Published on August 25th, 2025 by Bob Ciura

Dividend investing is ultimately about replacing your working income with a passive income stream for a financially free retirement (or early retirement).

The reality of inflation means that your passive income stream can’t just be static. It must be perpetually growing.

To build perpetually growing – lasting – retirement income, invest in a reasonably diversified basket of income securities that have the following characteristics:

- Pay dividends (the higher the yield the better)

- Are likely to grow their payments (the faster the better)

- Have safe dividends so you are likely to see stable or better income during a recession (the safer the dividend, the better)

Dividend investments should be safe, growing income securities.

When it comes to safe and growing income, there are no better stocks than the Dividend Kings. The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

You can see the full downloadable spreadsheet of all 56 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

The 10 top retirement income stocks below are Dividend Kings based in the U.S., with current yields above 2.5%, equal to double the current dividend yield of the S&P 500 Index.

In addition, they all have Dividend Risk Score of ‘A’, indicating strong dividend safety.

The 10 stocks are ranked by dividend yield below.

Table of Contents

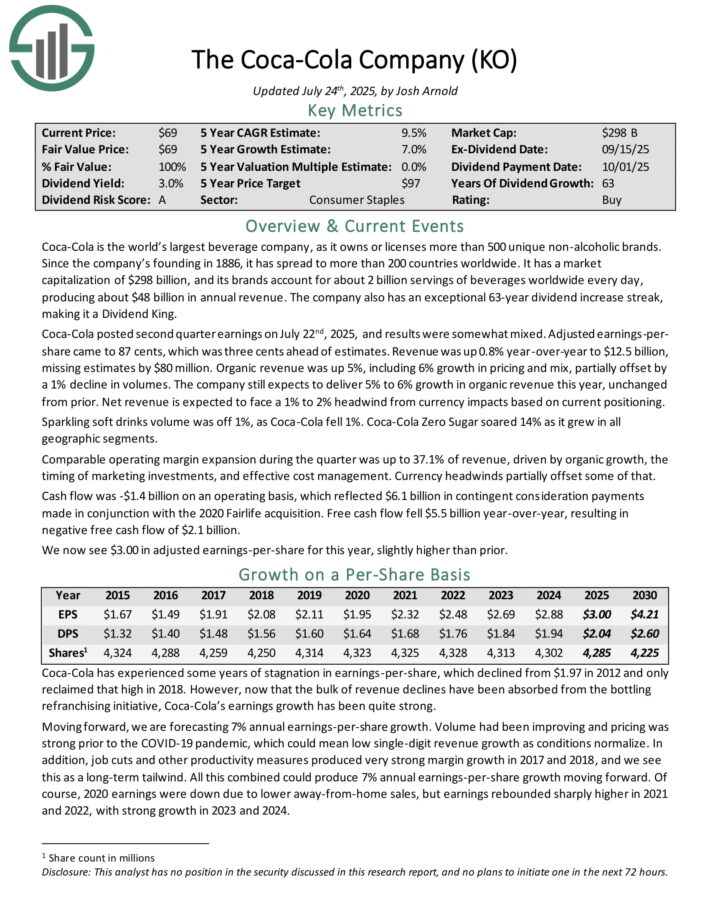

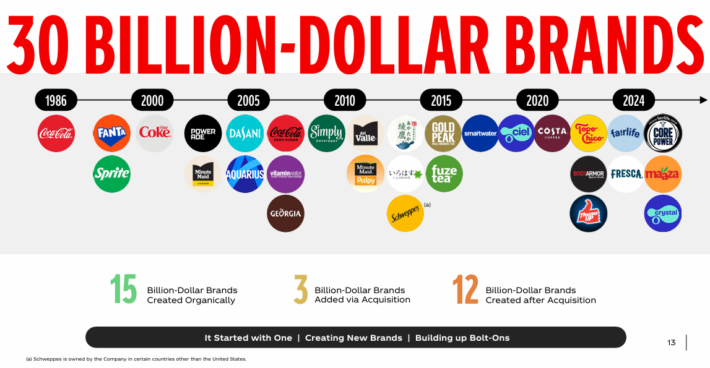

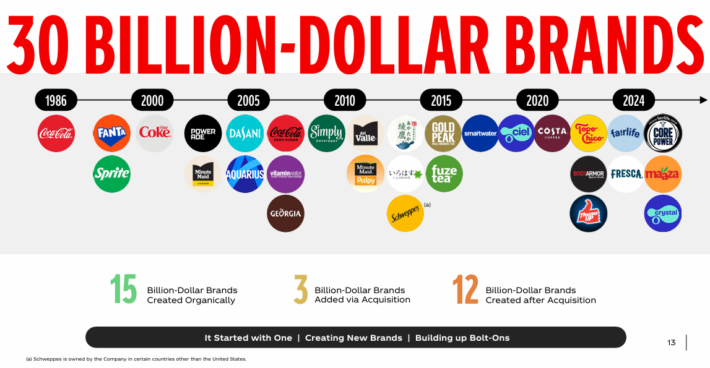

Top Retirement Income Stock: Coca-Cola Co. (KO)

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

Coca-Cola now has 30 billion-dollar brands in its portfolio, which each generate at least $1 billion in annual sales.

Source: Investor Presentation

