Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Trump loves low interest rates. And he really really really wants a low rates guy at the Federal Reserve. As Claire Jones reported in MainFT over the weekend.

Donald Trump has said he will only pick a new Federal Reserve chair who will cut US interest rates, as he called on the central bank to slash borrowing costs to 1 per cent.

Haven’t we seen this film before?

No, not that film.

Sure, there may be lessons from President Erdoğan’s decadal dalliance with trying to strong-arm Turkey’s interest rates down — and whether this was causally connected to the country’s soaring inflation rates, collapsing currency and teetering banking system.

But our minds first went to the drama around the birth of the modern Fed in 1951. The story was told with gusto by Robert Hetzel and Ralph Leach in a gripping narrative account over 20 years ago. And while readers would be well-served by reading the whole thing, we’ve pulled out some highlights from what later became known as the Treasury-Fed Accord.

Once the US entered WWII, inflationary concerns were put to one side in favour of national security. Short-term interest rates were pegged at 0.375 per cent, and yield curve control was implemented — with a cap on long-bond yields of 2.5 per cent.

But while short rates could be — and were — lifted in 1947, the US Treasury insisted the Fed maintain the ceiling on longer-term bond yields. For President Truman it was a moral question of protecting the market value of war bonds purchased by patriots (he had himself been rinsed when he had to sell $100 of a WWI Liberty Loan for $80 on his return from France).

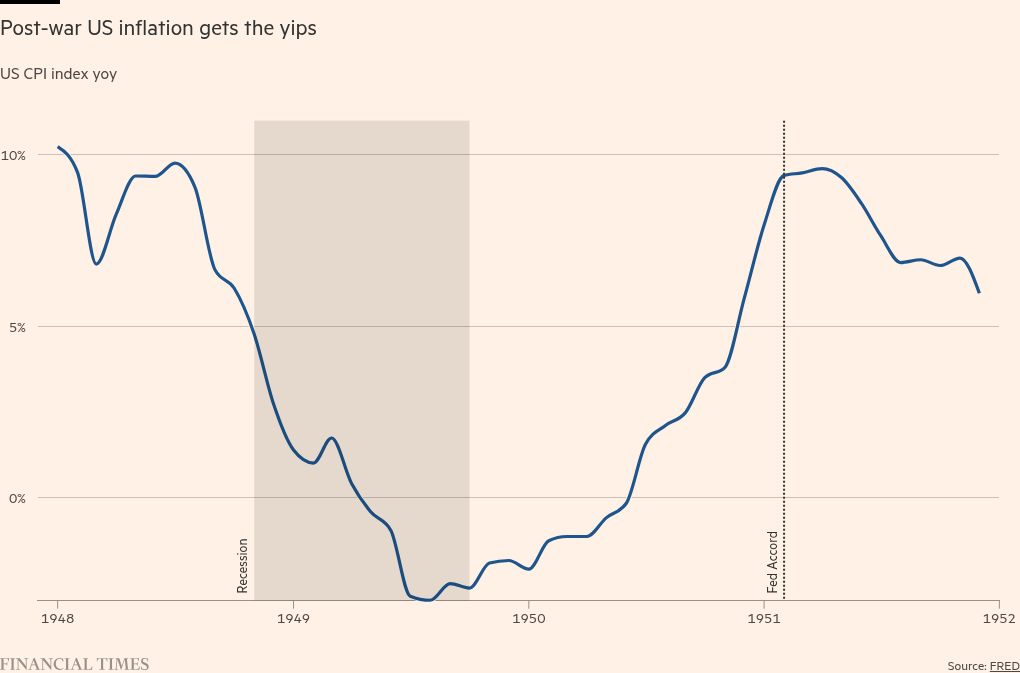

The Federal Reserve board was not happy. Because after the initial postwar bust, inflation was getting yippy again.

