Article published on August 13th, 2025 by Bob Ciura

Spreadsheet data updated daily

Dividend growth investing gives investors a little bit of everything.

Most investing styles focus heavily on one aspect of investing.

- Value investors are looking for deep discounts to intrinsic value

- Growth investors are looking for fast growth rates

- And income investors are looking for very high yields to maximize income

Dividend growth investors care about valuation. Investing in a significantly overvalued security can mean low yields now. Conversely, significantly undervalued securities mean a somewhat higher starting yield – and the possibility of capital gains from valuation multiple mean reversion.

Dividend growth investors care about growth. Faster growth means your dividend income will rise quicker. The ‘growth’ in dividend growth investing should make it very apparent that growth matters for dividend growth investors.

And dividend growth investors care about yield. The higher the yield, the more dividends one receives, both now and in the future.

Investors looking for stocks that combine dividend yield and growth, should consider the Dividend Champions, a group of stocks with 25+ years of consecutive dividend increases.

With this in mind, we created a downloadable list of over 130 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 69 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

The Dividend Champions list is much more expansive. There are many high-quality Dividend Champions that are not included on the Dividend Aristocrats list.

To find 10 stocks that give dividend growth investors a little bit of everything, we screened the Sure Analysis Research Database for 10 stocks with 25+ years of dividend increases.

Further, we screened for Dividend Champions that have positive future expected earnings growth of at least 5% annually, and have price-to-earnings ratios below 20.

Lastly, the 10 stocks below have current dividend yields above 2.5%, approximately double the average dividend yield of the S&P 500 Index right now.

The combination of these factors provide a list of 10 dividend stocks that give investors a little bit of everything.

The 10 stocks are sorted by current dividend yield, in ascending order.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

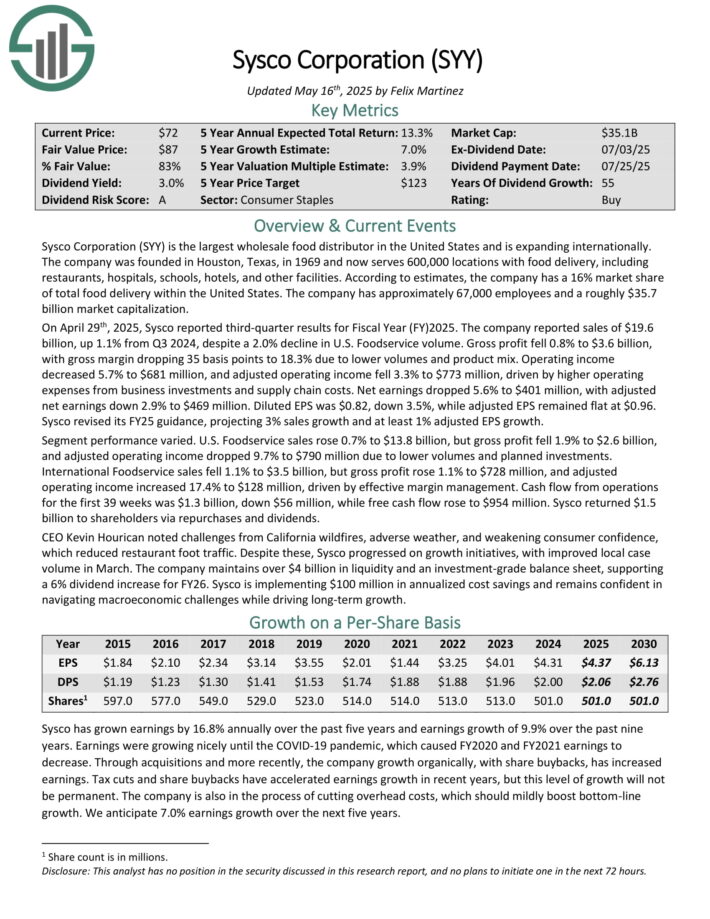

Dividend Stock With A Little Bit of Everything: Sysco Corp. (SYY)

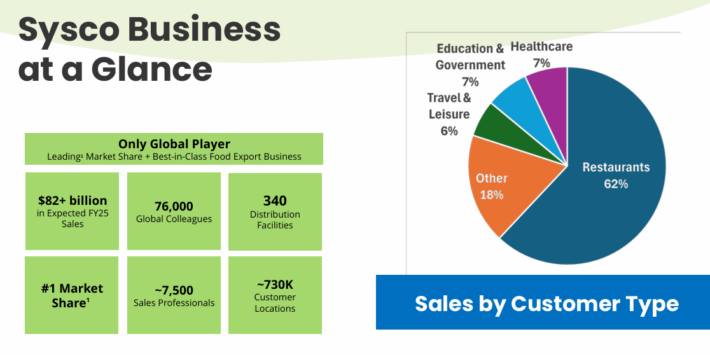

Sysco Corporation is the largest wholesale food distributor in the United States. The company serves 600,000 locations with food delivery, including restaurants, hospitals, schools, hotels, and other facilities.

