-

Intuitive Machines is the only publicly traded company to have successfully landed a spacecraft on the moon in the last 50 years.

-

It's landed twice, and has NASA contracts to try twice more.

-

Intuitive Machines shares went on sale last month, falling 14% in price.

Sometimes, bad news for a stock investor can be good news for a stock buyer. Take the case of Intuitive Machines (NASDAQ: LUNR).

One month ago, I asked myself if Intuitive Machines — a stock I already own — might be worth buying even more of, after its share price nearly doubled from the price at which I first bought it. Paying twice the price for the very same stock ordinarily wouldn't sound like much of a bargain. In fact, after running the valuation on the stock in May, I ended up hedging my bet and arguing it might be worth buying. Yet it also seemed to cost more than I usually consider an acceptable valuation for an unprofitable space stock.

But that was then, and this is now. Over the past month, shares of Intuitive Machines have slumped 14%, closing Friday below $11 a share. For existing shareholders, that's disappointing. For investors looking to buy into Intuitive Machines for the first time, however, it may be an opportunity.

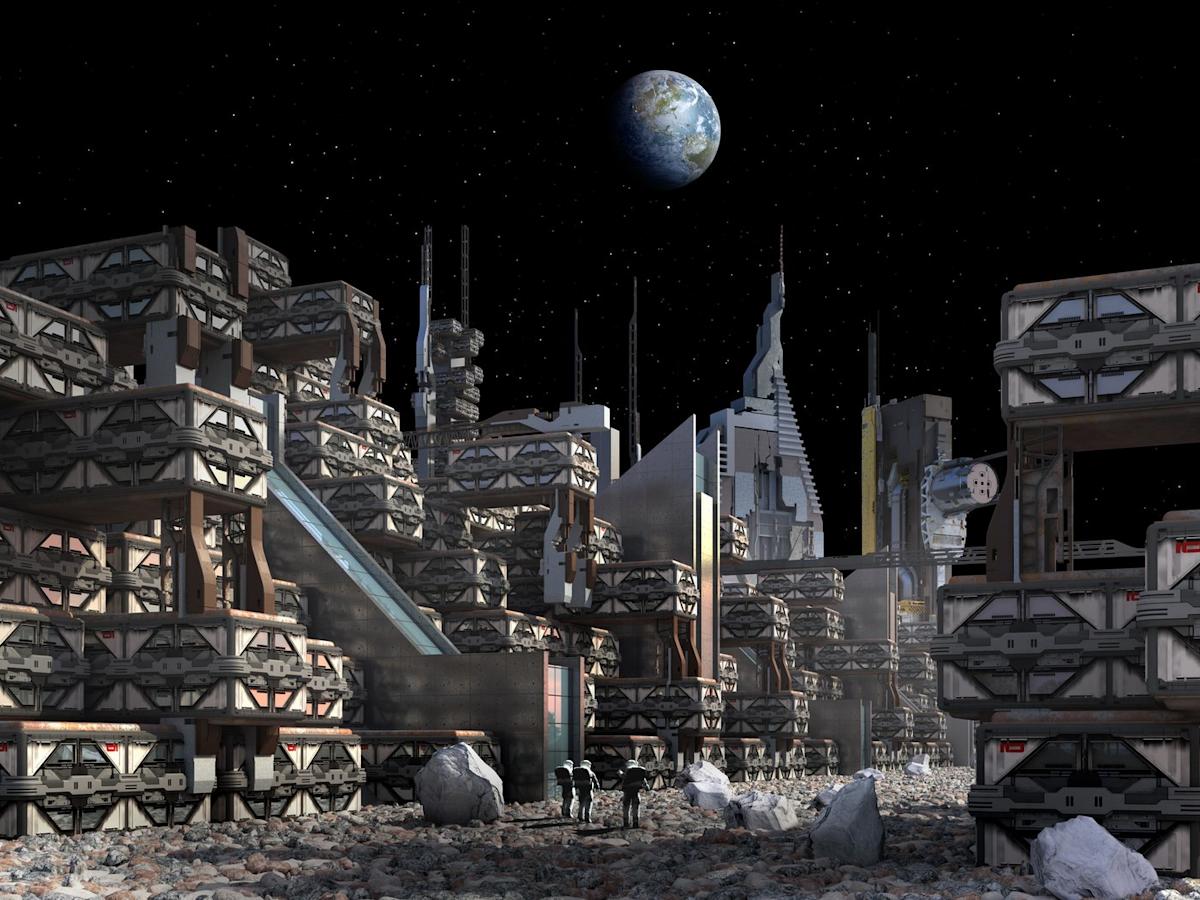

In case you're unfamiliar with the company, Intuitive Machines is the very definition of a space stock. The company is best known for being the first private company to land a spacecraft on the moon, and for landing an American spacecraft on the moon for the first time since the Apollo era 50 years ago.

It has in fact landed spacecraft on the moon twice now. Granted, neither landing was 100% successful — both vehicles toppled over on their sides after landing — but they did touch down safe and intact before keeling over. The company has secured NASA contracts for two more landing attempts, scheduled to take place in 2026 and 2027. And Intuitive Machines has promised to “incorporate … lessons learned” from the first two partially successful landings to try and improve its performance on the next two.

According to filings with the Securities and Exchange Commission (SEC), the company was paid $132 million for its first landing and $122 million for the second (with both NASA and various commercial customers contributing to the revenue). Intuitive Machines' third mission, IM-3, is said to be priced at $87 million, but that number may be increased, and doesn't yet include payments from commercial customers.