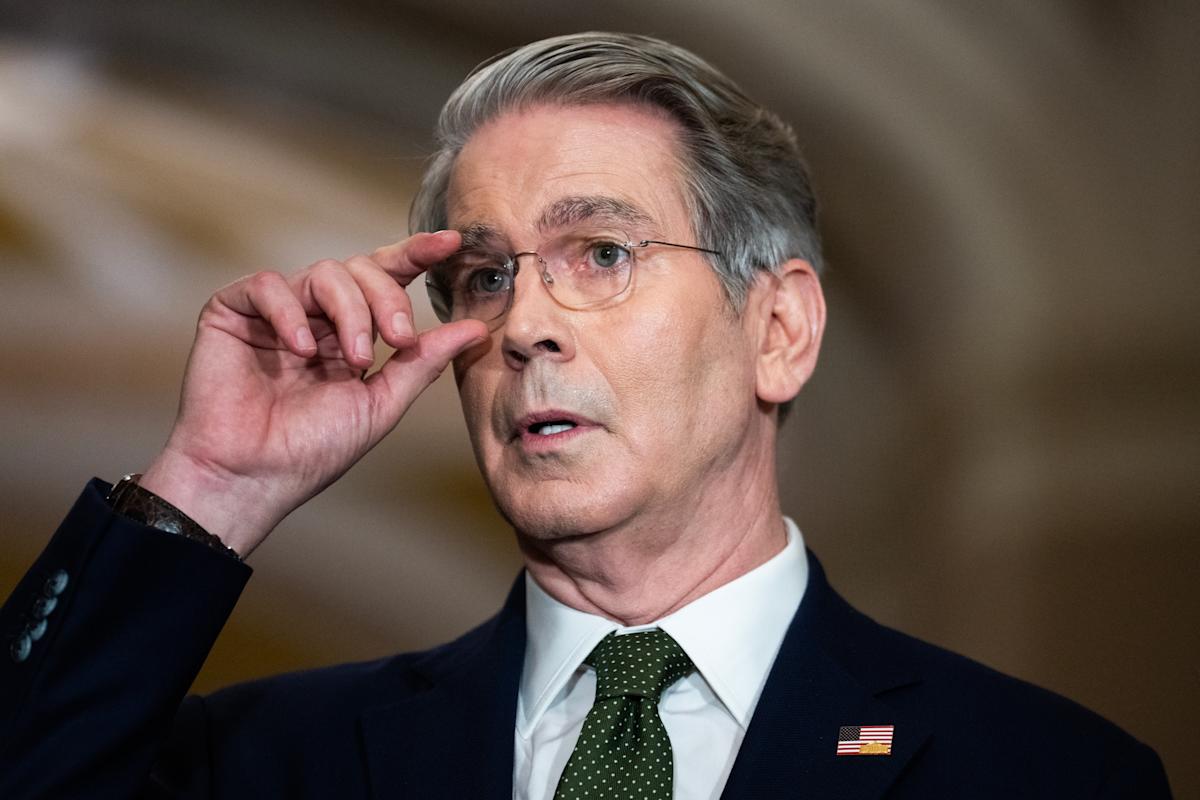

Treasury Secretary Scott Bessent said Tuesday night that he thinks the Federal Reserve could cut interest rates by September or “sooner” because of mild inflation thus far from President Trump’s tariffs.

“I think that the criteria is that tariffs were not inflationary. If they're going to follow that criteria, I think that they could do it sooner than then, but certainly by September,” Bessent said, adding that “I guess this tariff derangement syndrome happens even over at the Fed.”

His comments on Fox News’s “The Ingraham Angle,” come as Bessent’s boss, President Trump, intensifies his own pressure on the Fed and chairman Jerome Powell to lower rates by as many as 3 percentage points.

“Jerome—You are, as usual, ‘Too Late',” Trump told Powell in a note the president posted on Truth Social Monday, telling the Fed chair that he has “cost the USA a fortune” and urging him to “lower The Rate—by a lot!”

Bessent has also ramped up his commentary about the Fed this week, once again arguing that no inflation has yet shown up from tariffs and if it does it will be a one-time increase that wouldn’t justify any rate increases.

Bessent is among the candidates to replace Powell when the Fed chair’s term expires next May, according to people close to the administration.

On Bloomberg Monday the Treasury secretary compared the Fed to an old person who takes a fall and then is likely to fall again because he or she keeps looking down at his or her feet. The original fall in his view was the Fed’s slow reaction to a rise in inflation in 2022.

“They seem a little frozen at the wheel here,” he told Bloomberg.

On Tuesday, Powell didn’t rule out an interest rate reduction this month at the Fed’s next meeting on July 28-29 but noted the central bank would have cut rates by now if not for the tariffs introduced by the Trump administration.

“We went on hold when we saw the size of the tariffs and essentially all inflation forecasts for the United States went up materially as a consequence of the tariffs,” he said on a panel at a European Central Bank monetary policy conference in Portugal.

The Fed lowered rates by a full percentage point in 2024 but has held rates steady so far in 2025 as it waits to see if inflation will pick up this summer due to the tariffs.

“I wouldn't take any meeting off the table or put it directly on the table,” Powell said when asked about the possibility of a cut in July. “It's going to depend on how the data evolved.”