Published on September 3rd, 2025 by Bob Ciura

Kevin O’Leary is Chairman of O’Shares Investment Advisors, but you probably know him as “Mr. Wonderful”.

He can be seen on CNBC as well as the television show Shark Tank. Investors who have seen him on TV have likely heard him discuss his investment philosophy.

You can download the complete list of all of O’Shares Investment Advisors stock holdings by clicking the link below:

OUSA owns stocks that are market leaders with strong profits, diversified business models, and they pay dividends to shareholders.

This article analyzes the fund’s 10 highest-yielding holdings in detail.

Table of Contents

The top 10 highest yielding stocks in the O’Shares FTSE U.S. Quality Dividend ETF are listed in order of their current dividend yield, from lowest to highest.

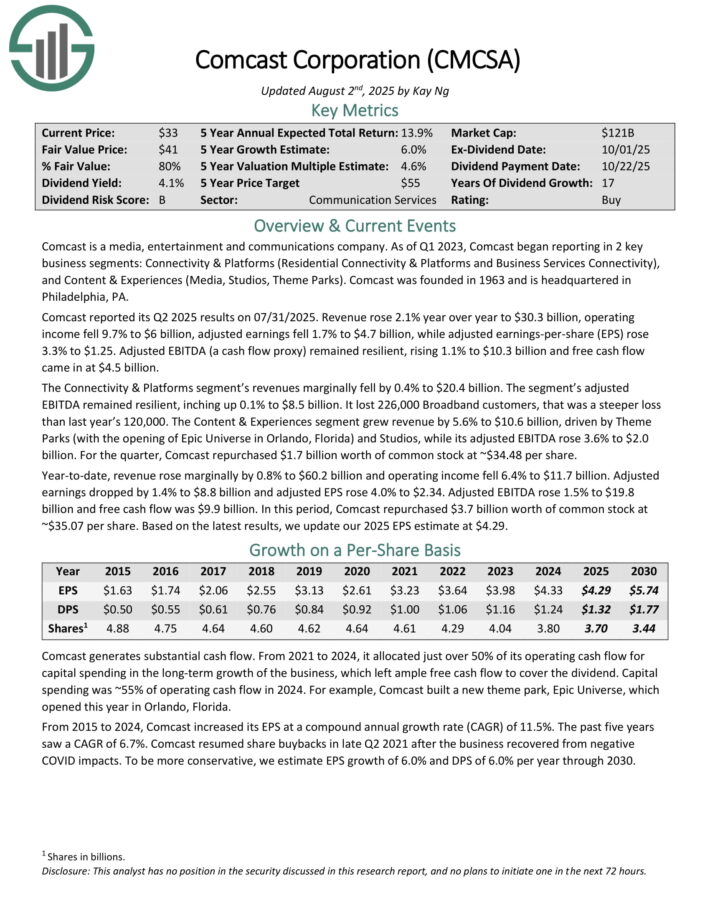

No. 10: Comcast Corp. (CMCSA)

Dividend Yield: 3.9%

Comcast is a media, entertainment and communications company. It reports in two key business segments: Connectivity & Platforms (Residential Connectivity & Platforms and Business Services Connectivity), and Content & Experiences (Media, Studios, Theme Parks).

Comcast reported its Q2 2025 results on 07/31/2025. Revenue rose 2.1% year over year to $30.3 billion, operating income fell 9.7% to $6 billion, adjusted earnings fell 1.7% to $4.7 billion, while adjusted earnings-per-share rose 3.3% to $1.25. Adjusted EBITDA remained resilient, rising 1.1% to $10.3 billion and free cash flow came in at $4.5 billion.

The Connectivity & Platforms segment’s revenues marginally fell by 0.4% to $20.4 billion. The segment’s adjusted EBITDA remained resilient, inching up 0.1% to $8.5 billion. It lost 226,000 Broadband customers, that was a steeper loss than last year’s 120,000.

The Content & Experiences segment grew revenue by 5.6% to $10.6 billion, driven by Theme Parks (with the opening of Epic Universe in Orlando, Florida) and Studios, while its adjusted EBITDA rose 3.6% to $2.0 billion. For the quarter, Comcast repurchased $1.7 billion worth of common stock at ~$34.48 per share.