Source: Investor Presentation

On April 29th, 2025, Sysco reported third-quarter results for Fiscal Year (FY)2025. The company reported sales of $19.6 billion, up 1.1% from Q3 2024, despite a 2.0% decline in U.S. Foodservice volume. Gross profit fell 0.8% to $3.6 billion, with gross margin dropping 35 basis points to 18.3% due to lower volumes and product mix.

Operating income decreased 5.7% to $681 million, and adjusted operating income fell 3.3% to $773 million, driven by higher operating expenses from business investments and supply chain costs. Net earnings dropped 5.6% to $401 million, with adjusted net earnings down 2.9% to $469 million.

Diluted EPS was $0.82, down 3.5%, while adjusted EPS remained flat at $0.96. Sysco revised its FY25 guidance, projecting 3% sales growth and at least 1% adjusted EPS growth.

Click here to download our most recent Sure Analysis report on SYY (preview of page 1 of 3 shown below):

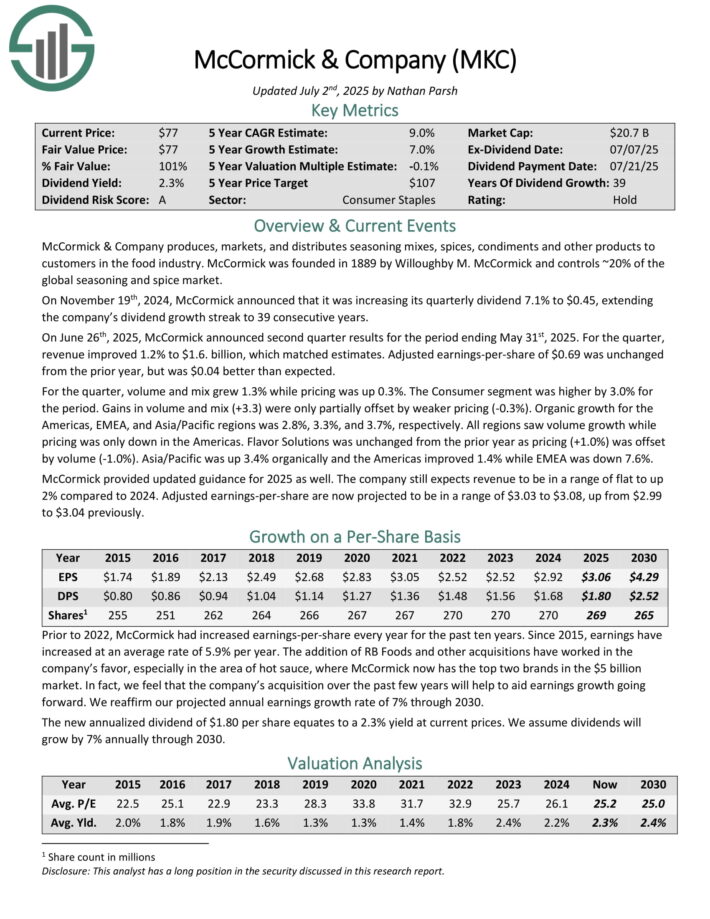

Dividend Stock With A Little Bit of Everything: McCormick & Co. (MKC)

McCormick & Company produces, markets, and distributes seasoning mixes, spices, condiments and other products to customers in the food industry. McCormick was founded in 1889 by Willoughby M. McCormick and controls ~20% of the global seasoning and spice market.

On June 26th, 2025, McCormick announced second quarter results for the period ending May 31st, 2025. For the quarter, revenue improved 1.2% to $1.6. billion, which matched estimates. Adjusted earnings-per-share of $0.69 was unchanged from the prior year, but was $0.04 better than expected.

For the quarter, volume and mix grew 1.3% while pricing was up 0.3%. The Consumer segment was higher by 3.0% for the period. Gains in volume and mix (+3.3) were only partially offset by weaker pricing (-0.3%).