The Fed wanted to raise short rates, but the 2.5 per cent long bond yield cap seriously impaired their ability to do so. Higher short rates prompted the market to sell longer term bonds, in effect forcing the Fed into more and more QE to defend the cap. All this — they reckoned — was driving up inflation.

But at the time, monetary policy was still in the hands of the president and the US Treasury. This became an tempting tool to use when the Korean war erupted in 1950, as Hetzel and Leach noted:

Truman had compelling reasons to freeze interest rates. On January 25, 1951, he froze wages and prices, apart from farm prices. Raising the cost of borrowing, especially on home mortgages, while freezing wages was poison. More important, in January 1951 Truman confronted the possibility of world war . . . Truman and [Secretary of the Treasury] Snyder wanted to keep down the cost of financing the deficits that would emerge from a wider war.

As war in Korea escalated, consumers rushed to buy goods, commodity prices soared, and CPI inflation — in the three months ending February 1951 — was running at an annualised rate of 21 per cent. Yikes.

Truman therefore summoned not just Fed chairman McCabe but the entire Federal Open Market Committee to the White House to impress on them their patriotic duty to maintain confidence in government securities during a time of national crisis. The White House followed up with a press statement declaring that:

The Federal Reserve Board has pledged its support to President Truman to maintain the stability of Government securities as long as the emergency lasts.

Unfortunately, the FOMC had done no such thing. Maintaining public ambiguity as to their commitment to continue doing the Treasury’s bidding was one of the few cards they had. And Fed governor Marriner Eccles made sure the New York Times and the Washington Post knew it.

Perhaps unsurprisingly, acrimony ensued with FOMC members making it ever clearer — and with ever-increasing volume — that rising inflation was the direct result of the yield cap forced on them by the Treasury.

When Treasury secretary John Wesley Snyder headed into hospital for a cataract operation on 11 February, negotiations with the Fed were formally handed to a deputy, Treasury assistant secretary William McChesney Martin. The assumption (perhaps even the instruction) was to pause the escalating crisis for a few weeks until Snyder returned.

However, Martin — a financial wunderkind who had become president of the NYSE more than a decade earlier at the age of just 31 — moved quickly.

Martin struck an accord between the Fed and Treasury. It involved a grand debt swap which stripped bondholders of their at-the-money put option (which is what forcing QE upon an unwilling Fed in effect was) in exchange for the ability to trade them in for higher coupon Treasuries under the new monetary regime. Somehow he sold the plan to his still hospital-bound boss.

If this sounds like a Fed win, it needs to be weighed against what might be seen as the price: McCabe’s resignation as chairman of the Fed.

Truman could put in his guy at the Fed — a loyal Treasury guy. Someone who understood his bigger picture. A low-rates guy. Who did he choose? Why, William McChesney Martin of course.

The initial reaction of the Fed’s board and staff was that “the Fed had won the battle but lost the war”, according to Leach, an economist at the US central bank at the time. The Fed might have broken free from the Treasury, but then the Treasury “recaptured it by installing its own man”.

Low-rates Martin was confirmed by the Senate on March 21. And in his first statement as chairman he proclaimed that:

. . . [u]nless inflation is controlled, it could prove to be an even more serious though to the vitality of our country than the more spectacular aggressions of enemies outside our borders. I pledge myself to support all reasonable measures to preserve the purchasing power of the dollar.

Wait, what? Rather than a supine low-rates guy, Martin became a fierce defender of central bank independence, articulating the job of the Fed to be “the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

He hiked rates and inflation fell (though given monetary policy’s long and variable lags, it beggars belief that the fall was entirely Martin’s doing). Today, the accord that Martin engineered is considered the birth of the modern independent US central bank.

How did Truman take this?

Some years later, Martin happened to encounter Harry Truman on a street in New York City. Truman stared at him, said one word, “traitor,” and then continued.

What’s the lesson for Trump? If you really wants a low-rates guy make sure you appoint a genuine, abject stooge rather than a new Martin.