Year-to-date, revenue rose marginally by 0.8% to $60.2 billion and operating income fell 6.4% to $11.7 billion. Adjusted earnings dropped by 1.4% to $8.8 billion and adjusted EPS rose 4.0% to $2.34. Adjusted EBITDA rose 1.5% to $19.8 billion and free cash flow was $9.9 billion.

Click here to download our most recent Sure Analysis report on CMCSA (preview of page 1 of 3 shown below):

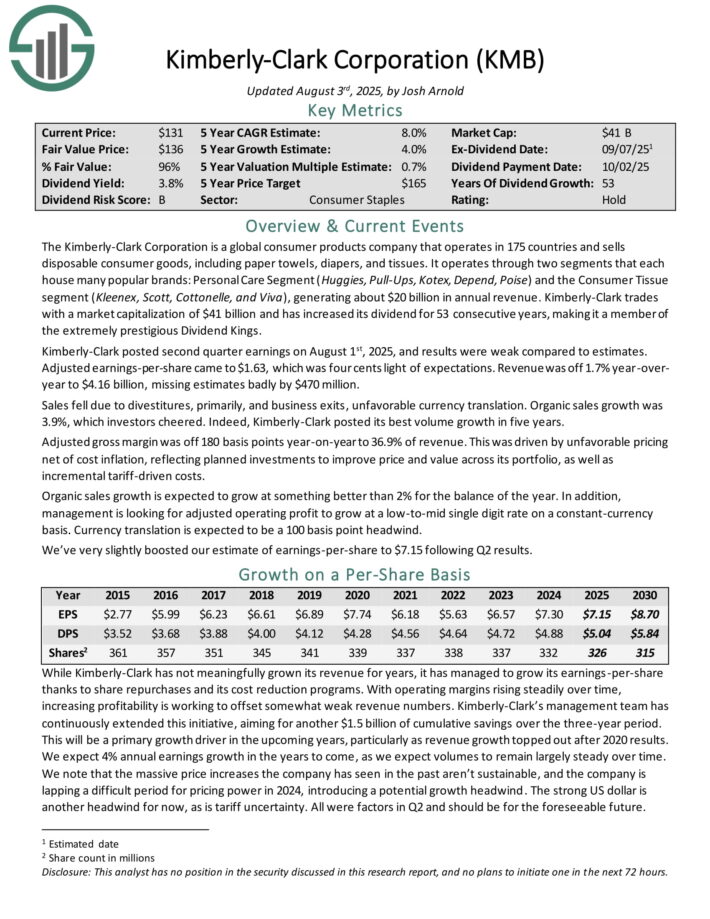

No. 9: Kimberly-Clark Corp. (KMB)

Dividend Yield: 3.9%

Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates segments that each house many popular brands: the Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise), the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), and a professional segment.

Kimberly-Clark posted second quarter earnings on August 1st, 2025, and results were weak compared to estimates. Adjusted earnings-per-share came to $1.63, which was four cents light of expectations. Revenue was off 1.7% year-over-year to $4.16 billion, missing estimates badly by $470 million.

Sales fell due to divestitures, primarily, and business exits, unfavorable currency translation. Organic sales growth was 3.9%, which investors cheered. Indeed, Kimberly-Clark posted its best volume growth in five years.

Adjusted gross margin was off 180 basis points year-on-year to 36.9% of revenue. This was driven by unfavorable pricing net of cost inflation, reflecting planned investments to improve price and value across its portfolio, as well as incremental tariff-driven costs.

Click here to download our most recent Sure Analysis report on Kimberly-Clark (preview of page 1 of 3 shown below):