Coca-Cola posted second quarter earnings on July 22nd, 2025, and results were somewhat mixed. Adjusted earnings-per-share came to 87 cents, which was three cents ahead of estimates. Revenue was up 0.8% year-over-year to $12.5 billion, missing estimates by $80 million.

Organic revenue was up 5%, including 6% growth in pricing and mix, partially offset by a 1% decline in volumes. The company still expects to deliver 5% to 6% growth in organic revenue this year, unchanged from prior. Net revenue is expected to face a 1% to 2% headwind from currency impacts based on current positioning.

Sparkling soft drinks volume was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% as it grew in all geographic segments. Comparable operating margin expansion during the quarter was up to 37.1% of revenue, driven by organic growth, the timing of marketing investments, and effective cost management. Currency headwinds partially offset some of that..

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

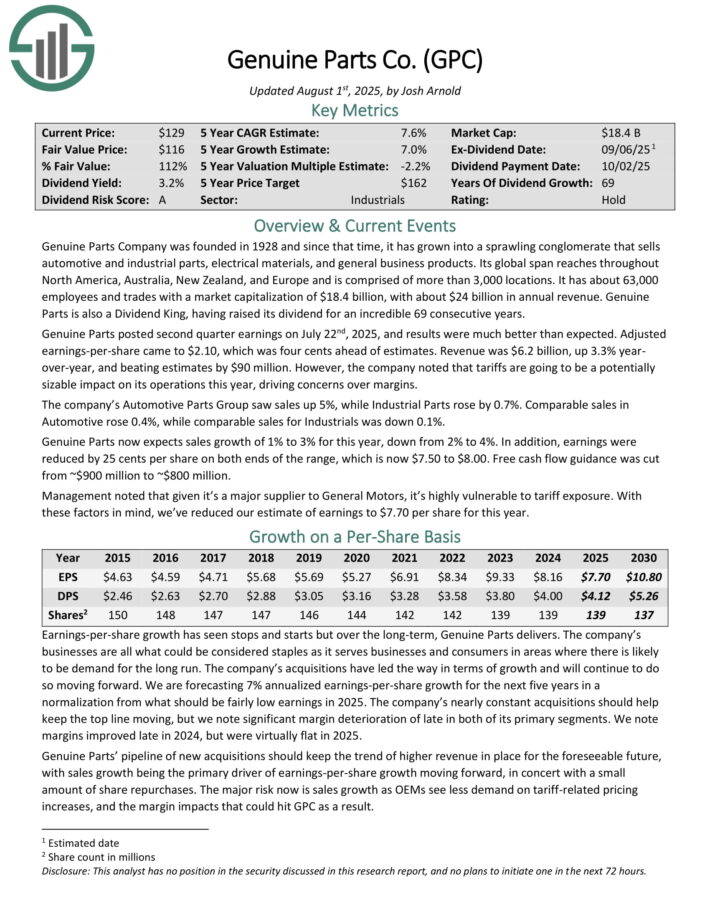

Top Retirement Income Stock: Genuine Parts Co. (GPC)

Genuine Parts has the world’s largest global auto parts network, with more than 10,800 locations worldwide. As a major distributor of automotive and industrial parts, Genuine Parts generates annual revenue of nearly $24 billion.

It operates two segments, which are automotive (includes the NAPA brand) and the industrial parts group which sells industrial replacement parts to MRO (maintenance, repair, and operations) and OEM (original equipment manufacturer) customers.

Genuine Parts posted second quarter earnings on July 22nd, 2025, and results were much better than expected. Adjusted earnings-per-share came to $2.10, which was four cents ahead of estimates. Revenue was $6.2 billion, up 3.3% year-over-year, and beating estimates by $90 million.

