 billion, which was $330 million above estimates.

Adjusted earnings-per-share of $2.85 compared very favorably to $2.44 in the previous year and was $0.04 better than expected.

For the quarter, revenues for Qualcomm CDMA Technologies, or QCT, grew 18% to $9.47 billion. Handset sales increased 12% to $6.93 billion, Internet of Things grew 27% to $1.58 billion, and Automotive sales improved 59% to $959 million. Qualcomm Technology Licensing, or QTL, was unchanged at $1.32 billion.

Qualcomm repurchased 11 million shares during the quarter at an average price of ~$155. Qualcomm has ~$13 billion, or 8.5% of its market capitalization, remaining on its purchase reauthorization.

Qualcomm is projected to earn $11.77 per share in fiscal year 2025.

Click here to download our most recent Sure Analysis report on QCOM (preview of page 1 of 3 shown below):

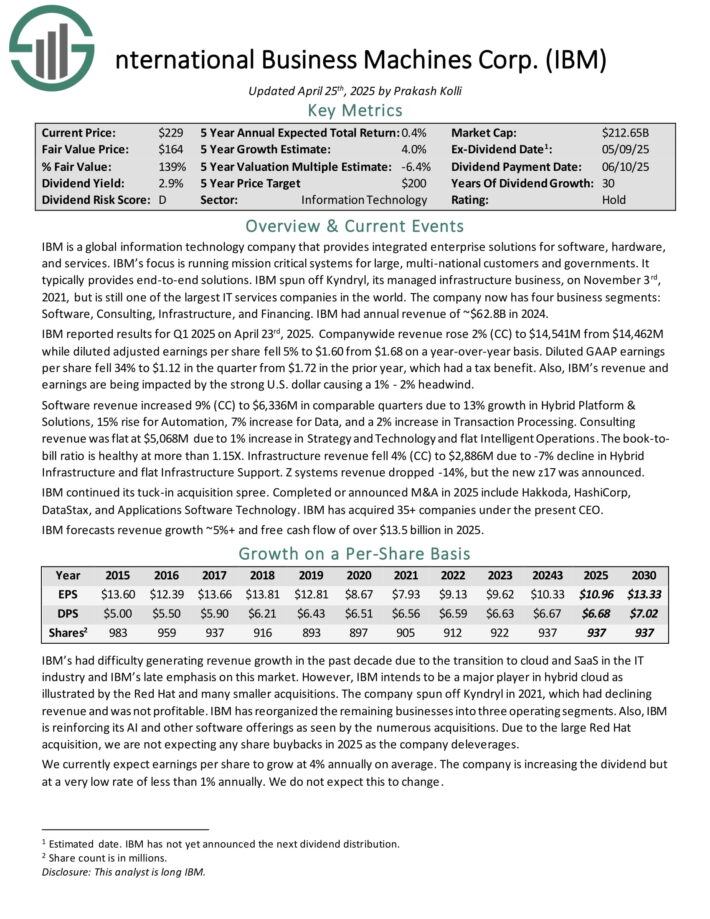

High Dividend Tech Stock #9: International Business Machines (IBM)

IBM is a global information technology company that provides integrated enterprise solutions for software, hardware, and services.

IBM’s focus is running mission critical systems for large, multi-national customers and governments. It typically provides end-to-end solutions.

The company now has four business segments: Software, Consulting, Infrastructure, and Financing. IBM had annual revenue of ~$62.8B in 2024.

IBM reported results for Q1 2025 on April 23rd, 2025. Company-wide revenue rose 2% while diluted adjusted earnings per share fell 5% to $1.60 from $1.68 on a year-over-year basis.

Diluted GAAP earnings per share fell 34% to $1.12 in the quarter from $1.72 in the prior year, which had a tax benefit. Also, IBM’s revenue and earnings are being impacted by the strong U.S. dollar causing a 1% – 2% headwind.

Software revenue increased 9% in comparable quarters due to 13% growth in Hybrid Platform & Solutions, 15% rise for Automation, 7% increase for Data, and a 2% increase in Transaction Processing.