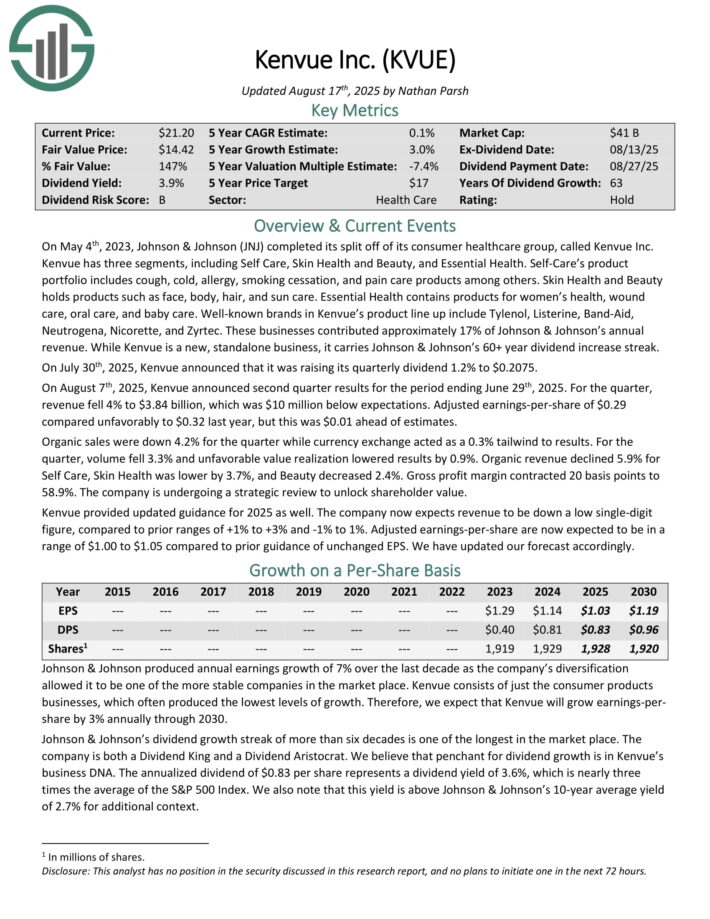

No. 8: Kenvue Inc. (KVUE)

Dividend Yield: 4.0%

Kenvue was spun off from Johnson & Johnson (JNJ) in 2023. It has three segments, including Self Care, Skin Health and Beauty, and Essential Health.

Self-Care’s product portfolio includes cough, cold, allergy, smoking cessation, and pain care products among others. Skin Health and Beauty holds products such as face, body, hair, and sun care. Essential Health contains products for women’s health, wound care, oral care, and baby care.

Well-known brands in Kenvue’s product line up include Tylenol, Listerine, Band-Aid, Neutrogena, Nicorette, and Zyrtec. These businesses contributed approximately 17% of Johnson & Johnson’s annual revenue.

On August 7th, 2025, Kenvue announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue fell 4% to $3.84 billion, which was $10 million below expectations. Adjusted earnings-per-share of $0.29 compared unfavorably to $0.32 last year, but this was $0.01 ahead of estimates.

Organic sales were down 4.2% for the quarter while currency exchange acted as a 0.3% tailwind to results. For the quarter, volume fell 3.3% and unfavorable value realization lowered results by 0.9%.

Organic revenue declined 5.9% for Self Care, Skin Health was lower by 3.7%, and Beauty decreased 2.4%. Gross profit margin contracted 20 basis points to 58.9%. The company is undergoing a strategic review to unlock shareholder value.

Click here to download our most recent Sure Analysis report on KVUE (preview of page 1 of 3 shown below):

