A newly published, 38-page research titled The Bull Case for ETH contends that Ethereum (ETH) could ultimately command a fully diluted market capitalization of roughly $85 trillion, implying a long-run price near $706,000 per coin. The work—dated June 2025 and signed by twenty-one contributors including core researcher Danny Ryan, Bankless co-founder Ryan Sean Adams, and investor Vivek Raman—seeks to re-frame ETH as “digital oil”: a yield-bearing, deflationary reserve asset that simultaneously powers and secures the emerging on-chain economy.

The authors open with the claim that the global financial system “is on the cusp of a generational transformation, as assets worldwide become digitized and transition on-chain.” In this transition, they argue, Ethereum has “emerged as [the] foundation” because it combines the deepest developer community with “unparalleled reliability and zero downtime.”

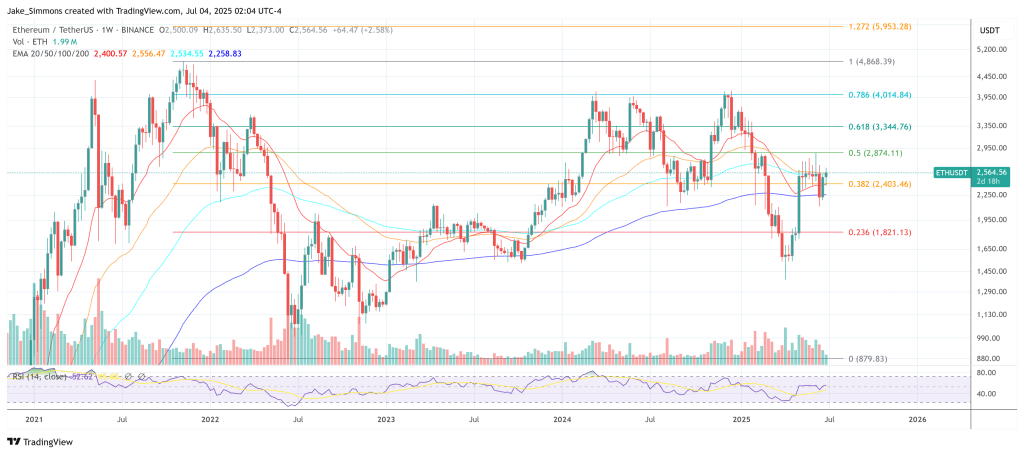

Yet, they add, ETH the asset “remains among the most significantly mispriced opportunities in global markets today,” still trading well below its 2021 peak despite a series of technical upgrades and solidifying dominance in tokenized assets and stable-coin settlement.

“ETH is the next generational asymmetric investment opportunity, positioned to emerge as a core holding for institutional digital-asset portfolios,” the report states. “It is digital oil—the fuel, collateral, and reserve asset powering the internet’s new financial system.”

Framing Ethereum Against Traditional Stores Of Value

To reach the headline valuation, the study compares Ethereum’s native asset with four established reservoirs of value: proven crude-oil reserves (~ $85 trillion), gold (~ $22 trillion), the global bond market (~ $141 trillion) and worldwide broad money supply, M2 (~ $93 trillion). averaging those four benchmarks yields an indicative “long-term potential” of $85 trillion for ETH’s aggregate valuation, or roughly $706,000 per coin.

The authors emphasise that this figure is not a price target on a timetable but rather an end-state equilibrium if Ethereum succeeds in acting simultaneously as energy commodity, monetary metal, sovereign-grade collateral and base-layer money for a digital economy.

Crucial to their thesis is Ethereum’s monetary design. Gross issuance tops out at 1.51 percent of supply per year, while roughly 80 percent of transaction fees are destroyed, driving net issuance toward deflation as on-chain activity rises.

Since the September 2022 merge to proof-of-stake, the study notes, effective supply growth has hovered near 0.09 percent—lower than both fiat money and Bitcoin. The report frames this programme as “predictable scarcity” that contrasts with Bitcoin’s hard-cap model, which the authors argue may eventually under-incentivise miners and weaken Bitcoin’s security budget.

Another pillar is staking yield: validators earn base issuance plus a share of fees for securing the chain, making staked ETH “a productive, yield-bearing digital commodity.” The paper likens that yield to gold-lending revenue or oil-reserve leasing, but emphasises that, unlike those physical commodities, ETH’s yield is natively programmable and automatically compounding.

Roughly 32.6 percent of the current ETH supply already serves as collateral in DeFi or enterprise infrastructure, while an additional 3.5 percent has migrated to other blockchains. As tokenized real-world assets proliferate, the authors foresee rising demand for a “globally neutral, censorship-resistant reserve asset” within settlement protocols—an economic role they argue only ETH can fill without external counterparty risk.

Near-Term And Medium-Term Milestones For ETH

While the ultimate scenario envisions a six-figure ETH, the study outlines interim milestones: a “short-term” price of $8,000 (~US $1 trillion market cap) and a “medium-term” level of $80,000 (~US $10 trillion). Four catalysts are identified: First, the rapid tokenization of real-world assets and institutional on-chain infrastructure. Second is the institutional appetite for native staking yield, especially once staked-ETH exchange-traded funds come to market.

The third argument is the “race to stockpile ETH,” evidenced by an embryonic strategic-reserve pool that already counts nearly US $2 billion in publicly disclosed holdings. Moreover, the authors predict growing use of ETH in treasury management, where its neutrality, programmability and yield allow automated collateral, escrows and payments.

“ETH stands alone as the neutral reserve asset uniquely positioned to secure and power the global tokenized financial system,” the authors write, characterising the current market price as “a temporary mispricing, not a structural weakness.”

However, the report’s authors also concede that Ethereum’s complexity makes valuation “more challenging” than Bitcoin’s simpler digital-gold narrative. They also warn that ETH cannot be modelled like a technology equity: discounted-cash-flow methods capture neither ETH’s commodity burn nor its role as base-layer collateral.

Nevertheless, they argue that multipronged utility—fuel, store of value, collateral and yield—creates an upside “which could even surpass Bitcoin’s.” In their words, ETH is “an entirely new category of asset,” requiring comparables drawn from energy, monetary metals, sovereign bonds and global money supplies rather than from fee-generating software platforms.

At press time, ETH traded at $2,564.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.