Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

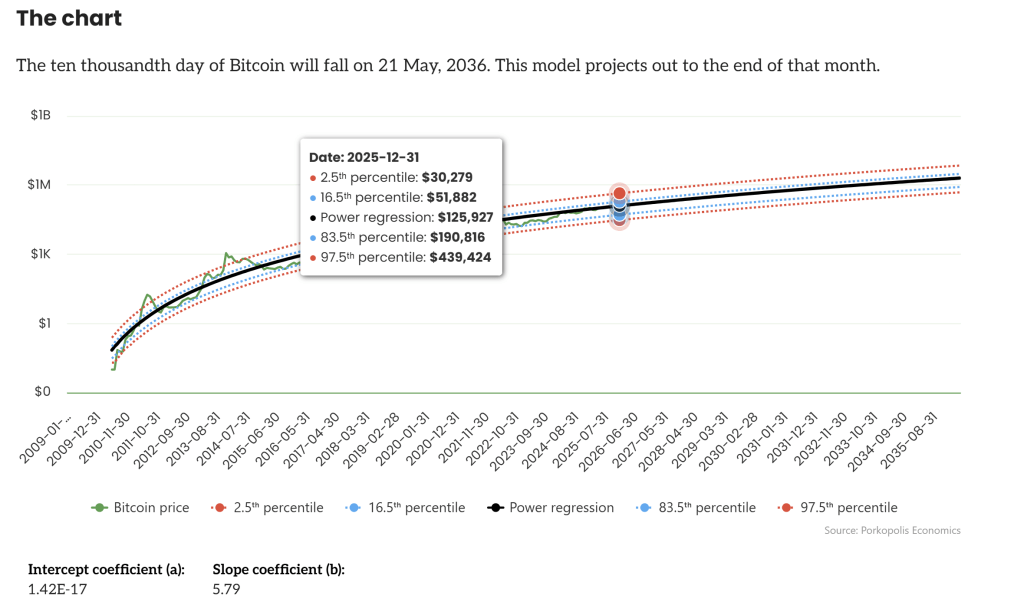

Matthew Mežinskis, the analyst behind Porkopolis Economics and co-host of the “crypto_voices” podcast, told Marty Bent on TFTC that Bitcoin’s late-cycle upside remains larger than most models imply, arguing that price action continues to track a long-standing “power trend” that has governed every prior boom. Anchoring his view in percentile “bands” around that trend, he contends the market can still deliver a two-to-three-times move into year-end, placing a $250,000 to $375,000 range in play.

Bitcoin 4-Year Cycle Still In Play?

Mežinskis frames the thesis in stark, testable terms. “Bitcoin has traditionally during the booms very easily gotten above the 80th percentile each time,” he said, noting that the strongest phases in earlier cycles climbed “very easily” above the 90th as well. He defines the 80th percentile as roughly 1.3× the trend and the 90th as 2×. On his model, the end-2025 trend value sits near $125,000, which fixes the 80th-percentile validation line at about $170,000 and the 90th at $250,000. “If we don’t get above 170k by year end or into like the first couple months of next year then I would…rethink the idea of the four-year cycles,” he said, before stressing that “it hasn’t been invalidated yet.”

Related Reading

The centerpiece of his outlook is a simple rule-of-thumb extrapolation from those bands. “The 90th is 2x…so 2x is $250k,” he explained. He then extends the historical envelope to the mid-90s percentiles to size a more aggressive—but still precedent-based—target. “In 2021…it was a 96th percentile…the 2.8x—round it here—3x,” he said. “Totally base case, totally possible…would be 2 to 3x the trend…$250k to $375k Bitcoin.” Even as he embraces that range, he tempered expectations for a blow-off beyond it. “I would be very surprised if Bitcoin went above $350 or $375k by the end of the year, but I think it’s possible.”

His framework is deliberately non-technical in the chartist sense. “We’re just looking at the power trend and where the price typically is over or under trend every four years,” he said. The model—represented by a “black line” he’s tracked since 2016—has, in his telling, proved more durable than the once-fashionable stock-to-flow approach: “It’s like the best trend line in all of finance…certainly better than the old stock-to-flow ratio.”

