Updated on July 29th, 2025 by Bob Ciura

It isn’t surprising that we favor stocks that pay dividends, as studies have shown that owning income producing securities is an excellent way to build wealth while also protecting to the downside.

In bull markets, dividends can add to the gains from the stock while also purchasing additional shares. When prices decline, dividends can reduce the losses while being used to acquire more shares at a now lower price.

With this in mind, we created a full list of the Dividend Kings, a group of stocks with over 50 consecutive years of dividend increases.

You can see the full downloadable spreadsheet of all 55 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

The Dividend Kings have rewarded shareholders with rising income for decades.

The following 10 stocks represent Dividend Kings that can continue to raise their dividends for decades to come.

The list includes 10 Dividend Kings with our highest Dividend Risk Score of ‘A’ in the Sure Analysis Research Database, that also have payout ratios below 60% to ensure a sustainable dividend payout.

The stocks are sorted by dividend payout ratio, from lowest to highest.

Table of Contents

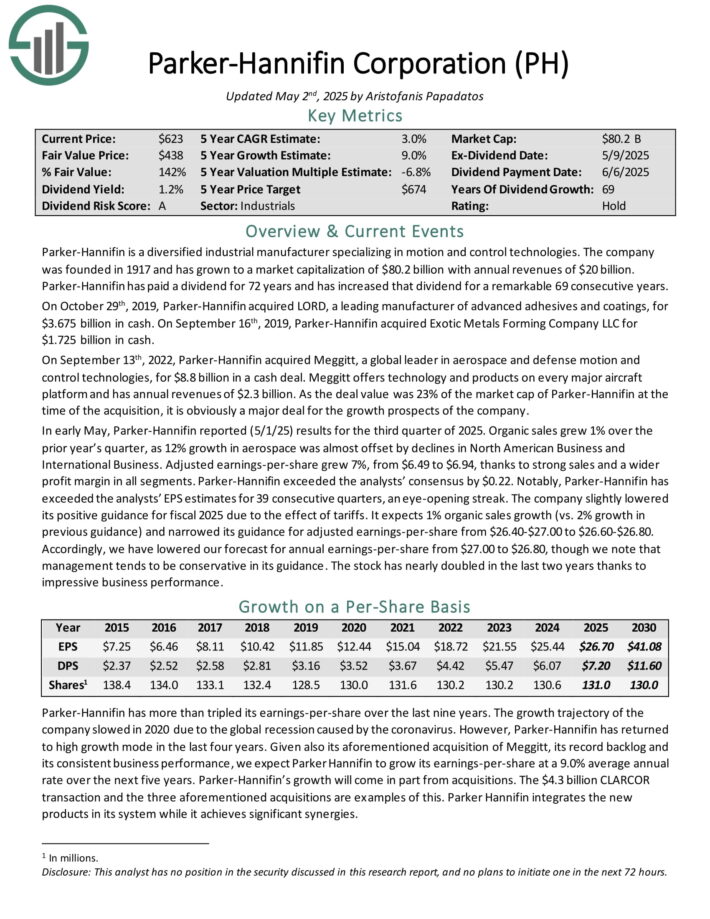

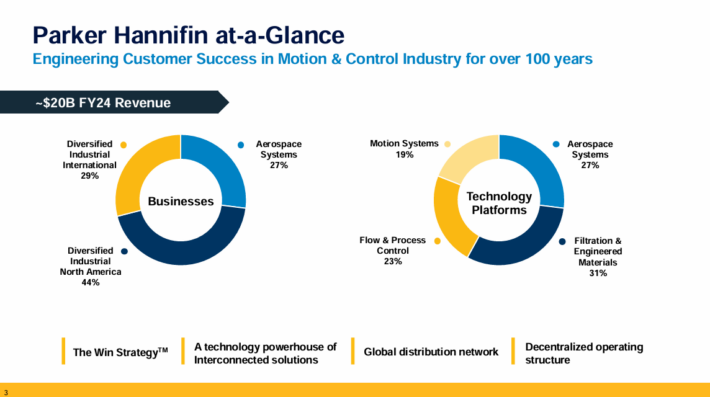

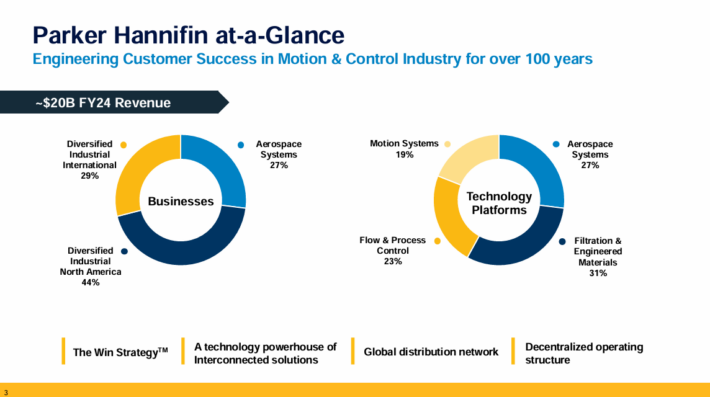

Dividend King To Hold Forever: Parker-Hannifin Corp. (PH)

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $20 billion.