Organic growth for the Americas, EMEA, and Asia/Pacific regions was 2.8%, 3.3%, and 3.7%, respectively. All regions saw volume growth while pricing was only down in the Americas.

McCormick provided updated guidance for 2025 as well. The company still expects revenue to be in a range of flat to up 2% compared to 2024.

Adjusted earnings-per-share are now projected to be in a range of $3.03 to $3.08, up from $2.99 to $3.04 previously.

Click here to download our most recent Sure Analysis report on MKC (preview of page 1 of 3 shown below):

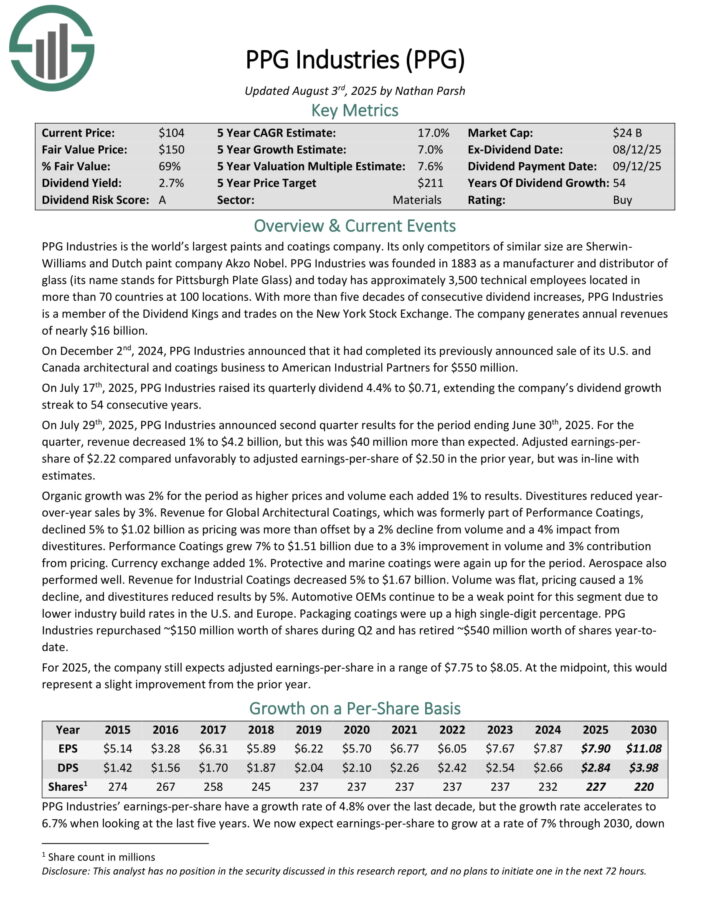

Dividend Stock With A Little Bit of Everything: PPG Industries (PPG)

PPG Industries is the world’s largest paints and coatings company. It has approximately 3,500 technical employees located in more than 70 countries at 100 locations.

With more than five decades of consecutive dividend increases, PPG Industries is a member of the Dividend Kings. It generates annual revenue of nearly $16 billion.

On July 17th, 2025, PPG Industries raised its quarterly dividend 4.4% to $0.71, extending the company’s dividend growth streak to 54 consecutive years.

On July 29th, 2025, PPG Industries announced second-quarter results. For the quarter, revenue decreased 1% to $4.2 billion, but this was $40 million more than expected. Adjusted earnings-per-share of $2.22 compared unfavorably to adjusted earnings-per-share of $2.50 in the prior year, but was in-line with estimates.

Organic growth was 2% for the period as higher prices and volume each added 1% to results. Divestitures reduced year-over-year sales by 3%. Revenue for Global Architectural Coatings declined 5% to $1.02 billion as pricing was more than offset by a 2% decline from volume and a 4% impact from divestitures.

Performance Coatings grew 7% to $1.51 billion due to a 3% improvement in volume and 3% contribution from pricing. Currency exchange added 1%. Protective and marine coatings were again up for the period.

PPG Industries repurchased ~$150 million worth of shares during Q2 and has retired ~$540 million worth of shares year-to-date.

