Updated on August 25th, 2024 by Bob Ciura

Investors looking for higher levels of income should consider high dividend stocks. We define high dividend stocks as having current yields above 5%.

If interest rates decline in the months ahead, high dividend stocks still provide investors with more income than most alternatives.

With this in mind, we have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all high dividend stocks (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

However, not all high-yield stocks make equally good investments.

Many stocks with extremely high yields are at risk of cutting their dividends if their underlying fundamentals, such as earnings or free cash flow, do not support the dividend payout.

This is particularly true during recessions, when many cyclical companies struggle with declining revenue and profits.

Therefore, it is important for income investors to assess whether a high dividend yield is sustainable.

The following 15 stocks with high dividend yields above 5%, also have strong business models and established track records of maintaining their dividends.

Table Of Contents

All stocks in this list have dividend yields above 5%, making them very appealing for income investors, and Dividend Risk scores of ‘B’ or ‘C’ to focus on sustainable dividends.

The 15 high dividend stocks are listed in order by dividend yield, from lowest to highest, from the Sure Analysis Research Database.

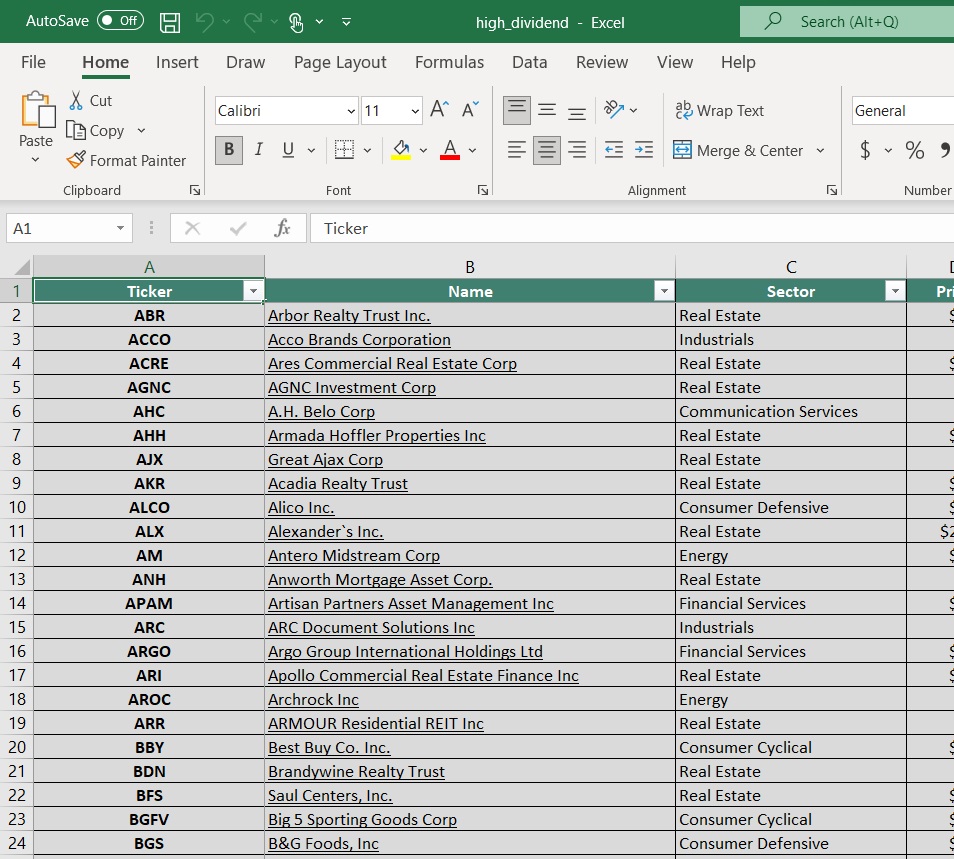

High Dividend Stock For Decades: Franklin Resources (BEN)

Franklin Resources, founded in 1947 and headquartered in San Mateo, CA, is a global asset manager with a long and successful history. The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

As of June 30th, 2025, assets under management (AUM) totaled $1.612 trillion for the $12 billion market cap company.

On July 31st, 2020, Franklin Resources acquired Legg Mason (previous ticker LM) for $4.5 billion in cash, to go along with the assumption of $2 billion in debt.

On August 1st, 2025, Franklin Resources reported third-quarter 2025 results for the period ending June 30, 2025. Total assets under management equaled $1.612 trillion, up $71 billion sequentially, as a result of $78 billion of net market change, distributions, and other, and $2.7 billion of cash management net inflows, partly offset by $9.3 billion of long-term net outflows.

For the quarter, operating revenue totaled $2.064 billion, down 3% year-over-year. On an adjusted basis, net income equaled $263 million or $0.49 per share, down 18% from $0.60 in Q3 2024. During Q3, Franklin repurchased 7.3 million shares of stock for $157 million. Franklin ended the quarter with $5.9 billion in cash and investments.

Click here to download our most recent Sure Analysis report on BEN (preview of page 1 of 3 shown below):

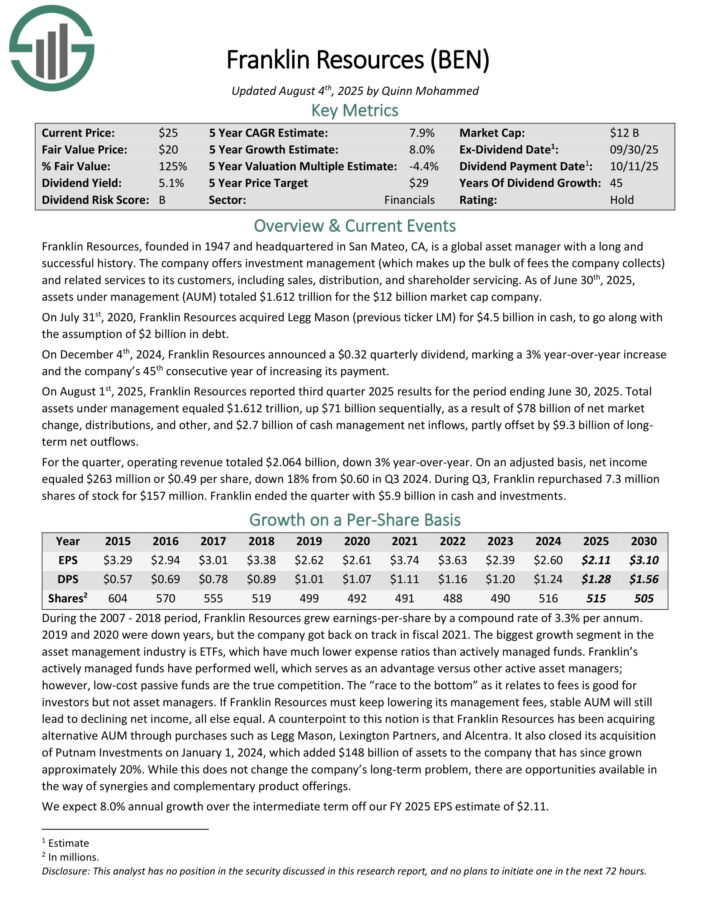

High Dividend Stock For Decades: Best Buy Co. (BBY)

Best Buy Co. Inc. is one the largest consumer electronics retailers in North America with operations in the U.S. and Canada. Best Buy sells consumer electronics, personal computers, software, mobile devices, and appliances and provides services.

