August 1 marks the eighth anniversary of a key moment in Bitcoin’s (BTC) history — the initial activation of Segregated Witness (SegWit) in 2017, a key software upgrade that reshaped the network’s future and triggered a hard fork.

The move, known as “Bitcoin Independence Day,” reduced miner influence over the protocol and led to the creation of Bitcoin Cash (BCH), highlighting the community's divisions over how Bitcoin should scale to support global use.

The “block size wars” were fought between those who wanted to keep the Bitcoin block size small and “big blockers,” a coalition of miners and businesses that wanted to include more transactions in each block to make BTC suitable for everyday payments and commercial transactions.

Big blockers, led by “Bitcoin Jesus,” Roger Ver, argued that Bitcoin fell short of Satoshi Nakamoto’s vision of a peer-to-peer electronic cash system since its ledger’s limited block space could never scale enough to accommodate the world’s transactions.

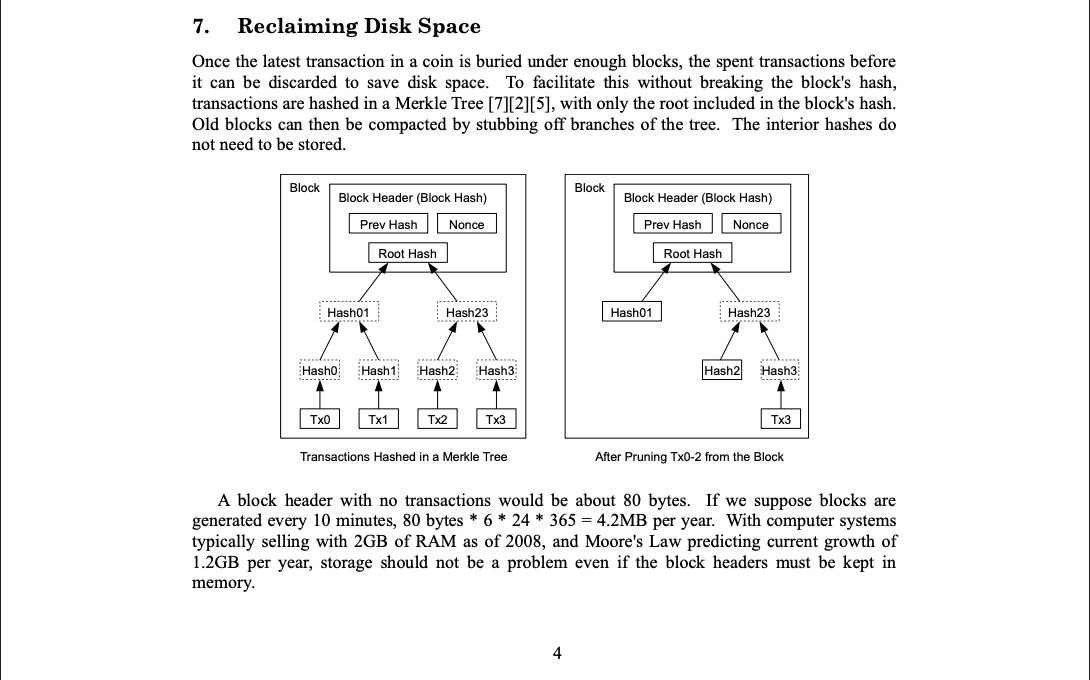

Node operators, developers and BTC users mounted a strong opposition to the bigger block proposals, arguing that raising the block size would also increase storage requirements for node operators.

A potential increase in storage requirements would make running a node prohibitive for the average user, thereby centralizing the Bitcoin network in the hands of a few large players who could run the required hardware.

Bitcoin Improvement Proposal (BIP) 91 was activated in August 2017, paving the way for scaling through the BTC Lightning Network, a way of facilitating offchain payment channels between two or more users, with one final settlement on the Bitcoin ledger.

On Aug. 1, 2017, the big blockers split from the Bitcoin network, resulting in BCH creation and altering Bitcoin history forever.

Related: OG Bitcoiners are rotating out, but it’s a healthy dynamic: Analysts

Bitcoin and BCH, where are they now?

Since the Bitcoin Cash hard fork in August 2017, the price has oscillated, hitting an all-time high of about $1,600 in May 2021 during the previous bull market cycle.

However, the price soon collapsed, hitting an all-time low of about $90 during the 2022 bear market. Currently, BCH is trading at about $552 — the same price levels it was trading at eight years ago, immediately following its debut.

Meanwhile, the price of Bitcoin has appreciated by about 4,200% during that same eight-year period. On Aug. 1, 2017, BTC was trading hands at about $2,718 and is currently trading at about $115,000, down from its all-time high of about $122,000 recorded in July.

Today, Bitcoin boasts a market cap of over $2.2 trillion, while Bitcoin Cash has a total market cap of around $10.9 billion.

The schism between the two networks highlights the debate between those who want to use the BTC network for a variety of purposes, including retail purchases and file storage, versus those defining BTC as a decentralized store of value — a conflict that still rages today.

Magazine: Bitcoin OG Willy Woo has sold most of his Bitcoin: Here’s why