Consulting revenue was flat due to 1% increase in Strategy and Technology and flat Intelligent Operations. The book-to-bill ratio is healthy at more than 1.15X.

Infrastructure revenue fell 4% (CC) due to -7% decline in Hybrid Infrastructure and flat Infrastructure Support. Z systems revenue dropped -14%, but the new z17 was announced.

Click here to download our most recent Sure Analysis report on IBM (preview of page 1 of 3 shown below):

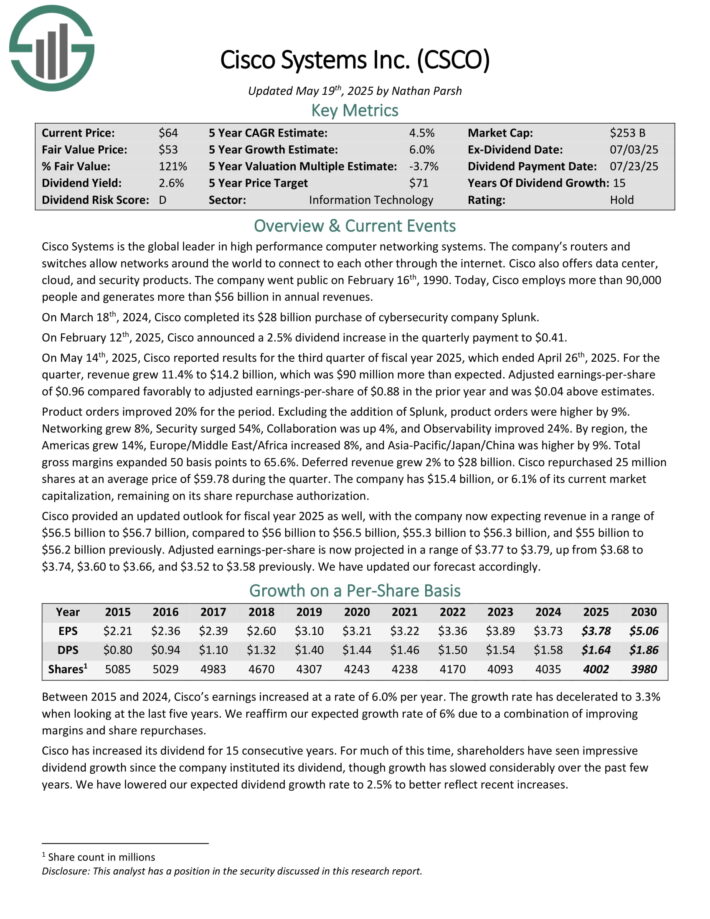

High Dividend Tech Stock #8: Cisco Systems (CSCO)

Cisco Systems is the global leader in high performance computer networking systems. The company’s routers and switches allow networks around the world to connect to each other through the internet. Cisco also offers data center, cloud, and security products.

On May 14th, 2025, Cisco reported results for the third quarter of fiscal year 2025, which ended April 26th, 2025. For the quarter, revenue grew 11.4% to $14.2 billion, which was $90 million more than expected. Adjusted earnings-per-share of $0.96 compared favorably to adjusted earnings-per-share of $0.88 in the prior year and was $0.04 above estimates.

Product orders improved 20% for the period. Excluding the addition of Splunk, product orders were higher by 9%. Networking grew 8%, Security surged 54%, Collaboration was up 4%, and Observability improved 24%. By region, the Americas grew 14%, Europe/Middle East/Africa increased 8%, and Asia-Pacific/Japan/China was higher by 9%.

