Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The big news this morning is that India’s financial regulator has banned Jane Street from the country’s markets for a “sinister scheme” to manipulate Indian stocks and derivatives.

The Securities and Exchange Board of India allege that the US trading firm made $550mn of illegal gains from these strategies, which it is now wants back before the ban will be lifted. As MainFT reported:

The Securities and Exchange Board of India said its decision to limit Jane Street’s access to India’s securities markets stemmed from a months-long investigation.

“JS Group was undertaking an intentional, well planned, and sinister scheme and artifice to manipulate cash & futures markets and hence manipulate the BANKNIFTY [Indian bank stocks] index level, to entice small investors to trade at unfavourable and misleading prices, and to the advantage of the JS Group,” the regulator said in its interim order.

“Entities are restrained from accessing the securities market and are further prohibited from buying, selling or otherwise dealing in securities, directly or indirectly,” it added.

The regulator has asked Jane Street to put $550mn of “illegal gains” in an escrow account, the statement said. If this money is transferred, a person close to the investigation said, the ban could be lifted. Under Indian law, the company could ultimately face a fine up to three times that amount.

Jane Street disputes the allegations, and said in a statement that it is “committed to operating in compliance with all regulations in the regions we operate around the world”. In a letter to SEBI Jane Street said that the trades were designed to manage its options exposure.

Obviously, Alphaville jumped over to SEBI’s website to read the full interim order and have uploaded it for readers to enjoy. 🍿🍿🍿🍿🍿🍿

The first thing that stood out to us is that the trigger for SEBI’s investigation was the 2024 lawsuit that the trading firm launched against Millennium Management and two former Jane Street traders who had jumped ship to the hedge fund.

The lawsuit alleged that the traders had stolen a “highly valuable, unique, and proprietary” trading strategy, which was quickly revealed to revolve around India’s booming options market. Jane Street and Millennium settled the lawsuit in December, but judging from SEBI’s report it has cast a long (and expensive) shadow.

If you want to know the details of what SEBI terms Jane Street’s “intra-day index manipulation strategy” — which seems to be the main but not only issue here — the report zooms in on January 17, 2024 for “detailed scrutiny” because the regulator estimates that it was the most profitable day for Jane Street in India.

The regulator estimates that the trading firm made INR734.93 crore (ca $86mn) in that one day. The relevant section starts on page 12 and what it lacks in narrative flair it more than makes up for in granular detail.

Basically, SEBI alleges that Jane Street went long the Indian bank equity index BANKNIFTY through futures and the stocks themselves, but much shorter through options — with positions over seven times larger than the long position. It then allegedly dumped nearly all its long positions in BANKNIFTY stocks, hammering the stocks and lifting the value of the larger put option position.

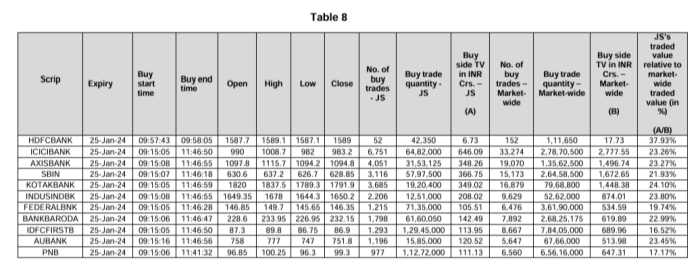

Here is a SEBI table showing Jane Street’s cash equity trading that day (high res zoomable version):

And its futures trading (high res zoomable version):

The aggregate size was humongous. SEBI estimates that Jane Street’s net trading value clocked in at about $511mn, more than three times the position of the market’s second largest player and about 15-25 per cent of the entire market’s traded value. Over the course of eight minutes, Jane Street had built a long position of INR572 crores, or $67mn.

This almost single-handedly helped lift the BANKNIFTY index by over 1 per cent over the course of the buying spree, according to the Indian financial watchdog:

The size, timing, alignment, and aggressive nature of JS Group’s buy-side trades across high-weight constituents during this window supports the inference that the Group’s actions contributed materially to this upward movement.

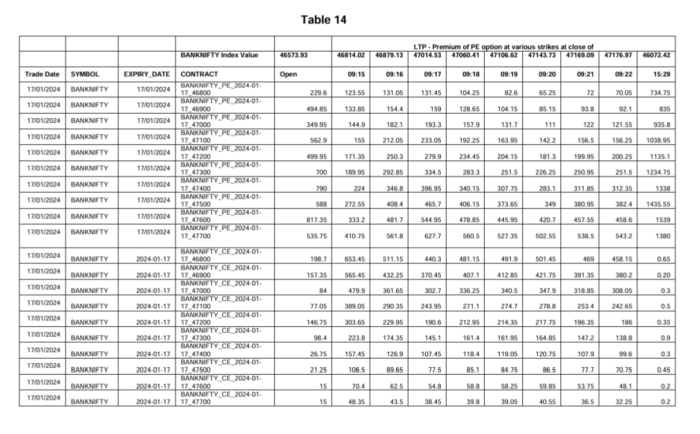

SEBI alleges that Jane Street then used this spike to aggressively sell calls and buy puts on Indian bank stocks, with the short position eventually coming totalling INR8,751 crores, or over $1bn. (high res zoomable version):

SEBI says that Jane Street then began “systematically squaring off and dumping” its long positions in futures and stocks between 11:49 and the market’s close at 15:30. As a result, the stocks tanked and the larger option positions rose in value.

The Indian regulator estimates that Jane Street lost INR61.6 crore ($7.2mn) on buying and subsequent selling of its long positions, but overall netted INR734.9 crores ($86mn) through its lucrative options trades.

The Millennium lawsuit revealed that Jane Street made $1bn in 2023 from the Indian options strategy that its defecting traders allegedly took with them to Millennium, and this must presumably be it.

Still, Jane Street’s disclosures to lenders said that Asia as a whole only accounted for 14 per cent of its $10.5bn of net trading revenues in 2023 (ie about $1.47bn), so an Indian ban is embarrassing but not disastrous for the firm. In 2024 its net trading revenues nearly doubled to $20.5bn.

We’re still going through the full 105-page report so we’ll update with anything else we spot (the alleged manipulation around the market close looks interesting). Holler in the comments if you see something we might have missed.

Further reading:

— How Jane Street rode the ETF wave to ‘obscene’ riches (FTAV)

— Jane Street interns make more than Keir Starmer and Jay Powell (FTAV)