The company’s Automotive Parts Group saw sales up 5%, while Industrial Parts rose by 0.7%. Comparable sales in Automotive rose 0.4%, while comparable sales for Industrials was down 0.1%.

Genuine Parts now expects sales growth of 1% to 3% for this year, down from 2% to 4%. In addition, earnings were reduced by 25 cents per share on both ends of the range, which is now $7.50 to $8.00.

Click here to download our most recent Sure Analysis report on GPC (preview of page 1 of 3 shown below):

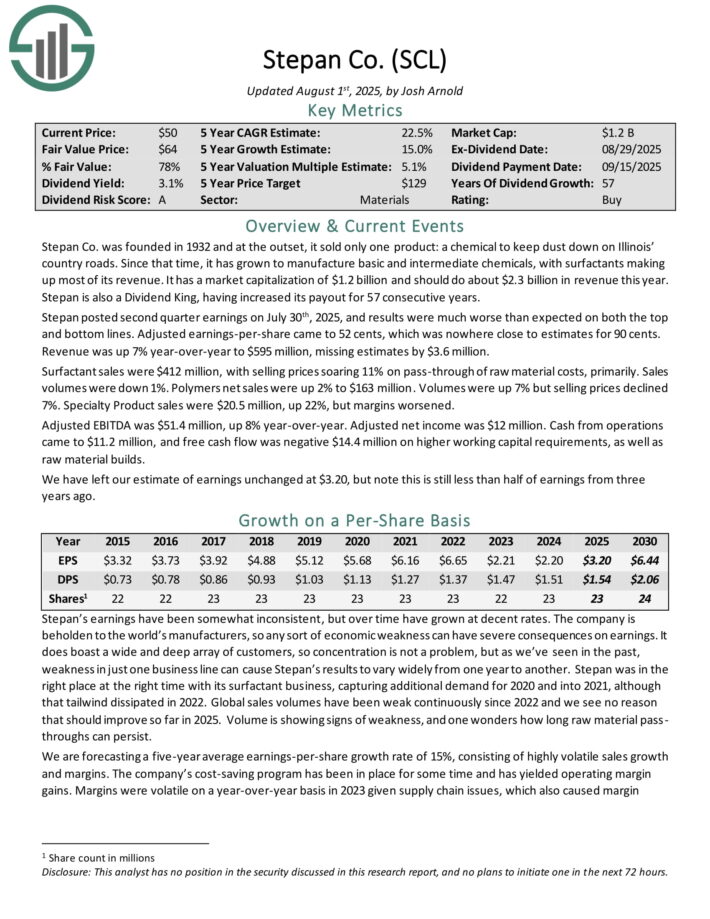

Top Retirement Income Stock: Stepan Co. (SCL)

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets.

The surfactants business is Stepan’s largest by revenue. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Stepan posted second quarter earnings on July 30th, 2025, and results were much worse than expected on both the top and bottom lines. Adjusted earnings-per-share came to 52 cents, which was nowhere close to estimates for 90 cents. Revenue was up 7% year-over-year to $595 million, missing estimates by $3.6 million.

Surfactant sales were $412 million, with selling prices soaring 11% on pass-through of raw material costs, primarily. Sales volumes were down 1%. Polymers net sales were up 2% to $163 million. Volumes were up 7% but selling prices declined 7%. Specialty Product sales were $20.5 million, up 22%, but margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted net income was $12 million. Cash from operations came to $11.2 million, and free cash flow was negative $14.4 million on higher working capital requirements, as well as raw material builds.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