Click here to download our most recent Sure Analysis report on Cisco Systems (CSCO) (preview of page 1 of 3 shown below):

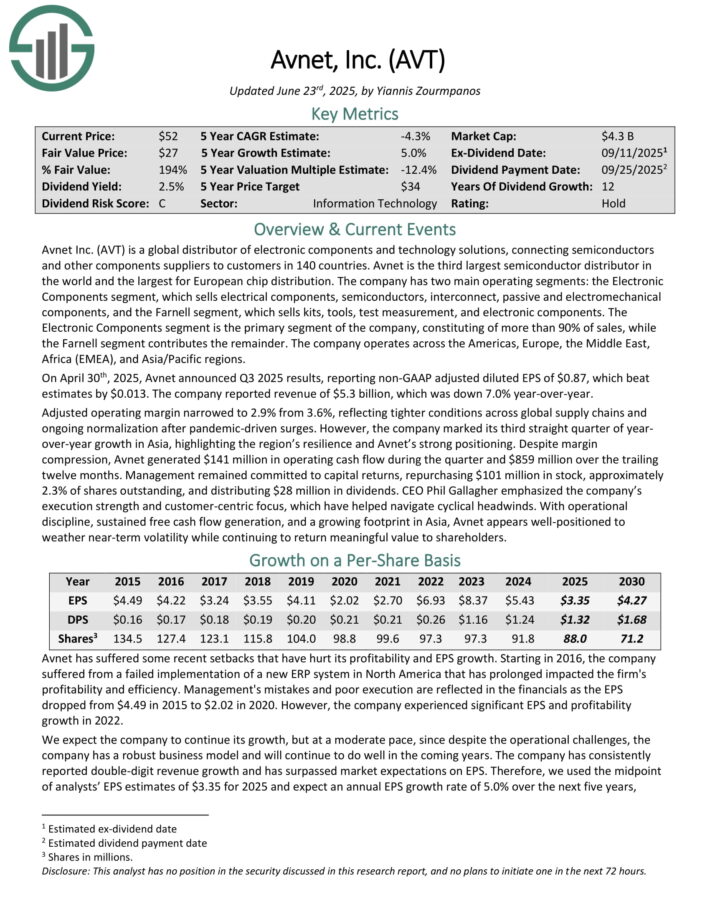

High Dividend Tech Stock #7: Avnet Inc. (AVT)

Avnet is a global distributor of electronic components and technology solutions, connecting semiconductors and other components suppliers to customers in 140 countries. Avnet is the third-largest semiconductor distributor in the world and the largest for European chip distribution.

The company has two main operating segments: the Electronic Components segment, which sells electrical components, semiconductors, interconnect, passive and electro-mechanical components, and the Farnell segment, which sells kits, tools, test measurement, and electronic components.

The Electronic Components segment is the primary segment of the company, constituting of more than 90% of sales, while the Farnell segment contributes the remainder. The company operates across the Americas, Europe, the Middle East, Africa (EMEA), and Asia/Pacific regions.

On April 30th, 2025, Avnet announced Q3 2025 results, reporting non-GAAP adjusted diluted EPS of $0.87, which beat estimates by $0.013. The company reported revenue of $5.3 billion, which was down 7.0% year-over-year.

Adjusted operating margin narrowed to 2.9% from 3.6%, reflecting tighter conditions across global supply chains and ongoing normalization after pandemic-driven surges.

Despite margin compression, Avnet generated $141 million in operating cash flow during the quarter and $859 million over the trailing twelve months.

Management remained committed to capital returns, repurchasing $101 million in stock, approximately 2.3% of shares outstanding, and distributing $28 million in dividends.

Click here to download our most recent Sure Analysis report on AVT (preview of page 1 of 3 shown below):