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

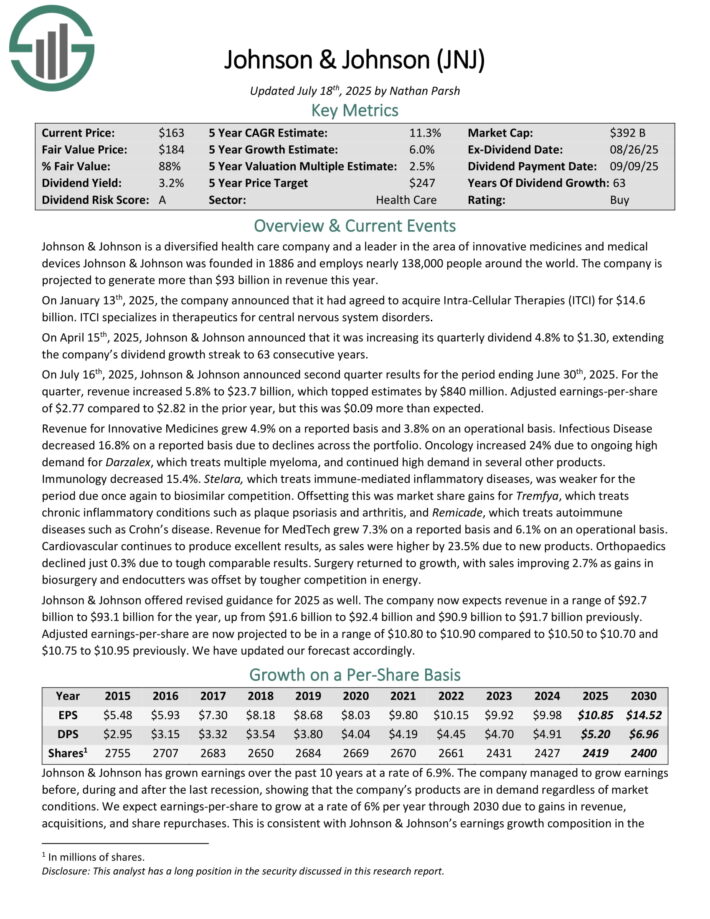

Dividend Stock With A Little Bit of Everything: Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified health care company and a leader in the area of innovative medicines and medical devices Johnson & Johnson was founded in 1886.

On July 16th, 2025, Johnson & Johnson announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue increased 5.8% to $23.7 billion, which topped estimates by $840 million.

Adjusted earnings-per-share of $2.77 compared to $2.82 in the prior year, but this was $0.09 more than expected.

Revenue for Innovative Medicines grew 4.9% on a reported basis and 3.8% on an operational basis. Infectious Disease decreased 16.8% on a reported basis due to declines across the portfolio.

Oncology increased 24% due to ongoing high demand for Darzalex, which treats multiple myeloma, and continued high demand in several other products.

Johnson & Johnson offered revised guidance for 2025 as well. The company now expects revenue in a range of $92.7 billion to $93.1 billion for the year, up from $91.6 billion to $92.4 billion and $90.9 billion to $91.7 billion previously.

Adjusted earnings-per-share are now projected to be in a range of $10.80 to $10.90.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

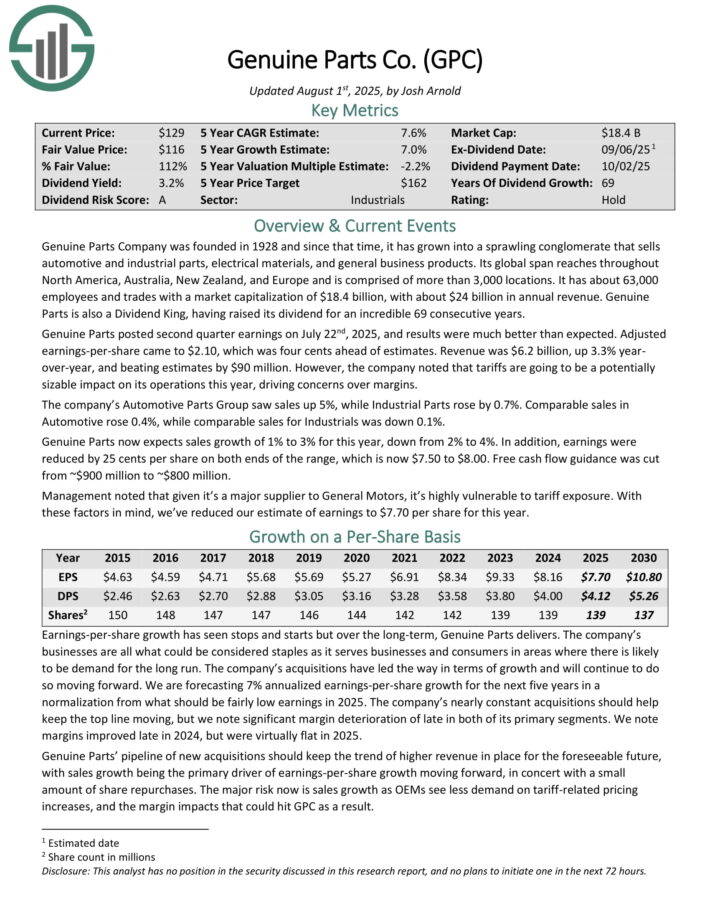

Dividend Stock With A Little Bit of Everything: Genuine Parts Co. (GPC)