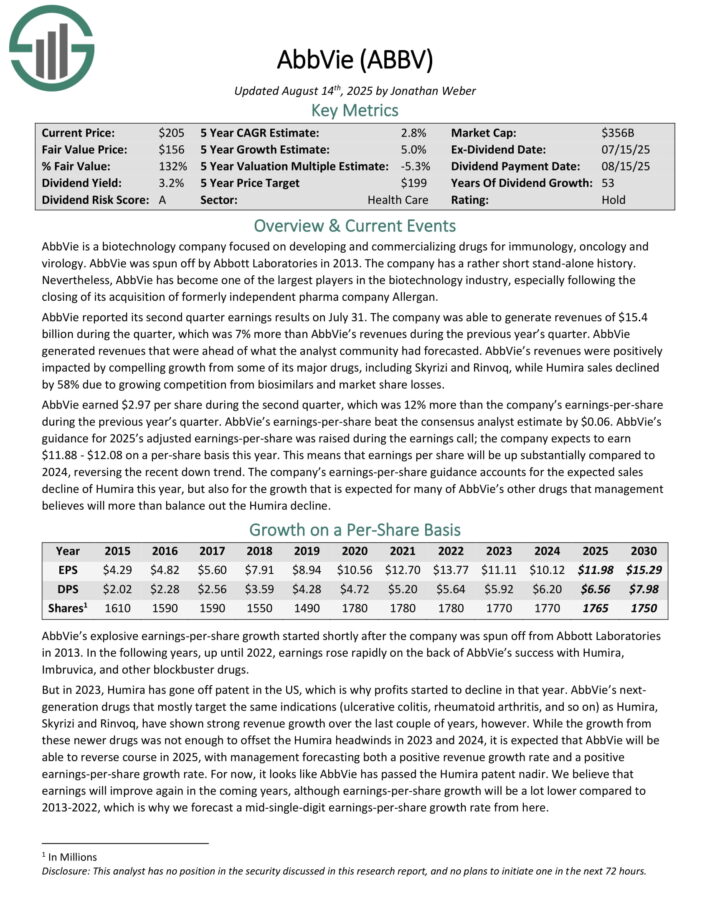

Top Retirement Income Stock: AbbVie Inc. (ABBV)

AbbVie is a biotechnology company focused on developing and commercializing drugs for immunology, oncology and virology. AbbVie was spun off by Abbott Laboratories in 2013.

AbbVie has become one of the largest players in the biotechnology industry, especially following the closing of its acquisition of formerly independent pharma company Allergan.

AbbVie reported its second quarter earnings results on July 31. The company was able to generate revenues of $15.4 billion during the quarter, which was 7% more than AbbVie’s revenues during the previous year’s quarter.

Revenues were positively impacted by compelling growth from some of its major drugs, including Skyrizi and Rinvoq, while Humira sales declined by 58% due to growing competition from biosimilars and market share losses.

AbbVie earned $2.97 per share during the second quarter, up 12% year-over-year. Earnings-per-share beat the consensus analyst estimate by $0.06.

Guidance for 2025’s adjusted earnings-per-share was raised during the earnings call; the company expects to earn $11.88 – $12.08 on a per-share basis this year.

Click here to download our most recent Sure Analysis report on ABBV (preview of page 1 of 3 shown below):

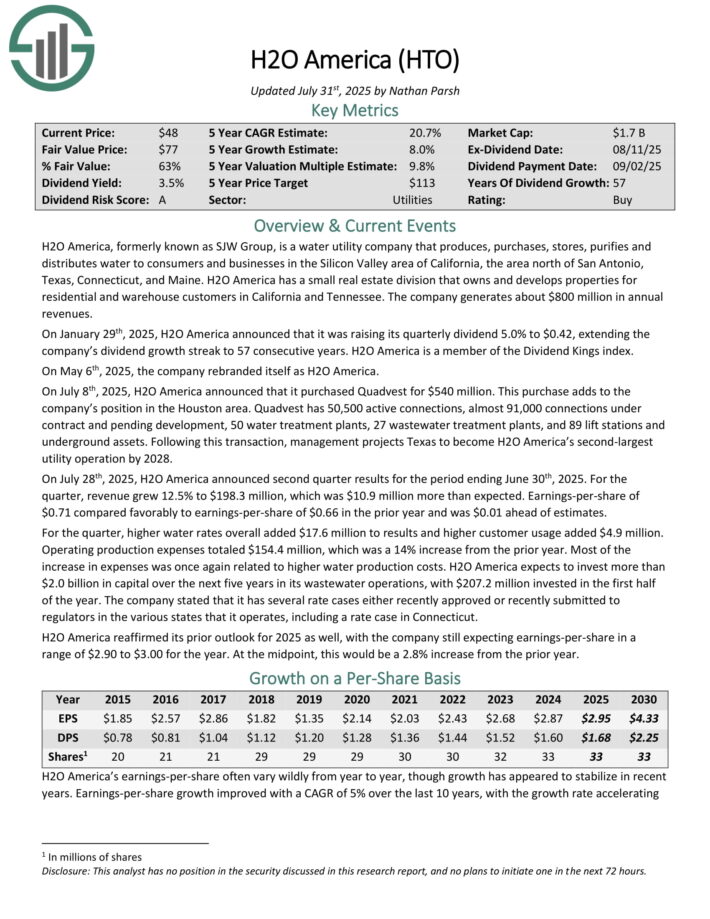

Top Retirement Income Stock: H2O America (HTO)

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On July 8th, 2025, H2O America announced that it purchased Quadvest for $540 million. This purchase adds to the company’s position in the Houston area.

