With AI igniting an investor frenzy, every month, more startups obtain unicorn status.

Using data from Crunchbase and PitchBook, TechCrunch tracked down the VC-backed startups that became unicorns so far this year. While most are AI-related, a surprising number are focused in other industries like satellite space companies like Loft Orbital and blockchain-based trading site Kalshi.

This list will be updated throughout the year, so check back and see the latest powerhouse startups who are now worth over $1 billion.

June

Linear — $1.25 billion: This software development product management tool last raised an $82 million Series C, valuing the company at $1.25 billion, according to Pitchbook. The company, founded in 2019, has raised more than $130 million in funding to date from investors including Accel and Sequoia Capital.

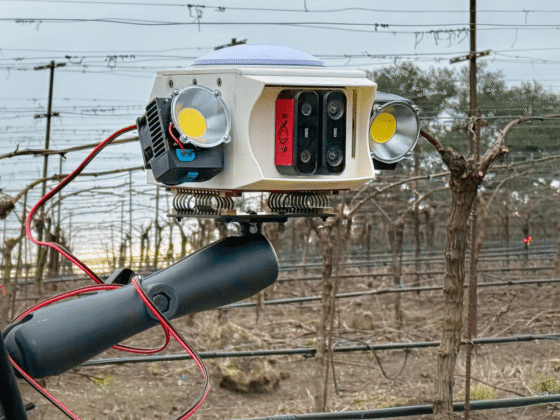

Gecko — $1.62 billion: This company makes data-gathering robotics that climb, crawl, swim, and fly. Founded in 2013, the company last raised a $121 million Series D, valuing the company at $1.6 billion, according to Pitchbook. The company has raised more than $340 million in funding to date from investors including Cox Enterprises and Drive Capital.

Meter — $1.38 billion: This company, which offers managed Internet infrastructure service to enterprises, last raised a $170 million Series C, valuing the company at $1.38 billion, according to Pitchbook. The company, founded in 2015, has raised more than $250 in funding to date, from investors including General Catalyst, Sequoia Capital, Sam Atlaman, and Lachy Groom.

Teamworks — This sports software company last raised a $247 million Series F, valuing the company at $1.25 billion, according to Pitchbook. The company, founded in 2006, has raised more than $400 million in funding to date from investors including Seaport Capital and General Catalyst.

Thinking Machines — This AI research company, founded just last year by OpenAI alumn Mira Murati, raised a $2 billion seed round, valuing the company at $10 billion, according to Pitchbook. The company’s investors include a16z and Nvidia.

Kalshi — $2 billion: The popular prediction markets company, founded in 2018, last raised an $185 million Series C, valuing the company at $2 billion, according to Pitchbook. The company has raised more than $290 million in funding to date, from investors including Sequoia and Global Founders Capital.

Decagon — This customer service AI agent company, founded in 2023, last raised a $131 million Series C, valuing the company at $1.5 billion, according to Pitchbook. The company has raised more than $231 million in funding to date, from investors including a16z and Accel.

May

Pathos — $1.6 billion: This drug development company, founded in 2020, last raised a $365 million Series D, valuing the company at $1.6 billion, according to Pitchbook. The company has raised more than $460 million to date from investors, including General Catalyst and Altimeter Capital Management.

Statsig — $1.1 billion: This product development platform, founded in 2021, last raised an $100 million Series C, valuing the company at $1.1 billion, according to Pitchbook. The company has raised around $153 million to date, from investors including Sequoia, Mardona, and ICONIQ Growth.

SpreeAI — $1.5 billion: This shopping tech company last raised an undisclosed round, according to Pitchbook, that valued the company at $1.5 billion. The company, founded in 2020, has raised more than $20 million to date from investors including The Davidson Group.

Function — $2.5 billion: This health tech company, founded in 2020, last raised a $200 million round, according to Pitchbook, valuing the company at $2.5 billion. The company has raised more than $250 million in funding to date, from investors including a16z.

Owner — $1 billion: This restaurant marketing software company, founded in 2018, last raised a $120 million Series C, valuing the company at $1 billion, per Pitchbook. The company has raised more than $180 million in funding to date, from investors including Headline, Redpoint Ventures, SaaStr Fund, and Meritech Capital.

Awardco — $1 billion: This employee engagement platform last raised a $165 million Series B, valuing the company at $1 billion, per Pitchbook. The company, founded in 2012, has raised more than $230 million in funding to date, from investors including General Catalyst.

April

Nourish — $1 billion: This dietitian tele-health company last raised a $70 million Series B, according to Pitchbook, valuing the company at $1 billion. The company, founded in 2020, has raised more than $100 million in funding to date from investors including Index Ventures and Thrive Capital.

Chapter — $1.38 billion: This Medicare guide health tech company, founded in 2013, last raised a $75 million Series D, valuing it at $1.38 billion, according to Pitchbook. The company has raised $186 million in funding to date, with investors including XYZ Venture Capital and Narya.

