Key Points

- Borrowers currently on SAVE, PAYE, or ICR will switch to RAP or IBR next year.

- Monthly payments could rise sharply for borrowers under these plans.

- Examples show some SAVE borrowers may owe hundreds more each month under new plans.

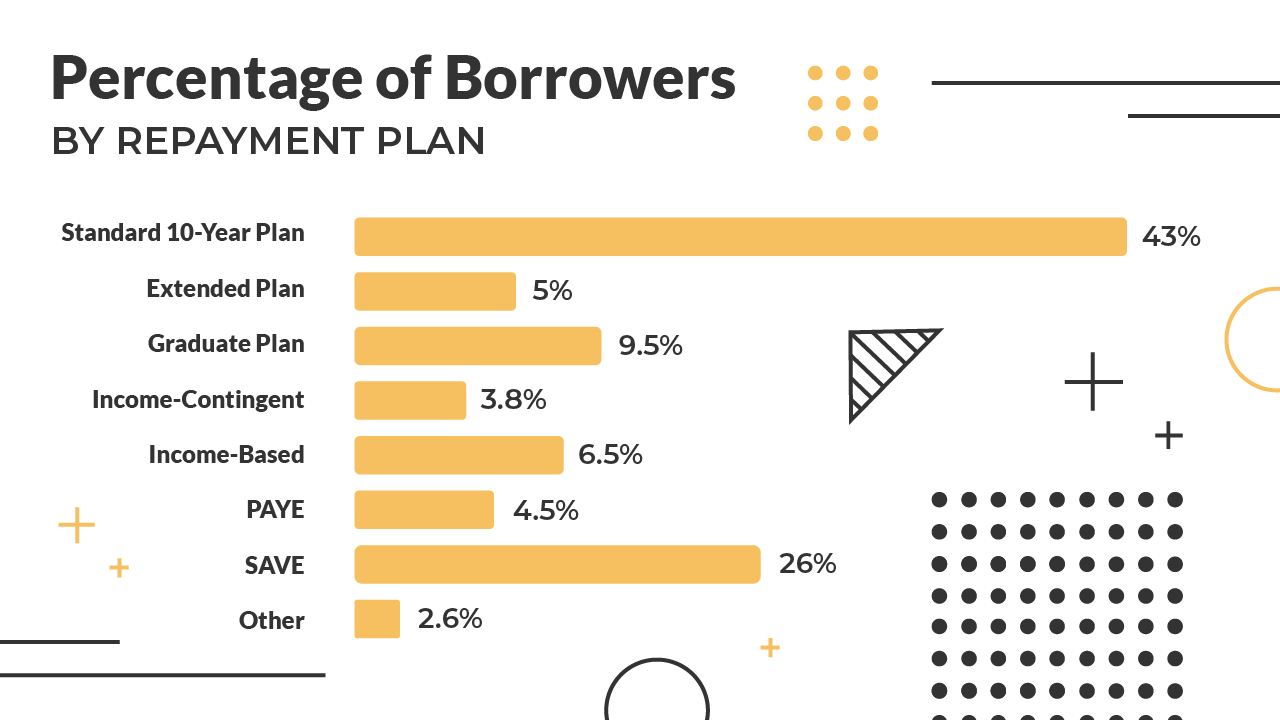

Millions of federal student loan borrowers enrolled in income-driven repayment (IDR) plans like PAYE and SAVE may soon face higher monthly bills. Under the Senate-passed version of the One Big Beautiful Bill (which is working it's way in the House right now), SAVE, ICR, and PAYE will be phased out for current borrowers by July 1, 2028. After that date, all remaining borrowers will be required to enroll in either a revised version of the Income-Based Repayment plan (IBR) or a new plan called the Repayment Assistance Plan (RAP).

The changes are significant. While the bill promises a simplified system for new borrowers, the shift could cost current borrowers more each month, especially those who currently benefit from the lower payment formula under SAVE or PAYE.

The SAVE plan, which is currently paused due to a legal injunction and would be ending regardless of legislation, caps monthly payments at just 5% of discretionary income for some borrowers. By comparison, RAP payments will range from 1% to 10%, depending on income level, but use a less generous income definition.

Borrowers who took loans before July 1, 2026, will migrate to an amended version of IBR sometime between July 2026 and June 2028. But those in the SAVE forbearance or those consolidating loans after July 1, 2026, could be forced into more expensive repayment far sooner.

Would you like to save this?