Parker-Hannifin has increased the dividend for 69 consecutive years.

Source: Investor Presentation

In early May, Parker-Hannifin reported (5/1/25) results for the third quarter of 2025. Organic sales grew 1% over the prior year’s quarter, as 12% growth in aerospace was almost offset by declines in North American Business and International Business.

Adjusted earnings-per-share grew 7%, from $6.49 to $6.94, thanks to strong sales and a wider profit margin in all segments.

Parker-Hannifin exceeded the analysts’ consensus by $0.22. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 39 consecutive quarters.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

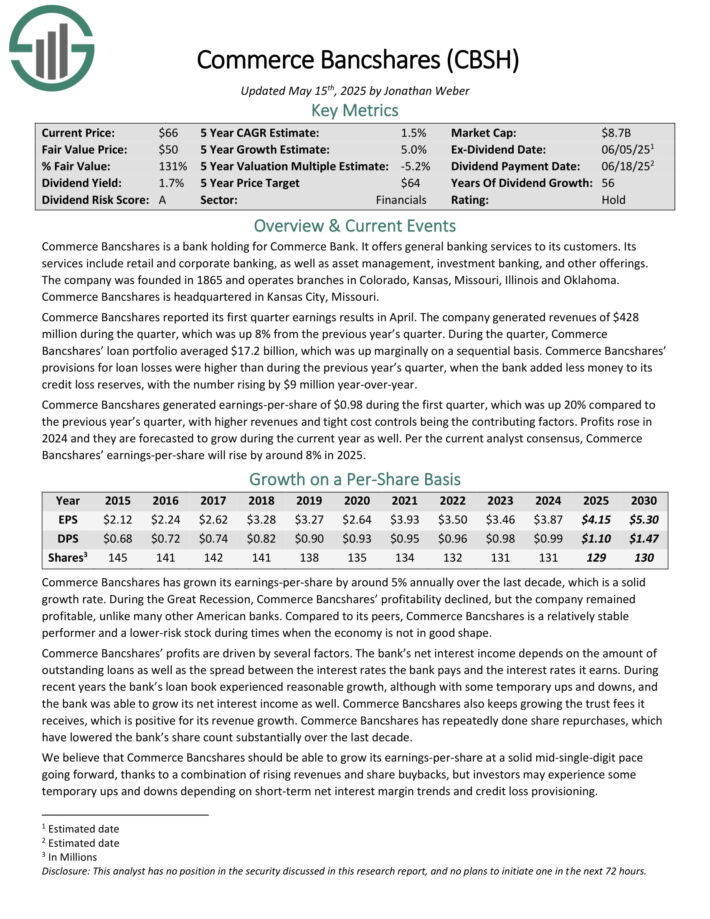

Dividend King To Hold Forever: Commerce Bancshares (CBSH)

Commerce Bancshares is a bank holding for Commerce Bank. It offers general banking services to its customers. Its services include retail and corporate banking, as well as asset management, investment banking, and other offerings.

The company was founded in 1865 and operates branches in Colorado, Kansas, Missouri, Illinois and Oklahoma.

Commerce Bancshares reported its first quarter earnings results in April. The company generated revenues of $428 million during the quarter, which was up 8% from the previous year’s quarter.

During the quarter, Commerce Bancshares’ loan portfolio averaged $17.2 billion, which was up marginally on a sequential basis.

Provisions for loan losses were higher than during the previous year’s quarter, when the bank added less money to its credit loss reserves, with the number rising by $9 million year-over-year.

Commerce Bancshares generated earnings-per-share of $0.98 during the first quarter, which was up 20%, with higher revenues and tight cost controls being the contributing factors.

Profits rose in 2024 and they are forecasted to grow during the current year as well.

Click here to download our most recent Sure Analysis report on CBSH (preview of page 1 of 3 shown below):

