Income investors often focus on a stock's dividend yield, but dividend yield alone doesn't provide anywhere near enough information when it comes to selecting exchange-traded funds (ETFs).

For example, the iShares Select Dividend ETF (DVY 0.57%) is a popular fund with over $20 billion in net assets, thanks largely to its 3.7% yield. But at the end of the day, this iShares ETF may not be the best choice for most income investors, and the reasons become clear when comparing it to another dividend-focused ETF.

What does the iShares ETF do?

The iShares Select Dividend ETF tracks the Dow Jones U.S. Select Dividend Index, which uses certain screening criteria to buy 100 financially strong dividend payers and then weights them by dividend yield. This means the highest-yielding stocks make up the biggest positions for the fund and have the biggest impact on its performance.

Image source: Getty Images.

The index's screening process has these requirements for its holdings:

- They paid dividends in each of the past five years.

- Dividends increased over the five-year span, though not necessarily in every year.

- They had positive earnings over the past year.

- The ratio of net income to dividends paid, or dividend coverage, is 167% or better.

From the resulting list, which excludes real estate investment trusts (REITs), the 100 highest-yielding stocks are included in the Dow Jones U.S. Select Dividend Index and, thus, the iShares ETF.

The iShares Select Dividend ETF has a dividend yield of around 3.7% as of this writing, which compares favorably to the S&P 500 index's roughly 1.3% yield. However, the fund's expense ratio is rather high for an ETF at 0.38%.

A better choice to consider

The Schwab U.S. Dividend Equity ETF (SCHD 0.96%) also holds 100 stocks, though in this case, the fund's portfolio is market-cap weighted. That means the largest companies have the greatest impact on the fund's performance.

The Schwab ETF's screening criteria are also different as it tracks the Dow Jones U.S. Dividend 100 index instead. This index only includes companies that have increased their dividends every year for at least a decade (again, REITs are excluded). A composite score is calculated for each of these companies by looking at their ratio of cash flow to total debt, return on equity, dividend yield, and five-year dividend growth rate. The 100 companies with the highest composite scores make into the index.

The Schwab ETF boasts a higher yield of 4.0%. Its expense ratio is also lower at 0.06%.

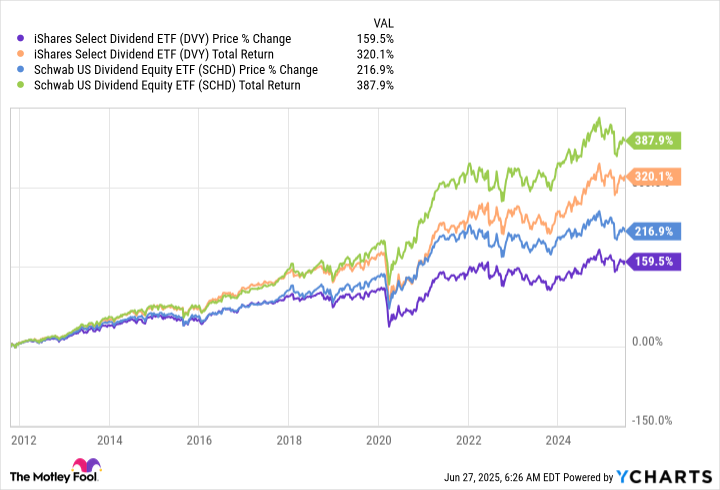

Data by YCharts.

The proof is in the returns and yield

With that information, picking the better overall dividend ETF for your portfolio should be fairly easy if you're looking to maximize income: The Schwab U.S. Dividend Equity ETF has a higher yield.

But don't stop there because a higher yield isn't the only thing you're getting with the Schwab ETF — it's also much less expensive to own. An investor with $10,000 invested in each option would owe $38 in fees to the iShares fund versus just $6 to the Schwab fund. With fees paid annually on the total value of your position in each ETF, the higher expense ratio can add up to hundreds or thousands of dollars over time.

The real icing on the cake, however, is evident by comparing the returns these two ETFs have provided to investors. The Schwab ETF's price performance has beaten that of the iShares ETF over the past decade. And as the chart above highlights, so has its total return, which includes the reinvestment of dividends.

Taking these key performance metrics into account, it appears the screening process backing the iShares Select Dividend ETF falls short. If you're a dividend investor who wants an ETF that screens for quality stocks, the Schwab U.S. Dividend Equity ETF is worth a look.