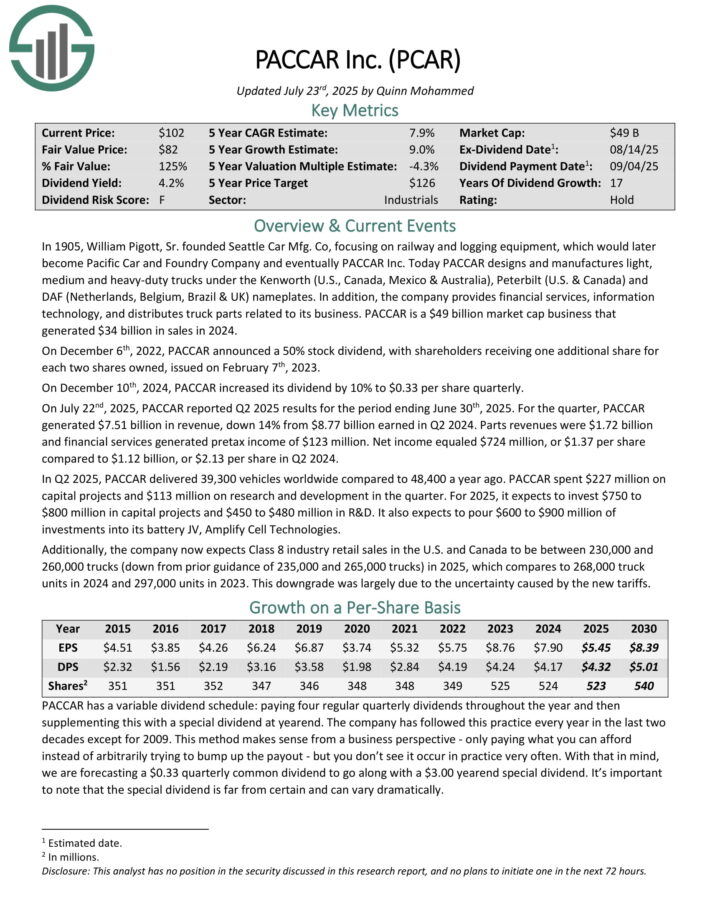

No. 7: Paccar Inc. (PCAR)

Dividend Yield: 4.4%

PACCAR designs and manufactures light, medium and heavy-duty trucks under the Kenworth (U.S., Canada, Mexico & Australia), Peterbilt (U.S. & Canada) and DAF (Netherlands, Belgium, Brazil & UK) nameplates.

In addition, the company provides financial services, information technology, and distributes truck parts related to its business. PACCAR is a $49 billion market cap business that generated $34 billion in sales in 2024.

On December 10th, 2024, PACCAR increased its dividend by 10% to $0.33 per share quarterly. On July 22nd, 2025, PACCAR reported Q2 2025 results. For the quarter, PACCAR generated $7.51 billion in revenue, down 14% from $8.77 billion earned in Q2 2024.

Parts revenues were $1.72 billion and financial services generated pretax income of $123 million. Net income equaled $724 million, or $1.37 per share compared to $1.12 billion, or $2.13 per share in Q2 2024.

In Q2 2025, PACCAR delivered 39,300 vehicles worldwide compared to 48,400 a year ago. PACCAR spent $227 million on capital projects and $113 million on research and development in the quarter.

For 2025, it expects to invest $750 to $800 million in capital projects and $450 to $480 million in R&D. It also expects to pour $600 to $900 million of investments into its battery JV, Amplify Cell Technologies.

Click here to download our most recent Sure Analysis report on PCAR (preview of page 1 of 3 shown below):

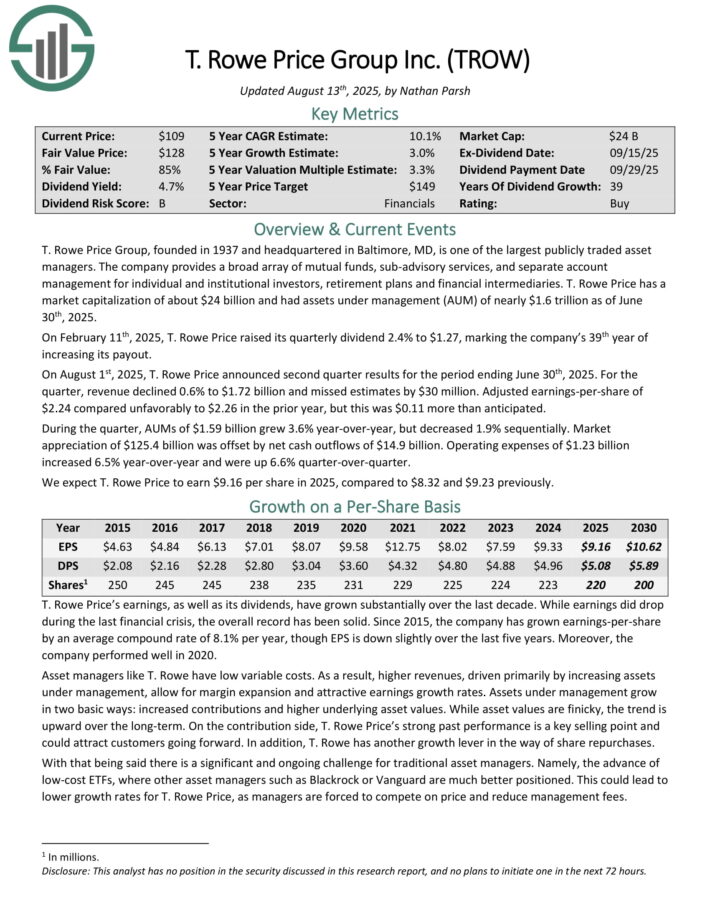

No. 6: T. Rowe Price Group (TROW)

Dividend Yield: 4.8%

T. Rowe Price Group is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, sub-advisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries.