Genuine Parts Company was founded in 1928 and since that time, it has grown into a sprawling conglomerate that sells automotive and industrial parts, electrical materials, and general business products. Its global span reaches throughout North America, Australia, New Zealand, and Europe and is comprised of more than 3,000 locations.

It has about 63,000 employees and trades with a market capitalization of $18.4 billion, with about $24 billion in annual revenue. Genuine Parts is also a Dividend King, having raised its dividend for 69 consecutive years.

Genuine Parts posted second quarter earnings on July 22nd, 2025, and results were much better than expected. Adjusted earnings-per-share came to $2.10, which was four cents ahead of estimates. Revenue was $6.2 billion, up 3.3% year-over-year, and beating estimates by $90 million.

The company’s Automotive Parts Group saw sales up 5%, while Industrial Parts rose by 0.7%. Comparable sales in Automotive rose 0.4%, while comparable sales for Industrials was down 0.1%.

Genuine Parts now expects sales growth of 1% to 3% for this year, down from 2% to 4%. In addition, earnings were reduced by 25 cents per share on both ends of the range, which is now $7.50 to $8.00.

Click here to download our most recent Sure Analysis report on GPC (preview of page 1 of 3 shown below):

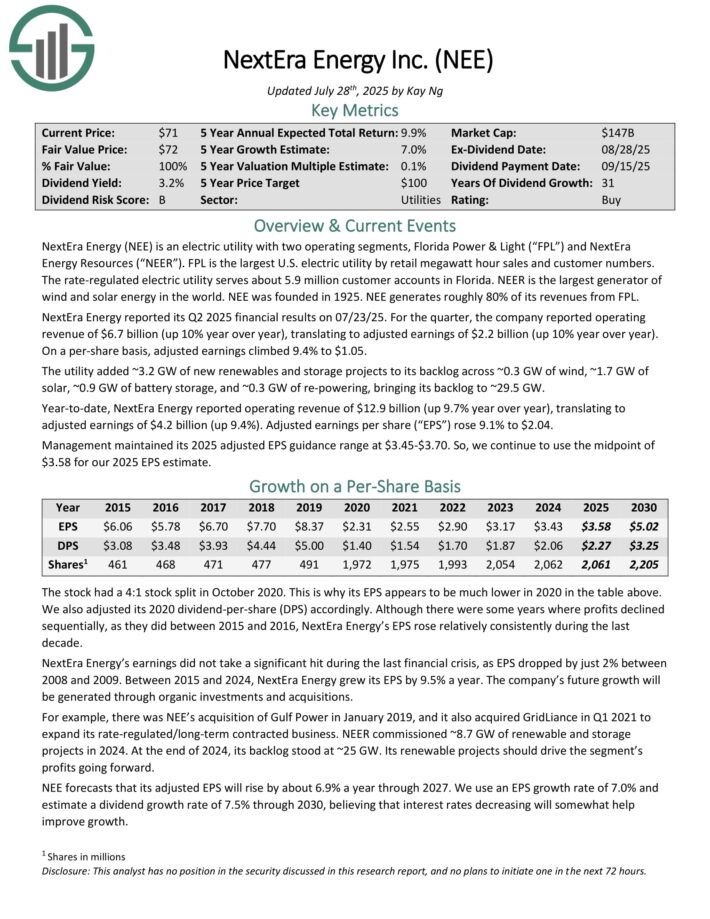

Dividend Stock With A Little Bit of Everything: NextEra Energy (NEE)

NextEra Energy is an electric utility with two operating segments, Florida Power & Light (“FPL”) and NextEra Energy Resources (“NEER”). FPL is the largest U.S. electric utility by retail megawatt hour sales and customer numbers.

The rate-regulated electric utility serves about 5.9 million customer accounts in Florida. NEER is the largest generator of wind and solar energy in the world. NEE was founded in 1925. NEE generates roughly 80% of its revenues from FPL.

