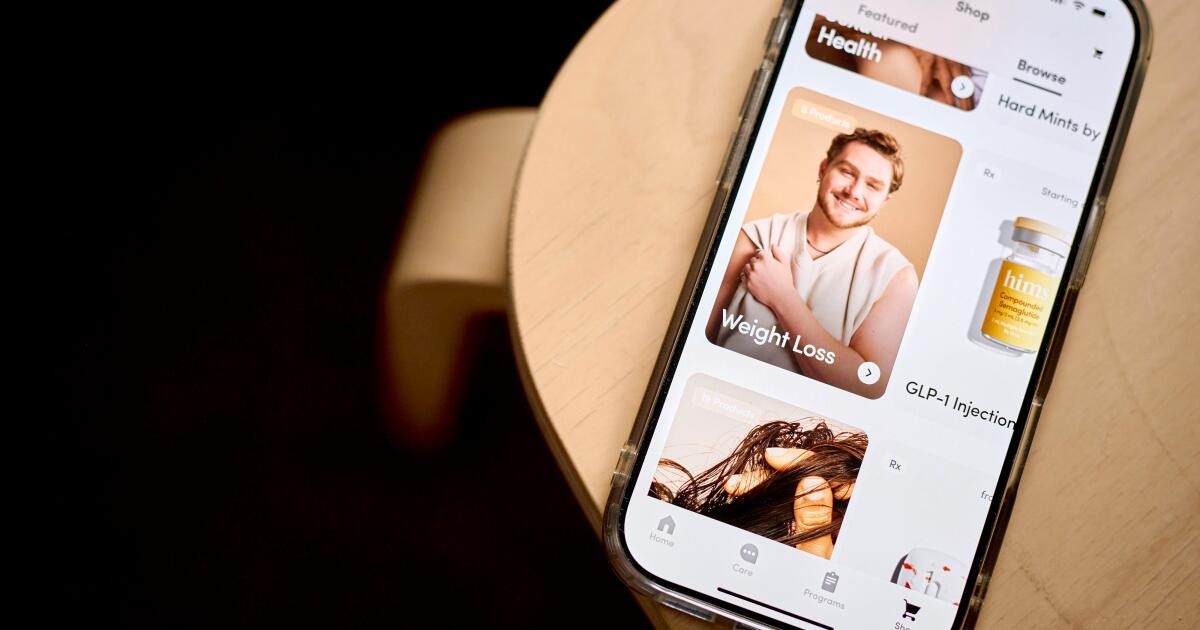

Hims & Hers, the high-flying telehealth company that rapidly ascended from a buzzy startup selling Viagra to a multibillion-dollar business with a Super Bowl ad, had a hard week.

The San Francisco company’s shares took a dive Monday after its partnership with Novo Nordisk crumbled. The Danish drugmaker abruptly ended its agreement to let Hims & Hers directly sell its popular weight-loss drug, prompting the companies to spar publicly.

Less than two months after agreeing to partner with Hims & Hers, Novo Nordisk accused the telehealth company of putting patient safety at risk through “deceptive” marketing and selling a knockoff version of its drug Wegovy. Hims & Hers fired back, alleging that Novo Nordisk was “misleading the public” and wanted to “control clinical standards and steer patients to Wegovy.”

The messy split is the latest hurdle facing Hims & Hers, a platform where people subscribe to get help for hair loss, improve sex, lose weight and address other health problems. The company aims to reach $6.5 billion in revenue by 2030. The tussle also highlights the tensions between telehealth platforms and pharmaceutical companies.

“The termination of this partnership suggests that Novo still views Hims’ marketing and sales tactics as a threat to branded Wegovy and indicates Novo considers Hims more of a competitor than a true partner,” Aaron DeGagne, a senior analyst of healthcare at PitchBook, said in a statement.

Hims & Hers’ stock price has swung wildly this year. The price had at one point soared more than 150% this year before the Novo split knocked off a nearly a third of its valuation on Monday. Its share price rose nearly 7% on Friday to end the week at $49.41.

Hims & Hers is disrupting the healthcare industry, testing the limits of regulations to make it easier to buy popular drugs at lower prices. Its showdown with Novo could help define how far it can go.

While Hims & Hers faces more legal risks after the breakup, some analysts said they don’t expect the fallout to heavily harm the company’s growth. The company is expanding beyond just treating weight loss. Still, Hims & Hers is losing a potential source of revenue.

“Even with all these revenue streams, the bigger concern (rightfully so) is the ability for these revenue streams to fill the expected hole that the end of the NovoCare partnership creates,” Michael Cherny, a senior research analyst at Leerink Partners, said in a note.