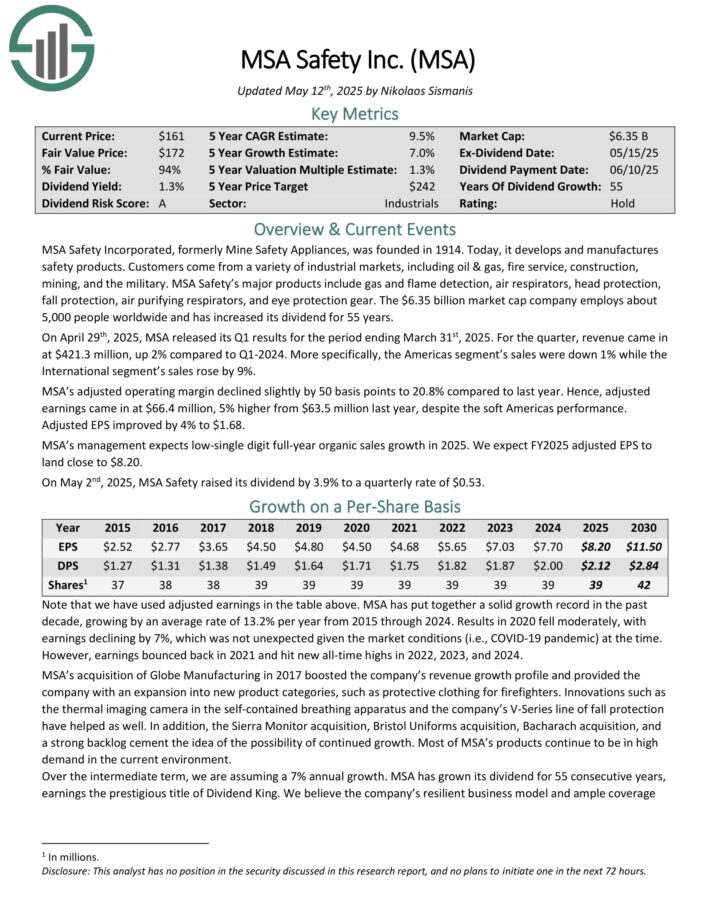

Dividend King To Hold Forever: MSA Safety Inc. (MSA)

MSA Safety Incorporated, formerly Mine Safety Appliances, was founded in 1914. Today, it develops and manufactures safety products.

Customers come from a variety of industrial markets, including oil & gas, fire service, construction, mining, and the military.

MSA Safety’s major products include gas and flame detection, air respirators, head protection, fall protection, air purifying respirators, and eye protection gear.

On April 29th, 2025, MSA released its Q1 results. For the quarter, revenue came in at $421.3 million, up 2% compared to Q1-2024.

More specifically, the Americas segment’s sales were down 1% while the International segment’s sales rose by 9%.

MSA’s adjusted operating margin declined slightly by 50 basis points to 20.8% compared to last year. Adjusted EPS improved by 4% to $1.68.

Click here to download our most recent Sure Analysis report on MSA (preview of page 1 of 3 shown below):