Quadvest has 50,500 active connections, almost 91,000 connections under contract and pending development, 50 water treatment plants, 27 wastewater treatment plants, and 89 lift stations and underground assets.

On July 28th, 2025, H2O America announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue grew 12.5% to $198.3 million, which was $10.9 million more than expected.

Earnings-per-share of $0.71 compared favorably to earnings-per-share of $0.66 in the prior year and was $0.01 ahead of estimates.

For the quarter, higher water rates overall added $17.6 million to results and higher customer usage added $4.9 million. Operating production expenses totaled $154.4 million, which was a 14% increase from the prior year.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

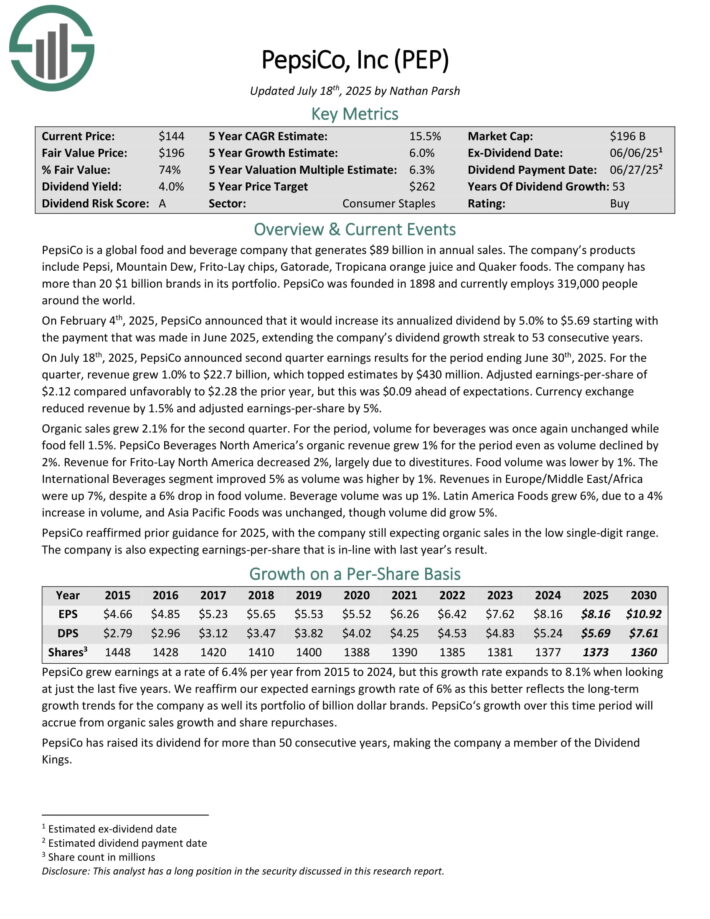

Top Retirement Income Stock: PepsiCo Inc. (PEP)

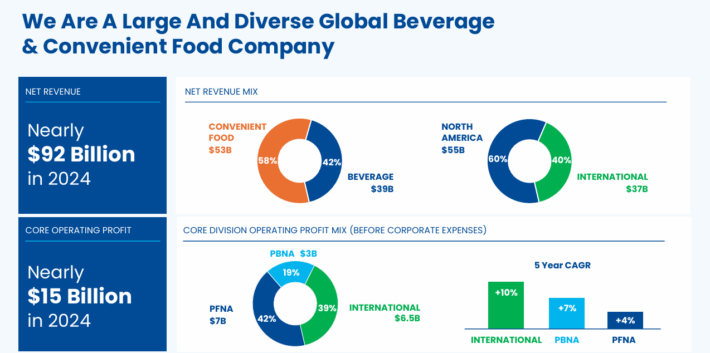

PepsiCo is a global food and beverage company. Its products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On July 18th, 2025, PepsiCo announced second quarter earnings results for the period ending June 30th, 2025. For the quarter, revenue grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 compared unfavorably to $2.28 the prior year, but this was $0.09 ahead of expectations. Currency exchange reduced revenue by 1.5% and adjusted earnings-per-share by 5%.