T. Rowe Price had assets under management (AUM) of nearly $1.6 trillion as of June 30th, 2025.

On February 11th, 2025, T. Rowe Price raised its quarterly dividend 2.4% to $1.27, marking the company’s 39th year of increasing its payout.

On August 1st, 2025, T. Rowe Price announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue declined 0.6% to $1.72 billion and missed estimates by $30 million. Adjusted earnings-per-share of $2.24 compared unfavorably to $2.26 in the prior year, but this was $0.11 more than anticipated.

During the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, but decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by net cash outflows of $14.9 billion. Operating expenses of $1.23 billion increased 6.5% year-over-year and were up 6.6% quarter-over-quarter.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

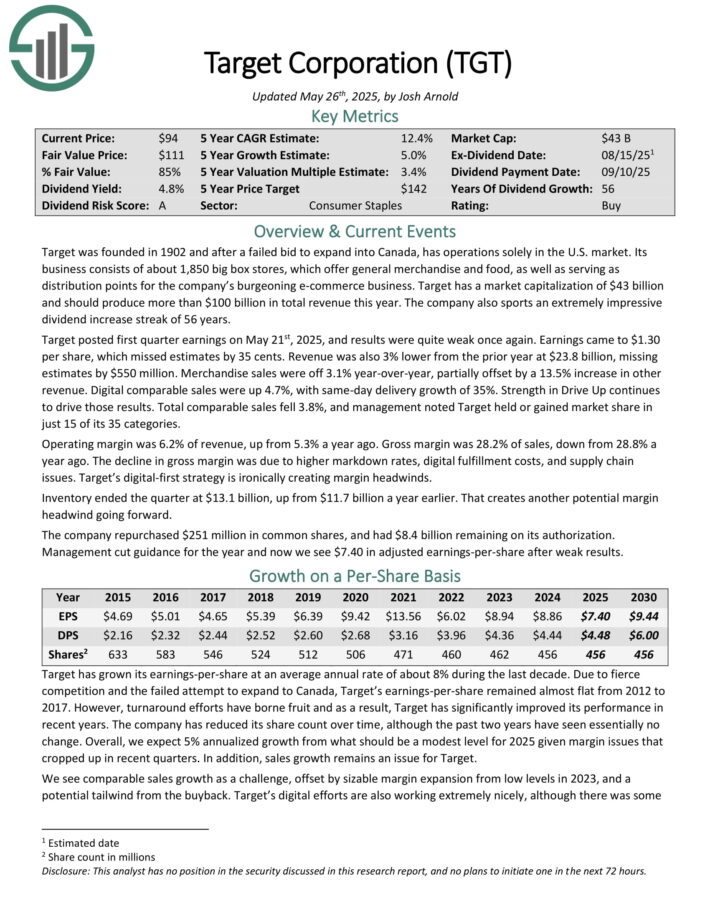

No. 5: Target Corporation (TGT)

Dividend Yield: 4.9%

Target was founded in 1902 and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target posted first quarter earnings on May 21st, 2025, and results were weak. Earnings came to $1.30 per share, which missed estimates by 35 cents. Revenue was also 3% lower from the prior year at $23.8 billion, missing estimates by $550 million. Merchandise sales were off 3.1% year-over-year, partially offset by a 13.5% increase in other revenue.

Digital comparable sales were up 4.7%, with same-day delivery growth of 35%. Strength in Drive Up continues to drive those results. Total comparable sales fell 3.8%, and management noted Target held or gained market share in just 15 of its 35 categories.

The company is investing heavily in its business in order to navigate through the changing landscape in the retail sector. The payout is now 61% of earnings for this year, which is elevated from historical levels, but the dividend remains well-covered.

Target’s competitive advantage comes from its everyday low prices on attractive merchandise in its guest-friendly stores.

