In December last year, I made a post introducing US ETF company Avantis establishing a presence in the UCITS markets. You can read Reviewing Avantis Global Equity and Global Small Cap Value UCITS ETFs (Now Available to Singaporean Investors)

I talked more about Avantis Global Equity Fund (ticker: AVGC) and Avantis Global Small Cap Fund (AVGS) in the article mainly because they were the only available funds.

Shortly after the post, they also release the Avantis Emerging Markets Equity Fund (AVEM) to the public.

After reviewing and understanding more about the fund, I decided to reallocate the emerging market allocation in Daedalus Income Portfolio from iShares EIMI into AVEM. The main reason is to better align the portfolio to Daedalus more systematic active philosophy. I would have no problem using Dimensional’s Emerging Markets Large Cap Core Equity Fund but I wish to keep the money in my Interactive Brokers account to better compartmentalize the portfolio away from money for other financial goals.

I thought its good time I talked about it.

The fund started off as their most tiny fund with US$9 million in AUM if my memory don’t fail me too badly. Since then, they have grown the AUM to $51 million today. Some readers have asked my channels if there is a concern about their small AUM size.

I am not sure what is the concern here. Perhaps they need a certain size to remain cost efficient but I think their worry is smaller fund, more susceptible to close down. I think if the fund gives me a 100% premium performance over the benchmark index over 15 years and close down due to the size, I would not complain much.

I would just begrudgingly switch over to another fund that helps me express a systematic active philosophy for emerging markets like Dimensional Emerging Large Cap Core or iShares Edge MSCI EM Value Factor UCITS ETF USD (EMVL).

Actually EMVL will be a pretty good option.

What is more important to us is:

- We can understand whether the manager has a coherent strategy.

- Whether that strategy is sound and align to our own philosophy.

- Have they shown a history of implementing and executing the strategy well.

- Implemented in a low cost manner.

A few of these more systematic active funds and ETFs is that.

If the UCITS business does not work out for Avantis, and they do the same thing as Vanguard and leave a region, then it is not a problem.

It is a much bigger problem if they anyhow invest your money, consistently change their strategy, then decide to close down the fund. In the former case, they have invested and expose you to the risk and return in a manner you understood and agree. In the later, they basically take your money to gamble.

Avantis Emerging Markets Equity Performance

Anytime I took a look at how AVEM did against EIMI, I was quite surprised.

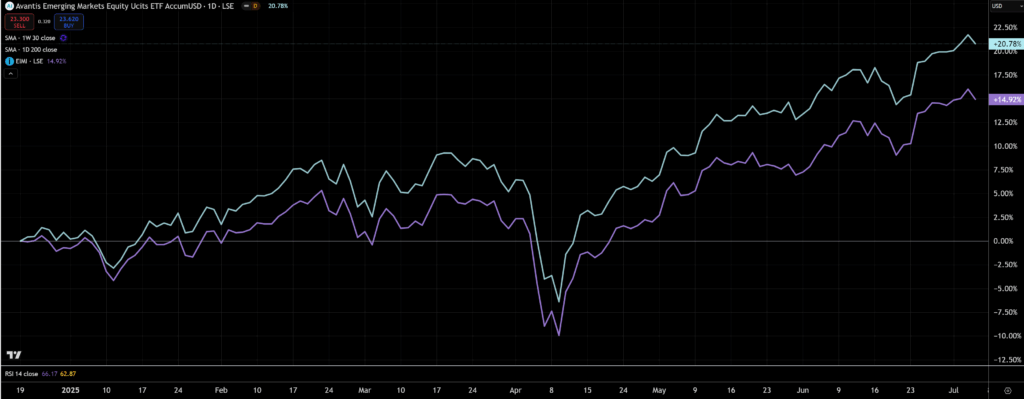

If we take a look at how AVEM (light blue) did against EIMI (light purple):

Since last Thursday, AVEM did 20.8% versus 14.9% since inception. Emerging markets have generally did well.

If you wish to track AVEM performance, you can review them at Morningstar at this page. If you try Googling Morningstar you might hit pages of different kind of return in different currencies.