The percentile overlays are frequency-based markers: the 90th denotes a level above which only 10 percent of observations sit, the 99th above only 1 percent. Historically, he observed, the most explosive cycles—2013 and 2017—briefly reached the 99th percentile, roughly 4.6× trend, a zone 2021 never touched. That “softer top” dynamic is consistent, he argues, with maturation: “As Bitcoin gets more adopted, these peaks do come down.”

Pushing beyond the base case, Mežinskis addressed the outlier narratives circulating on social media. He acknowledged hearing projections in the “$444,000 in November” neighborhood and mapped them to his high-percentile bands: “400,000 is the 97th…[between] the 97th and 98th percentile, it’s pretty rare.” Those levels, at about 3½× trend, are—by definition—levels the market spends very little time above.

Related Reading

None of this, he emphasized, is a timer. The framework “doesn’t tell you the time…we’re just assuming the four-year cycle.” If the cycle extends or compresses, the model won’t predict that path; it only sketches the altitude the market has historically achieved once a boom is underway. “If the market gets heated…if grandma’s getting excited this Thanksgiving…and giving her grandchildren money to buy Bitcoin, then perhaps it could happen again,” he quipped, before reiterating: “Absolutely possible that we have lower highs and even possible that we get out of the four-year cycle, but I’m still not seeing it based on the price action.”

Mežinskis also flagged the hazards that often follow euphoria, warning that narrative shifts at elevated plateaus can coincide with leverage-driven fragility. Should Bitcoin treasury companies lever short-dated convertible debt to chase higher prices, a downturn could expose maturity and liquidity mismatches.

“You could see absolutely a cascading [of] liquidations of these Bitcoin treasury companies,” he said, adding that reflexive waves can “go as high as the White House” in terms of policy attention if the cycle crescendos at scale. He was careful not to present that as a base case—“I’m not saying that it will”—so much as a reminder that what climbs on leverage can unwind through the same channel.

The test he sets for the market over the next few months is crisp. A move above the 80th-percentile line—about $170,000 given his end-2025 trend—would keep the four-year template intact; a run into the 90th-percentile band would align with prior booms and mechanically prints a ~$250,000 spot price; an excursion toward the mid-90s percentiles would extend the tape to roughly $375,000, a level he calls the “max” he would expect this cycle—even if, as history shows, brief overshoots cannot be ruled out. For now, the structure that’s guided Bitcoin since 2016 “hasn’t been invalidated yet,” and until it is, Mežinskis’ message is unambiguously bullish: the bands are there, the tape has visited them before, and the upper ones still sit far above spot.

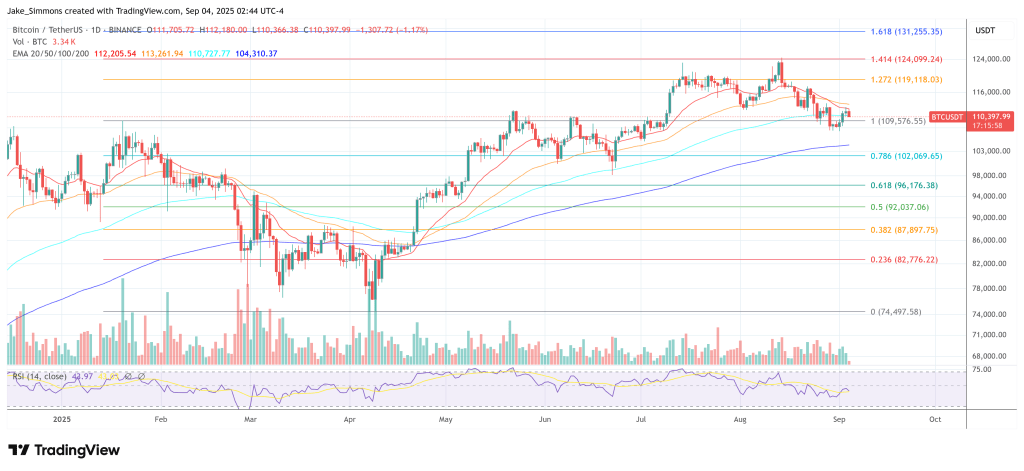

At press time, BTC traded at $110,397.

Featured image created with DALL.E, chart from TradingView.com