At end of Q4 FY2025, Best Buy operated 886 Best Buy stores and 24 Best Buy Outlet Centers in the U.S., 20 Pacific Sales Stores, 21 Yardbird Stores, 128 Best Buy stores in Canada, and 29 Best Buy Mobile Stand-Alone Stores in Canada. The company’s annual sales exceeded $13.5B in fiscal 2025.

Best Buy reported Q1 FY2026 results on May 29th, 2025. Enterprise revenue decreased to $8,767M from $8,847M and non-GAAP diluted earnings per share decreased to $1.15 from $1.20 on a year-over-year basis. GAAP diluted EPS declined to $0.95 from $1.13.

Comparable enterprise revenue decreased -0.7%. Domestic revenue fell -0.9% on lower comparable sales and store closures. Sales were lower for 3 out of 5 categories. Comparable domestic online sales increased 2.1% compared to the prior year. Domestic online sales comprised about 31.7% of total domestic revenue.

Click here to download our most recent Sure Analysis report on BBY (preview of page 1 of 3 shown below):

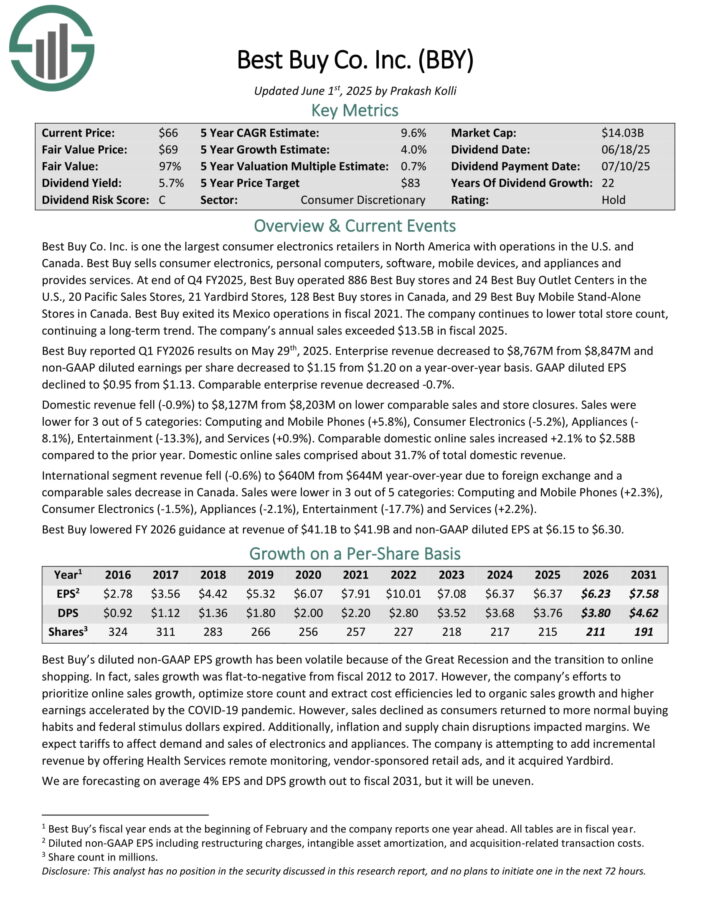

High Dividend Stock For Decades: Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb is a leading drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On July 31st, 2025, Bristol-Myers announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue inched higher by 0.6% to $12.3 billion, which was $890 million more than expected. Adjusted earnings-per-share of $1.46 compared unfavorably to $2.07 in the prior year and was $0.36 below estimates.

That said, EPS had favorable impact of $0.57per share related to an in-process research and development charge related to the company’s partnership with BioNTech.

U.S. revenues declined 3% to $8.5 billion. International grew 10% to $3.8 billion, but revenue grew 8% when excluding currency exchange. Eliquis, which prevents blood clots, grew 8% to $3.7 billion as U.S. growth was partially offset by changes in Medicare Part D related to legislation to lower drug prices.

Eliquis remains the top oral anticoagulant outside of the U.S. and generated more than $13 billion in revenue for 2024, which was a 9% increase from the prior year. Opdivo, which treats cancers such as advanced renal carcinoma, was higher by 7% to $2.6 billion due once again to global volume growth.

Bristol-Myers provided revised guidance for 2025 as well. Adjusted earnings-per-share are now projected to be in a range of $6.35 to $6.65 for the year.

Click here to download our most recent Sure Analysis report on BMY (preview of page 1 of 3 shown below):

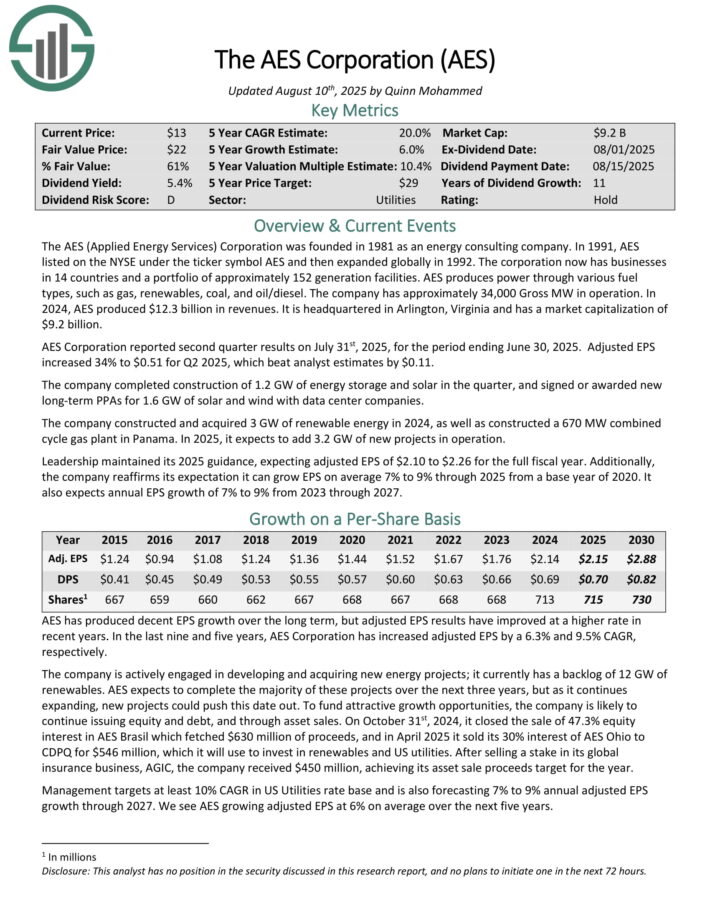

High Dividend Stock For Decades: AES Corp. (AES)

The AES (Applied Energy Services) Corporation was founded in 1981 as an energy consulting company. The corporation now has businesses in 14 countries and a portfolio of approximately 152 generation facilities.

AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel. The company has approximately 34,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported second quarter results on July 31st, 2025, for the period ending June 30, 2025. Adjusted EPS increased 34% to $0.51 for Q2 2025, which beat analyst estimates by $0.11.

The company completed construction of 1.2 GW of energy storage and solar in the quarter, and signed or awarded new long-term PPAs for 1.6 GW of solar and wind with data center companies.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. In 2025, it expects to add 3.2 GW of new projects in operation. Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Additionally, the company reaffirms its expectation it can grow EPS on average 7% to 9% through 2025 from a base year of 2020. It also expects annual EPS growth of 7% to 9% from 2023 through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

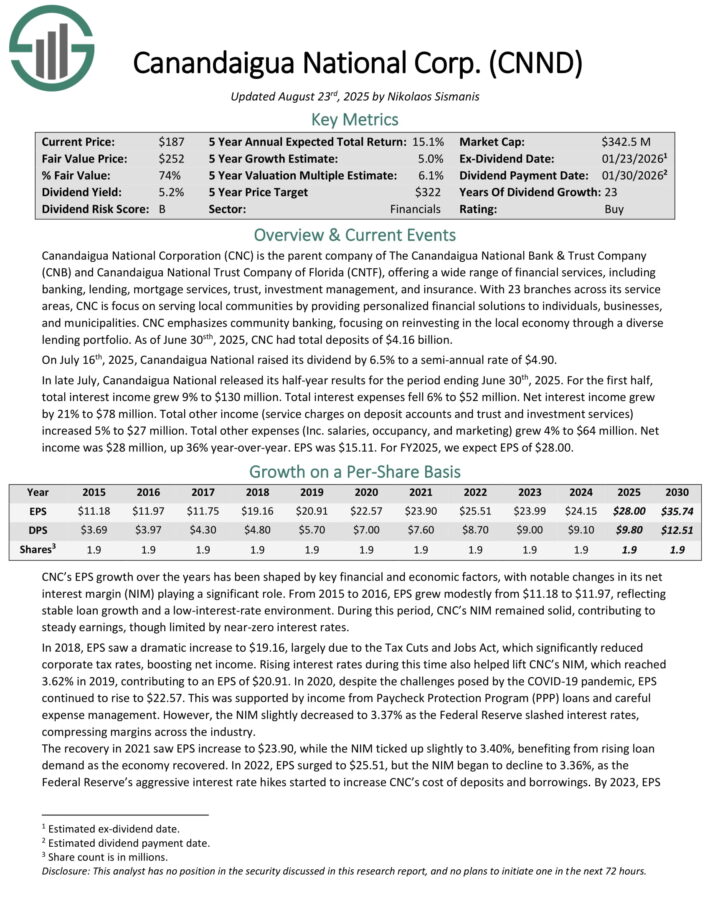

High Dividend Stock For Decades: Canandaigua National Corporation (CNND)

Canandaigua National Corporation (CNC) is the parent company of The Canandaigua National Bank & Trust Company (CNB) and Canandaigua National Trust Company of Florida (CNTF), offering a wide range of financial services, including banking, lending, mortgage services, trust, investment management, and insurance.

With 23 branches across its service areas, CNC is focus on serving local communities by providing personalized financial solutions to individuals, businesses, and municipalities. CNC emphasizes community banking, focusing on reinvesting in the local economy through a diverse lending portfolio.

As of June 30sth, 2025, CNC had total deposits of $4.16 billion. On July 16th, 2025, Canandaigua National raised its dividend by 6.5% to a semi-annual rate of $4.90.

In late July, Canandaigua National released its half-year results for the period ending June 30th, 2025. For the first half, total interest income grew 9% to $130 million. Total interest expenses fell 6% to $52 million. Net interest income grew by 21% to $78 million.

Total other income (service charges on deposit accounts and trust and investment services) increased 5% to $27 million. Total other expenses (Inc. salaries, occupancy, and marketing) grew 4% to $64 million. Net income was $28 million, up 36% year-over-year. EPS was $15.11.

Click here to download our most recent Sure Analysis report on CNND (preview of page 1 of 3 shown below):

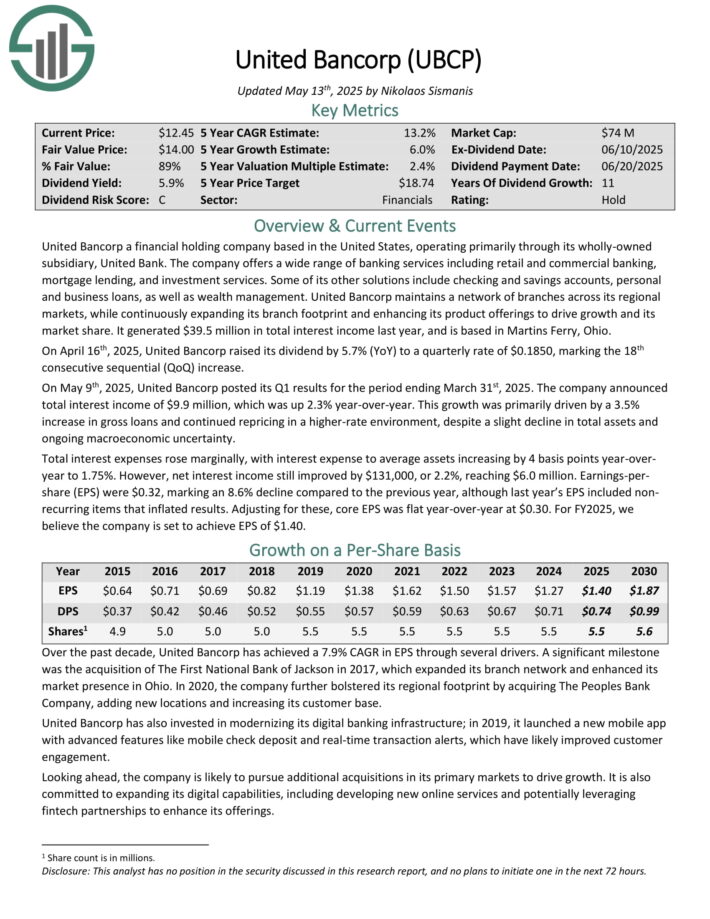

High Dividend Stock For Decades: United Bancorp (UBCP)

United Bancorp a financial holding company based in the United States, operating primarily through its wholly-owned subsidiary, United Bank. The company offers a wide range of banking services including retail and commercial banking, mortgage lending, and investment services.