NextEra Energy reported its Q2 2025 financial results on 07/23/25. For the quarter, the company reported operating revenue of $6.7 billion (up 10% year over year), translating to adjusted earnings of $2.2 billion (up 10% year over year). On a per-share basis, adjusted earnings climbed 9.4% to $1.05.

The utility added ~3.2 GW of new renewables and storage projects to its backlog across ~0.3 GW of wind, ~1.7 GW of solar, ~0.9 GW of battery storage, and ~0.3 GW of re-powering, bringing its backlog to ~29.5 GW.

Year-to-date, NextEra Energy reported operating revenue of $12.9 billion, up 9.7% year over year, translating to adjusted earnings of $4.2 billion, up 9.4%. Adjusted earnings per share rose 9.1% to $2.04.

Management maintained its 2025 adjusted EPS guidance range at $3.45-$3.70.

Click here to download our most recent Sure Analysis report on NEE (preview of page 1 of 3 shown below):

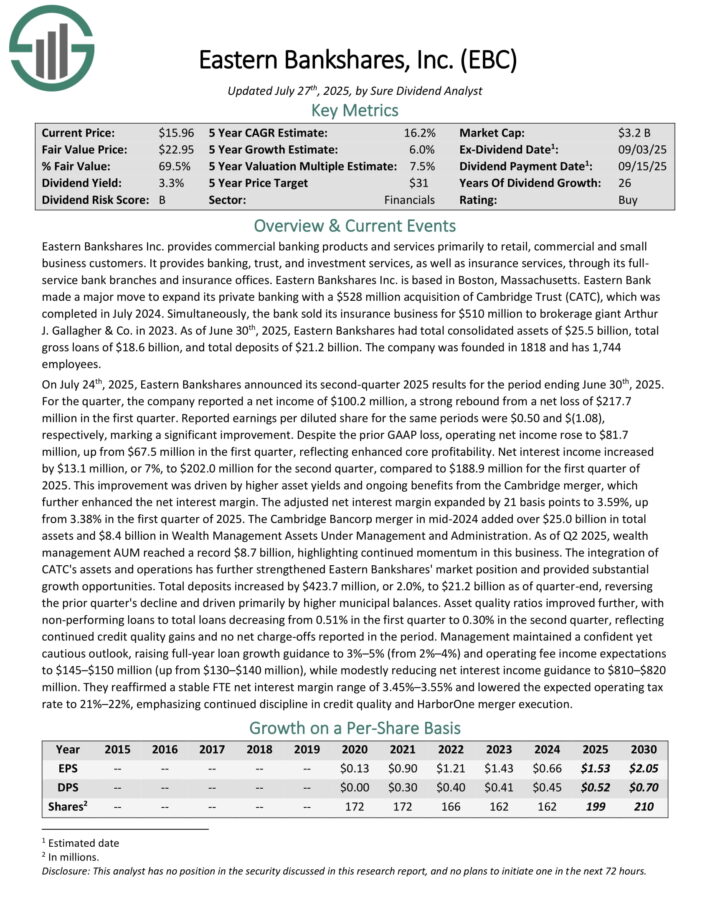

Dividend Stock With A Little Bit of Everything: Eastern Bankshares (EBC)

Eastern Bankshares Inc. provides commercial banking products and services primarily to retail, commercial and small business customers. It provides banking, trust, and investment services, as well as insurance services, through its full service bank branches and insurance offices.

As of March 31, 2025, Eastern Bankshares had total consolidated assets of $25.0 billion, total gross loans of $18.2 billion, and total deposits of $20.8 billion. The company was founded in 1818 and has 1,744 employees.

On July 24th, 2025, Eastern Bankshares announced its second-quarter 2025 results for the period ending June 30th, 2025.

For the quarter, the company reported a net income of $100.2 million, a strong rebound from a net loss of $217.7 million in the first quarter. Reported earnings per diluted share for the same periods were $0.50 and $(1.08), respectively, marking a significant improvement.

Despite the prior GAAP loss, operating net income rose to $81.7 million, up from $67.5 million in the first quarter, reflecting enhanced core profitability.

Net interest income increased by $13.1 million, or 7%, to $202.0 million for the second quarter, compared to $188.9 million for the first quarter of 2025. This improvement was driven by higher asset yields and ongoing benefits from the Cambridge merger.

