Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Arthur Hayes has published a new essay, “Quid Pro Stablecoin,” arguing that the United States’ sudden political enthusiasm for bank-issued stablecoins is less about “financial freedom” and more about arming the Treasury with a multi-trillion-dollar “liquidity bazooka.” The former BitMEX chief—writing in his personal newsletter—contends that investors who postpone buying Bitcoin until the Federal Reserve resumes quantitative easing will serve as “exit liquidity” for those who bought earlier.

How The Money Printer Is Already Warming Up

At the core of Hayes’ thesis is the claim that eight “too-big-to-fail” banks hold roughly $6.8 trillion in demand and time deposits that can be transformed into on-chain dollars. Once customers migrate from legacy accounts to bank stablecoins—he cites JPMorgan’s forthcoming “JPMD” token as the template—those deposits become collateral that can be recycled into Treasury bills. “Adoption of stablecoins by TBTF banks creates up to $6.8 trillion of T-bill buying power,” he writes, adding that the product simultaneously slashes compliance overhead because “an AI agent trained on the corpus of relevant compliance regulations can perfectly ensure that certain transactions are never approved.”

Related Reading

Hayes layers a second mechanism on top of the stablecoin flow. If Congress strips the Federal Reserve of its ability to pay interest on reserve balances—a proposal floated by Senator Ted Cruz—banks would have to replace that lost income by buying short-dated Treasuries. He estimates the policy could “liberate another $3.3 trillion of inert reserves,” bringing the prospective fire-power for government debt purchases to $10.1 trillion. “This $10.1 trillion liquidity injection will act upon risky assets in the same way Bad Gurl Yellen’s $2.5 trillion injection did… PUMP UP THE JAM!” Hayes asserts.

The essay frames the bipartisan GENIUS Act as the legislative linchpin. By barring non-banks from issuing interest-bearing stablecoins, Washington “hands the stablecoin market to banks,” ensuring that fintech issuers such as Circle cannot compete at scale and that deposit flight is funneled into the institutions most likely to bankroll the Treasury. Hayes calculates that the cost savings and enhanced net-interest margins could increase the combined market capitalisation of the big banks by more than 180 percent, a trade he describes as “non-consensus” but executable “in SIZE.”

Buy Bitcoin Before The Fed Blinks

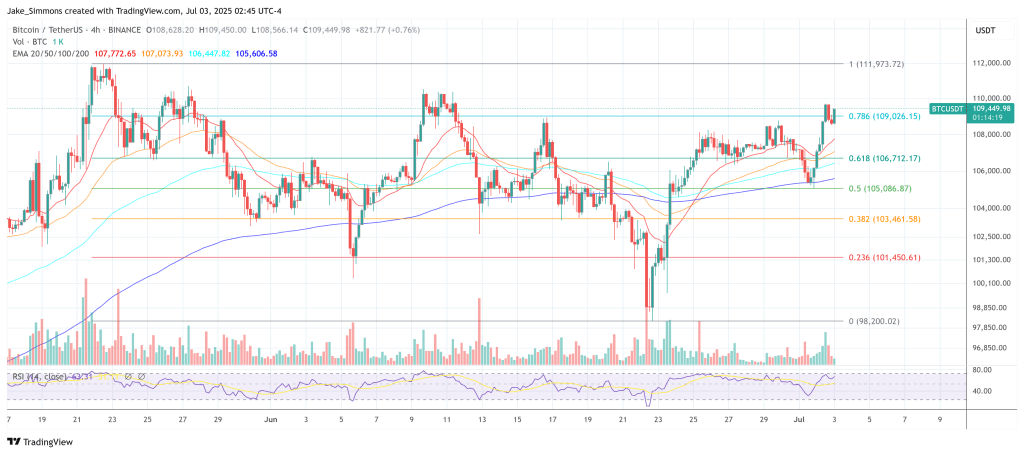

Despite his long-term enthusiasm, Hayes cautions that a temporary liquidity drain looms once Congress passes what he labels Trump’s “Big Beautiful Bill.” Refilling the Treasury General Account to its $850 billion target could contract dollar liquidity by nearly half a trillion dollars, an impulse he believes may knock Bitcoin back toward the mid-$90,000s and keep prices range-bound until the Federal Reserve’s annual Jackson Hole conference in late August.

Related Reading

“I believe that between now and the August Jackson Hole Fed speech to be given by beta cuck towel bitch boy Jerome Powell, the market will trade sideways to slightly lower. If the TGA refill proves to be dollar liquidity negative, then the downside is $90,000 to $95,000. If the refill proves to be a nothingburger, Bitcoin will chop in the $100,000s without a decisive break above the $112,000 all-time-high,” Hayes writes.

The punchline, however, is resolutely bullish. Hayes ridicules advisers steering clients into bonds on the premise that yields will fall: “If you’re still waiting for Powell to whisper ‘QE infinity’ in your ear before you go risk-on, congrats — you’re the exit liquidity. Instead go long Bitcoin. Go long JPMorgan. Forget about Circle.”

In his view, the political machinery that props up US deficits has already selected bank stablecoins as the next round of stealth quantitative easing, and Bitcoin—alongside JPMorgan stock—is positioned to absorb the spill-over.

Hayes signs off with a stark imperative: “Don’t sit on the sidelines waiting for Powell to bless the bull market.” The liquidity horse, he argues, has already bolted; investors who hesitate to buy Bitcoin risk being trampled beneath it. “You will miss out on Bitcoin pumping 10x to $1 million,” he concludes.

At press time, Bitcoin traded at $109,449.

Featured image from YouTube, chart from TradingView.com