The first half of 2025 has been a challenging one for Singapore REITs. At the start of the year, CME FedWatch projections suggested a possible rate cut by March. However, the U.S. Federal Reserve held firm, keeping interest rates unchanged to date. In April, the announcement of US reciprocal tariffs triggered a pullback in S-REIT prices. While a 90-day extension was later granted, the looming 9 July deadline continues to weigh on sentiment.

As of 30 June, the iEdge S-REIT Index is still hovering around its starting point for the year. Now, let’s take a closer look at how individual S-REITs have performed over the past six months in terms of total return.

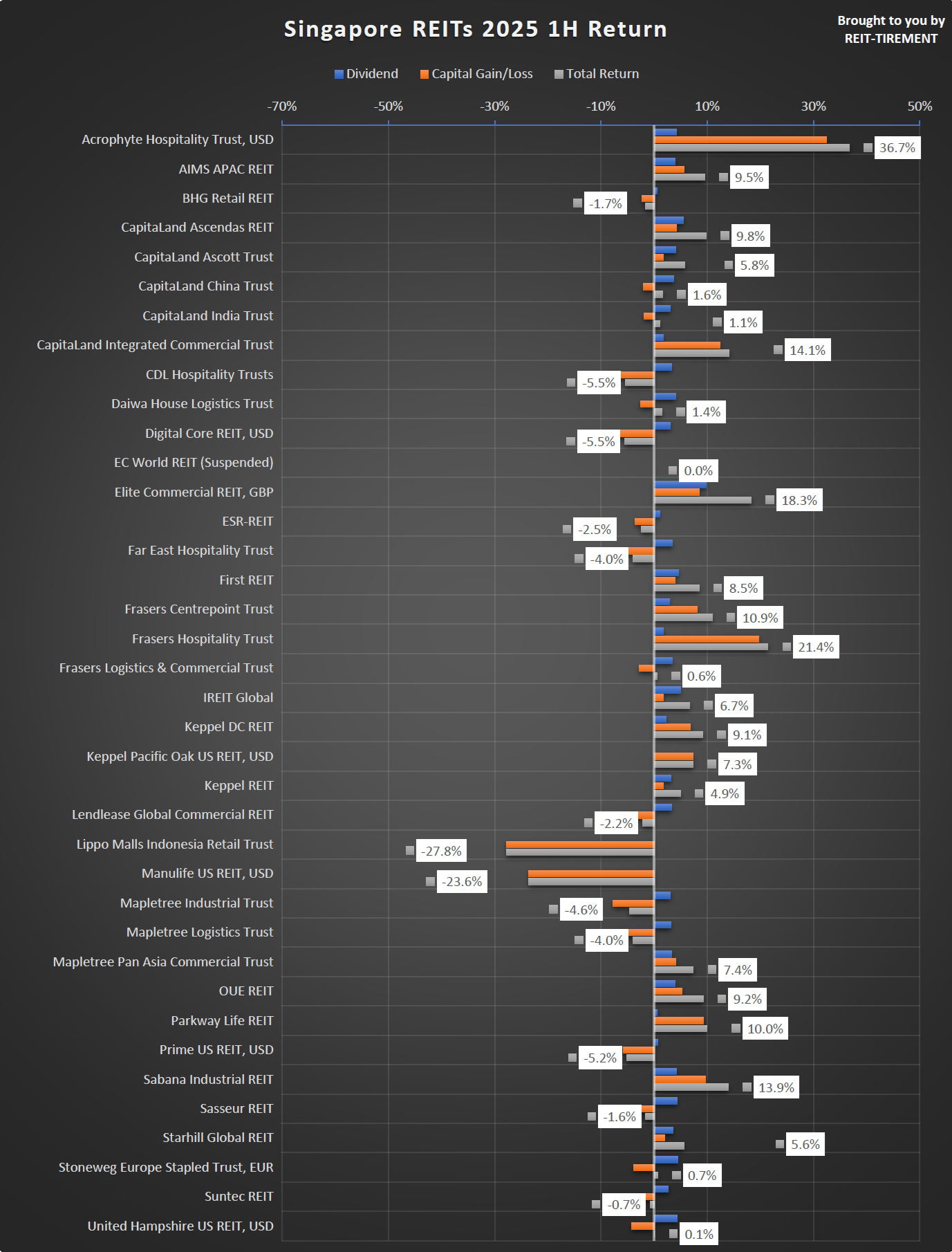

Overall Returns

The graph below shows the total returns for each counter, including Business Trust CapitaLand India Trust. Dividend yields are calculated based on ex-dividend dates.

Total returns, inclusive of dividends, have been largely positive. More than half of the S-REITs delivered…