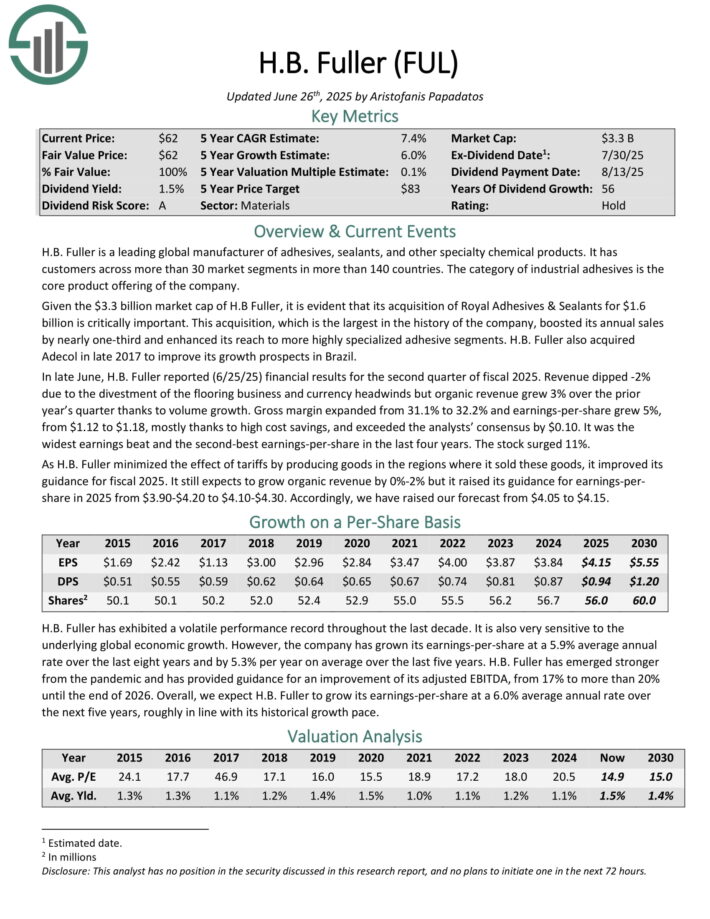

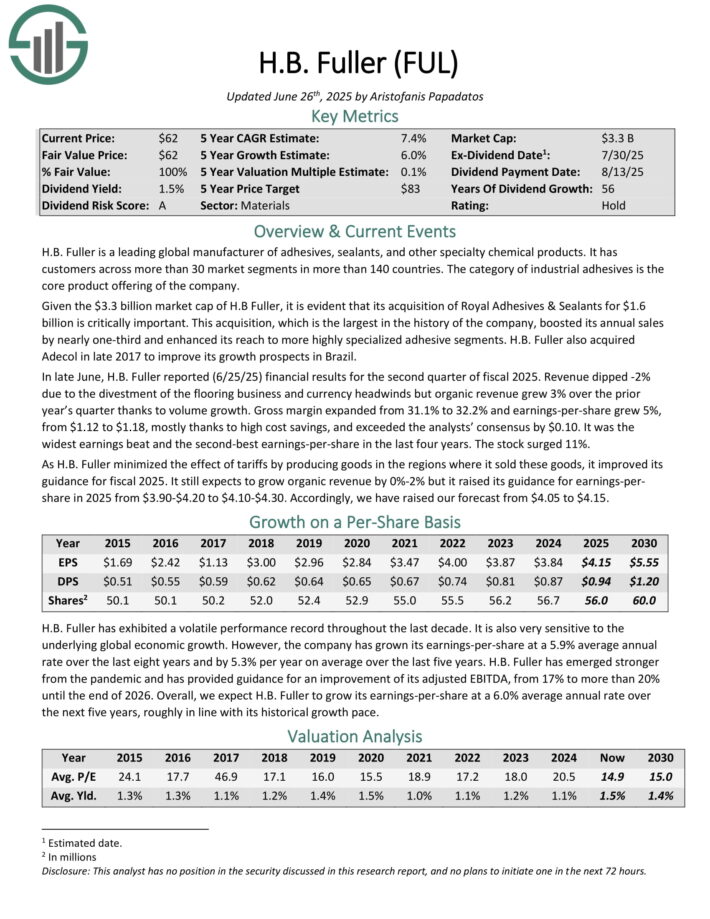

Dividend King To Hold Forever: H.B. Fuller Company (FUL)

H.B. Fuller is a leading global manufacturer of adhesives, sealants, and other specialty chemical products.

It has customers across more than 30 market segments in more than 140 countries. The category of industrial adhesives is the core product offering.

H.B. Fuller is a leading global manufacturer of adhesives, sealants, and other specialty chemical products. It has customers across more than 30 market segments in more than 140 countries. The category of industrial adhesives is the core product offering of the company.

In late June, H.B. Fuller reported (6/25/25) financial results for the second quarter of fiscal 2025. Revenue dipped -2% due to the divestment of the flooring business and currency headwinds but organic revenue grew 3% over the prior year’s quarter thanks to volume growth.

Gross margin expanded from 31.1% to 32.2% and earnings-per-share grew 5%, from $1.12 to $1.18, mostly thanks to high cost savings, and exceeded the analysts’ consensus by $0.10. It was the widest earnings beat and the second-best earnings-per-share in the last four years.

It still expects to grow organic revenue by 0%-2% but it raised its guidance for earnings-per-share in 2025 from $3.90-$4.20 to $4.10-$4.30.

Click here to download our most recent Sure Analysis report on FUL (preview of page 1 of 3 shown below):

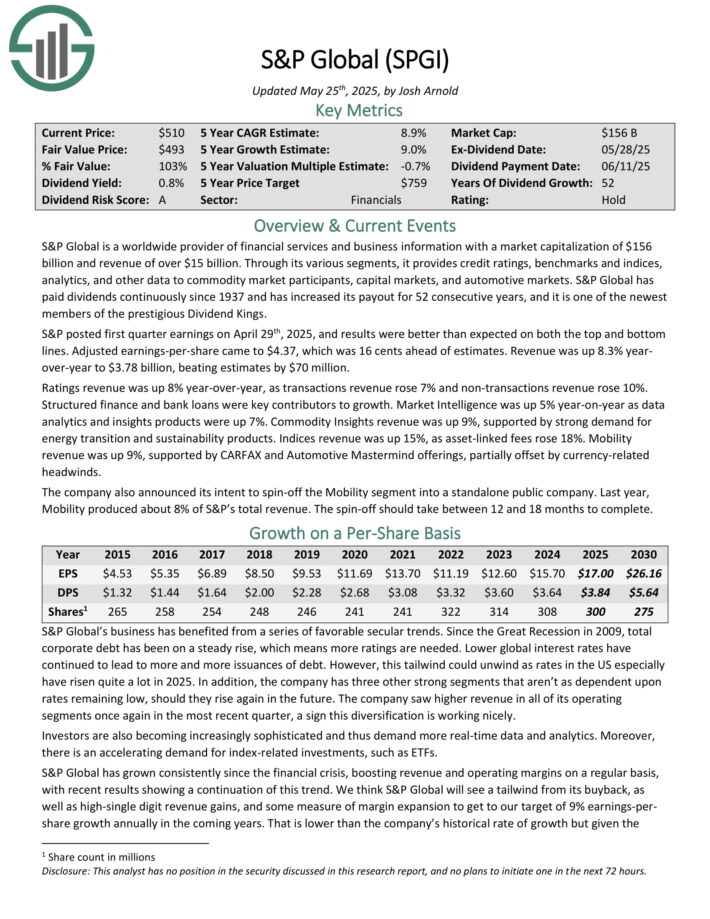

Dividend King To Hold Forever: S&P Global Inc. (SPGI)

S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion.

Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.

S&P posted first quarter earnings on April 29th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $4.37, which was 16 cents ahead of estimates. Revenue was up 8.3% year-over-year to $3.78 billion, beating estimates by $70 million.

Ratings revenue was up 8% year-over-year, as transactions revenue rose 7% and non-transactions revenue rose 10%. Structured finance and bank loans were key contributors to growth.

Market Intelligence was up 5% year-on-year as data analytics and insights products were up 7%. Commodity Insights revenue was up 9%, supported by strong demand for energy transition and sustainability products. Indices revenue was up 15%, as asset-linked fees rose 18%.

Mobility revenue was up 9%, supported by CARFAX and Automotive Mastermind offerings, partially offset by currency-related headwinds.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

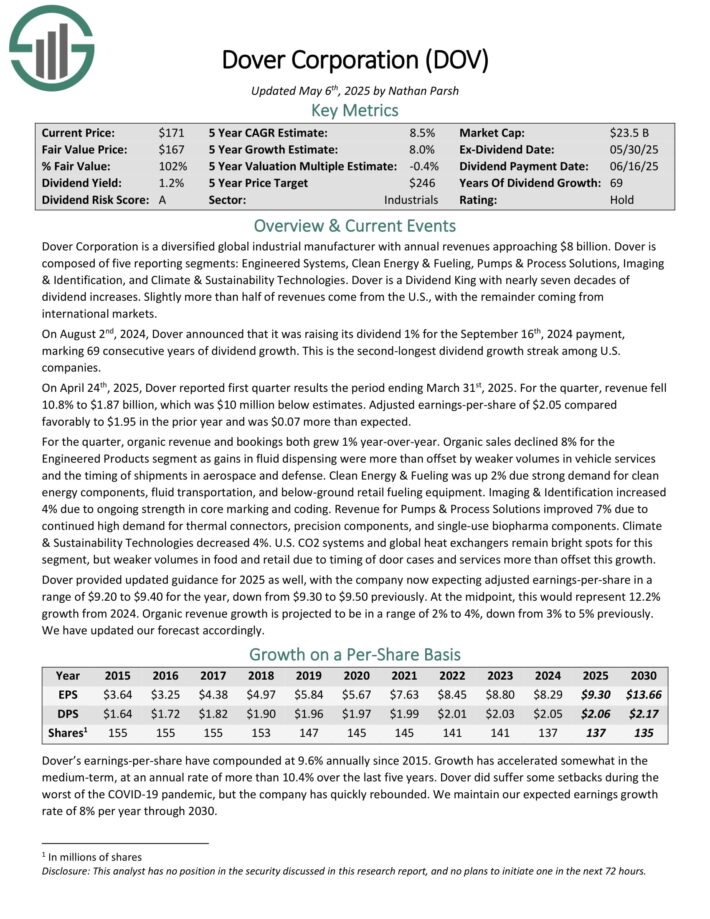

Dividend King To Hold Forever: Dover Corp. (DOV)

Dover Corporation is a diversified global industrial manufacturer with annual revenues approaching $8 billion.

Dover is composed of five reporting segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies.

On April 24th, 2025, Dover reported first quarter results the period ending March 31st, 2025. For the quarter, revenue fell 10.8% to $1.87 billion, which was $10 million below estimates.

Adjusted earnings-per-share of $2.05 compared favorably to $1.95 in the prior year and was $0.07 more than expected.

For the quarter, organic revenue and bookings both grew 1% year-over-year. Organic sales declined 8% for the Engineered Products segment as gains in fluid dispensing were more than offset by weaker volumes in vehicle services and the timing of shipments in aerospace and defense.

Dover provided updated guidance for 2025 as well, with the company now expecting adjusted earnings-per-share in a range of $9.20 to $9.40 for the year.

At the midpoint, this would represent 12.2% growth from 2024. Organic revenue growth is projected to be in a range of 2% to 4%.

Click here to download our most recent Sure Analysis report on DOV (preview of page 1 of 3 shown below):