Organic sales grew 2.1% for the second quarter. For the period, volume for beverages was once again unchanged while food fell 1.5%.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

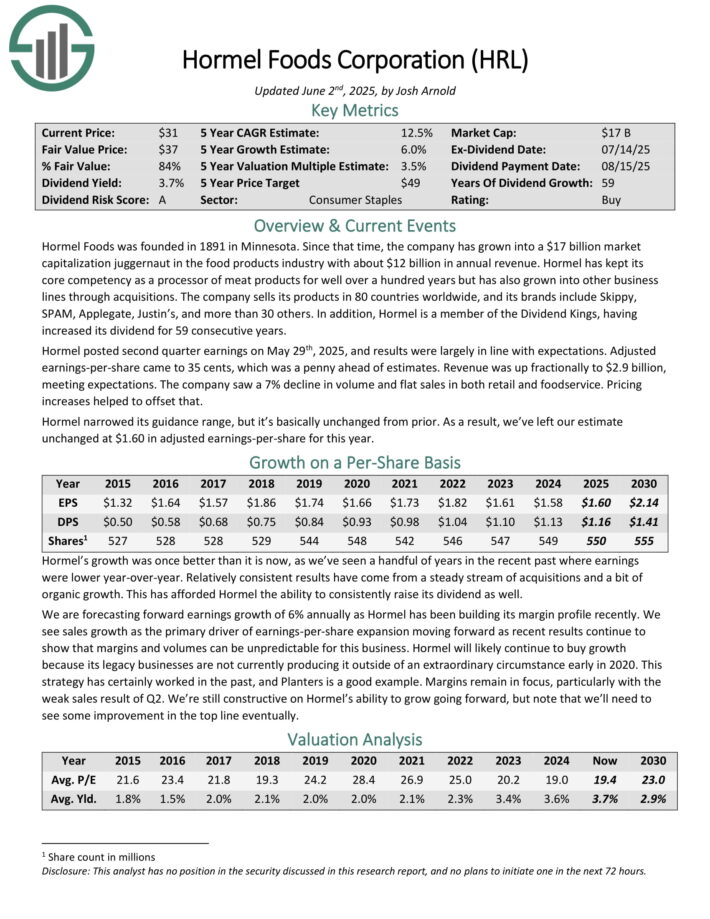

Top Retirement Income Stock: Hormel Foods (HRL)

Hormel Foods is a juggernaut in the food products industry with nearly $10 billion in annual revenue. It has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

It has also pursued acquisitions to drive growth. For example, in 2021, Hormel acquired the Planters snack nuts business from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s growth.

Hormel posted second quarter earnings on May 29th, 2025, and results were largely in line with expectations. Adjusted earnings-per-share came to 35 cents, which was a penny ahead of estimates.

Revenue was up fractionally to $2.9 billion, meeting expectations. The company saw a 7% decline in volume and flat sales in both retail and foodservice. Pricing increases helped to offset that.

Click here to download our most recent Sure Analysis report on HRL (preview of page 1 of 3 shown below):

