Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Fundraising from initial public offerings in London has tumbled to its lowest level in at least 30 years, in a stark sign of the waning attractiveness of the UK’s equity markets for companies and investors.

The five listings on UK markets in the first six months of the year raised £160mn, the lowest half-year amount in Dealogic data going back to 1995.

The total marks a 98 per cent fall from a bumper six months of fundraising at the start of 2021 during the coronavirus pandemic and is below levels reached in 2009 in the aftermath of the global financial crisis.

The figures come amid growing anxiety over the UK’s position as a global centre for equity finance as it increasingly struggles to compete with the allure of Wall Street’s deep, liquid markets.

London used to be a “Goliath equity market”, said Sharon Bell, equities strategist at Goldman Sachs. Now, she said, it was in a downward spiral that was creating a “nasty precedent.”

She added: “You get fewer companies, they are less liquid, you see the best growth companies listing elsewhere, therefore any companies that arise are reluctant to list in the UK.”

Taking into account both IPOs and follow-on issuance by listed companies, the opening six months of 2025 were the worst first half of a year for capital raised since 2012, with £8.8bn raised. Adjusted for inflation, this was the worst first half since at least 1995.

More than half of that amount came from the two final sales in GSK’s spin-off to the listed market of consumer pharmaceuticals company Haleon. The two transactions totalled just under £5bn.

The biggest IPO on UK’s public markets this year has been that of professional services firm MHA Plc, which raised £98mn when it floated on the junior Alternative Investment Market (AIM).

The data appears to confound hopes among some London financiers that 2025 could mark a revival in listings activity in London.

The latest blow to the UK stock market came this week with news that the chief executive of London’s biggest listed company, AstraZeneca, had spoken privately about moving the company’s listing to New York — a development that has led to dismay among City investors.

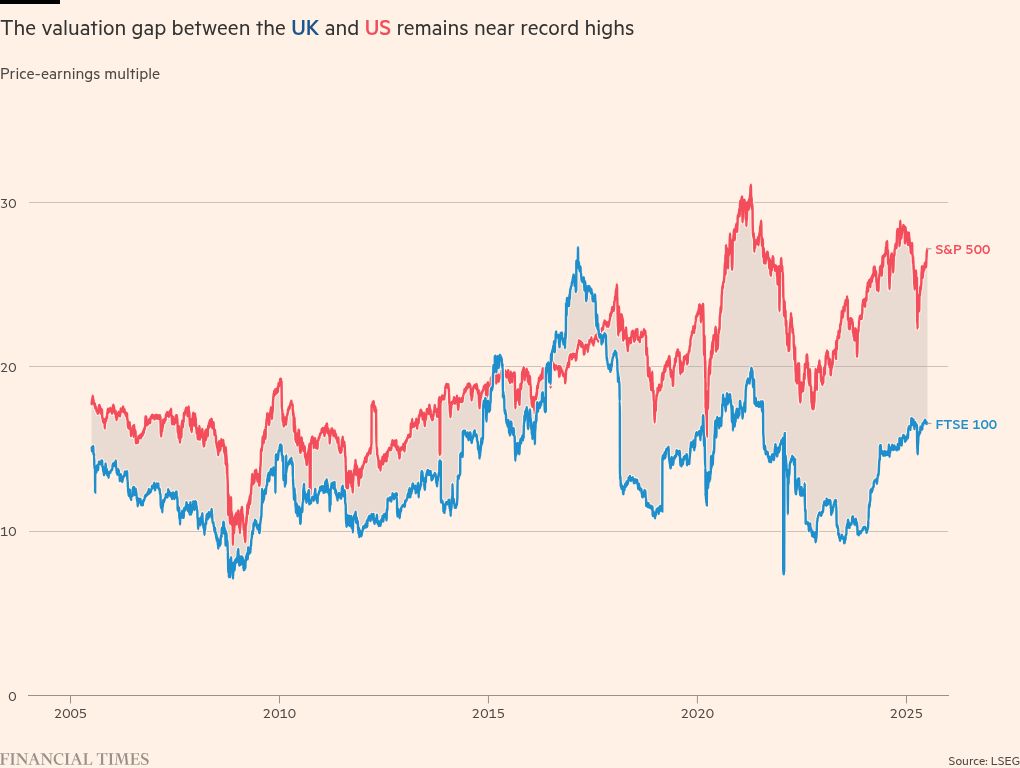

Lower valuations compared with Wall Street are making a London listing a less lucrative prospect for some companies looking to raise capital. The price-to-earnings ratio for the blue-chip FTSE 100 index is about 16.6, compared with 27.2 for the S&P 500, according to LSEG data.

“I worry about the ability to raise capital for companies in the UK, and how expensive it is to raise capital relative to other countries,” said Bell.

A number of UK companies, most recently fintech star Wise, have announced they will move their primary listing to the US, while private equity buyouts are also proving costly. This week, KKR outbid Advent International to take over high-tech equipment maker Spectris.

However, analysis by the Financial Times has shown that European companies that add a US listing often do not see an uplift in their valuations.

“It feels like every week that goes by, another firm is either being bought out by private equity or is relisting in the US,” said Michael Healy, UK managing director at investment platform IG.

“I’m quite concerned that we’re at a critical juncture for the UK market. It’s withering and dying.”

As public markets had become less liquid, “you lose that growth cycle”, said Joe Little, chief investment officer at HSBC Asset Management. “Having liquid capital markets is an important part of the financial ecosystem.

“Yesterday’s small-cap companies are today’s mid-cap companies, and maybe tomorrow’s giants,” he added.

The trend has been driven in part by more companies choosing to remain unlisted and financing their growth through private capital. This leaves investors with a dwindling, less diverse pool of opportunities, which can reduce interest in the equity market.

The Labour government has proposed reforms to try to boost London’s markets, including simplifying listing requirements.

But in a speech at the Capital Markets Industry Taskforce conference last week, Julia Hoggett, chief executive of the London Stock Exchange Group, said: “We still have not seen the real turning points in terms of flows of risk capital within and into the UK.”

One high-profile reform has been the Financial Conduct Authority’s approval of the Private Intermittent Securities and Capital Exchange System (Pisces), a new venue for buying and selling stakes in private companies.

But some investors say more focus needs to be given to the public equity market.

“Nearly all [the government’s] proposals to date have been about private companies,” said Gervais Williams, head of equities at UK investor Premier Miton.

“They’ve been very distracted by the private side of things but they’ve not put enough action on the quoted company market.”