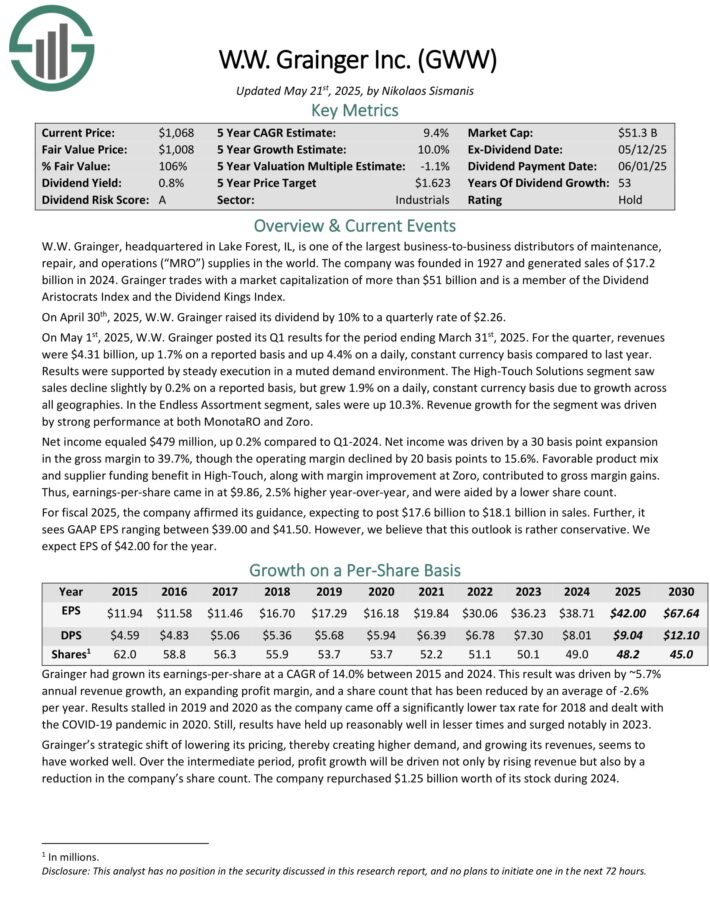

Dividend King To Hold Forever: W.W. Grainger Inc. (GWW)

W.W. Grainger, headquartered in Lake Forest, IL, is one of the world’s largest business-to-business distributors of maintenance, repair, and operations (“MRO”) supplies.

Grainger has more than 4.5 million active customers, with more than 30 million products offered globally.

On April 30th, 2025, W.W. Grainger raised its dividend by 10% to a quarterly rate of $2.26.

On May 1st, 2025, W.W. Grainger posted its Q1 results for the period ending March 31st, 2025. For the quarter, revenues were $4.31 billion, up 1.7% on a reported basis and up 4.4% on a daily, constant currency basis compared to last year.

Net income equaled $479 million, up 0.2% compared to Q1-2024. Net income was driven by a 30 basis point expansion in the gross margin to 39.7%, though the operating margin declined by 20 basis points to 15.6%.

Favorable product mix and supplier funding benefit in High-Touch, along with margin improvement at Zoro, contributed to gross margin gains. Earnings-per-share came in at $9.86, 2.5% higher year-over-year, and were aided by a lower share count.

Click here to download our most recent Sure Analysis report on GWW (preview of page 1 of 3 shown below):