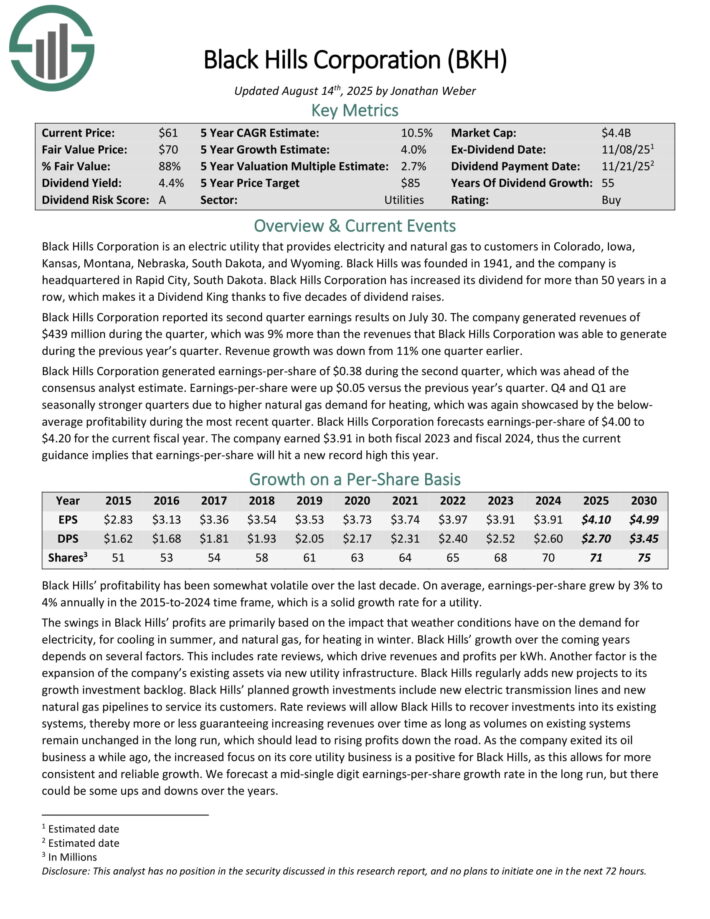

Top Retirement Income Stock: Black Hills Corp. (BKH)

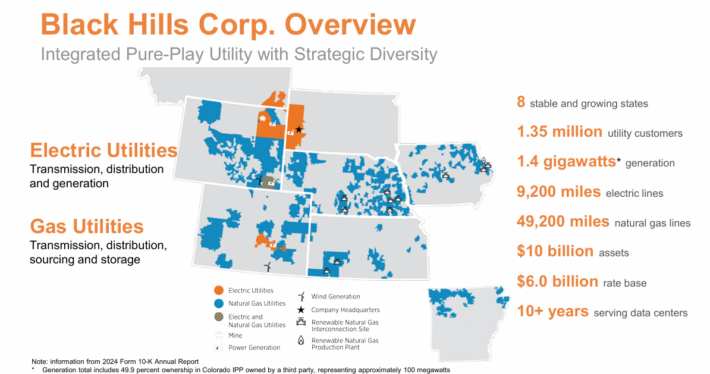

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.35 million utility customers in eight states. Its natural gas assets include 49,200 miles of natural gas lines. Separately, it has ~9,200 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its second quarter earnings results on July 30. The company generated revenues of $439 million during the quarter, up 9% year-over-year.

Black Hills Corporation generated earnings-per-share of $0.38 during the second quarter, which was ahead of the consensus analyst estimate.

Earnings-per-share were up $0.05 versus the previous year’s quarter. Q4 and Q1 are seasonally stronger quarters due to higher natural gas demand for heating.

Black Hills Corporation forecasts earnings-per-share of $4.00 to $4.20 for the current fiscal year.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

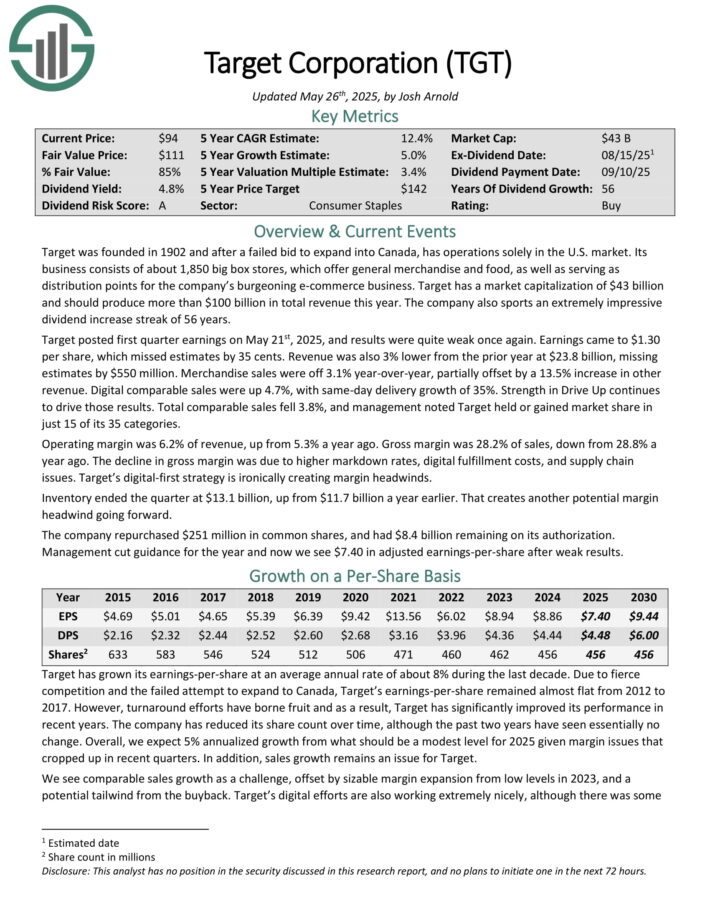

Top Retirement Income Stock: Target Corporation (TGT)

Target was founded in 1902 and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target posted first quarter earnings on May 21st, 2025, and results were weak. Earnings came to $1.30 per share, which missed estimates by 35 cents. Revenue was also 3% lower from the prior year at $23.8 billion, missing estimates by $550 million. Merchandise sales were off 3.1% year-over-year, partially offset by a 13.5% increase in other revenue.