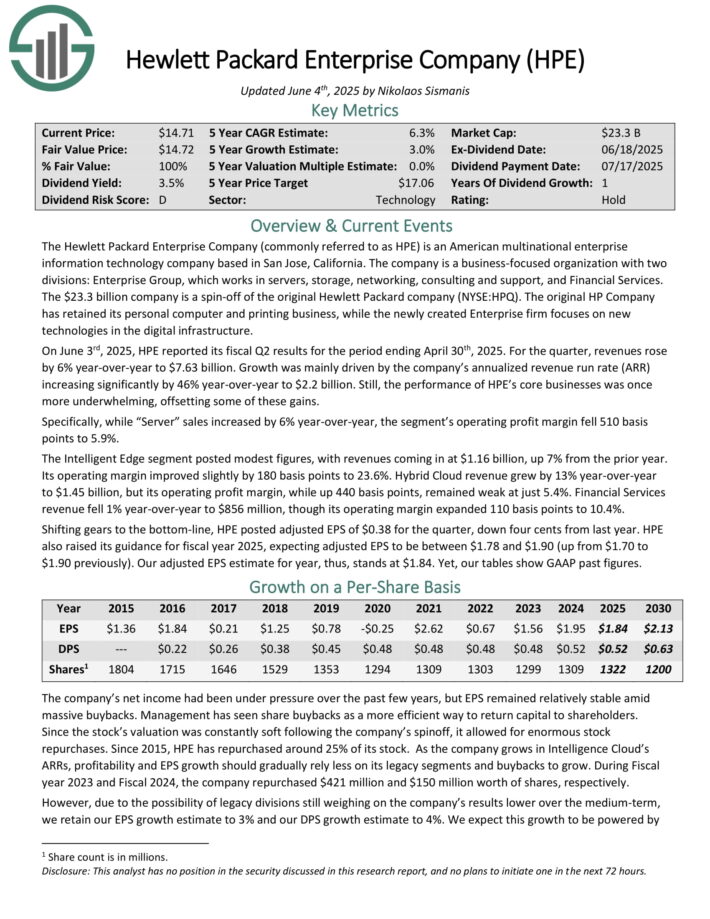

High Dividend Tech Stock #6: Hewlett Packard Enterprise (HPE)

The Hewlett Packard Enterprise Company (commonly referred to as HPE) is an American multinational enterprise information technology company based in San Jose, California.

The company is a business-focused organization with two divisions: Enterprise Group, which works in servers, storage, networking, consulting and support, and Financial Services. The Enterprise firm focuses on new technologies in the digital infrastructure.

On June 3rd, 2025, HPE reported its fiscal Q2 results for the period ending April 30th, 2025. For the quarter, revenues rose by 6% year-over-year to $7.63 billion.

Growth was mainly driven by the company’s annualized revenue run rate (ARR) increasing significantly by 46% year-over-year to $2.2 billion. Still, the performance of HPE’s core businesses was once more underwhelming, offsetting some of these gains.

Specifically, while “Server” sales increased by 6% year-over-year, the segment’s operating profit margin fell 510 basis points to 5.9%. The Intelligent Edge segment posted modest figures, with revenues coming in at $1.16 billion, up 7% from the prior year.

Its operating margin improved slightly by 180 basis points to 23.6%. Hybrid Cloud revenue grew by 13% year-over-year to $1.45 billion, but its operating profit margin, while up 440 basis points, remained weak at just 5.4%.

Financial Services revenue fell 1% year-over-year to $856 million, though its operating margin expanded 110 basis points to 10.4%.

HPE posted adjusted EPS of $0.38 for the quarter, down four cents from last year. HPE also raised its guidance for fiscal year 2025, expecting adjusted EPS to be between $1.78 and $1.90.

Click here to download our most recent Sure Analysis report on HPE (preview of page 1 of 3 shown below):