Some of its other solutions include checking and savings accounts, personal and business loans, as well as wealth management. United Bancorp maintains a network of branches across its regional markets, while continuously expanding its branch footprint and enhancing its product offerings to drive growth and its market share.

It generated $39.5 million in total interest income last year, and is based in Martins Ferry, Ohio.

On April 16th, 2025, United Bancorp raised its dividend by 5.7% (YoY) to a quarterly rate of $0.1850, marking the 18th consecutive sequential (QoQ) increase.

On May 9th, 2025, United Bancorp posted its Q1 results for the period ending March 31st, 2025. The company announced total interest income of $9.9 million, which was up 2.3% year-over-year.

This growth was primarily driven by a 3.5% increase in gross loans and continued repricing in a higher-rate environment, despite a slight decline in total assets and ongoing macroeconomic uncertainty.

Total interest expenses rose marginally, with interest expense to average assets increasing by 4 basis points year-over-year to 1.75%. However, net interest income still improved by $131,000, or 2.2%, reaching $6.0 million. Earnings-per-share (EPS) were $0.32, marking an 8.6% decline compared to the previous year.

Click here to download our most recent Sure Analysis report on UBCP (preview of page 1 of 3 shown below):

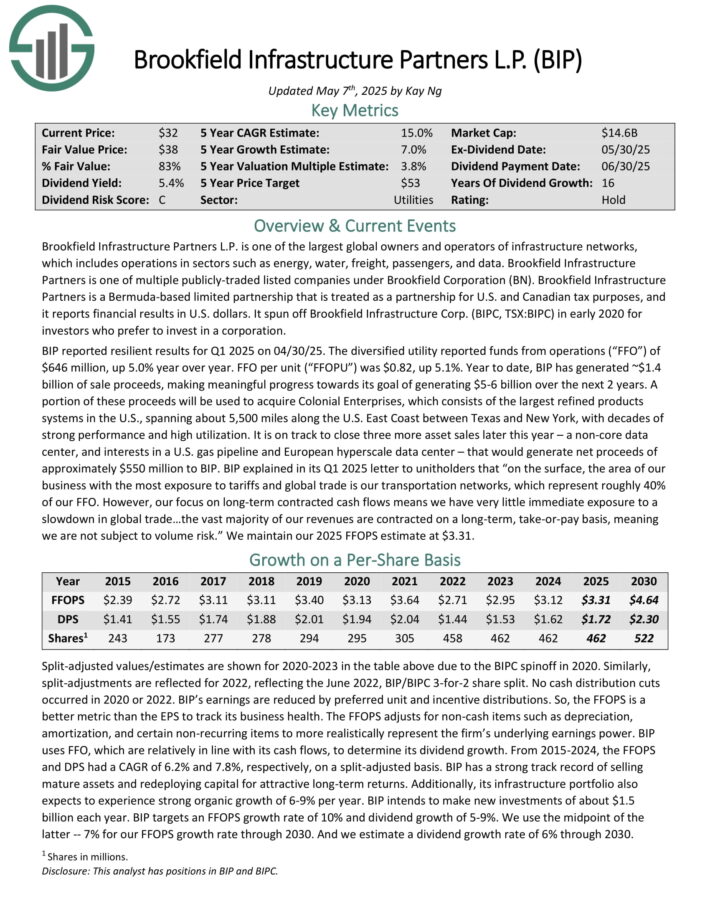

High Dividend Stock For Decades: Brookfield Infrastructure Partners LP (BIP)

Brookfield Infrastructure Partners L.P. is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data.

Brookfield Infrastructure Partners is one of four publicly-traded listed partnerships that is operated by Brookfield Asset Management (BAM).

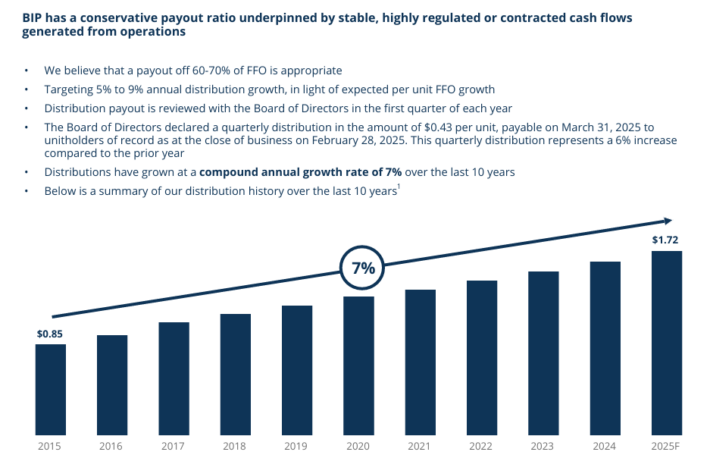

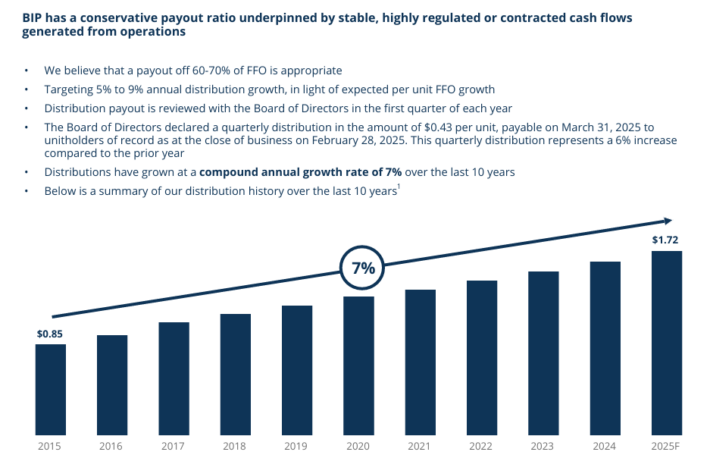

BIP has delivered 8% compound annual distribution growth over the past 10 years.

