Key Points

- Interest charges will resume August 1 for over 7 million borrowers in SAVE forbearance.

- Borrowers will see balances grow even while payments remain paused, adding new financial pressure.

- Borrowers are stuck in paperwork backlogs, limiting their ability to change repayment plans.

Starting August 1, student loan borrowers enrolled in the now-blocked SAVE repayment plan will begin accruing interest again, even though they’re not required to make payments. This shift affects over 7 million borrowers currently in administrative forbearance, who were originally assured they wouldn’t face additional costs while the plan remained frozen by the courts.

The Department of Education says it’s interpreting a February court order as requiring the change, though the ruling contains no such instruction. The relevant court documents simply prevent the department from forgiving balances or expanding SAVE’s benefits but make no mention of resuming interest accrual.

The sudden shift comes with minimal notice – just 22 days. This also comes on top of huge processing delays for repayment plan changes – meaning that some borrowers who want to leave SAVE are not even able to at this time.

Would you like to save this?

No Legal Requirement, But Interest Returns Anyway

The policy change appears to be a discretionary decision under the Trump administration, not a mandate from the courts. A February 2025 opinion from the 8th Circuit Court of Appeals instructed a lower court to broaden its injunction against SAVE but did not direct the Department to charge interest.

In fact, the court’s own language pointed to borrower protection as a factor in its stay. “All borrowers currently impacted by our administrative stay are in administrative forbearance and thus not required to pay principal or interest on their loans,” the ruling stated.

Still, the Department now says interest will resume and borrowers will be responsible for all accrued amounts starting tomorrow. Depending on when you borrowed your loan (since interest rates are determined by the year of your loan), interest could build quickly.

Estimates suggest an average of $300 per month in added interest, or $3,500 per year per borrower. Across the full population of SAVE borrowers, the annual cost could top $27 billion.

This also comes as some borrowers have reported that interest has been accruing during the forbearance and it shouldn't have been. However, this hasn't been fixed on all borrower accounts yet. In fact, one borrower even asked the court to step in to help fix this issue:

@thecollegeinvestor Someone filed a motion to stop the SAVE plan interest from resuming… we’ll see if it goes anywhere. #studentloans #studentloanforgiveness #saveplan ♬ original sound – The College Investor

Few Options Available For Borrowers And Limited Time To Act

The timing leaves little room for borrowers to make changes to their repayment plans. Those wishing to switch into a different income-driven repayment (IDR) plan face delays. More than 1.5 million IDR applications remain backlogged, and the Department of Education recently announced it's simply cancelling some older applications that were never processed.

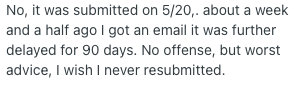

Borrowers who do attempt to leave the SAVE forbearance may find that their servicer can’t complete the transition before interest resumes. Even those who submitted applications earlier this summer may not have been processed yet. We've had several borrowers report to us that they've been waiting in processing limbo since May 2025:

Also, some borrowers in SAVE may be blocked by the “partial financial hardship” requirement. While this was repealed by the One Big Beautiful Bill Act (OBBBA), it's still going to take loan servicers several months to update their systems to be able to process these applications.

This traps borrowers in a status where interest accrues, but they have no practical ability to change plans or begin payments to avoid it.

Compounding the issue, borrowers are reporting mixed communication from their loan servicers and the Department of Education directly – with many stating they haven't received any notices. With the SAVE forbearance set to continue for the foreseeable future, many borrowers may not even know that interest has resumed until balances begin to grow.

What Student Loan Borrowers Can Do Now

Options are limited, but a few paths are available:

- Stay in Forbearance: Most SAVE borrowers may be better off waiting. Payments aren’t due, and many may still benefit from PSLF buyback or potentially moving to the new Repayment Assistance Plan (RAP) directly in 2026.

- Switch to Another IDR Plan: Borrowers eligible for IBR may consider switching. But given processing delays and blocked forgiveness in other plans (like PAYE and ICR), this may not be worth the hassle unless close to forgiveness under PSLF.

- Seek PSLF Forgiveness: Borrowers within a few payments of PSLF should consider applying for a buyback of missed months or switching to a qualifying plan immediately.

The SAVE plan was formally repealed under the OBBBA, and borrowers will transition into IBR or can opt for the new Repayment Assistance Plan (RAP) sometime between July 2026 and June 2028. Whether interest should be accruing during this time remains a point of dispute.

For now, interest resumes tomorrow. Payments don’t. And every individual borrower has their own set of variables to assess whether it makes sense to change repayment plans or stay and wait it out.

Don't Miss These Other Stories:

Editor: Colin Graves

The post 7 Million Student Loan Borrowers Will Start Seeing Interest Resume Tomorrow appeared first on The College Investor.