Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Stablecoins are pretty cool in theory. They promise near-to-instant transfers of any value across any border, at transaction costs that could be far below what’s currently charged. Smart contracts might take the counterparty risk out of escrow and look useful for stuff like subscriptions, insurance and sports betting. And since everything happens in realtime on a public blockchain, there’s full transparency.

In practice, in the more than 10 years since their invention, stablecoins have carved out a few real-world niches but have not been widely adopted for anything other than crypto trading.

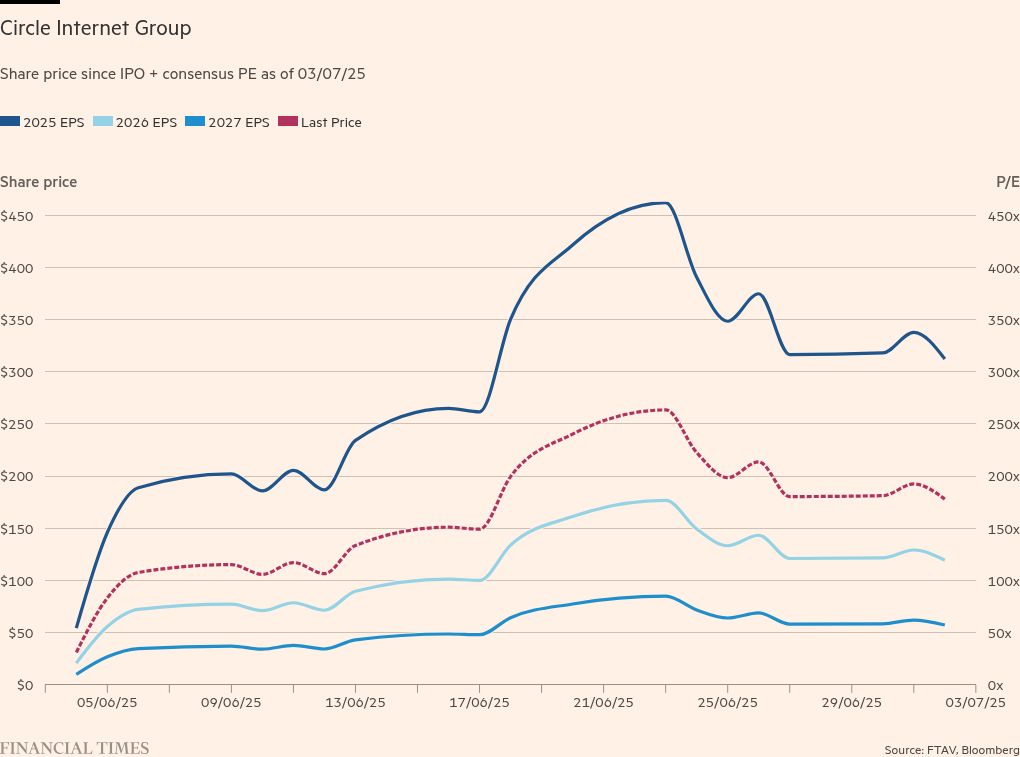

That hasn’t stopped people throwing around some very big numbers, however. For a blast of optimism, try the three brokers that led Circle’s recent IPO.

Goldman Sachs says in its Circle initiation note that most investors expect the value of stablecoins in circulation to grow from $240bn to more than $1tn. Citigroup includes in its total addressable market estimates $195tn of cross-border transfers and $1 quadrillion of flows sent via SWIFT. JPMorgan says it’s “in the realm of possibility” for stablecoins to take 10 per cent of the $22tn US M2 money supply.

Meanwhile, over on the Global Markets Strategy desk at JPMorgan, they’re firmly in the realm of probability:

We find forecasts for an exponential expansion of the stablecoin universe from $250bn currently to $1tr-$2tr over the coming years as far too optimistic and we are looking for a more moderate expansion to $500bn by 2028.

The starting point for analyst Nikolaos Panigirtzoglou and team is to look at what exists now rather than what doesn’t. There won’t be much appetite to hold zero-yielding assets whose value is eroded by inflation, they say in a note published today, so it’s more useful to look at how stablecoins’ role as “lubricant” in the crypto ecosystem might evolve.

Currently, that describes an estimated 88 per cent of demand:

From here, the analysis is finger-in-the-air stuff.

The overall size of the crypto universe might double between the 2024 and 2028 bitcoin halving events, they say. That’s 30 per cent growth from current levels and implies a bitcoin price in 2028 of ~$140,000, which isn’t based on anything but appears as good a guess as any.

