The modern-day Dow Jones Industrial Average contains a variety of industry-leading companies across stock market sectors — making it an excellent way to discover blue chip companies to build a portfolio around. Here's why Apple (AAPL -0.43%), Microsoft (MSFT 0.05%), Visa (V 0.49%), and American Express (AXP -0.44%) are particularly compelling Dow stocks to buy in June and hold for decades to come.

Image source: Getty Images.

Two tech giants heading in different directions

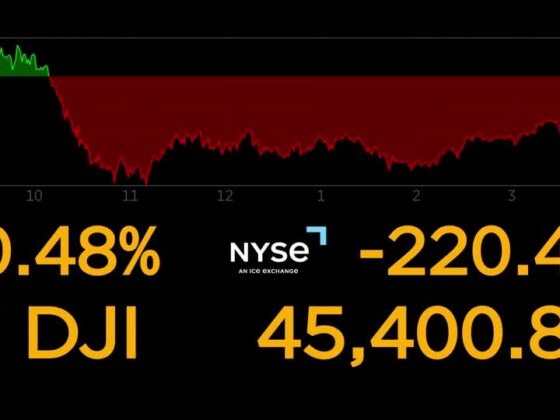

Apple used to be the most valuable company in the world, but it has taken a back seat behind Microsoft and Nvidia as Apple is down 22% year to date at the time of this writing, while Microsoft is up nearly 7%.

Microsoft has given investors everything they could have asked for amid tariff tensions. The company continues to grow at an impressive rate while maintaining high operating margins. Microsoft is investing in artificial intelligence (AI) and cloud computing at a breakneck pace while buying back a significant amount of stock, raising its dividend by around 10% per year, and maintaining an exceptional balance sheet. The company's business model is relatively insulated from trade risks, so it's no wonder why the stock is knocking on the door of a new all-time high.

But the same can't be said of Apple. It assembles the vast majority of key products, like iPhones, in China — making it extremely vulnerable to tariffs. Apple stock has been on a roller coaster in 2025 as investors try to digest policies that seem to change overnight. President Trump has cast Apple onto the front lines of the trade war with China, with the latest decision being a 25% tariff on iPhones not made in the U.S.

While Apple can adjust its supply chain to offset some tariff risk, it would be extremely difficult for Apple to make iPhones as cost-effectively outside of China. So, in the near term, Apple may just have to absorb the tariff hit and hope resolutions come soon or pass along a portion of the costs to consumers.

The good news is that Apple has highly anticipated products with AI features coming this fall which may be enough to pique consumer interest and justify higher price tags. Investors can catch a glimpse of Apple's latest technology updates and features by tuning into its Worldwide Developers Conference from June 9 to June 13.

Given tariff risks, some folks may want to take a wait-and-see approach to Apple. But the stock is fairly beaten down, and folks who think Apple has the brand power and innovation to justify price hikes may want to consider buying the stock in June. Apple's valuation is at reasonable levels with a price-to-earnings (P/E) ratio of 30.4 and a forward P/E of 27.2 compared to a five-year median P/E of 29.3.

Business models that are built to last

The fact that American Express and Visa are both in the Dow despite the index having only 30 components tells you just how massive the payment processing industry has become. And while there are similarities between the two companies, there are also some key differences worth understanding before buying either stock.

Visa has a simpler business model and is arguably lower risk and lower reward than American Express. It is a pure-play payment processor that collects fees based on the frequency and volume of transactions on its credit and debit cards. The company has expanded its network and boosted its global business. The more cards engaged with the network, the more potential Visa has for collecting fees. The fees are worth it for merchants if Visa cards are customers' desired form of payment. It's not worth potentially losing a sale by not accepting Visa.

Visa is an extremely high-margin, capital-light business. Other than its operating expenses, it doesn't need to invest a lot of money to expand its network. In fact, Visa is so profitable that it converts around two-thirds of every dollar in sales into operating income.

American Express acts as a payment processor and a card issuer, whereas Visa works with banks and other financial institutions to issue cards. American Express also offers checking accounts, high-yield savings accounts, and other products.

American Express takes on more risk than Visa, but it has an impeccable risk management track record. American Express attracts affluent customers due to the high annual fees on its cards and some of the best cardholder perks available.

While Visa's expenses mainly go toward maintaining its network, American Express spends more on card member rewards than on operating expenses. However, the strategy has proven highly effective, as American Express cardholders are heavily incentivized to use their cards on any purchase possible, thereby increasing the size and legitimacy of the American Express network.

Visa and American Express have excellent business models that support consistent stock buybacks and growing dividends — making both companies worthwhile foundational holdings for investors looking for stocks to buy and hold for decades to come.

Four high-conviction buys to load up on this summer

Apple, Microsoft, Visa, and American Express don't jump off the page with high yields. But that's only because all four companies have seen their stock prices grow rapidly. As a result, their dividend yields have compressed even though all four companies consistently boost their payouts year after year.

What's more, all four companies regularly repurchase stock, meaning that the dividend isn't the only means of returning capital to shareholders. Add it all up, and investors looking for quality growth stocks they can buy at reasonable valuations may want to consider Apple, Microsoft, Visa, and American Express in June.

American Express is an advertising partner of Motley Fool Money. Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Visa. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.