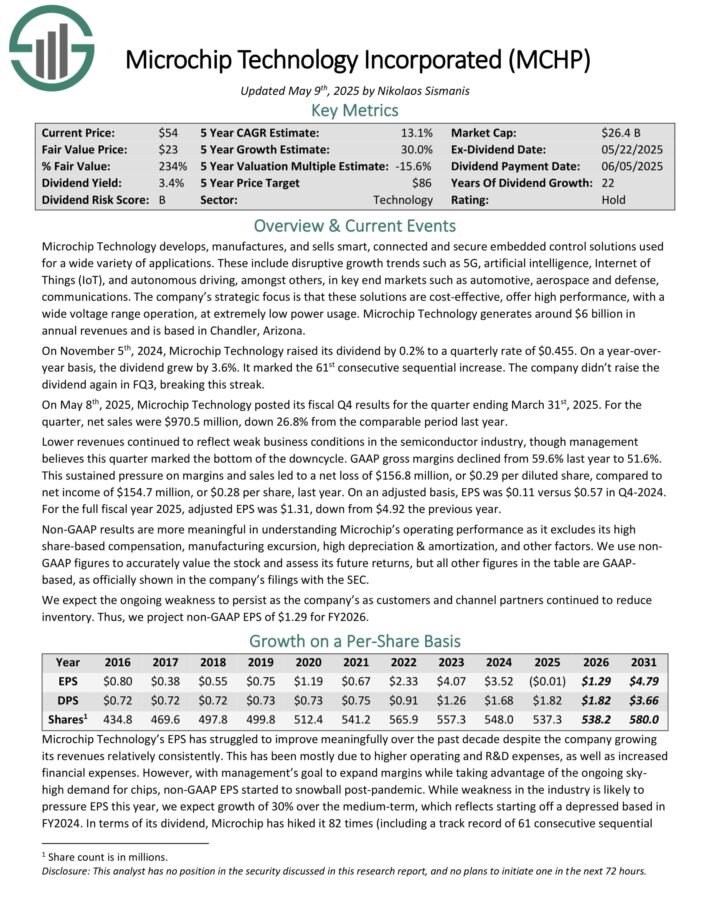

High Dividend Tech Stock #5: Microchip Technology (MCHP)

Microchip Technology develops, manufactures, and sells smart, connected and secure embedded control solutions used for a wide variety of applications.

These include disruptive growth trends such as 5G, artificial intelligence, Internet of Things (IoT), and autonomous driving, amongst others, in key end markets such as automotive, aerospace and defense, communications.

Microchip Technology generates around $6 billion in annual revenues and is based in Chandler, Arizona.

On May 8th, 2025, Microchip Technology posted its fiscal Q4 results for the quarter ending March 31st, 2025. For the quarter, net sales were $970.5 million, down 26.8% from the comparable period last year.

Lower revenues continued to reflect weak business conditions in the semiconductor industry, though management believes this quarter marked the bottom of the downcycle. GAAP gross margins declined from 59.6% last year to 51.6%.

This sustained pressure on margins and sales led to a net loss of $156.8 million, or $0.29 per diluted share, compared to net income of $154.7 million, or $0.28 per share, last year.

On an adjusted basis, EPS was $0.11 versus $0.57 in Q4-2024. For the full fiscal year 2025, adjusted EPS was $1.31, down from $4.92 the previous year.

Click here to download our most recent Sure Analysis report on MCHP (preview of page 1 of 3 shown below):