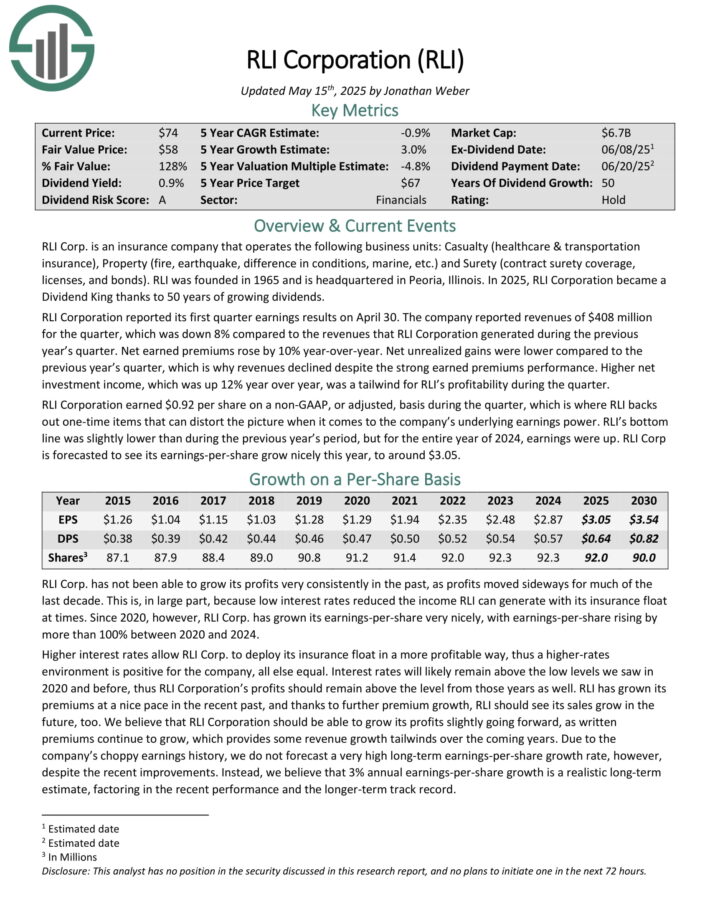

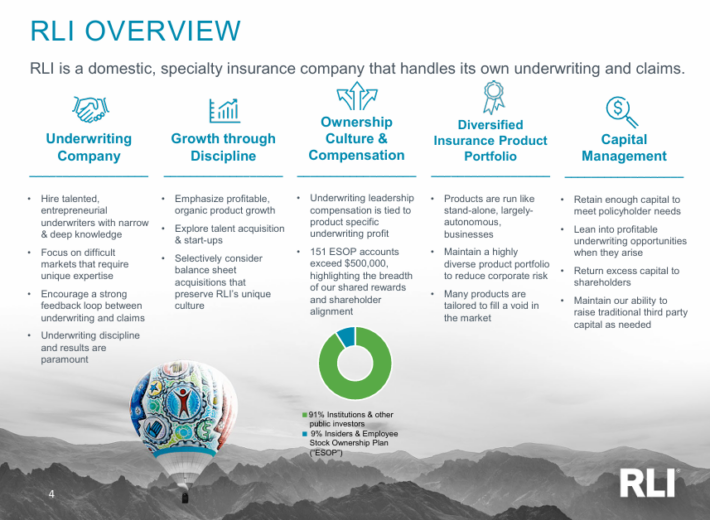

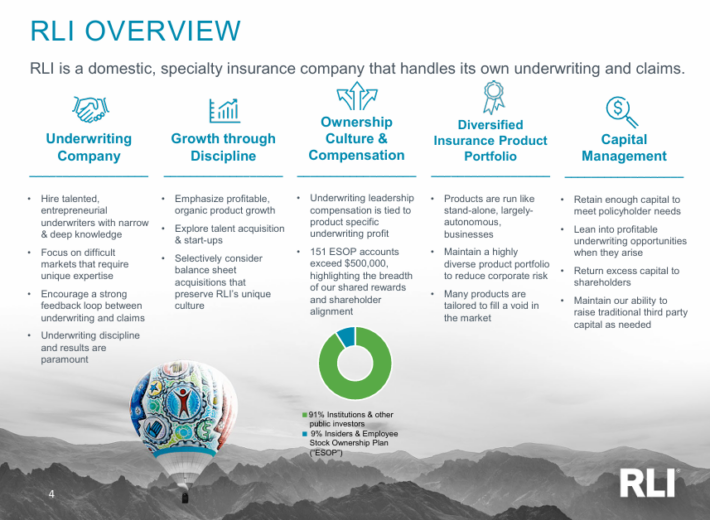

Dividend King To Hold Forever: RLI Corp. (RLI)

RLI Corp. is an insurance company that operates the following business units: Casualty (healthcare & transportation insurance), Property (fire, earthquake, difference in conditions, marine, etc.) and Surety (contract surety coverage, licenses, and bonds).

Source: Investor Presentation

RLI Corporation reported its first quarter earnings results on April 30. The company reported revenues of $408 million for the quarter, which was down 8% year-over-year. Net earned premiums rose by 10% year-over-year.

Net unrealized gains were lower compared to the previous year’s quarter, which is why revenues declined despite the strong earned premiums performance.

Higher net investment income, which was up 12% year over year, was a tailwind for RLI’s profitability during the quarter. RLI Corporation earned $0.92 per share on a non-GAAP, or adjusted, basis during the quarter.

Click here to download our most recent Sure Analysis report on RLI (preview of page 1 of 3 shown below):

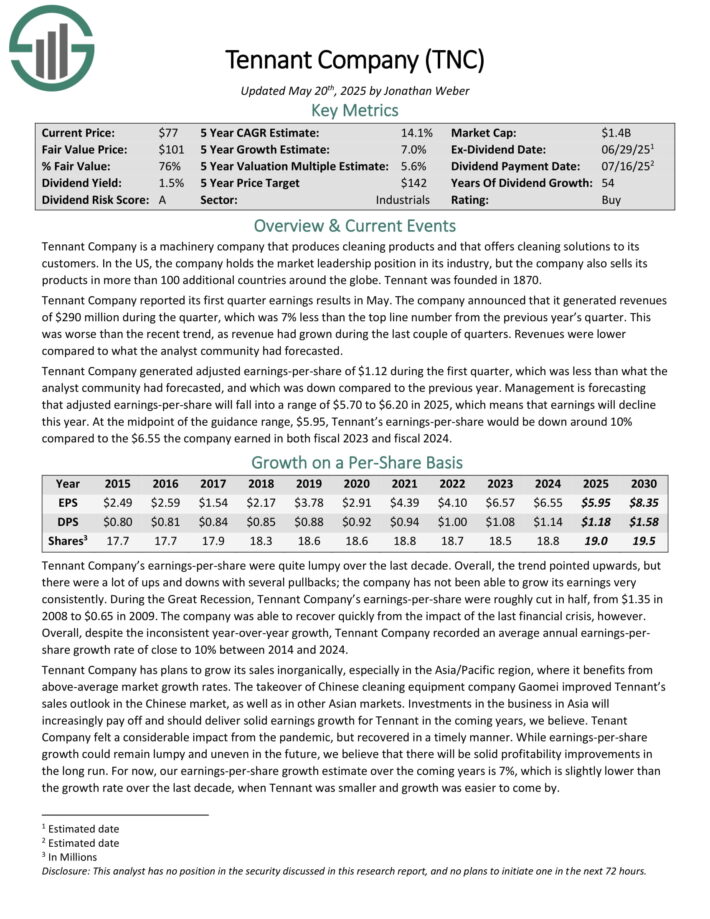

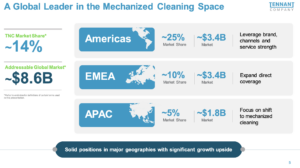

Dividend King To Hold Forever: Tennant Co. (TNC)

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its customers.