Source: Investor Presentation

BIP reported resilient results for Q1 2025 on 04/30/25. The diversified utility reported funds from operations of $646 million, up 5.0% year over year. FFO per unit (“FFOPU”) was $0.82, up 5.1%.

Year to date, BIP has generated ~$1.4 billion of sale proceeds, making meaningful progress towards its goal of generating $5-6 billion over the next 2 years.

A portion of these proceeds will be used to acquire Colonial Enterprises, which consists of the largest refined products systems in the U.S., spanning about 5,500 miles along the U.S. East Coast between Texas and New York.

Click here to download our most recent Sure Analysis report on Brookfield Infrastructure Partners (preview of page 1 of 3 shown below):

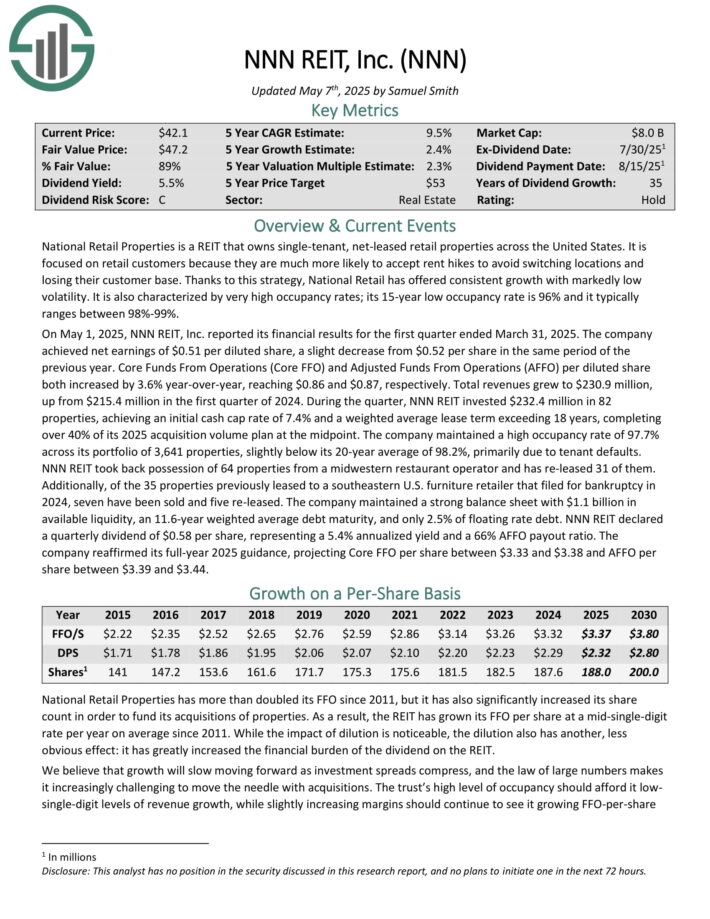

High Dividend Stock For Decades: NNN REIT (NNN)

National Retail Properties is a REIT that owns single-tenant, net-leased retail properties across the United States. It is focused on retail customers because they are much more likely to accept rent hikes to avoid switching locations and losing their customer base.

On May 1, 2025, NNN REIT, Inc. reported its financial results for the first quarter ended March 31, 2025. The company achieved net earnings of $0.51 per diluted share, a slight decrease from $0.52 per share in the same period of the previous year.

Core Funds From Operations (Core FFO) and Adjusted Funds From Operations (AFFO) per diluted share both increased by 3.6% year-over-year, reaching $0.86 and $0.87, respectively. Total revenues grew to $230.9 million, up from $215.4 million in the first quarter of 2024.

During the quarter, NNN REIT invested $232.4 million in 82 properties, achieving an initial cash cap rate of 7.4% and a weighted average lease term exceeding 18 years, completing over 40% of its 2025 acquisition volume plan at the midpoint.

The company maintained a high occupancy rate of 97.7% across its portfolio of 3,641 properties, slightly below its 20-year average of 98.2%, primarily due to tenant defaults.

Click here to download our most recent Sure Analysis report on NNN (preview of page 1 of 3 shown below):

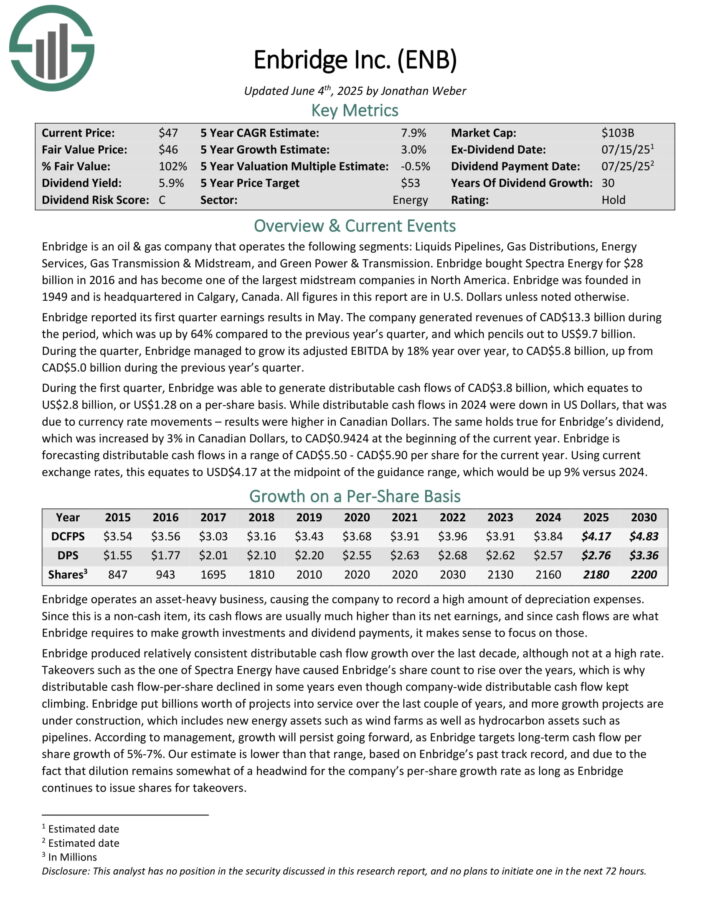

High Dividend Stock For Decades: Enbridge Inc. (ENB)

Enbridge is an oil & gas company that operates the following segments: Liquids Pipelines, Gas Distributions, Energy Services, Gas Transmission & Midstream, and Green Power & Transmission. Enbridge bought Spectra Energy for $28 billion in 2016 and has become one of the largest midstream companies in North America.