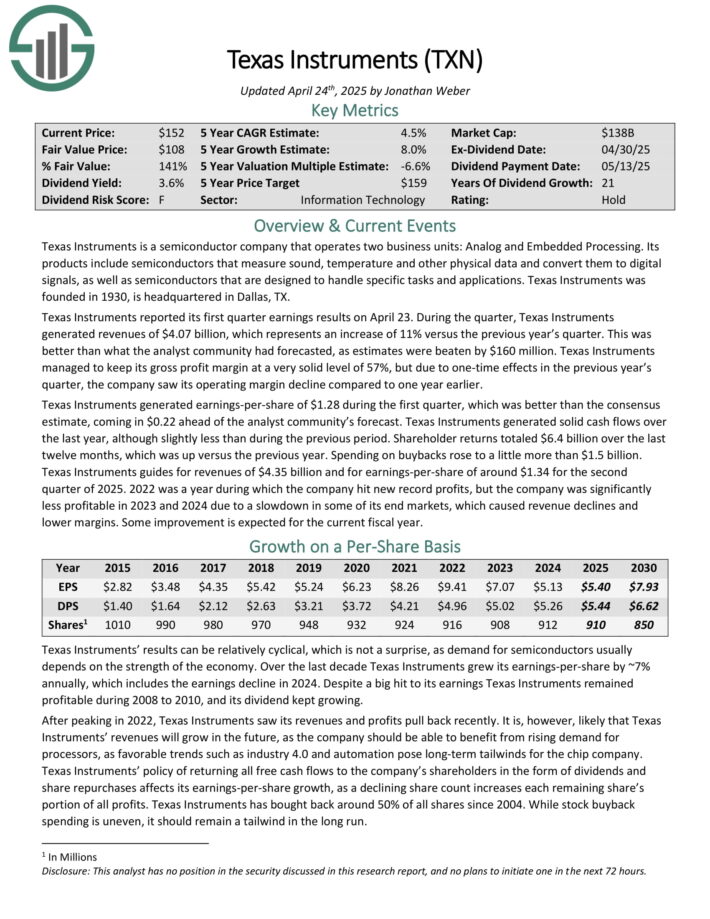

High Dividend Tech Stock #4: Texas Instruments (TXN)

Texas Instruments is a semiconductor company that operates two business units: Analog and Embedded Processing.

Its products include semiconductors that measure sound, temperature and other physical data and convert them to digital signals, as well as semiconductors that are designed to handle specific tasks and applications.

Texas Instruments reported its first quarter earnings results on April 23. During the quarter, Texas Instruments generated revenues of $4.07 billion, which represents an increase of 11% versus the previous year’s quarter.

This was better than what the analyst community had forecasted, as estimates were beaten by $160 million. Texas Instruments managed to keep its gross profit margin at a very solid level of 57%.

Texas Instruments generated earnings-per-share of $1.28 during the first quarter, which was better than the consensus estimate, coming in $0.22 ahead of the analyst community’s forecast. Texas Instruments generated solid cash flows over the last year, although slightly less than during the previous period.

Shareholder returns totaled $6.4 billion over the last twelve months, which was up versus the previous year. Spending on buybacks rose to a little more than $1.5 billion.

Texas Instruments guides for revenues of $4.35 billion and for earnings-per-share of around $1.34 for the second quarter of 2025.

Click here to download our most recent Sure Analysis report on TXN (preview of page 1 of 3 shown below):

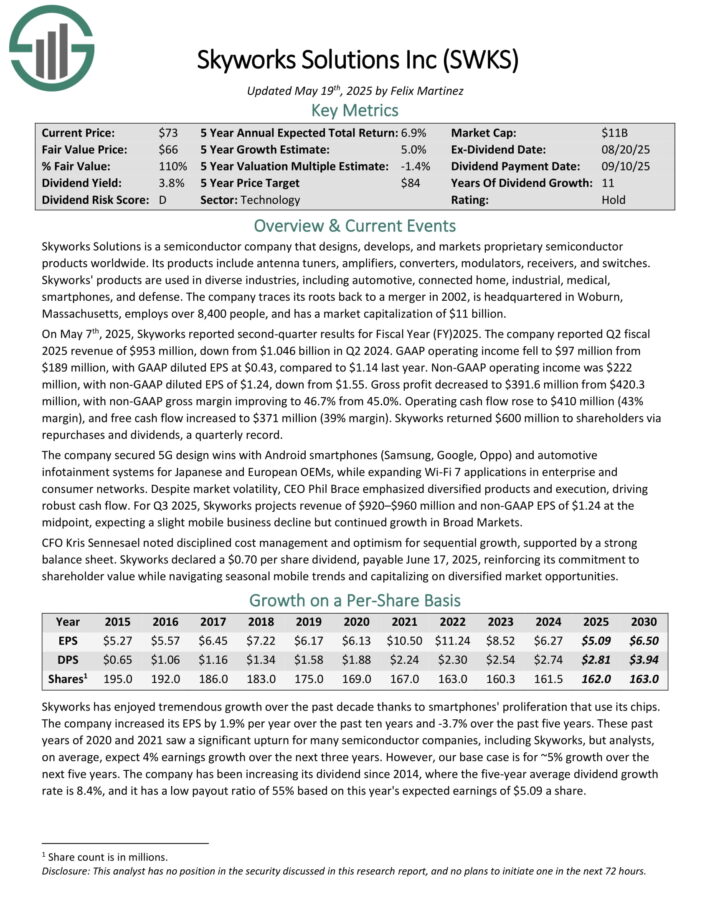

High Dividend Tech Stock #3: Skyworks Solutions (SWKS)

Skyworks Solutions is a semiconductor company that designs, develops, and markets proprietary semiconductor products worldwide. Its products include antenna tuners, amplifiers, converters, modulators, receivers, and switches.