Threatlocker — $1.2 billion: This Orlando-based data protection company last raised a $60 million Series E, valuing the company at $1.2 billion, according to Pitchbook. The company, founded in 2017, has raised more than $200 million in funding to date, from investors including General Atlantic and StepStone Group.

Cyberhaven — $1 billion: This data detection company last raised a $100 million Series D in April, according to Pitchbook, valuing the company at $1 billion. The company, launched in 2015, has raised more than $200 million in funding to date, with investors including Khlosa Ventrues and Redpoint Ventures.

March

Fleetio — $1.5 billion: This Alabama-based startup creates software to help make fleet operations easier. It last raised a $454 million Series D at a $1.5 billion valuation, according to PitchBook. It was launched in 2012 and has raised $624 million in funding to date, with investors including Elephant and Growth Equity at Goldman Sachs Alternatives.

The Bot Company — $2 billion: This robotics platform last raised a $150 million early-stage round, valuing it at $2 billion, according to PitchBook. The company, which was founded in 2024, has raised $300 million to date in funding.

Celestial AI — $2.5 billion: The AI company raised a $250 million Series C led by Fidelity that valued the company at $2.5 billion, per Crunchbase. The company, based in California, was launched in 2020 and counts BlackRock and Engine Ventures as investors. It has raised more than $580 million in capital to date, per PitchBook.

Underdog Fantasy — $1.3 billion: The sports gaming company last raised a $70 million Series C valuing the company at $1.3 billion, according to Crunchbase. The company, founded in 2020, has raised more than $100 million in capital to date, per PitchBook. Investors include Spark Capital.

Build Ops — $1 billion: This software company last raised a $122.6 million Series C, valuing it at $1 billion. Build Ops, which was launched in 2018, has raised $273 million in total, according to PitchBook, with investors including Founders Fund and Fika Ventures.

Insilico Medicine — $1 billion: The drug research company raised a $110 million Series E valuing the company at $1 billion, per Crunchbase. It launched in 2014, has raised more than $500 million to date in capital, and counts Lilly Ventures and Value Partners Group as investors.

Olipop — $2 billion: This popular probiotic soda company last raised a $137.9 million Series C at a $1.96 billion valuation. It was founded in 2018 and has raised $243 million to date with investors including Scoop Ventures and J.P. Morgan Growth Equity Partners.

Peregrine — $2.5 billion: This data analysis and integration platform, launched in 2017, last raised a $190 million Series C with a valuation of $2.5 billion. It has raised more than $250 million in funding to date, according to PitchBook, with investors including Sequoia and Fifth Down Capital.

Assured — $1 billion: The AI company helps process claims and last raised a $23 million Series B, valuing the company at $1 billion. It was launched in 2019 and has raised a little more than $26 million to date, with investors including ICONIQ Capital and Kleiner Perkins.

February

Abridge — $2.8 billion: This medtech company, founded in 2018, last raised a $250 million Series D at a $2.75 billion valuation, per PitchBook. The company has raised more than $460 million to date in funding and counts Elad Gil and IVP as investors.

OpenEvidence — $1 billion: This medtech company, founded in 2017, last raised a $75 million Series A at a $1 billion valuation, per PitchBook. The company has raised $135 million to date in funding and counts Sequoia Capital as an investor.

Hightouch — $1.2 billion: The data platform, founded in 2018, last raised an $80 million Series C at a $1.2 billion valuation, per PitchBook. The company has raised $171 million to date in funding and counts Sapphire Ventures and Bain Capital Ventures as investors.

January

Kikoff — $1 billion: This personal finance platform last raised an undisclosed amount that valued it at $1 billion, according to PitchBook. The company, founded in 2019, has raised $42.5 million to date and counts Female Founders Fund, Lightspeed Venture Partners, and basketballer Steph Curry as investors.

Netradyne — $1.35 billion: Founded in 2015, this computer vision startup raised a $90 million Series D valuing it at $1.35 billion, according to Crunchbase. The round was led by Point72 Ventures.

Hippocratic AI — $1.6 billion: This startup, founded in 2023, creates healthcare models. It raised a $141 million Series B, valuing it at $1.64 billion, according to Crunchbase. The round was led by Kleiner Perkins.

Truveta — $1 billion: This genetic research company raised a $320 million round valuing it at $1 billion, according to Crunchbase. Founded in 2020, its investors include the CVCs from Microsoft and Regeneron Pharmaceuticals.

Clay — $1.25 billion: Founded in 2017, Clay is an AI sales platform. The company raised a $40 million Series B, valuing it at $1.25 billion, according to PitchBook. It has raised more than $100 million to date and counts Sequoia, First Round, Boldstar, and Box Group as investors.

Mercor — $2 billion: This contract recruiting startup raised a $100 million Series B valuing it at $2 billion. The company, founded in 2022, counts Felicis, Menlo Ventures, Jack Dorsey, Peter Thiel, and Anthology Fund as investors.

Loft Orbital — $1 billion: Founded in 2017, the satellite company raised a $170 million Series C valuing the company at $1 billion, according to Crunchbase. Investors in the round included Temasek and Tikehau Capital.

This post was updated to reflect what Peregine does.