Enbridge was founded in 1949 and is headquartered in Calgary, Canada.

Enbridge reported its first quarter earnings results in May. The company generated revenues of CAD$13.3 billion during the period, which was up by 64% compared to the previous year’s quarter, and which pencils out to US$9.7 billion.

During the quarter, Enbridge grew its adjusted EBITDA by 18% year over year. Distributable cash flows came to US$2.8 billion, or US$1.28 on a per-share basis.

Enbridge is forecasting distributable cash flows in a range of CAD$5.50 – CAD$5.90 per share for the current year. Using current exchange rates, this equates to USD$4.17 at the midpoint of the guidance range, which would be up 9% versus 2024.

Click here to download our most recent Sure Analysis report on ENB (preview of page 1 of 3 shown below):

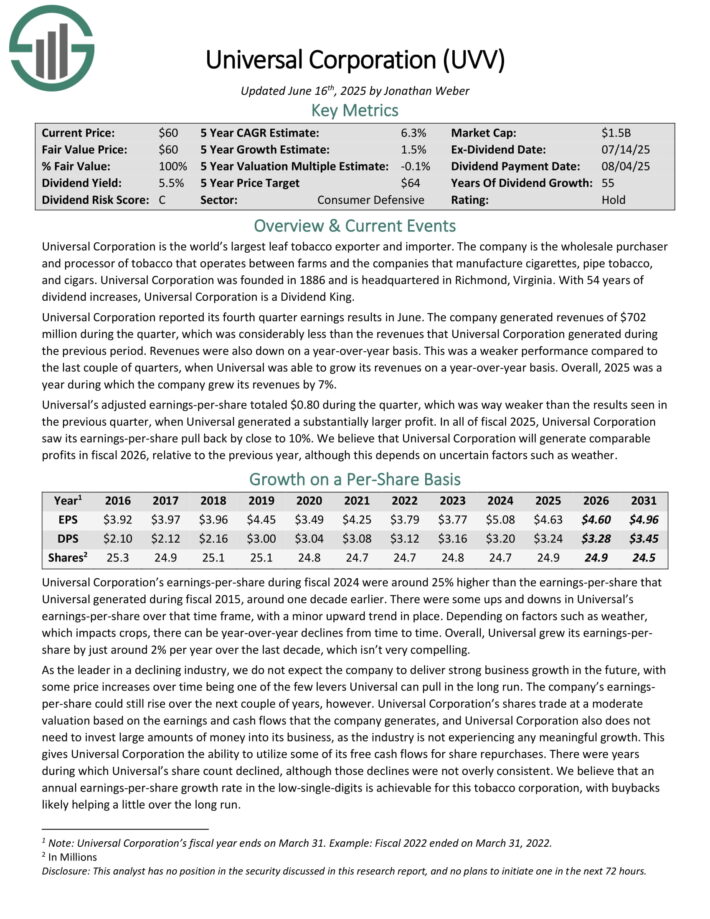

High Dividend Stock For Decades: Universal Corp. (UVV)

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal Corporation was founded in 1886 and is headquartered in Richmond, Virginia.

Universal Corporation reported its fourth quarter earnings results in June. The company generated revenues of $702 million during the quarter, which was considerably less than the revenues that Universal Corporation generated during the previous period. Revenues were also down on a year-over-year basis.

This was a weaker performance compared to the last couple of quarters, when Universal was able to grow its revenues on a year-over-year basis. Overall, 2025 was a year during which the company grew its revenues by 7%.

Universal’s adjusted earnings-per-share totaled $0.80 during the quarter, which was way weaker than the results seen in the previous quarter, when Universal generated a substantially larger profit. In all of fiscal 2025, Universal Corporation saw its earnings-per-share pull back by close to 10%.

Click here to download our most recent Sure Analysis report on UVV (preview of page 1 of 3 shown below):

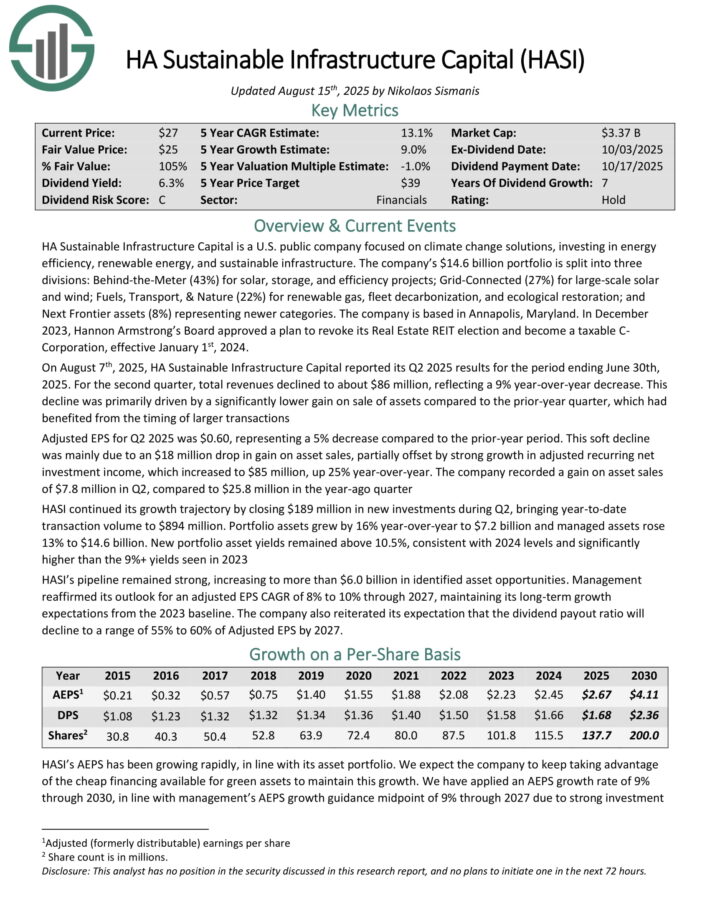

High Dividend Stock For Decades: HA Sustainable Infrastructure Capital (HASI)

HA Sustainable Infrastructure Capital is a U.S. public company focused on climate change solutions, investing in energy efficiency, renewable energy, and sustainable infrastructure.

The company’s $14.6 billion portfolio is split into three divisions: Behind-the-Meter (43%) for solar, storage, and efficiency projects; Grid-Connected (27%) for large-scale solar and wind; Fuels, Transport, & Nature (22%) for renewable gas, fleet decarbonization, and ecological restoration; and Next Frontier assets (8%) representing newer categories.

