Ethereum is currently undergoing a price correction, slipping below key levels as selling pressure grows across the broader market. Despite this pullback, institutional interest in ETH remains resilient, with major players continuing to add aggressively to their holdings. Analysts have raised the possibility of a deeper correction, pointing to mounting volatility and the inability of ETH to reclaim the $4,500 zone. However, the long-term outlook still leans bullish as onchain data highlights consistent demand from whales and institutions.

According to analyst Ted Pillows’ data, large-scale investors have been particularly active in recent days, withdrawing ETH from exchanges and reallocating it into long-term strategies and DeFi protocols. This divergence between short-term price weakness and long-term accumulation highlights Ethereum’s unique position in the current market cycle.

While price action may continue to test lower levels in the near term, the fundamentals of Ethereum remain intact, with capital rotation and institutional flows supporting the broader bullish thesis. For investors, the coming weeks could prove decisive, as the market weighs short-term volatility against the persistent confidence of whales betting on Ethereum’s long-term strength.

Whale Accumulation Reinforces Ethereum Position

According to Pillows, Ethereum continues to attract large-scale buyers despite the recent correction, with data showing that three fresh wallets purchased $148,860,000 worth of ETH in the past few days. Such aggressive accumulation reinforces the conviction that institutions and whales maintain in Ethereum’s long-term potential, even as short-term volatility pressures the broader crypto market.

While many retail investors are cautious, institutional players appear to be quietly stacking ETH, preparing for the next leg of growth. Their actions indicate not only faith in Ethereum’s fundamentals but also a recognition of its expanding role in decentralized finance (DeFi), tokenization, and as collateral within the broader crypto economy.

The conviction displayed by these whales is a positive signal for the market, and one of the key reasons why ETH has been outperforming Bitcoin recently. As capital rotation continues to favor Ethereum, it suggests that big players are positioning for stronger relative performance compared to BTC.

Technically, ETH must hold above the $4,000 level to preserve its bullish structure and maintain strength against Bitcoin. A breakdown below this threshold could weaken its position, but holding firm would provide the foundation for another surge. With whale conviction still rising, Ethereum’s resilience in this consolidation phase could set the stage for its next major move.

Consolidation Above Key Price Levels

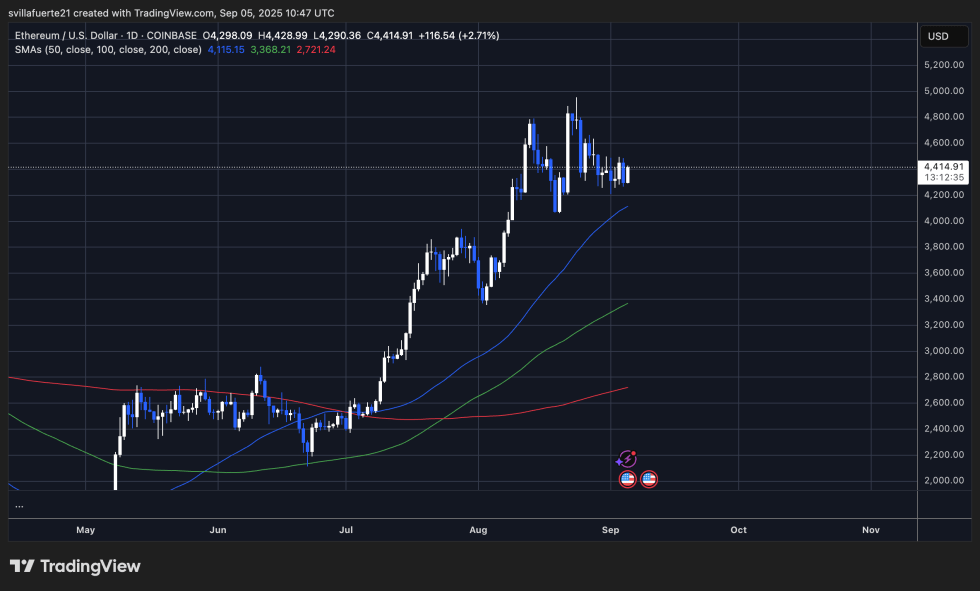

Ethereum (ETH) is currently trading at $4,414, showing resilience after weeks of heightened volatility. The daily chart highlights a period of sideways consolidation just below the $4,500 resistance, a key level that bulls must reclaim to confirm renewed momentum.

The moving averages provide important context: the 50-day SMA around $4,115 acts as the nearest short-term support, while the 100-day SMA at $3,368 remains further below, reinforcing the bullish structure despite the correction. The 200-day SMA sits at $2,721, well beneath the current price, underscoring ETH’s long-term strength in this cycle.

Recent price action shows repeated attempts to break through the $4,500 level, each time meeting selling pressure. This rejection pattern highlights market caution, as traders anticipate further tests of support levels before a decisive move. Should ETH fail to hold above $4,200, the next significant demand area lies closer to $3,900.

On the other hand, if buying pressure resumes, particularly from whales and institutions that have been accumulating aggressively, a breakout above $4,500 could quickly target the $4,800 region. For now, Ethereum remains in consolidation mode, balancing between strong fundamentals and the weight of short-term selling.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.