Skyworks’ products are used in diverse industries, including automotive, connected home, industrial, medical, smartphones, and defense.

On May 7th, 2025, Skyworks reported second-quarter results for Fiscal Year (FY)2025. The company reported Q2 fiscal 2025 revenue of $953 million, down from $1.046 billion in Q2 2024.

GAAP operating income fell to $97 million from $189 million, with GAAP diluted EPS at $0.43, compared to $1.14 last year. Non-GAAP operating income was $222 million, with non-GAAP diluted EPS of $1.24, down from $1.55.

Skyworks returned $600 million to shareholders via repurchases and dividends, a quarterly record.

The company secured 5G design wins with Android smartphones (Samsung, Google, Oppo) and automotive infotainment systems for Japanese and European OEMs, while expanding Wi-Fi 7 applications in enterprise and consumer networks.

Click here to download our most recent Sure Analysis report on SWKS (preview of page 1 of 3 shown below):

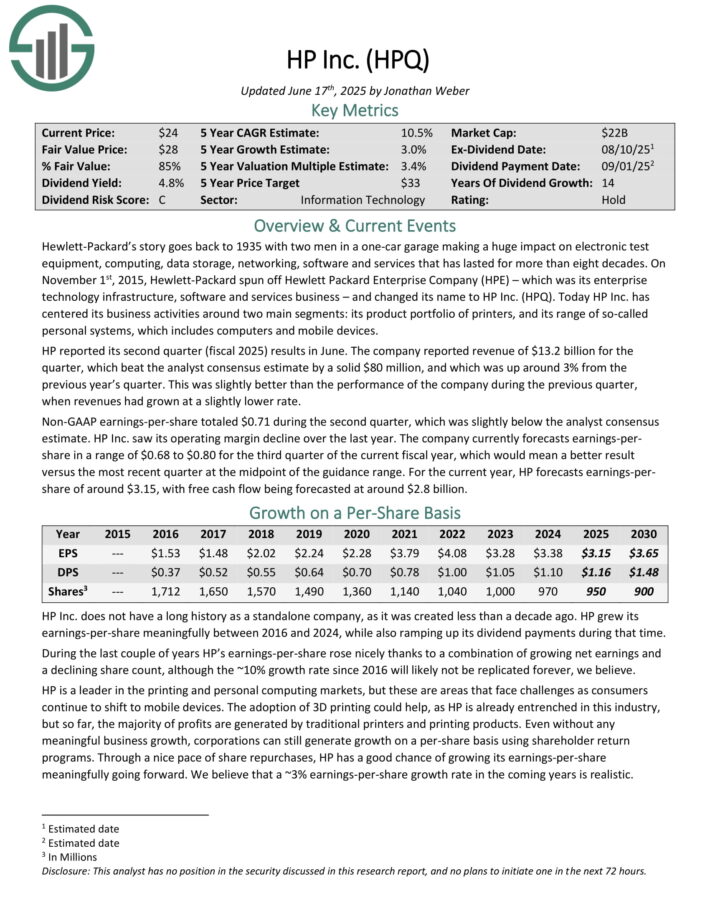

High Dividend Tech Stock #2: HP Inc. (HPQ)

Hewlett-Packard’s story goes back to 1935 with two men in a one-car garage making a huge impact on electronic test equipment, computing, data storage, networking, software and services that has lasted for more than eight decades.