On August 7th, 2025, HA Sustainable Infrastructure Capital reported its Q2 2025 results for the period ending June 30th, 2025. For the second quarter, total revenues declined to about $86 million, reflecting a 9% year-over-year decrease.

This decline was primarily driven by a significantly lower gain on sale of assets compared to the prior-year quarter, which had benefited from the timing of larger transactions.

Adjusted EPS for Q2 2025 was $0.60, representing a 5% decrease compared to the prior-year period. This soft decline was mainly due to an $18 million drop in gain on asset sales, partially offset by strong growth in adjusted recurring net investment income, which increased to $85 million, up 25% year-over-year.

Click here to download our most recent Sure Analysis report on HASI (preview of page 1 of 3 shown below):

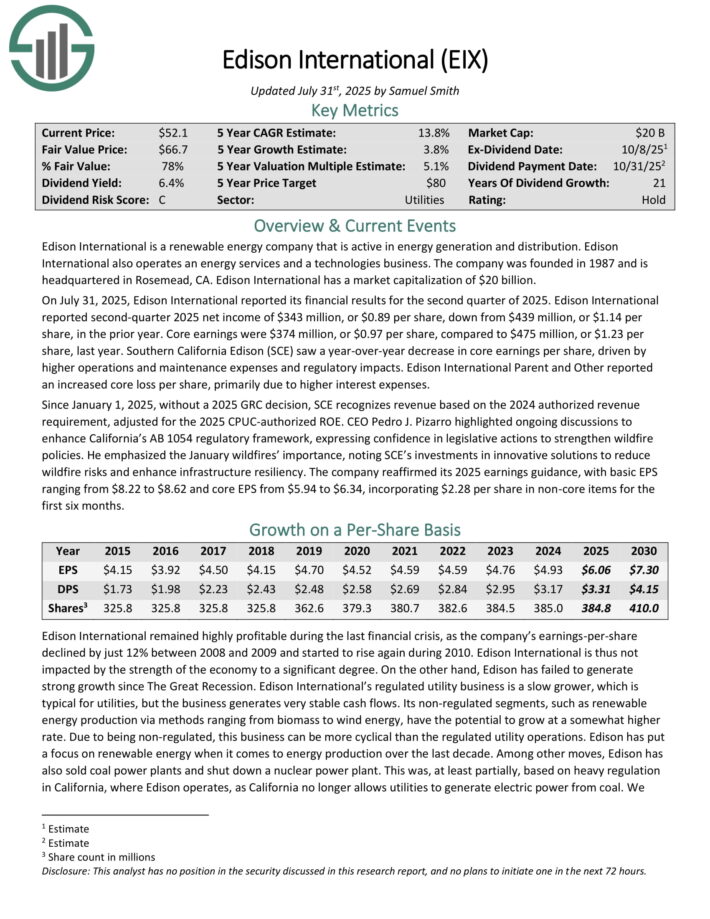

High Dividend Stock For Decades: Edison International (EIX)

Edison International is a renewable energy company that is active in energy generation and distribution. Edison International also operates an energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, CA.

On July 31, 2025, Edison International reported its financial results for the second quarter of 2025. Edison International reported second-quarter 2025 net income of $343 million, or $0.89 per share, down from $439 million, or $1.14 per share, in the prior year.

Core earnings were $374 million, or $0.97 per share, compared to $475 million, or $1.23 per share, last year. Southern California Edison (SCE) saw a year-over-year decrease in core earnings per share, driven by higher operations and maintenance expenses and regulatory impacts.

Edison International Parent and Other reported an increased core loss per share, primarily due to higher interest expenses.

The company reaffirmed its 2025 earnings guidance, with basic EPS ranging from $8.22 to $8.62 and core EPS from $5.94 to $6.34, incorporating $2.28 per share in non-core items for the first six months.

Click here to download our most recent Sure Analysis report on EIX (preview of page 1 of 3 shown below):

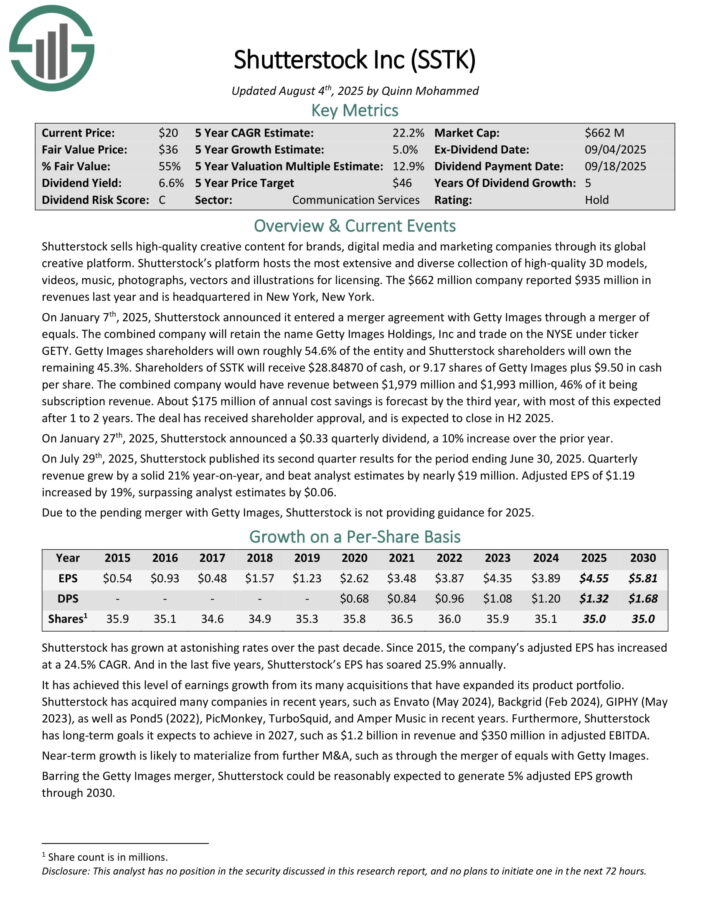

High Dividend Stock For Decades: Shutterstock, Inc. (SSTK)

Shutterstock sells high-quality creative content for brands, digital media and marketing companies through its global creative platform.

Its platform hosts the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations for licensing. The company reported $935 million in revenues last year.

On January 7th, 2025, Shutterstock announced it entered a merger agreement with Getty Images through a merger of equals. The combined company will retain the name Getty Images Holdings, Inc and trade on the NYSE under ticker GETY.

Getty Images shareholders will own roughly 54.6% of the entity and Shutterstock shareholders will own the remaining 45.3%. Shareholders of SSTK will receive $28.84870 of cash, or 9.17 shares of Getty Images plus $9.50 in cash per share.