In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe.

Source: Investor Presentation

Tennant Company reported its first quarter earnings results in May. The company announced that it generated revenues of $290 million during the quarter, which was 7% less than the top line number from the previous year’s quarter.

This was worse than the recent trend, as revenue had grown during the last couple of quarters. Revenues were lower compared to what the analyst community had forecast.

Tennant Company generated adjusted earnings-per-share of $1.12 during the first quarter, which was less than what the analyst community had forecast, and was down compared to the previous year.

Management is forecasting that adjusted earnings-per-share will fall into a range of $5.70 to $6.20 in 2025, which means that earnings will decline this year. At the midpoint of the guidance range, $5.95, Tennant’s earnings-per-share would be down around 10%.

Click here to download our most recent Sure Analysis report on TNC (preview of page 1 of 3 shown below):

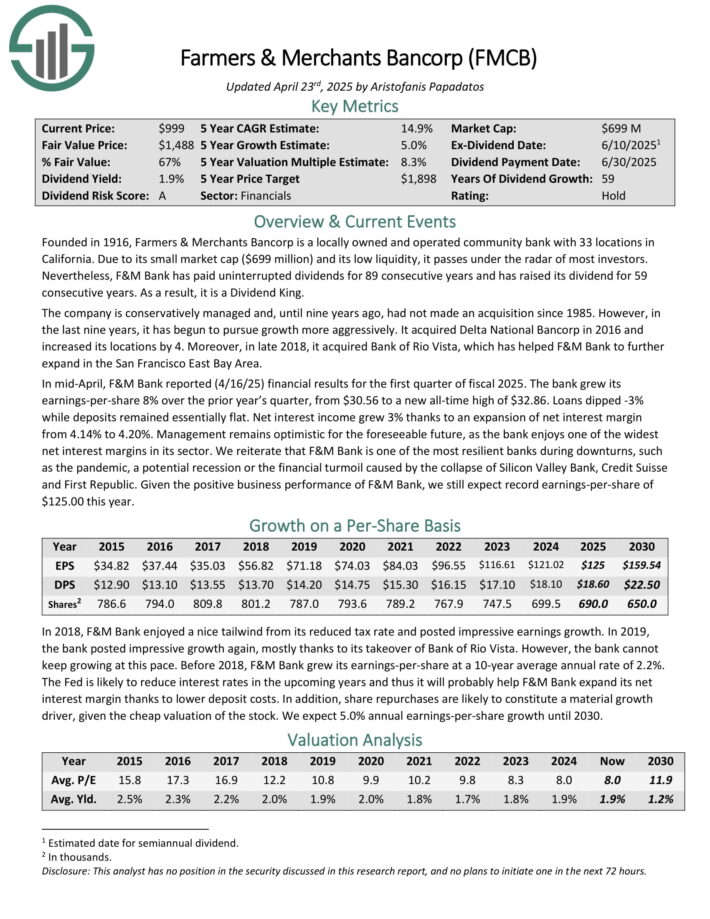

Dividend King To Hold Forever: Farmers & Merchants Bancorp (FMCB)

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors.

F&M Bank has paid uninterrupted dividends for 89 consecutive years and has raised its dividend for 59 consecutive years.

In mid-April, F&M Bank reported (4/16/25) financial results for the first quarter of fiscal 2025. The bank grew its earnings-per-share 8% over the prior year’s quarter, from $30.56 to a new all-time high of $32.86.

Loans dipped -3% while deposits remained essentially flat. Net interest income grew 3% thanks to an expansion of net interest margin from 4.14% to 4.20%.

F&M Bank is a prudently managed bank, which has always targeted a conservative capital ratio. The bank currently has a total capital ratio of 15.2%, which results in the highest regulatory classification of “well capitalized.”

Moreover, its credit quality remains exceptionally strong, as there are extremely few non-performing loans and leases in its portfolio.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

Final Thoughts

Screening to find the best Dividend Kings is not the only way to find high-quality dividend growth stocks to hold forever.

Sure Dividend maintains similar databases on the following useful universes of stocks:

There is nothing magical about investing in the Dividend Kings. They are simply a group of high-quality businesses with shareholder-friendly management teams that have strong competitive advantages.

Purchasing businesses with these characteristics–at fair or better prices–and holding them forever, will likely result in strong long-term investment performance.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.