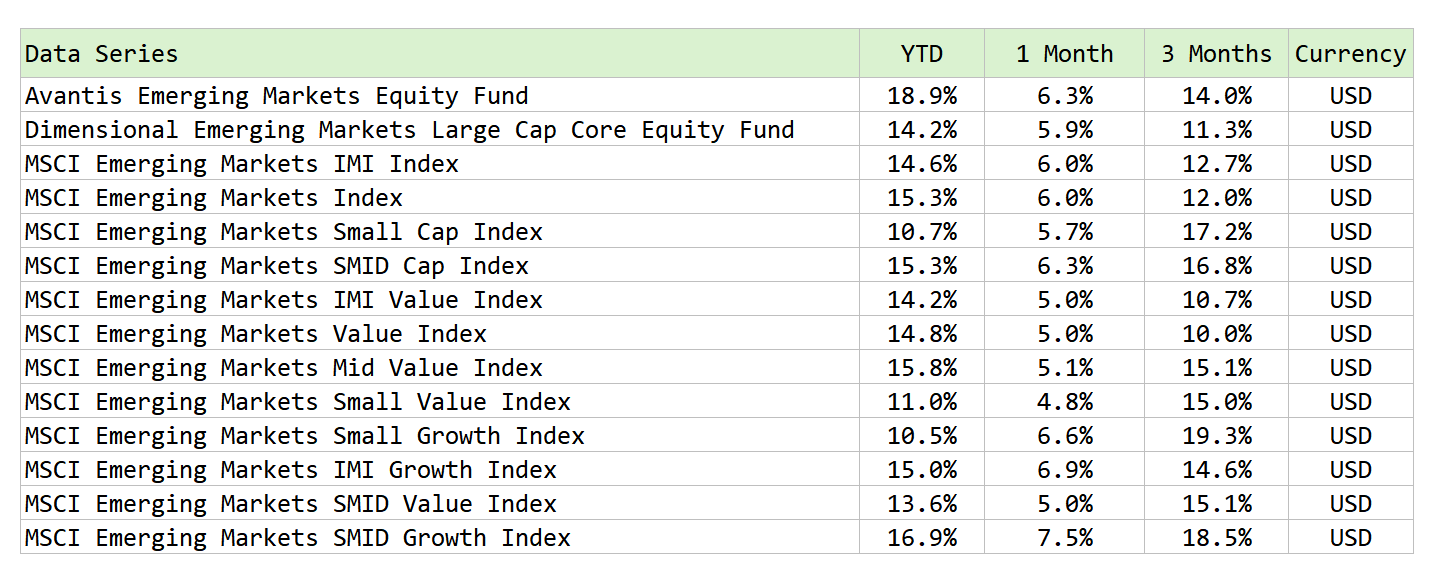

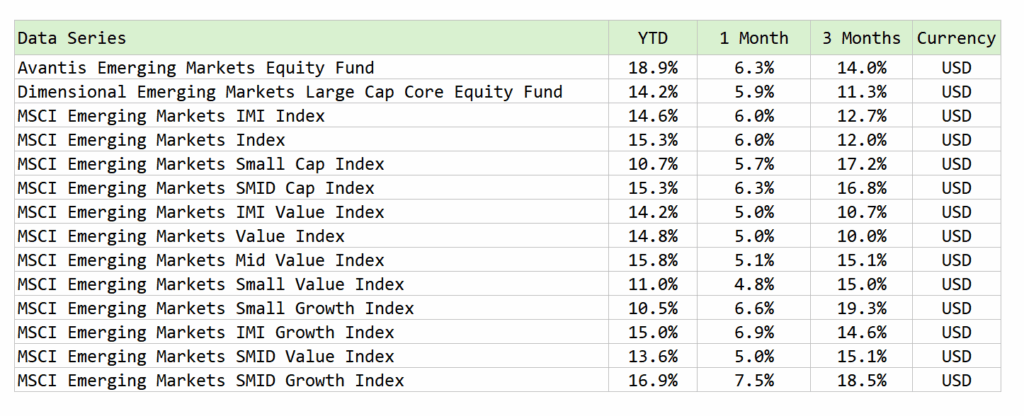

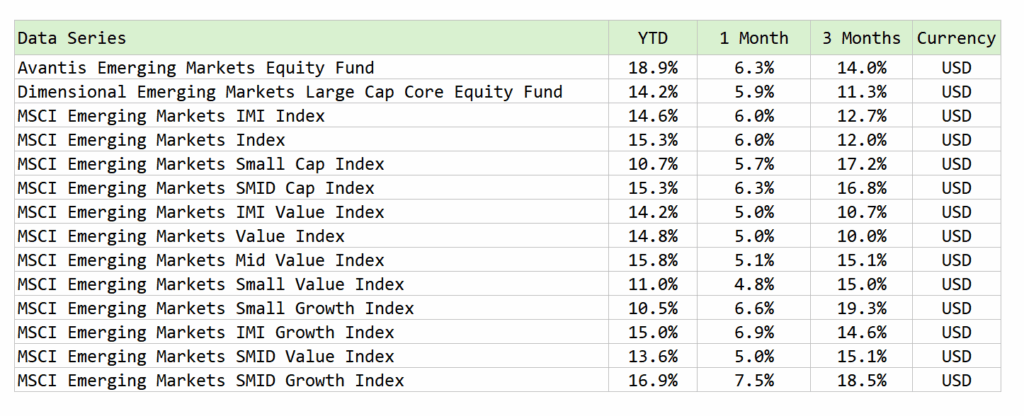

I put AVEM’s performance till end of June over here with the index return of various Emerging Market indexes:

IMI stands for Investable Market Index, which means the index includes large-cap, mid-cap and small-cap stocks. SMID stands for Small and Mid Cap so it excludes large cap stocks.

Before we start, note that this is a very short six-months. Probably not the time frame to see if this is a good fund or bad fund.

What I am trying to do is to figure out where the performance is attributed to.

Generally:

- Larger companies were doing better than the smaller companies.

- But smaller companies were doing much better than larger companies in the last three months.

- Growthy companies were doing better than cheaper companies.

- In the last 3 months, the growthy larger companies were doing better than the larger value companies.

- In the last 3 months, the growthy small companies were doing better than the small value companies.

Avantis runs a systematic strategy based around the research of what consistently gets you companies that gives high expected returns.

And that ends up with companies that are:

- Fairly profitable companies but very cheap.

- Highly profitable companies that are fair in price or even cheaper.

- Smaller companies that fit #1 and #2

If you wish to understand more about Avantis’ systematic strategy, you can read my first article on them.

AVEM benchmark against the MSCI Emerging Markets IMI index, which means unlike Dimensional’s strategy they prefer to cover some smaller companies as well. The fund is pretty diversified over 1,498 companies. The Dimensional Large Cap Core covers 1,502 companies despite its large cap focus. The MSCI Emerging Market has 1,203 companies while IMI has 3,099 companies.