Click here to download our most recent Sure Analysis report on EBC (preview of page 1 of 3 shown below):

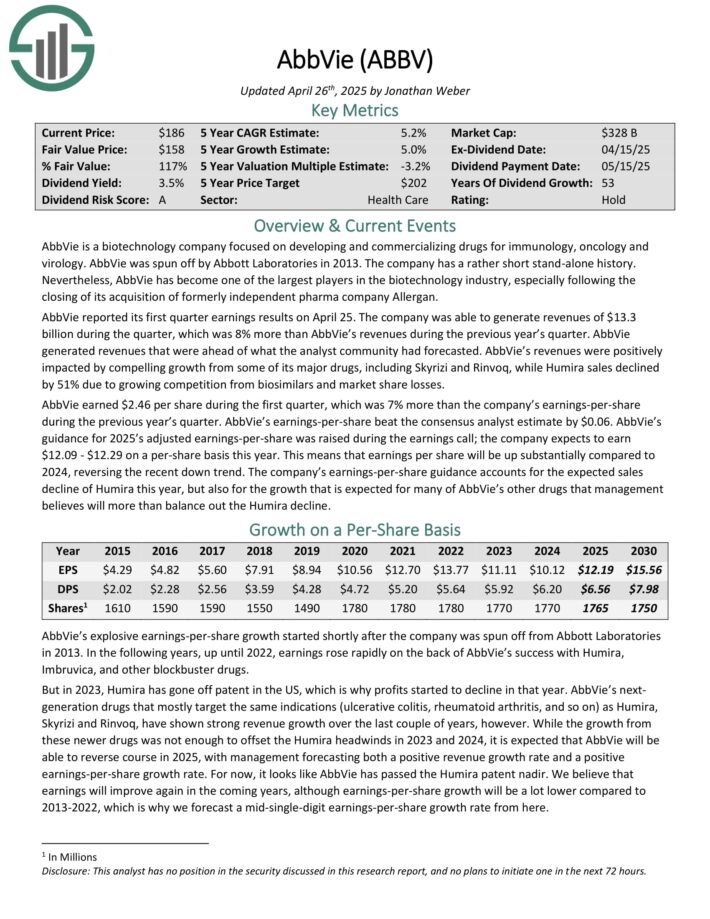

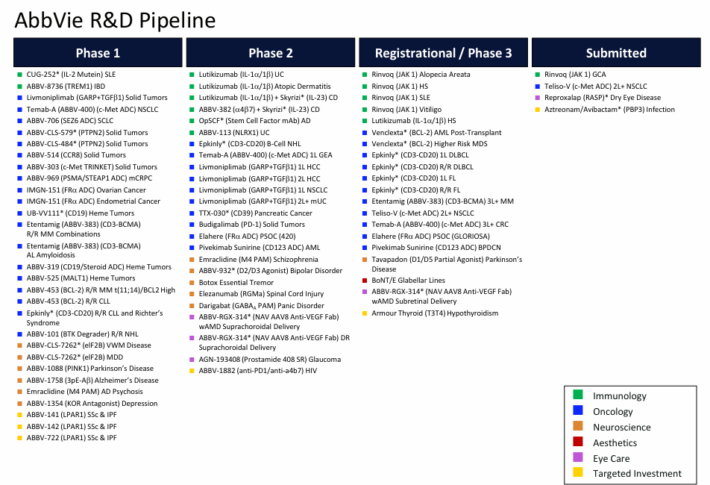

Dividend Stock With A Little Bit of Everything: AbbVie Inc. (ABBV)

AbbVie is a pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. Its most important product is Humira, which is now facing biosimilar competition in Europe and the U.S.

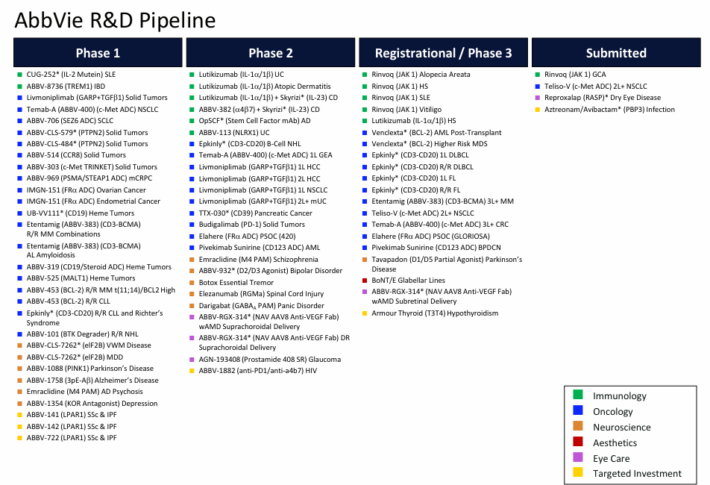

While this has had a noticeable impact on the company, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

Source: Investor Presentation

AAbbVie reported its first quarter earnings results on April 25. The company was able to generate revenues of $13.3 billion during the quarter, which was 8% more than AbbVie’s revenues during the previous year’s quarter.