What's Changing

Once the Big Beautiful Bill becomes law (which hasn't happened yet, but it's on track to), current income-driven repayment plans phase out. The law states that borrowers in PAYE, ICR, and SAVE (including related forbearances) will migrate to an amended version of IBR between July 1, 2026 and June 30, 2028.

While the exact timeline is unknown, it's likely that SAVE will migrate very soon due to the ongoing litigation.

Borrowers in these plans will automatically move to IBR, but they can also self-select the RAP plan after July 1, 2026. The Senate bill does keep Old and New IBR, so borrowers with loans originating before July 1, 2014, will pay 15% of discretionary income and receive forgiveness after 25 years (Old IBR). Those with loans issued on or after that date will pay 10% of discretionary income, with forgiveness after 20 years (New IBR). Discretionary income is defined as income above 150% of the federal poverty line.

Here's a breakdown:

- Existing IBR: Stays in IBR, can opt for RAP

- SAVE: Moves to IBR, can opt for RAP

- PAYE: Moves to IBR, can opt for RAP

- ICR: Moves to IBR, can opt for RAP

Current standard, extended, and graduated repayment plan borrowers can remain in those plans, provided they don't consolidate or take new loans out after July 1, 2026.

Example: Low-Income Borrower On SAVE

Consider a single borrower earning $35,000 annually (AGI) with no dependents and $30,000 in federal student loan debt. The borrower is currently in administrative forbearance due to SAVE, but prior to the freeze they were making payments. They first borrowed in 2018.

- Under SAVE: Their monthly payment would be $5 per month.

- Under Amended New IBR: Their monthly payment would be $103 per month.

- Under RAP: Their monthly payment would rise to $87.50 per month.

That's a big jump for borrowers on a low income, but in this scenario the new RAP plan is better than IBR.

Example: Married Borrower On SAVE

Consider a married borrower earning $55,000 annually (AGI) with one dependent and $40,000 in federal student loan debt. They first borrowed in 2020.

- Under SAVE: Their monthly payment would be $0 per month.

- Under Amended New IBR: Their monthly payment would be $136 per month.

- Under RAP: Their monthly payment would rise to $179 per month.

That's another big jump for borrowers on a low income, whether they choose IBR, or RAP.

Example: Married Borrower On PAYE

A married borrower earning $60,000 with $40,000 in federal student loans and one child currently on the PAYE plan. If they

- Under PAYE: Their monthly payment would be $177 per month.

- Under NEW IBR: It would remain $177 per month.

- Under OLD IBR: It would be $266 per month.

- Under RAP: Their payment would be $200 per month.

This example highlights how the date the borrower first borrowed can make a difference. If they first took out a loan after 2014, they'd be in New IBR, and it wouldn't really change their payment. But if they borrowed between 2007 and 2014, they'd be in Old IBR and face a higher monthly payment. In that case, RAP could be better.

Borrowers Need To Plan Before 2026

While the full switch won’t happen until sometime between 2026 and 2028, borrowers must make key decisions well before then. Any new loans taken out after July 1, 2026, will automatically place the borrower in the new RAP or new Standard repayment plans. Consolidating existing loans after that date could also force a borrower out of their current plan and into RAP.

The SAVE plan is stuck due to the court injunctions, and may face an ending sooner rather than later. While the Congressionally-mandated date may be 2028, it's likely the court will act sooner, and you could be forced to change sooner – even late 2025 or early 2026. See our full SAVE plan timeline estimates.

Furthermore, it's important to note that if you do take out a loan after July 1, 2026, you will lose access to these existing plans. The law says all loans must be repaid under the same plan (except when the plan isn't legally allowed – like Parent PLUS loans). So, if you borrow a new loan, you're going to only have access to RAP or Standard for all your loans.

No Action May Cost You

Parent PLUS borrowers have more specific actions they need to take if they want to continue to have access to ICR and PSLF. We break down the details for Parent PLUS borrowers here. If you're a parent PLUS borrower, not taking action by June 30, 2026 could cost you.

And, if you miss a deadline, end up in a repayment plan, and don't make payments, you could end up in student loan default.

With loan servicing backlogs and widespread confusion over new rules, borrowers are encouraged to document their loan types, payment histories, and family size now.

They should also monitor Department of Education announcements and take action well before the deadlines. The transition period from 2026 to 2028 will be governed by Department of Education rules, so you need to ensure you don't miss communication from your loan servicer.

Don't Miss These Other Stories:

Editor: Colin Graves

The post New Student Loan Rule Could Raise Your Payments Overnight appeared first on The College Investor.