The combined company would have revenue between $1,979 million and $1,993 million, 46% of it being subscription revenue. About $175 million of annual cost savings is forecast by the third year, with most of this expected after 1 to 2 years.

On July 29th, 2025, Shutterstock published its second quarter results for the period ending June 30, 2025. Quarterly revenue grew by a solid 21% year-on-year, and beat analyst estimates by nearly $19 million. Adjusted EPS of $1.19 increased by 19%, surpassing analyst estimates by $0.06.

Click here to download our most recent Sure Analysis report on SSTK (preview of page 1 of 3 shown below):

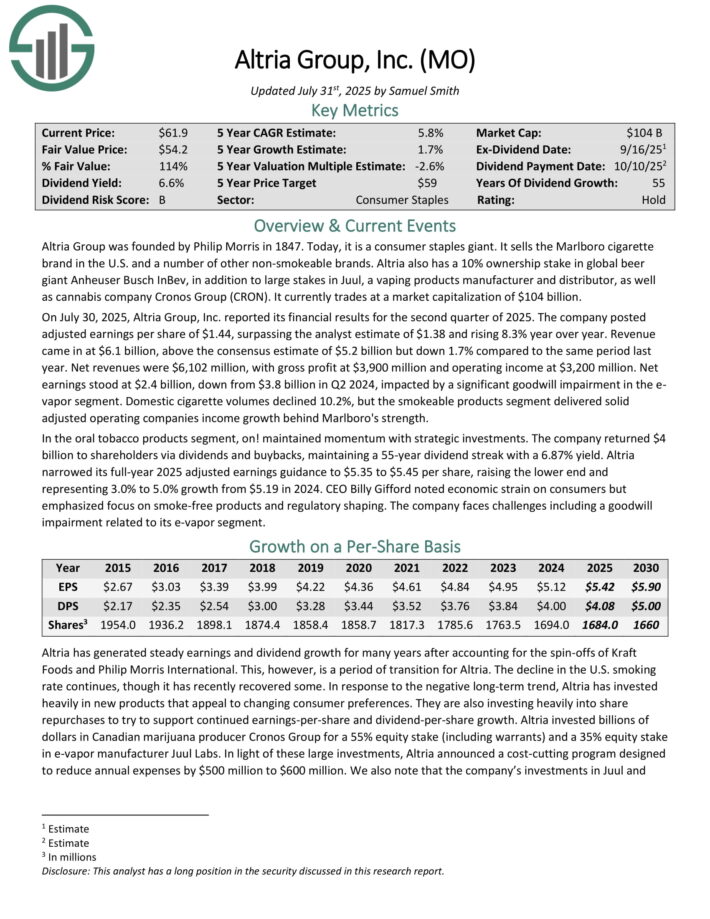

High Dividend Stock For Decades: Altria Group (MO)

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

This is a period of transition for Altria. The decline in the U.S. smoking rate continues. In response, Altria has invested heavily in new products that appeal to changing consumer preferences, as the smoke-free category continues to grow.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the Canadian cannabis producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its financial results for the second quarter of 2025. The company posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% year over year.

Revenue came in at $6.1 billion, above the consensus estimate of $5.2 billion but down 1.7% compared to the same period last year. Net revenues were $6,102 million, with gross profit at $3,900 million and operating income at $3,200 million.

Net earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a significant goodwill impairment in the e-vapor segment.

Domestic cigarette volumes declined 10.2%, but the smokeable products segment delivered solid adjusted operating companies income growth behind Marlboro’s strength.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

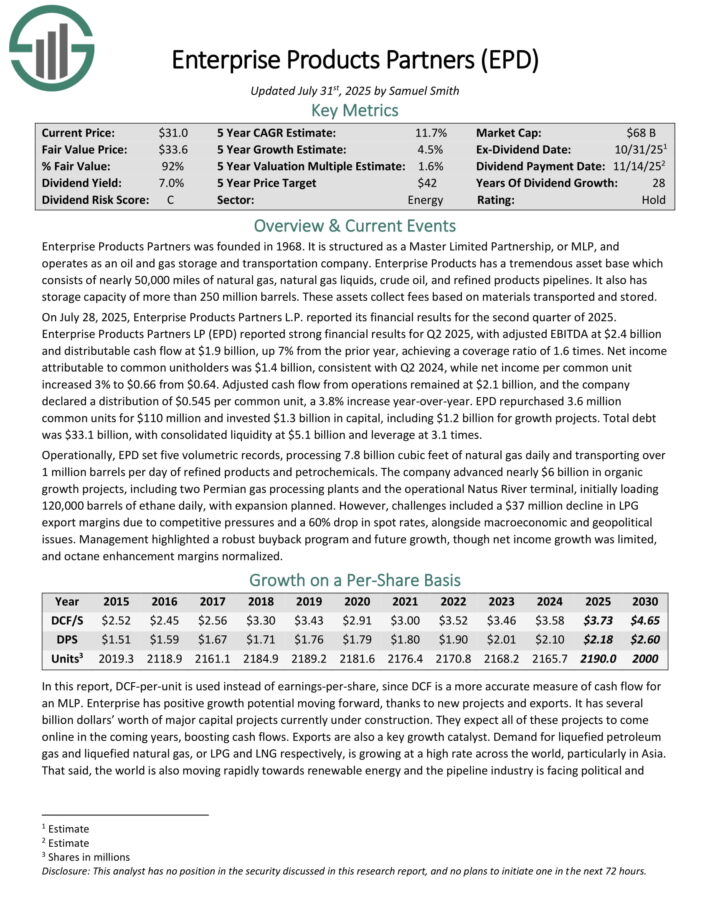

High Dividend Stock For Decades: Enterprise Products Partners (EPD)

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company. Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

On July 28, 2025, Enterprise Products Partners L.P. reported its financial results for the second quarter of 2025. Distributable cash flow was $1.9 billion, up 7% from the prior year, with a coverage ratio of 1.6 times. Net income per common unit increased 3% to $0.66 from $0.64.

Adjusted cash flow from operations remained at $2.1 billion, and the company declared a distribution of $0.545 per common unit, a 3.8% increase year-over-year. EPD repurchased 3.6 million common units for $110 million and invested $1.3 billion in capital, including $1.2 billion for growth projects.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

The 15 high dividend stocks analyzed above all have dividend yields of 5% or higher. And importantly, these securities generally have better risk profiles than the average high-yield stock.

That said, a dividend is never guaranteed, and high dividend stocks are potentially at risk of dividend reductions or suspensions if a recession occurs in the near future.

Investors should continue to monitor each stock to make sure their fundamentals and growth remain on track, particularly among stocks with extremely high dividend yields.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.