Your returns will eventually be based on the securities holdings in your fund, which is ultimately based on the strategy. If it is an indexing strategy, then its based on the index weighing. If it is a systematic active strategy like Dimensional’s, EMVL or AVEM, then it is based around the systematic securities selection in the strategy.

AVEM higher weightage to the profitability factor (which tends to show up in growth companies) and greater number of small, mid size companies may have improved their performance relative to Dimensional’s. But what is remarkable is that there is a shift in large cap and small cap performance in the 6 months and AVEM managed to capture the return in the systematic manner.

If we invest in AVEM, we probably have to note that we probably get more mid-cap size companies that are more profitable and companies that are fair in value. This strategy will suck if large cap emerging markets did very well for a long time or value companies do value well for a long time.

I am pleasantly surprised by how Avantis have executed with AVEM thus far. Let’s see if I will have to swallow these words at the end of the year.

For those who are interested in investing in AVEM or EMVL, these are UCITS ETFs that are listed on the London Stock Exchange. You can invest in them through a broker such as Interactive Brokers. These ETFs are domicile in Ireland and more tax efficient. The more important point is that currently Ireland have zero estate tax for foreign non-resident. ETFs domicile in the US would have 18-40% estate tax. Of course dividend withholding tax (if there are dividends distributed) is 15% relative to 30% for the US domiciled ones.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.