NovoCare is the pharmacy people were able to access on the Hims & Hers platform to buy the weight-loss drug.

Last year, Hims & Hers said in a letter to shareholders that the company expects its weight loss offerings will contribute at least $725 million of revenue in 2025 but that treatments outside of that category will make up the majority of its sales. Wegovy is just one weight-loss drug it offers.

Drug disruptor

Launched in 2017, Hims initially focused on treating men’s health issues such as hair loss and erectile dysfunction — concerns that people might feel too embarrassed to bring up in doctor visits. Instead, subscribers answer questions online, correspond with medical professionals virtually and get the prescribed drugs in visually pleasing packages delivered discreetly to their homes.

Andrew Dudum, one of the company’s co-founders and its chief executive, started Hims at venture studio Atomic in San Francisco. The startup, now known as Hims & Hers Health Inc., then expanded into women’s health, went public in 2021 and grew its workforce to more than 1,600 workers.

Hims & Hers’ annual revenue grew from $148.8 million in 2020 to $1.48 billion in 2024. The company also became profitable with its net income reaching $126 million in 2024, compared with a loss of $18 million in 2020. The company forecasts it will reach between $2.3 billion and $2.4 billion in revenue this year.

The company’s growth and 2.4 million-subscriber base was turbocharged as people looked for easier access and affordable options to the wildly popular weight-loss drugs Wegovy and Ozempic.

Despite strong results in the first quarter of this year, the company’s forecast for second-quarter revenue fell below analysts’ expectations. In May, Hims & Hers said it was slashing more than 4% of its workforce after signaling it would move away from selling cheaper alternatives to weight-loss drugs.

Its stock had initially surged in February after the company released a controversial Super Bowl ad promoting its treatment for weight loss. The ad marketed the telehealth platform as an affordable solution to a system that is “built to keep us sick and stuck.”

But the company’s aggressive marketing triggered backlash. Doctors, politicians and drugmakers quickly criticized the company for not disclosing the risks associated with the compounded drugs that Hims & Hers sometimes uses for weight loss.

With compounded drugs, licensed pharmacists alter, mix or combine ingredients of a drug to customize medicines. Though copying patented drugs is illegal, compounded knockoffs are allowed if they are tailored for a patient who might need something slightly different than what the patent-holding company produces. For example, a person might take a compounded drug if they’re allergic to a certain dye.

Taking compounded drugs comes with risks, according to the U.S. Food and Drug Administration. Unlike generics, they’re not approved by the FDA, a federal agency that verifies whether drugs are safe and effective .

Compounding drugs is also allowed when there’s a shortage of an FDA-approved drug, which has happened with Wegovy and Ozempic. But those drugs are no longer in shortage, and the FDA has warned the public about taking compounded drugs when it isn’t medically necessary.

Drug war erupts

The fallout between Hims & Hers and Novo Nordisk centers on its sales of compounded versions of Wegovy, a drug people inject to decrease hunger so they eat less and lose weight.

In April, the two companies teamed up to make obesity treatment more affordable and accessible. Starting at $599 per month, some people were able to get prescribed to Wegovy and a Hims & Hers membership. That was much cheaper than the previous cost of paying $1,999 per month for Wegovy on the Hims & Hers platform.

That partnership was short-lived. Novo Nordisk said this week that it’s cutting off Hims & Hers’ direct access to Wegovy.

“Hims & Hers Health, Inc. has failed to adhere to the law which prohibits mass sales of compounded drugs under the false guise of ‘personalization’ and are disseminating deceptive marketing that put patient safety at risk,” Novo Nordisk said in a statement.

Hims & Hers advertises a compounded drug that contains the same ingredients in Wegovy for $165 per month.

Novo Nordisk, citing its own investigation and a Brookings Institution report, said ingredients in knock-off drugs sold by telehealth entities and compounding pharmacies are manufactured in China and do not have FDA approval.

Novo Nordisk sells Wegovy through its pharmacy NovoCare and telehealth platforms LifeMD and Ro. On Thursday, the company also announced a partnership with WeightWatchers to sell Wegovy at a discounted price in July.

Dudum, Hims & Hers chief executive, said on social media site X that the telehealth provider would still provide a variety of treatments including Wegovy. The company says on its website that it works with pharmacies in Arizona and Ohio that are regulated.

“We refuse to be strong-armed by any pharmaceutical company’s anticompetitive demands that infringe on the independent decision making of providers and limit patient choice,” he said in the statement.