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

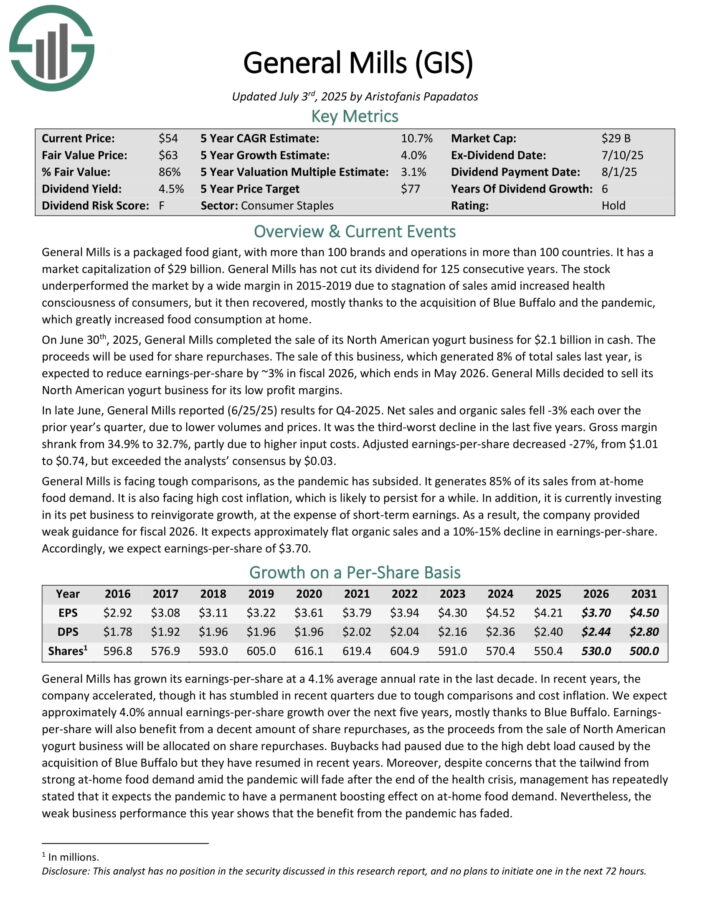

No. 4: General Mills (GIS)

Dividend Yield: 5.0%

General Mills is a packaged food giant, with more than 100 brands and operations in more than 100 countries. General Mills has not cut its dividend for 125 consecutive years.

On June 30th, 2025, General Mills completed the sale of its North American yogurt business for $2.1 billion in cash. The proceeds will be used for share repurchases. The sale of this business, which generated 8% of total sales last year, is expected to reduce earnings-per-share by ~3% in fiscal 2026.

In late June, General Mills reported (6/25/25) results for Q4-2025. Net sales and organic sales fell -3% each over the prior year’s quarter, due to lower volumes and prices. It was the third-worst decline in the last five years.

Gross margin shrank from 34.9% to 32.7%, partly due to higher input costs. Adjusted earnings-per-share decreased -27%, from $1.01 to $0.74, but exceeded the analysts’ consensus by $0.03.

Click here to download our most recent Sure Analysis report on GIS (preview of page 1 of 3 shown below)

