Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a conversation with The Bitcoin Economy podcast, Bloomberg Intelligence ETF analyst James Seyffart argued that the next, and potentially largest, leg of institutional demand for spot-Bitcoin exchange-traded funds will not come from pension funds, endowments, or sovereign wealth managers. Instead, it will arise when the country’s fragmented network of registered investment advisers (RIAs) finally gains full discretionary clearance to recommend Bitcoin ETFs to ordinary clients.

“The biggest bull case for the ETFs has been the unlocking of RIAs in 2025,” Seyffart said. “Right now the vast majority of the assets are stuck in that middle ground where, if a client specifically asks to buy a Bitcoin ETF, the adviser can act—but the adviser cannot initiate the recommendation.”

The Biggest Bull Case For Bitcoin In 2025

Seyffart broke the compliance bottleneck into a traffic-light schema that most financial advisers will recognise. A red-light firm bars Bitcoin entirely; a yellow-light firm permits unsolicited purchases (“If you come to me and ask for it, I can do it”); and a green-light firm allows the adviser to solicit an allocation (“I can recommend that you put two percent of your portfolio in Bitcoin”).

Related Reading

Wire-house broker–dealers—which still custody trillions of dollars—largely remain in the red or yellow camps, paralysed by multi-year due-diligence committees. Independent RIAs, by contrast, “were the early adopters,” Seyffart noted, because they “don’t have to wait for a due-diligence team of a bunch of people sitting in New York.” Yet even among independents, most advisers outsource portfolio construction to centralised model portfolios; until those models flag Bitcoin ETFs as eligible holdings, discretionary uptake will stay muted.

Seyffart’s focus on 2025 is calendrical, not calendrical: the first full-calendar year after launch gives compliance teams twelve months of daily NAV history—often a hard requirement before a new ETF can graduate from yellow to green status. “Usually it can take two to three years before an ETF gets approved,” he said, but the extraordinary size and liquidity of the spot-Bitcoin cohort is already accelerating that cycle.

Crucially, the next Form 13F reporting deadline on 15 August 2025 will reveal second-quarter holdings as of 30 June. Seyffart expects the data to confirm that “a lot more RIAs have come online and [are] buying this for their clients,” providing the first concrete measure of green-light conversions.

Related Reading

If the gatekeeping retreats, model-portfolio architects can incorporate Bitcoin’s historically uncorrelated returns into strategic-allocation frameworks. That in turn would grant advisers legal cover to solicit Bitcoin exposure, unleashing a flywheel of inflows. Seyffart cautioned that the same compliance teams will demand iron-clad fiduciary justifications—volatility, custody and tax treatment remain live concerns—but he argued that the ETFs now provide a wrapper familiar to any wealth platform.

Seyffart’s thesis is that the moment a critical mass of compliance committees flips from yellow to green—allowing advisers to recommend Bitcoin rather than merely transact it—flows could dwarf everything seen to date. Whether that inflection arrives in the next 12 months will determine, in his view, “the biggest bull case for Bitcoin.”

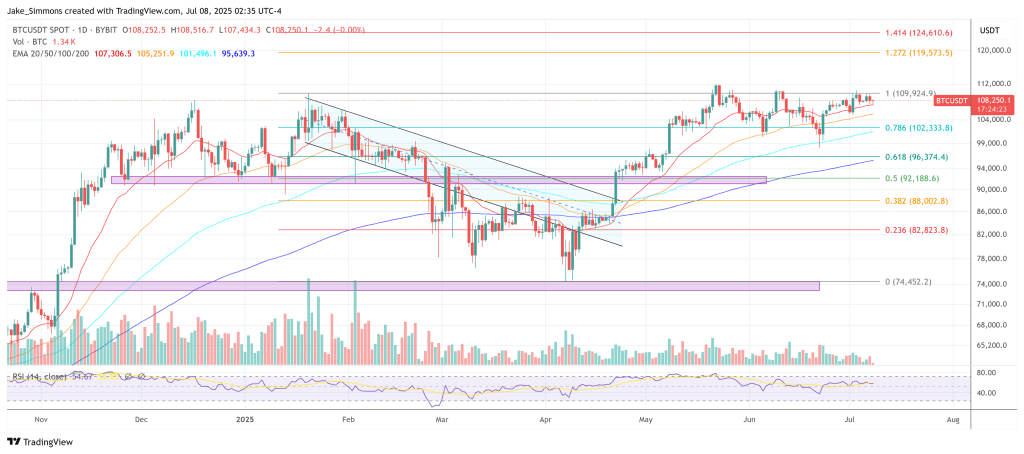

At press time, BTC traded at $108,250.

Featured image created with DALL.E, chart from TradingView.com