HP Inc. has centered its business activities around two main segments: its product portfolio of printers, and its range of so-called personal systems, which includes computers and mobile devices.

HP reported its second quarter (fiscal 2025) results in June. The company reported revenue of $13.2 billion for the quarter, which beat the analyst consensus estimate by a solid $80 million, and which was up around 3% from the previous year’s quarter.

This was slightly better than the performance of the company during the previous quarter, when revenues had grown at a slightly lower rate.

Non-GAAP earnings-per-share totaled $0.71 during the second quarter, which was slightly below the analyst consensus estimate. HP Inc. saw its operating margin decline over the last year.

The company currently forecasts earnings-per-share in a range of $0.68 to $0.80 for the third quarter of the current fiscal year.

Click here to download our most recent Sure Analysis report on HPQ (preview of page 1 of 3 shown below):

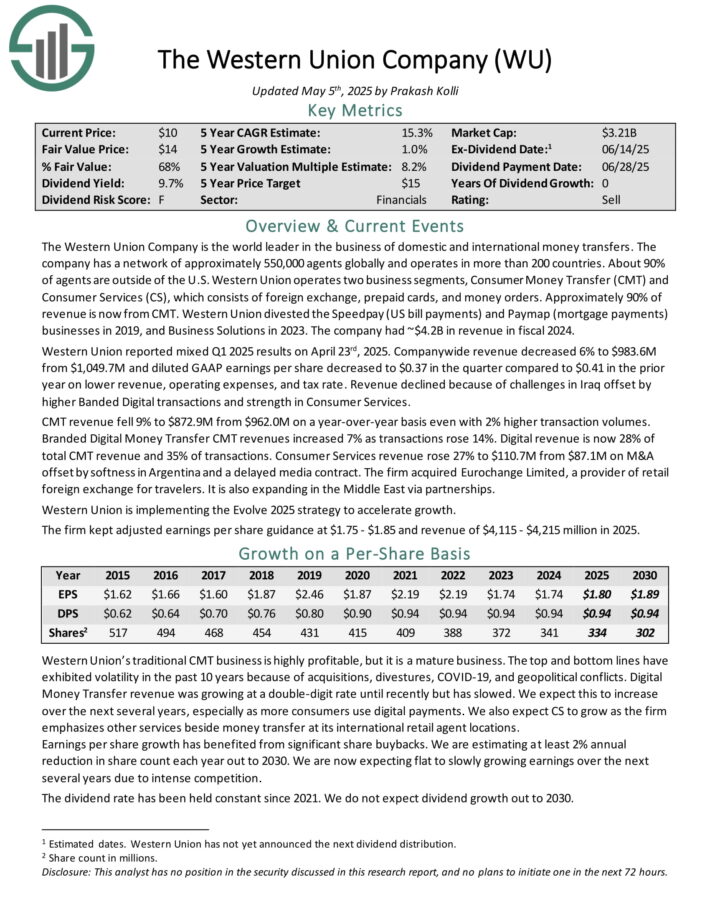

High Dividend Tech Stock #1: Western Union Company (WU)

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries.

About 90% of agents are outside of the US. Western Union operates two business segments, Consumer-to-Consumer (C2C) and Other (bill payments in the US and Argentina).

Western Union reported mixed Q1 2025 results on April 23rd, 2025. Company-wide revenue decreased 6% to $983.6M from $1,049.7M and diluted GAAP earnings per share decreased to $0.37 in the quarter compared to $0.41 in the prior year on lower revenue, operating expenses, and tax rate.

Revenue declined because of challenges in Iraq offset by higher Banded Digital transactions and strength in Consumer Services.

CMT revenue fell 9% to $872.9M from $962.0M on a year-over-year basis even with 2% higher transaction volumes. Branded Digital Money Transfer CMT revenues increased 7% as transactions rose 14%. Digital revenue is now 28% of total CMT revenue and 35% of transactions.

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

Final Thoughts

The tech sector has not historically been known for dividends, but this has changed in the past several years.

Many large, established tech stocks now pay dividends to shareholders.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.