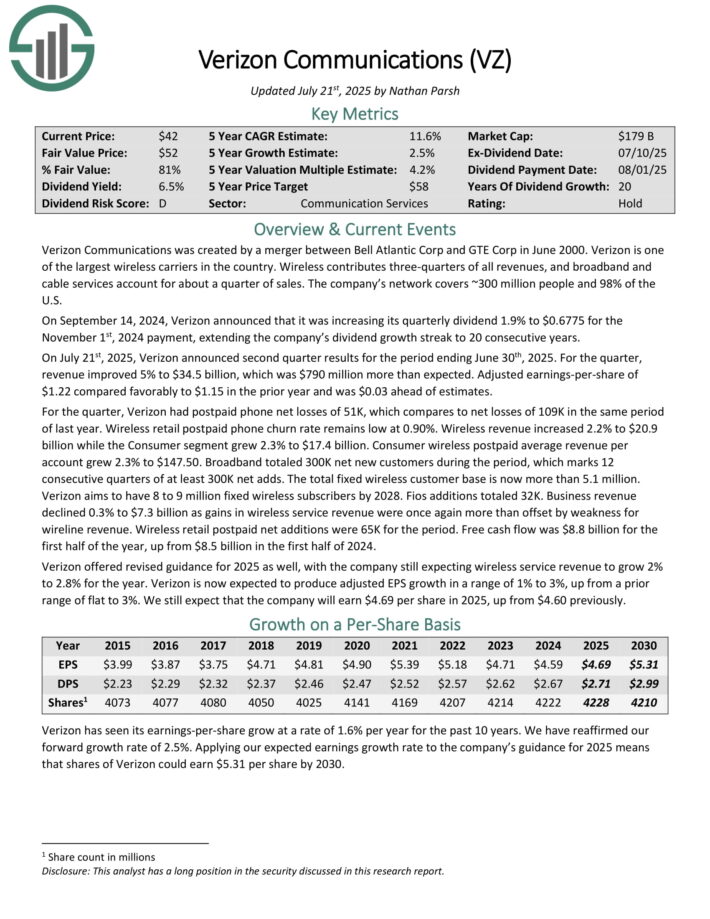

No. 3: Verizon Communications (VZ)

Dividend Yield: 6.2%

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless carriers in the country.

Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On July 21st, 2025, Verizon announced second-quarter results. For the quarter, revenue improved 5% to $34.5 billion, which was $790 million more than expected. Adjusted earnings-per-share of

$1.22 compared favorably to $1.15 in the prior year and was $0.03 ahead of estimates.

For the quarter, Verizon had postpaid phone net losses of 51K, which compares to net losses of 109K in the same period of last year. Wireless retail postpaid phone churn rate remains low at 0.90%. Wireless revenue increased 2.2% to $20.9 billion while the Consumer segment grew 2.3% to $17.4 billion.

Consumer wireless postpaid average revenue per account grew 2.3% to $147.50. Broadband totaled 300K net new customers during the period, which marks 12 consecutive quarters of at least 300K net adds.

The total fixed wireless customer base is now more than 5.1 million. Verizon aims to have 8 to 9 million fixed wireless subscribers by 2028. Fios additions totaled 32K. Business revenue

declined 0.3% to $7.3 billion as gains in wireless service revenue were once again more than offset by weakness for wireline revenue.

Wireless retail postpaid net additions were 65K for the period. Free cash flow was $8.8 billion for the first half of the year, up from $8.5 billion in the first half of 2024. .

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

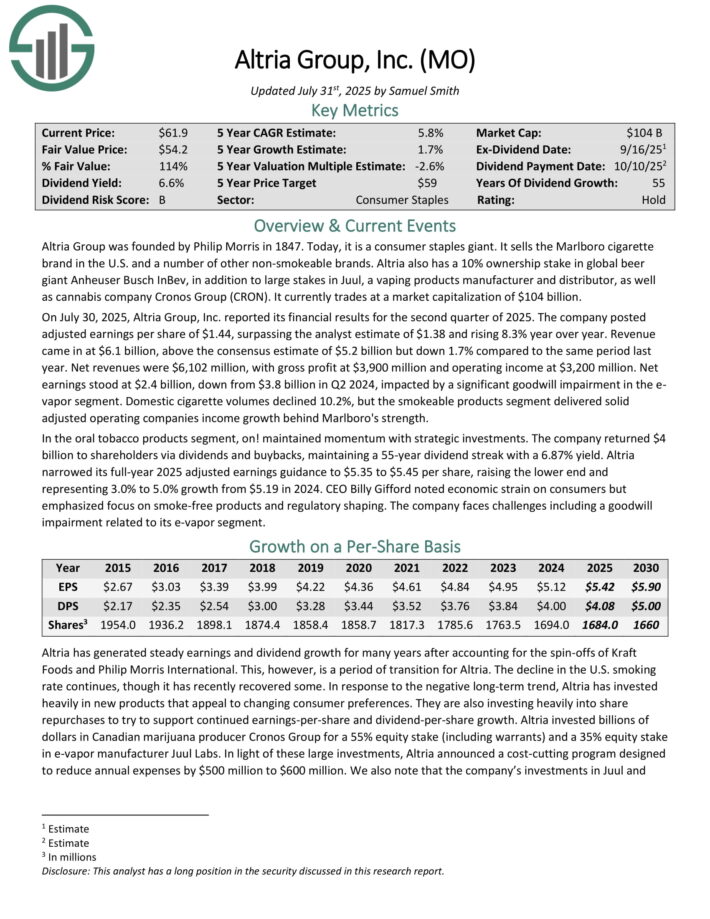

No. 2: Altria Group (MO)

Dividend Yield: 6.3%

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

This is a period of transition for Altria. The decline in the U.S. smoking rate continues. In response, Altria has invested heavily in new products that appeal to changing consumer preferences, as the smoke-free category continues to grow.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the Canadian cannabis producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its financial results for the second quarter of 2025. The company posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% year over year.