Digital comparable sales were up 4.7%, with same-day delivery growth of 35%. Strength in Drive Up continues to drive those results. Total comparable sales fell 3.8%, and management noted Target held or gained market share in just 15 of its 35 categories.

The company is investing heavily in its business in order to navigate through the changing landscape in the retail sector. The payout is now 61% of earnings for this year, which is elevated from historical levels, but the dividend remains well-covered.

Target’s competitive advantage comes from its everyday low prices on attractive merchandise in its guest-friendly stores.

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

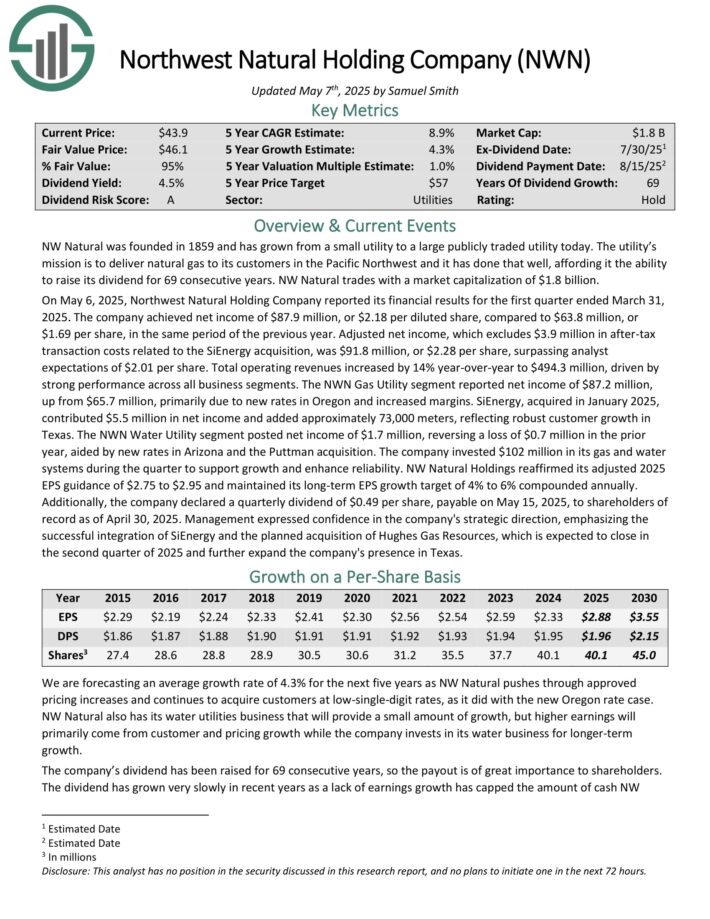

Top Retirement Income Stock: Northwest Natural Holding (NWN)

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest.

Source: Investor Presentation

On May 6, 2025, Northwest Natural Holding Company reported its financial results for the first quarter ended March 31, 2025. The company achieved net income of $87.9 million, or $2.18 per diluted share, compared to $63.8 million, or $1.69 per share, in the same period of the previous year.

Adjusted net income, which excludes $3.9 million in after-tax transaction costs related to the SiEnergy acquisition, was $91.8 million, or $2.28 per share, surpassing analyst expectations of $2.01 per share. Total operating revenues increased by 14% year-over-year to $494.3 million, driven by strong performance across all business segments.

The NWN Gas Utility segment reported net income of $87.2 million, up from $65.7 million, primarily due to new rates in Oregon and increased margins. SiEnergy, acquired in January 2025, contributed $5.5 million in net income and added approximately 73,000 meters, reflecting robust customer growth in Texas.

The NWN Water Utility segment posted net income of $1.7 million, reversing a loss of $0.7 million in the prior year, aided by new rates in Arizona and the Puttman acquisition.

NW Natural Holdings reaffirmed its adjusted 2025 EPS guidance of $2.75 to $2.95.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

Final Thoughts

Screening to find the best Dividend Kings is not the only way to find high-quality dividend growth stock ideas.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.