Investors seeking to diversify their holdings away from traditional private equity may want to look at search funds. Although these funds debuted in the mid-1980s, they have gained traction in recent years as the number of funds has grown exponentially and returns have been consistently attractive. This blog looks at search funds — what they are, how they differ from private equity, and why they should be on the radars of some investors.

What are Search Funds?

A search fund is an investment vehicle formed to find, acquire, and operate a closely held business. The fund uses predetermined investment criteria, such as minimum EBITDA and revenue, industry, and geography. The funds were conceived in 1984 by Irv Grousbeck, the MBA Class of 1980 Adjunct Professor of Management at Stanford University’s Graduate School of Business. Since then, over 700 search funds have been launched, creating an entire ecosystem known as entrepreneurship through acquisition (ETA). There are now search funds operating in Europe, Latin America, and Asia.

There are two primary types of search funds: the self-funded and the traditional model. A third, relatively new model, the independent sponsor model, is beginning to gain traction.

In the self-funded model, an entrepreneur uses savings and family contributions to fund expenses such as marketing, subscriptions, and travel. Term loans and government-backed programs usually fund the acquisition, depending on the market in which the entrepreneur operates. However, most self-funded entrepreneurs partner with several investors to finance the equity portion of the deal.

Under the traditional search fund model, the most prevalent, an entrepreneur raises capital by selling units to investors. These units represent an equity stake in the entrepreneur’s search fund. The capital covers search-related expenses for 24 to 36 months. Investors who purchase units at this stage receive the right but not the obligation to participate in financing the acquisition. They will have a right of first refusal to finance the entire equity portion of the acquisition before the entrepreneur approaches outside investors. A board of advisors provides the entrepreneur with guidance and support during the search phase and a full board of directors once the acquisition is made.

The investment horizon post-acquisition ranges from four- to seven-years. Recently, however, search funds have adopted a long-term hold strategy to maximize value creation. The search fund ecosystem is being driven by leading business schools such as the University of Virginia’s Darden School of Business, Harvard, Stanford’s GSB, and the University of Chicago Booth School of Business. These schools identified search funds as a path graduates can take to become CEOs of small businesses.

Search funds target small- to medium-sized businesses (SMBs) in underexplored markets, creating opportunities in areas often overlooked by private equity funds. Unlike private equity, which targets larger businesses with high competition, search funds operate in niches where valuations are lower, and deals are less contested. PE funds also invest in multiple companies while search funds are designed to invest in a single company. Many search funds tend to target businesses that serve local or regional markets, providing vital goods or services that can be scaled with proper management. Ideal acquisitions are companies that generate consistent positive cashflows, have recurring revenue, low customer churn, minimum EBITDA of $1 million, low exposure to external risks, and a strong management team. The opportunity lies in the value creation ability of the search fund.

The newest type of search fund is the independent sponsor model. This model allows entrepreneurs to pursue acquisitions without raising a traditional search fund upfront. Instead of securing committed capital before searching, independent sponsors identify and negotiate deals first, then raise equity and debt financing from investors on a deal-by-deal basis. This approach offers flexibility, enabling searchers to leverage their networks and expertise while aligning investor interests with specific opportunities.

The Value Proposition

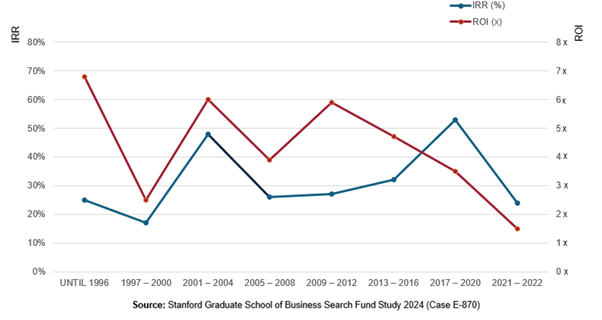

The Stanford Graduate School of Business 2024 Search Fund Study (Figure 1) analyzed the 681 search funds formed in the US and Canada since 1984. The funds reported an internal rate of return (IRR) of 35.1% and a return on investment (ROI) of 4.5x. The consistent performance across decades, despite changing macroeconomic conditions, underscores the resilience and long-term value-creation potential of the search fund model.

Figure 1 | IRR and ROI by Year of Company Acquisition.

Search funds offer a compelling investment model by aligning seamlessly with the long-term, strategic objectives of most investors who prioritize sustainable growth over quick exits. Unlike traditional private equity, search fund entrepreneurs emphasize operational value creation post-acquisition, dedicating themselves to hands-on management and value-add activities that enhance business efficiency and profitability, resulting in stronger operational performance. Search funds target undercapitalized small- to medium-sized businesses, unlocking unique opportunities in underexplored sectors with significant growth potential. This combination of alignment, operational focus, and access to untapped markets positions search funds as an attractive vehicle for investors seeking both financial returns and lasting impact.

Given the role of business schools, there are opportunities for family offices and institutional investors to partner with MBA programs to help cultivate a pipeline of skilled operators while creating search fund accelerators, structured programs offering capital, mentorship, and networks could professionalize the ecosystem and reduce risk.

The Future

The search fund model is gaining momentum, with growing adoption in Europe, Latin America and Asia, alongside rising interest from institutional investors seeking alternatives to traditional private equity. This expansion reflects the model’s appeal: high potential returns from entrepreneurial talent in underserved markets. Technology is poised to accelerate this trend as AI and data-driven tools streamline the funds search process. Search funds will benefit from faster target identification, due diligence, and enhanced post-acquisition operations through predictive analytics and efficiency gains.

Search funds stand out as a valuable alternative asset class, offering diversification, alpha potential, and operational upside in underserved markets. Their lower capital requirements, hands-on value creation, and alignment with long-term investor goals make them a compelling counterpoint to traditional private equity. In addition to their investment potential, search funds represent an opportunity to back entrepreneurial talent and reshape how value is created in the private markets.