Revenue came in at $6.1 billion, above the consensus estimate of $5.2 billion but down 1.7% compared to the same period last year. Net revenues were $6,102 million, with gross profit at $3,900 million and operating income at $3,200 million.

Net earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a significant goodwill impairment in the e-vapor segment.

Domestic cigarette volumes declined 10.2%, but the smokeable products segment delivered solid adjusted operating companies income growth behind Marlboro’s strength.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

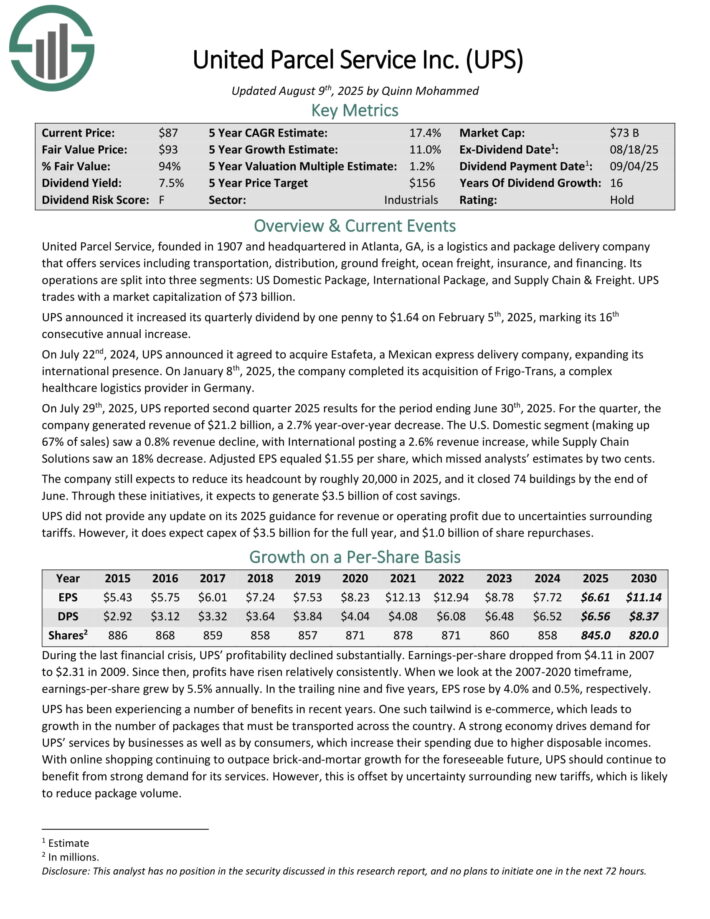

No. 1: United Parcel Service (UPS)

Dividend Yield: 7.7%

United Parcel Service, founded in 1907 and headquartered in Atlanta, GA, is a logistics and package delivery company that offers services including transportation, distribution, ground freight, ocean freight, insurance, and financing. Its operations are split into three segments: US Domestic Package, International Package, and Supply Chain & Freight.

On July 22nd, 2024, UPS announced it agreed to acquire Estafeta, a Mexican express delivery company, expanding its international presence. On January 8th, 2025, the company completed its acquisition of Frigo-Trans, a complex healthcare logistics provider in Germany.

On July 29th, 2025, UPS reported second quarter 2025 results for the period ending June 30th, 2025. For the quarter, the company generated revenue of $21.2 billion, a 2.7% year-over-year decrease. The U.S. Domestic segment (making up 67% of sales) saw a 0.8% revenue decline, with International posting a 2.6% revenue increase, while Supply Chain Solutions saw an 18% decrease. Adjusted EPS equaled $1.55 per share, which missed analysts’ estimates by two cents.

The company still expects to reduce its headcount by roughly 20,000 in 2025, and it closed 74 buildings by the end of June. Through these initiatives, it expects to generate $3.5 billion of cost savings.

Click here to download our most recent Sure Analysis report on UPS (preview of page 1 of 3 shown below):

Additional Resources

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.