Demand for dollarised deposits is likely to grow in line with emerging markets, JPMorgan says. According to the IMF’s World Economic Outlook data, EM nominal GDP growth is forecast to expand by 23 per cent by 2028.

Illicit activity won’t go away, but neither is it an obvious source of growth. Tighter crypto regulations and more effective policing might mean less funny stuff using Tether and Circle stablecoins, says JPMorgan, though there’s a wide variety of weird tokens that can pick up the slack.

That leaves payments:

While in a theoretical tokenized/blockchain based world, stablecoin-based payments would be faster, more efficient and interoperable, in practice at the moment these stablecoin based payments mostly start and finish with fiat, thus requiring on/off-ramps. This on/off ramp requirement adds significant friction/cost to the use of stablecoins for payments, making it less attractive compared to traditional financial systems, in particular if one takes into account the emergence of faster payment rails in the traditional financial system via fintech advancements in recent years. As a result, we find rather unrealistic the expectation of a massive increase in the use of stablecoins in payments. Indeed, our colleagues in US short-term rates research also note that market participants at the front end are skeptical of significant growth in the near term, in part due to the fact that the infrastructure/ecosystem for stablecoins remains underdeveloped. But even if one adopts an optimistic view and assumes, for example, a tenfold increase in the use of stablecoins in payments over the next couple of years, the stablecoin universe would only expand by $15bn x 10 = $150bn.

Stablecoin optimists point to the rapid adoption of the e-CNY, China’s central bank digital yuan, which has grown to a more than Rmb300bn market cap from Rmb13.6bn at the end of 2022. There’s no comparison, JPMorgan says:

First, the digital yuan is a central bank liability and thus it effectively replaces banknotes in circulation. While there does not appear to be a published target share of M0, there have been suggestions that a 10-15% share of M0 is a plausible medium-term goal, which would imply around RMB 1.3-2tr using current M0 levels. By contrast, stablecoins are a form of a tokenized MMF with zero interest, effectively a private sector liability rather than a central bank liability.

Second, the digital yuan does not operate through a fully decentralized blockchain-based ledger. Instead, it operates via a centralized network supervised by the PBoC and competes with other mobile/ electronic payment options in China such as Alipay and WeChat Pay.

Then is it better to think of stablecoins as global equivalents to Alipay and WeChat Pay? JPMorgan says no. Fintech payment companies offering collateralised electronic private money on their own platforms hasn’t proven the need for public blockchains; if anything, it proves the opposite:

Alipay/WeChat Pay digital money are private liabilities and are perhaps more similar to bank deposits in that regard which are also private liabilities. The difference between bank deposits and Alipay/WeChat balances is that the latter are backed by reserve funds that in turn hold public liabilities i.e. central bank reserves, while bank deposits are matched on the asset side by a mix of loans and debt securities, though they do have an additional guarantee via deposit protection arrangements.

In our mind, the strong expansion of Alipay and WeChat Pay should be viewed through the lens of a fintech payments revolution over the past decade in China that utilizes and increases the efficiency of traditional banking/financial system networks, rather than through the lens of a blockchain/crypto ecosystem revolution. In fact, it could be argued that the success and continued advancements in payments by fintechs, such as Alipay and WeChat Pay reduce the need for blockchain-based payment systems in the future.

All this pessimism might prove misplaced. As Yogi Berra (or possibly Niels Bohr) observed, it’s tough to make predictions, especially about the future. Efforts to make stablecoins work in the real world have only just begun, however, so a degree of caution may be advisable.

Circle Payments Network, a real-time cross-border settlement system, pushed through its first transaction in May and still relies on traditional payment rails for FX translation and last-mile delivery. Crypto remittances need FX liquidity to be more efficient than the existing networks, and it’s not obvious right now where that liquidity comes from.

Circle also has a project with ICE to trial using stablecoins as trading collateral. The promise is for shorter settlement periods and lower margin requirements. But since the market cap of all stablecoins currently represents less than 0.5 per cent of quarterly US equity volumes, disruption is a very long-term prospect. Goldman adds: “We believe that reserve audit frequency would need to shorten materially for exchanges to be comfortable using stablecoins as collateral.”

As for retail payments, they’re already reliable and cheap nearly everywhere except America. The TAM might be huge, but there’s not that much to disrupt.

All in all, JPMorgan’s strategy team sets out a sales pitch for stablecoins that strips out vapourware and hopium. If only their colleagues in ECM had taken a different approach when pricing Circle’s IPO. . . .