Revenues were positively impacted by compelling growth from some of its major drugs, including Skyrizi and Rinvoq, while Humira sales declined by 51% due to growing competition from biosimilars and market share losses.

AbbVie earned $2.46 per share during the first quarter, which was 7% more than the company’s earnings-per-share during the previous year’s quarter.

Click here to download our most recent Sure Analysis report on AbbVie (preview of page 1 of 3 shown below):

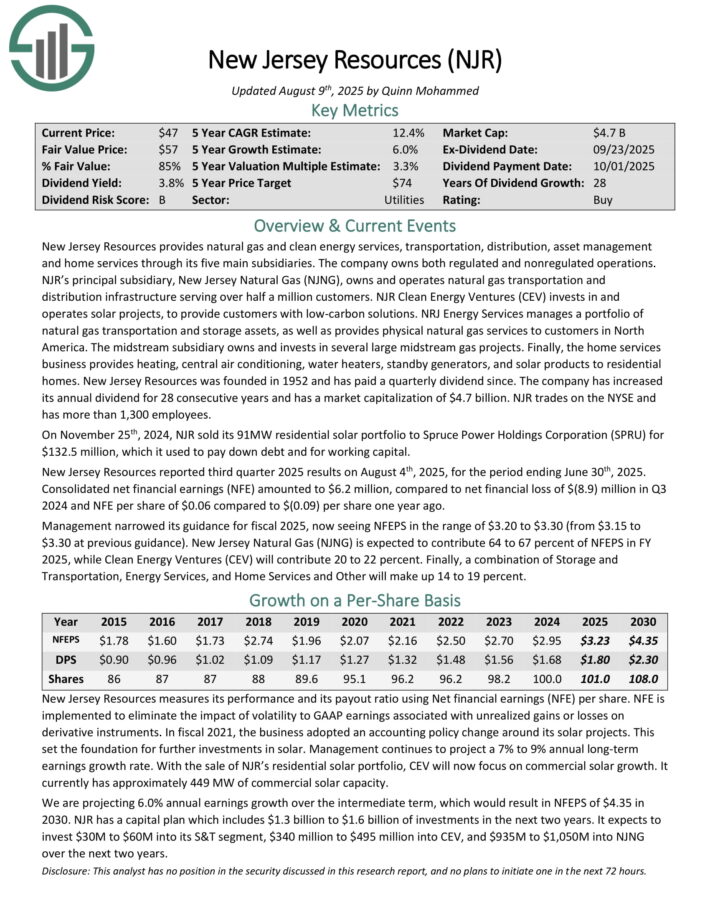

Dividend Stock With A Little Bit of Everything: New Jersey Resources (NJR)

New Jersey Resources provides natural gas and clean energy services, transportation, distribution, asset management and home services through its five main subsidiaries. The company owns both regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Natural Gas (NJNG), owns and operates natural gas transportation and distribution infrastructure serving over half a million customers.

NJR Clean Energy Ventures (CEV) invests in and operates solar projects, to provide customers with low-carbon solutions.

NRJ Energy Services manages a portfolio of natural gas transportation and storage assets, as well as provides physical natural gas services to customers in North America.

New Jersey Resources was founded in 1952 and has paid a quarterly dividend since. The company has increased its annual dividend for 28 consecutive years.

New Jersey Resources reported third quarter 2025 results on August 4th, 2025, for the period ending June 30th, 2025. Consolidated net financial earnings (NFE) amounted to $6.2 million, compared to net financial loss of $(8.9) million in Q3 2024 and NFE per share of $0.06 compared to $(0.09) per share one year ago.

Management narrowed its guidance for fiscal 2025, now seeing NFEPS in the range of $3.20 to $3.30 (from $3.15 to $3.30 at previous guidance).

Click here to download our most recent Sure Analysis report on NJR (preview of page 1 of 3 shown below):

Dividend Stock With A Little Bit of Everything: Sonoco Products (SON)

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

Additional Reading

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 55 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.